|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

Digital push in the financial sector due to COVID-19 pandemic

In addition to an assessment of the progress of digital transformation, the study results reflect the specific influence of the COVID-19 crisis.

As in many industries, COVID-19 was another resounding wake-up call for the financial industry in terms of digitalization. 75 percent of the study respondents regard this push as a lasting effect. Even now, there are already significantly more digital services available online than a year ago.

But this is just one facet of digital transformation. It also involves completely new business models, far beyond pure banking. Two thirds of the banks want to get involved here, but there is still a lack of know-how and experience. The current lack of business cases in this area also suggests that the assumed potential that many financial institutions are looking for may not actually exist.

Experience our study results interactively

The detailed statistical analyses can be found in our online study tool:

To the Digital Pulse Check Dashboard

Digital transformation of European banks: Study shows digitalization remains a challenging issue at European banks

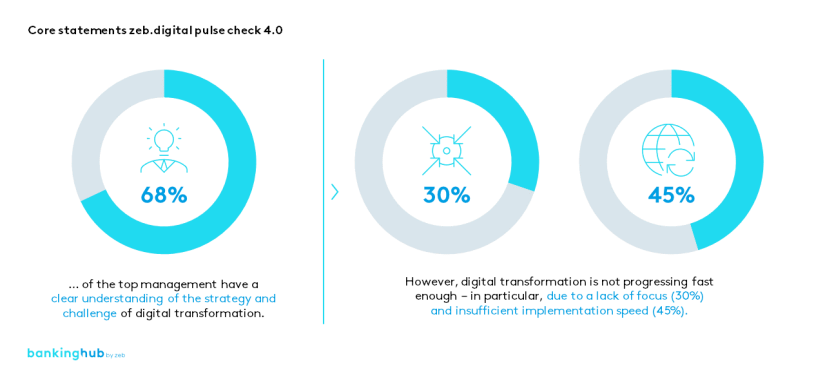

Banks have a clear understanding of the strategy and challenge of digital transformation. However, digital transformation is not progressing fast enough – in particular due to a lack of focus (30 percent) and also insufficient implementation speed (45 percent). The strategy is good, but implementation is lagging behind expectations.

Banks are aiming for an ambitious digital transformation, but in some cases are standing in their own way due to insufficient implementation speed and focus. 84 percent of banks regularly and systematically look at customer behavior, innovations and new technologies. However, only about a third (31 percent) look for an exchange of experiences beyond the financial industry.

The lack of focus and prioritization also acts as a stumbling block for participants that have already defined a need for action for the next 3–5 years with concrete goals, measures and responsibilities or for participants that have already defined challenges and fields of action in most areas. This shows that simply putting together a long list of digital projects and starting them all will get you nowhere. Surprisingly, digitalization in banks does not seem to be failing due to budget constraints. Only 17 percent see transformation costs as the greatest obstacle. The crucial challenges in trend recognition and evaluation are implementation speed as well as focus and prioritization.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Challenges for banks in opening up new business areas

The banks believe that the greatest challenges in opening up new business areas lie in unclear business cases and a lack of experience and skills.

Ultimately, banks who want to enter the platform business should not do so for the sake of digitalization, but rather develop a USP combined with a clear business case. There are already a number of positive examples where banks have set up a digital business together with municipalities, universities or even care services. Understandably, however, there is still a degree of uncertainty here: 45 percent of the banks are concerned about unrealistic expectations of potential.

Processes, data, IT: internal bank processes also continue to show room for improvement

Half of the job is finished, but there is still work to be done. The banks have now managed to make more than three quarters of their products available online. Compared to the last study from 2018, this is an increase in most segments. Two years ago, for example, the figure for current and savings accounts was 34 percent, whereas today 47 percent of banks offer the option of taking out a current account online. While it is important to look at what has been achieved, critically examining what needs to come next is just as crucial. The below-average online availability of mortgages shows that banks are still leaving a lot of potential unused and that more complex products still seem too difficult to offer digitally.

The importance of data for companies is widely known. In principle, this also applies to banks, except that the intelligent analysis of data is usually limited to sales purposes. Only 16 percent see the optimization of operations as a use case.

It is precisely here that tangible efficiency potentials could still be exploited, which would be much higher and bring more profit. The obstacles are manifold: For one thing, 88 percent do not use a comprehensive and systematic cost-benefit analysis. For another, more than 43 percent of the banks complain about a lack of know-how, 40 percent do not have the technical infrastructure to use data analytics, and 60 percent see the biggest hurdle in the current data protection regulations.

Digital transformation places high demands on the banking IT of European banks

Digitalization is largely IT-driven. Many banks are currently feeling the effects of this, as they realize that there is often a bottleneck here. Only 39 percent of respondents are satisfied with the performance of their own IT.

At 32 percent of respondents’ banks, release cycles take 4–6 months. The acceleration of release cycles often requires costly modernization of existing legacy IT architectures, a modification of development methods and complex organizational transformation.

Management and organization: digital skills are still lacking

In an adaptable company, people should voluntarily take on new roles and functions, show initiative and act responsibly. This only works if they have role models who act accordingly, if they are trusted and if there is a positive feedback culture that encourages change.

This currently seems far from the truth. Only 19 percent of respondents are convinced that most of their managers can be considered digital leaders.

A look at agile working methods shows that these have in principle arrived in the banks. They are mainly used in the area of change and innovation as well as the customer interface. In addition, cross-functional collaboration is practiced by more than half of the banks.

To ensure the success of digital transformation, it would be important to align the entire organization to agile working methods.

Conclusion: on the way to becoming a digital bank

It is evident that, at bank management level, there is no lack of digital strategies as well as understanding that transformation needs a broad foundation and that many facets, such as organization, processes and bank IT, must work together in order to be successful. However, many banks are not yet involving their employees strongly enough in their digital transformation, which is a profound change not only technologically but also culturally.

It takes a little courage to succeed in digital transformation. Courage, because it means not only offering products online, but also digitalizing processes and equipping employees and managers with new skills.

Banks that want to move outside their comfort zone, i.e. that want to significantly expand their business model, possibly beyond the financial sector, need to be even bolder. But even here, daring to do something at the right time can pay off in the end. For this, it is not enough to just have a good business idea; rather, a long-term willingness to invest and accept extensive changes to the core business model of one’s own bank are important for success.

Study booklet with all the results in detail

Download our interactive study booklet with all the results in detail here:

To the “zeb.digital pulse check 4.0”