|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

New standards for dealing with sustainability risks and negative sustainability impacts

The Disclosure Regulation (EU 2019/2088) in conjunction with the Taxonomy Regulation (EU 2020/852) define new standards for dealing with sustainability risks, negative sustainability impacts, advertising social and ecological aspects, as well as sustainable investments. They explain the levels and characteristics of disclosure for financial market participants and financial advisors, which have been further specified by the Final Report on draft Regulatory Technical Standards (JC 2021 03).

The new regulations demand a thorough analysis of the extent to which the regulations apply to the respective financial institution, of the new emerging disclosure obligations that result from the regulations, and the concrete measures that have to be taken.

Sustainability risk can arise in environmental, social, and business contexts and negatively affects the value of an investment. To enable retail customers to make fully informed decisions, it is important that they know about all sustainability risks and sustainability impacts on the business and have access to information regarding sustainable investments. Additionally, they need to be empowered to assess social and ecological advertising of financial products. The Disclosure Regulation ensures that such information is properly disclosed and helps customers to make informed decisions.

The Taxonomy Regulation defines sustainability, sustainable business activities, and the applicable businesses to build the basis for the new transparency obligation.

The Final Report adds a more detailed view. Here, the general requirements of the Disclosure Regulation are substantiated by concrete methods, contents, and presentation outlines for ultimate implementation.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Basically, there are seven financial products whose sustainability information has to be published:

- managed customer portfolios

- alternative investment funds (AIF)

- insurance-based investment products (IBIP)

- pension products

- pension schemes

- UCITS

- pan-European personal pension products (PEPP)

The new Disclosure Regulation specifically aims at financial market participants and financial advisors

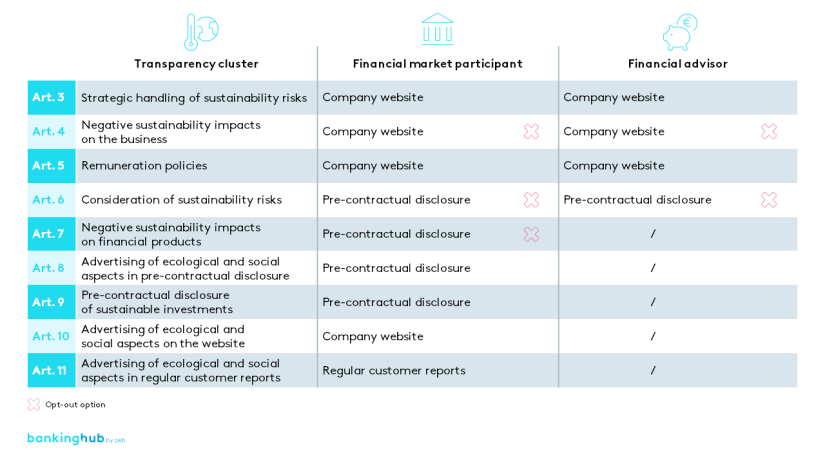

A participant is defined as a person or group who offers, creates, or manages any of the aforementioned products. A financial advisor, however, is a person or group who provides investment or insurance advice related to any of these financial products. See Figure 1 for the update process of sustainability disclosures:

Disclosure Regulation for financial market participants

According to Art. 3 (2) Disclosure Regulation, financial market participants have to publish information regarding their strategic handling of sustainability risks on their websites. They also have to disclose their products’ negative sustainability impacts on the business on their websites (Art. 4 Disclosure Regulation).

Additionally, financial market participants have to state whether their compensation policies are in line with sustainability risks (Art. 5 Disclosure Regulation). Moreover, according to Art. 6 Disclosure Regulation, they have to include in their pre-contractual disclosure the way sustainability risks are taken into account when making investment decisions and the impact of those risks on the return of their financial products.

The most important negative sustainability impacts on financial products have to be explained as part of the pre-contractual disclosure (Art. 7 Disclosure Regulation). Additionally, they have to provide information regarding the alignment of their products with the sustainability index and the achievement of sustainability goals (Art. 9 Disclosure Regulation).

Finally, financial market participants have to explain advertised ecological or social aspects and sustainable investments (Art. 8, 10 and 11 Disclosure Regulation). These explanations together with information on how the advertised aspects are analyzed and monitored have to be provided on their websites, in pre-contractual disclosures and in regularly published reports.

Disclosure Regulation for financial advisors

Financial advisors, by contrast, have fewer disclosure obligations. According to Art. 3 (2) Disclosure Regulation, financial advisors have to publish information regarding their strategic handling of sustainability risks on their websites. Moreover, in contrast to financial market participants, financial advisors do not have to disclose specific negative sustainability impacts of the products, but only have to disclose whether they include this aspect in their advisory business (Art. 4 Disclosure Regulation).

Similarly to the financial market participants’ obligations, financial advisors have to disclose on their websites whether their compensation policies are in line with sustainability risks (Art. 5 Disclosure Regulation). Finally, according to Art. 6 Disclosure Regulation, they have to include in their pre-contractual disclosure the way sustainability risks are taken into account when providing investment and insurance advisory services.

New disclosure obligations for financial market participants and financial advisors at a glance

For a visualization of the new disclosure obligations for financial market participants and financial advisors, see Figure 2:

There are three opt-out options that allow a reduction of the disclosure scope:

- First, financial market participants with less than 500 employees and financial advisors do not have to disclose negative sustainability impacts on the business (Art. 4 Disclosure Regulation) and instead are allowed to give a statement on why they do not publish such information.

- Next, according to Art. 6 Disclosure Regulation, financial market participants and financial advisors are allowed to clearly explain why they do not consider a certain sustainability risk as relevant and then do not have to disclose more information on this issue.

- Lastly, financial market participants can, in accordance with Art. 7 Disclosure Regulation, state and explain for each financial product why negative sustainability impacts on investment decisions are not considered.

Despite the legal possibilities of opt-out options, both financial market participants and financial advisors have to consider the signal they would be sending out when taking those options. Thus, institutions with a sustainable orientation are likely to not make use of these options out of strategic considerations.

Financial institutions need to follow three steps to ensure compliance with the new sustainability-related disclosure regulations:

- First, they have to check their responsibilities by applying the classification criteria for financial market participants and financial advisors and analyzing their offerings in order to identify the financial products concerned.

- Second, they have to compare the new obligations with their existing disclosure processes.

- Finally, the necessary changes in sustainability-related disclosure have to be implemented within the time frames set by the Disclosure Regulation.

zeb can support the implementation process of the new regulation in all aforementioned phases

We can evaluate the relevance of the regulation for the individual financial institution in the first place and subsequently provide possible formats and report requirements for the necessary disclosures. Eventually, zeb can define own models and possible data sources to ultimately ensure compliance with the new regulation.

Contact us here, if you’d like to learn more about our approach!