|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

Summary: Market potential for digital assets in Switzerland

- Based on investments in cryptocurrencies and security tokens, zeb expects a digital asset market potential of up to CHF 55 billion in Switzerland by 2024. To exploit this potential, the development of the regulatory framework, of technical solutions, and, for example, the general level of digitalization are crucial.

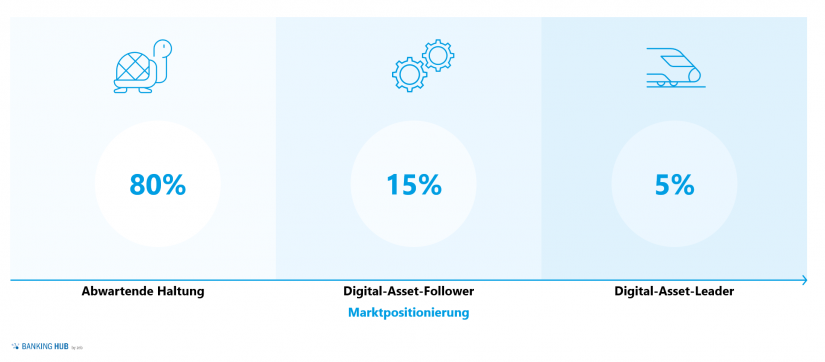

- Swiss financial institutions are hesitant in positioning themselves; only a few have a fully developed digital asset strategy and are consistently aiming to implement it by setting up corresponding service offers.

- In order to successfully cope with the trend towards DLT and digital assets, it is advisable for the majority of Swiss institutions to develop digital asset services. A classic crypto-based approach, which may heavily rely on gray- and white-labeling models, is sufficient for most institutions. But market leaders may take a more exploratory approach and test other service types in the market.

- When developing a new offer, both market maturity and the expected adoption of DLT services are decisive for the outcome. This is the only way to achieve a valuable monetization of the DLT potential.

Overview of the Swiss market – zeb’s assessment

With the entry into force of the DLT “blanket ordinance”[1] in February and August 2021, Switzerland as a “crypto nation” now has an excellent legal framework which will give an additional boost to the adoption of digital assets. The DLT “blanket ordinance” has made the regulatory framework for the Swiss DLT ecosystem transparent, while also providing it with improved entrepreneurial opportunities.

It is another proof of the DLT-friendly environment in Switzerland. Therefore, it is not surprising that an ecosystem of infrastructure and service providers, which is unique in the world, has sprung up in this country.

According to the latest Swiss Digital Asset & Wealth Management Report by CV VC, the Swiss crypto scene is made up of about 950 companies and about 5,200 employees.[2] It is an especially positive development that well-known blockchain protocols such as the Ethereum Foundation or Cardano have also established themselves in Switzerland.

If we focus on the traditional financial industry, it is nevertheless surprising that the adoption of DLT and digital assets by traditional Swiss financial institutions is progressing at a fairly slow pace. Although many institutions are pushing ahead with DLT pilot projects, only very few have so far drawn up a comprehensive digital asset strategy and have introduced their own offerings. Instead, a growing number of start-ups are competing for the exploitation of the existing potential.

As a result of their inactivity, traditional financial institutions are running the risk of lagging behind Swiss start-ups and international competitors. For this reason, zeb recommends that institutions promptly address this topic at a strategic level and at least launch a minimum DLT offering.

There certainly are incentives to deal with this topic in a more proactive way. From an investment perspective and on the basis of its own model calculations, zeb expects that the market for digital assets, measured in terms of invested assets, could develop to up to CHF 55 billion in Switzerland and up to CHF 1,605 billion in Europe by 2024. For comparison: that would be about 5% of the private onshore assets managed in Switzerland today.[3]

For financial institutions, this is a significant investment pool. The estimates by zeb include investments in cryptocurrencies and security tokens; the latter were derived based on the volume invested in alternative assets such as public and private equity & debt, real estate, and structured finance, and assuming a conversation rate of traditional assets into digital assets. However, crypto derivatives and NFTs[4] were not included.

DLT value proposition & reality check

The extent to which this investment potential can actually be monetized in the coming years depends on the development of the general framework and on several influencing factors: e.g., legal certainty, tradability of assets, future technological development & realized efficiency gains through DLT applications.

Despite its impressive potential, it is worth conducting an additional reality check to assess expectations. There are a couple of reasons why the adoption of digital assets does not yet fully meet expectations.

A reality check of key digital asset value propositions provides additional insights:

-

-

1st promise – democratization of financial markets

tokenization enables digital mapping & fractionation of assets. Swiss investors, but especially retail & affluent customers thus gain access to assets that were previously inaccessible due to budget restrictions.

Promise fulfilled: for banking institutions with large retail & affluent business, this presents an opportunity to monetize the expanded range of investment possibilities on the customer side.

-

2nd promise – new sources of capital and forms of investment

New sources of capital and forms of investment for start-up and established companies, security token offerings open up opportunities for new sources of capital. This applies especially to those companies that have been excluded from capital markets because of financial and regulatory hurdles. The well-developed Swiss SMEs appear to be an especially interesting target group.

Promise partly fulfilled: in truth, not all forms of capital benefit from tokenization. zeb sees the greatest potential in real assets and debt capital. However, a company’s main bank can offer good alternatives for debt capital in view of the current low interest rates.

-

3rd promise – increased liquidity

Digital asset markets are accessible 24/7, promising investors greater accessibility and shorter lead times for financial market transactions.

Promise partly fulfilled: due to the small number of regulated secondary markets, the hope of increased liquidity for digital assets, e.g., SME stocks, has not really been fulfilled yet. In Switzerland, however, the Taurus Digital Exchange and the SDX, for instance, will soon provide a remedy.

-

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

The reality check must only be viewed as an assessment of the current situation. It in no way suggests that Swiss financial institutions should not move ahead in the area of digital assets. The assessment of the value proposition can be used to help banks determine what type of digital asset services they should develop first and how fast they should proceed.

When developing the DLT offering, it is essential to consider the market maturity of individual digital asset offerings and the expected adoption of these services by customers. It is also important to align them with the existing in-house banking and segment strategy. In any case, such an assessment should differentiate services by cryptocurrencies such as BTC & ETH vs. security tokens (e.g., tokenized stocks). The decision not to offer cryptocurrencies does not mean that the introduction of a digital asset offering has to be given up entirely.

Figure 1: Market maturity of selected digital asset services (not differentiated by crypto vs. security token)

Figure 1: Market maturity of selected digital asset services (not differentiated by crypto vs. security token)Possible approaches to developing a service offering for digital assets

Given the maturity and adoption of digital asset services in the market, three approaches to developing a service offering have emerged among those Swiss banks that have already launched such an offer.[5]

Institutions with a wait-and-see attitude only deal with digital assets internally, if at all. In Switzerland, this group includes a large number of cantonal, regional, and major banks. In zeb’s view, this wait-and-see attitude is not an option in the medium to long term. Each institution should devise a DLT and digital asset strategy that is tailored to its business model and customer focus. This strategy should allow institutions to develop the necessary competencies to secure the income potential and to establish customer interfaces – despite low risk appetite. Attention should once more be drawn to the importance of differentiating between cryptocurrencies and other digital assets.

In contrast to companies with a wait-and-see attitude, some institutions have already established a crypto-focused basic offering in the market, e.g., Bank Julius Bär[6] or Swissquote. Institutions are approaching the topic with an offering that covers custody and trading of cryptocurrencies as well as derivatives related to cryptocurrencies. Assets from traceable crypto-related sources may also be permitted. In this way, certain KYC/AML competencies are extended to the crypto area.

The offered brokerage products are often just derivatives on cryptocurrencies and not crypto direct investments. In zeb’s view, this is the most appropriate approach for most Swiss institutions. It allows banks to develop their competence in digital assets further, while taking into account their strategy and their customers. In addition, it enables banks to access this topic within a few months – without the need for a large investment or the exploratory development of individual sub-topics to market maturity.

Finally, there are some institutions that are positioning themselves as digital asset leaders in Switzerland, e.g., Sygnum and Seba Bank or the private bank Maerki & Baumann. Digital asset leaders are characterized by a clear commitment to the DLT economy. They have a dedicated digital asset strategy and have (or plan to have) a broad range of offerings in the market that go beyond crypto brokerage and custody services.

Depending on the business model & synergy potential, it is thus possible to test new DLT topics proactively on the market and to address niche topics at an early stage, such as the tokenization of real assets. The following offerings, for instance, currently go beyond the traditional approach according to zeb: digital asset basic banking services (payments, cards, deposits, and loans), digital asset portfolio management, and advisory services, tokenization platforms or trading venues. The introduction of these offerings is only recommended with the aim of achieving a position as digital asset market leader, and if there is a willingness to face high development costs.

Three basic sourcing approaches

From an operational perspective, there are three basic sourcing approaches. The bank (or the institution) completely outsources the provision of digital asset services to a partner, practically pursuing a gray-labeling approach. Alternatively, it purchases a white-labeling offer from a B2B provider in a “full-service package” or develops the competencies internally – possibly by integrating individual providers.

Two demands have to be met:

-

-

- In light of the rapid developments in the market, a short time to market is crucial

- Because of the strategic relevance of the topic, it is advisable to build up internal know-how in the medium to long term

-

In view of the above, a partnership with a trusted B2B provider seems to make sense in order to achieve both goals. The ecosystem in Switzerland is also developing fast in the “provider sector”, e.g., with providers such as Custodigit or Incore.

More in-depth information on digital asset-related topics

If you and your institution would like to receive more in-depth information on digital asset-related topics, we would be happy to prepare a fitting discussion. zeb has a proven track record of success in a wide range of issues relating to digital assets.

Our past and current projects in Switzerland and other European countries have always been both of a strategic and technical nature.

If you and your institution would like to receive more in-depth information on digital asset-related topics, we would be happy to prepare a fitting discussion. zeb has a proven track record of success in a wide range of issues relating to digital assets. Our past and current projects in Switzerland and other European countries have always been both of a strategic and technical nature.