|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

What differentiates VR-Crowd from other equity crowdfunding providers?

We have talked to Claus Reder, member of the management board of VR-Bank Würzburg, and Josef Sperl, head of the “real estate owners” department and authorized officer at HAUSBANK MÜNCHEN eG. The interview examines the specific advantages that the equity crowdfunding platform VR-Crowd offers to corporate customers and investors.

The idea of jointly financing projects and giving investors a stake in social ventures is not new. Equity crowdfunding, i.e. crowd financing via digital platforms, has now become a widely known source of financing.

Claus Reder is a member of the management board of VR-Bank Würzburg which has explored “Beyond Banking” topics and new ways of banking as part of its strategy project.

Together with his team, Claus Reder pressed ahead with the innovative idea of establishing an equity crowdfunding platform within the strategy process of VR-Bank. In 2018, the first version of VR-Crowd was launched.

Josef Sperl is head of the “real estate owners” department and authorized officer at HAUSBANK MÜNCHEN eG. As a specialist bank for real estate, HAUSBANK MÜNCHEN eG was one of the first banks in the cooperative group of Volks-/Raiffeisenbanken to join VR-Crowd.

What exactly does VR-Crowd do?

Reder: Our VR-Crowd is a digital platform designed to provide equity to corporate customers in a cost-effective and highly flexible manner.

This has further advantages, e.g. an increase in brand awareness, as every project or company can present itself on our platform: in this way, investors worldwide are made aware of the project.

That’s effective advertising for all companies, whether they are still quite new or long established. As regional banks, we thus succeed in involving the people in our region in projects cleverly and in line with the cooperative principles.

What is the main advantage for you as a bank?

Reder: We as VR-Bank Würzburg had the idea – the platform is our “baby”, and we are really very proud of it. We realized early on that the competition did not yet offer such a platform. Board members from other banks regularly confirm this fact: VR-Crowd is a unique selling point in the region.

Above all, VR banks are the only ones able to offer the complete financial package from a single source, i.e. the debt tranche via VR banks and the equity tranche via VR-Crowd. This also lifts us above the comparability of offers and prices. We acquire new customers and inspire existing ones.

And if we look at the balance sheet of the affiliated banks, it is evident that VR-Crowd also has a positive effect on the equity of VR banks.

Partner banks and VR-Crowd projects

There are now 24 partner banks that have joined the platform. Mr. Sperl, what was the decisive reason for HAUSBANK MÜNCHEN eG to join VR-Crowd?

Sperl: HAUSBANK MÜNCHEN eG sees itself as the leading real estate financing institution in the Munich metropolitan area. With VR-Crowd, we want to address the current trend situation and provide answers to our customers’ needs.

As Mr. Reder has outlined above, VR-Crowd allows us to differentiate ourselves from the competition and be an even stronger partner for our specialized customers.

For HAUSBANK MÜNCHEN eG, VR-Crowd provides a new boost to revenue that also contributes to the strengthening of our brand profile in the age of digitalization.

However, it is essential for us that we exclusively finance projects with VR-Crowd which we judge to be absolutely successful – and would support anyway.

Which projects can be financed via VR-Crowd?

Reder: A great many projects, for instance: corporate financing for both fixed and current assets; projects from the renewable energy sector, especially relating to the fast-growing topic of citizen participation; real estate projects of all kinds for existing properties and development properties.

Figure 1: Successfully funded project: FitOne in Würzburg; further projects listed under: Current projects | VR-Crowd – invest now (only available in German)

Opportunities for corporate customers offered by the equity crowdfunding platform VR-Crowd

What benefits does VR-Crowd offer to corporate customers?

Sperl: Aside from the actual procurement of capital, there is the enormous advertising and marketing effect. It also eliminates the very difficult intermediation of the bank and a third-party mezzanine lender, and thus the intercreditor agreements that usually involve conflicts of interest.

In addition, crowd capital is equity-friendly. This is always an important argument and a major advantage of VR-Crowd, especially among property developers as they usually have many different projects running at the same time.

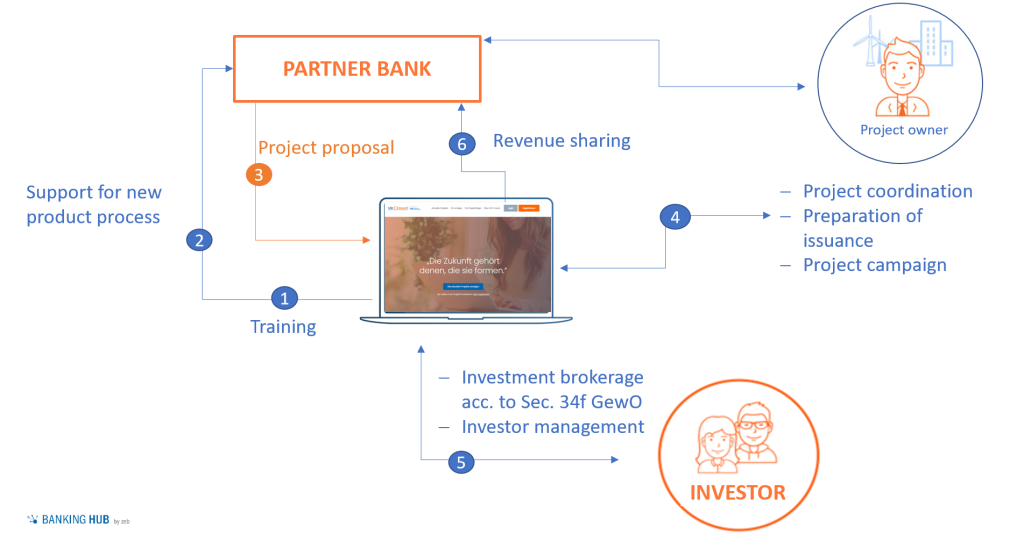

Figure 2: Illustration of a VR-Crowd collaboration; own representation

As a partner bank, what do you have to do in this context – and how much effort is involved for corporate customer advisors?

Sperl: Since an in-depth examination of the project and the investment is conducted as part of the loan application, especially with regard to risk, profitability and success, no separate examination effort is necessary for VR-Crowd.

Actually, “merely” the customers have to be convinced of the advantages of the VR-Crowd in the run-up to the application. Once investors are aware of this, the only important thing is the rapid and transparent exchange of information and queries.

Benefits and risks of equity crowdfunding

How do you attract corporate customers as new project owners for the platform?

Sperl: First, we explored the reasons that suggest equity crowdfunding as an alternative form of financing and looked at the additional benefits that it offers for customers.

We then summarized our benefit arguments in a short presentation for customers. All sales staff affected by this topic received comprehensive information, and they were involved in the process. As a result, they actively offer the product. We also offered events with intermediaries for professional customers and tax firms as part of our network and introduced VR-Crowd.

Additionally, we offer VR-Crowd to all eligible customers right away as part of their financing request: the customer receives an offer involving their required equity capital as well as another offer from the combination “equity capital and VR-Crowd”.

And how do you attract investors?

Reder: The platform already has a significant number of users. This is, of course, an advantage for a new partner bank.

VR-Crowd is designed on the investor side as a fully digital, open self-decision process; it is a real asset, especially in private banking as part of asset allocation and in retail banking via extensive marketing measures.

Are there any risks for investors and project owners?

Reder: Owing to the selection and multi-step examination process, the risk-opportunity profile is extremely well-balanced. There are actually no risks for the project owners, except that there may not be enough subscribers (investors) for the project and the targeted amount may not be reached.

Basically, as we all know, the risks for investors arise from providing subordinated capital for an investment. This may extend to total payment default.

Compared to competing platforms, however, investors have the advantage that the project has been examined in detail by a bank as to its success and that the bank supports the investment financially.

Since the bank is explicitly mentioned on the platform, it risks its reputation and is therefore very much interested in a successful realization and repayment.

Sperl: The project owners have the same risks as in the case of other silent partnerships. Due to the large reach and publicity of digital marketing, problems that occur could result in a reverse marketing effect, i.e. negative reports, which in the worst-case scenario would spread quickly and widely.

In addition, the authorization phase by BaFin may require a longer period of time.

Can any VR bank participate? Are there any obstacles? What are the requirements?

Reder: Every VR bank can participate! The only requirement is a partner bank contract with VR-Crowd. The contract guarantees the partner bank the excellent return.

The new product process (NPP) could be an obstacle, but we believe it isn’t. However, partner banks only make a suggestion, so some banks even waive an NPP.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

What does the future hold in store for VR-Crowd?

What’s new since 2022?

Reder: We have our own manager at the subsidiary VR-Crowd GmbH since January 1, 2022: Kerstin Amend-Maar. She was involved in the development of VR-Crowd from the very beginning – when she was still head of credit support at VR-Bank Würzburg. She knows VR-Crowd inside out.

As of January 1, 2022, we have also entered into an exclusive, strategic partnership with the consulting firm compentus. The consultants at compentus deal with sales and marketing activities as well as the rapid, successful implementation of the product at partner banks.

What plans do you have for the platform?

Reder: We want to become the number one in the equity crowdfunding market! We aim to attract new VR banks as partner banks every year: “What one person can’t do, can be achieved by many.” Equity crowdfunding pays full tribute to our cooperative origins, our core values as a cooperative bank, and people’s needs.

For this reason we continuously develop our bank further: we always keep an eye on what is happening in the financing market and design new services for the platform.

More about VR-Crowd

Four years ago, VR-Bank Würzburg set out to build its own equity crowdfunding platform as part of its strategy process accompanied by compentus: VR-Crowd is now a well-known platform which other VR banks can also join as “partner banks” – in the spirit of the cooperative motto: “What one person can’t do, can be achieved by many.”

Together with the investors, the VR banks finance projects in the areas of real estate, renewable energy or corporate financing.

Linking this form of financing to sustainable development goals is also likely to increase the interest of many regional banks in such platforms in the future.