|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

EU-wide standardization of crowdfunding

Crowdfunding is increasingly gaining importance as an alternative form of financing, allowing a large number of investors to invest in individual projects. It is especially popular in the real estate sector. With a financing volume of EUR 254.9 million in 2020 – approx. 77% of the total crowdfunding volume in Germany[1] – real estate financing is the largest crowdinvestment segment. For small and medium-sized companies too, crowdfunding is not only a financial instrument, but frequently also serves as an effective marketing program to attract attention in the market or to test a business idea (cf. recitals of the ECSP Regulation).

Crowdfunding is not only successful in Germany. It has also long established itself in other EU member states. However, the business models of crowdfunding service providers differ greatly, as they are strongly adapted to very different national frameworks: these range from no regulation at all to the strict application of investor protection rules.

So far, the provision of crowdfunding services has not been the subject of a targeted EU harmonization measure, as the EU MiFID II and AIFM Regulations have demonstrated in the past. With this in mind, on October 7, 2020, the European Parliament adopted a Regulation on European Crowdfunding Service Providers for Business (Regulation (EU) 2020/1503). The goal is to create a uniform legal framework that ensures a well-functioning single market, to realize the announced capital markets union and to achieve greater transparency and standardization to strengthen investor protection in the long term.

ECSP Regulation focuses on platform operators

Three parties are usually involved in the provision of crowdfunding services: investors, project owners and crowdfunding service providers. The latter provide online platforms that act as a kind of intermediary organization, bringing together the funding interests of investors and project owners. They therefore perform a very important function. The regulation now focuses on these crowdfunding service providers.

The scope of the ECSP Regulation extends to the offer of transferable securities (as defined by MiFID II) and the granting of loans. In contrast to subordinated loans, such loans can be issued without a fronting bank and can thus be brokered directly to investors via the online platform.

It is important to note that only crowdfunding offers that do not exceed a threshold of EUR 5 million are covered by the ECSP Regulation. This maximum amount is to be calculated as the sum of a project owner’s offers over the last twelve months. If the threshold values are exceeded, the facilitations provided by the ECSP Regulation, such as the preparation of the standardized key investment information sheet, no longer apply. Instead, the prospectus requirement under the Securities Prospectus Act applies.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Requirements entail high implementation costs

In some cases, the legislator imposes strict requirements on platform operators who wish to operate under the ECSP Regulation. Depending on the business model and the maturity level of the platform, meeting these requirements may involve high implementation costs. The requirements of the ECSP Regulation are substantiated by the regulatory technical standards of the European Securities and Markets Authority (ESMA) and the European Banking Authority (EBA).

In terms of content, there are specifically MiFID II-like conduct of business obligations, which, however, fall short of the MiFID II Regulation in terms of scope and depth of regulation. In addition to a general clause establishing effective and prudent management, effective and transparent procedures must be set up, for example for handling complaints and managing emergencies and conflicts of interest.

With regard to investors, the ECSP Regulation distinguishes between “sophisticated” and “non-sophisticated” investors. Concerning investor protection provisions, the ECSP Regulation especially aims to protect non-sophisticated investors. Platforms are instructed to test the level of knowledge of investors about the associated risks and to simulate their ability to bear loss. In this context, the assessment under the ECSP Regulation includes elements of both an appropriateness and suitability assessment under MiFID II. Non-sophisticated investors must also be granted a reflection period, during which they can revoke their expression of investment interest at any time before contracts are concluded.

The essential element of information in the context of investor protection is the key investment information sheet, for which the project owners are liable. Nevertheless, procedures are needed on the part of the platform operators to ensure the quality of the key investment information sheet and to promptly request the project owners to make rectifications. A sales and securities information sheet is not required under the ECSP Regulation, which eliminates the need for an authorization procedure and allows products to be brought to market more quickly.

Implementation of requirements and licensing application by November 2023

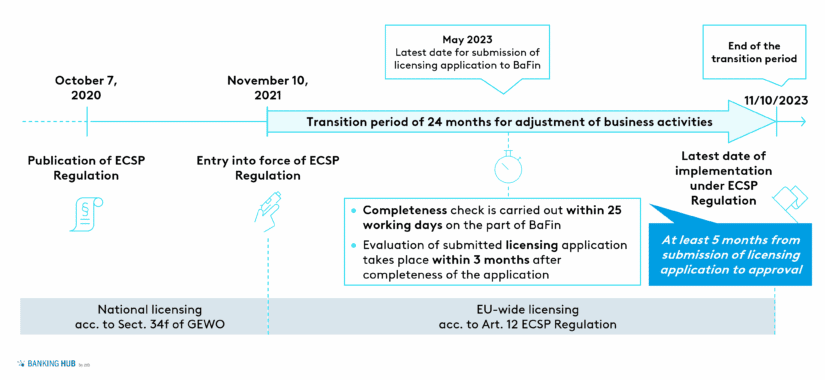

The ECSP Regulation has been in force since November 10, 2021. Platform operators or brokers in the area of crowdfunding who wish to offer loans and transferable securities throughout the EU therefore require a license from the authority of the member state in which they are established. The legislator has granted a transition period of 24 months to implement the requirements and apply for licenses. Accordingly, licenses must be obtained by November 10, 2023; otherwise no new projects may be brokered on the platform.

The contents and information to be provided in the application for licenses do not only refer to the isolated description of the concepts for implementing the ECSP Regulation requirements. Additionally, information and, if applicable, attachments must be included that provide information on the proper business organization and control procedures. Essentially, the following information must be provided:

- General information about the applicant company (incl. articles of association)

- Business plan including a description of the range of services as well as marketing measures

- Disclosure of operational risks

- Information and evidence on regulatory collateral

- Information on the management and owners as well as proof of their suitability

- Information on the organization (e.g. description of the implementation of the requirements of the ECSP Regulation, information on governance arrangements, business continuity plans in the event of a crisis, description of internal control procedures)

Opportunities and challenges under the ECSP Regulation

For crowdfunding service providers, it remains to be evaluated which opportunities and challenges arise from the ECSP Regulation, depending on their business model as well as their strategic target products, target customers and target markets. With the transition period – taking into account the examination periods on the part of the supervisory authority – the legislator does not allow abundant time for the evaluation of such a consideration. Only recently, the transition period was extended from November 2022 by a further twelve months to give market participants who have not yet positioned themselves on the topic of ECSP the opportunity to adapt their processes (cf. Figure 1).

The following is considered an opportunity: according to the ECSP Regulation, crowdfunding service providers can offer crowdfunding products throughout Europe in a legally secure manner, thus opening up scaling opportunities for project owners (issuers) as well as the potential development of new business areas. At the same time, investors are offered the opportunity to invest in interesting projects throughout the EU. The intermediary-free brokerage of loans without a fronting bank allows for a leaner fee structure. In addition, the creation of sales prospectuses is replaced by a key investment information sheet.

The time-to-market of a crowdfunding project may be reduced as no permission from the BaFin for prospectuses is required.

However, especially young companies will also face challenges in implementing the requirements fully. They need to do so in order to be able to make use of the facilitations provided by the ECSP Regulation when offering crowdfunding projects across the EU. The liability regime holds administrative, management and supervisory bodies of the project owner responsible for misstatements in the key investment information sheet. It deviates from common liability regimes, under which the project owner is liable only in cases of gross negligence. The executive bodies of the project owner, such as the management or the board of directors, are already personally liable for any negligence according to the German “Schwarmfinanzierungsbegleitgesetz” (accompanying law on crowdfunding).

zeb & Osborne Clarke as partners

zeb unites in-depth banking know-how with the legal expertise of our partners and lawyers from Osborne Clarke. Together, we have a proven track record in supporting a wide range of licensing procedures and are able to offer the best possible conditions for successful organizational transformation.