|

LISTEN TO AUDIO VERSION:

|

Today’s cost management

Today’s cost management function, which has already been implemented in several areas, defines a new cost governance role and has contributed to the development of advanced forecast and planning methodologies (even in terms of zero-based budgeting), thus supporting the achievement of strategic objectives and profitability targets. Nowadays, even the design and development of new products is within the function’s scope by means of advanced cost analysis methods (i.e. structure, composition, elasticity) up to the use of the current logic of target costing and design-to-cost with respect to short, medium and long-term objectives.

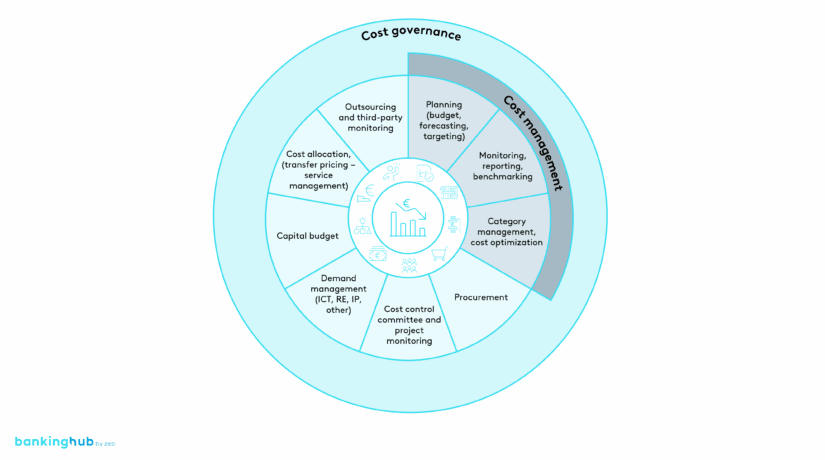

Over time, the above-mentioned dynamics have led to the development of separate and independent individual capabilities within the corporate organization and then to a gradual harmonization and tendency towards macrofunctions designed to ensure a consistent coordination within cost management and the pursuit of strategic objectives. To this effect, the different functions of procurement, demand management, cost planning, cost allocation, outsourcing, and cost reporting should thus merge into a cost governance area or at least introduce appropriate systems of close coordination and collaboration.

The current market and regulatory environment

Despite the important evolution of the role within the last two decades, the current setup of cost management functions in most banks – even in medium-sized/large ones – is apparently not sufficient to ensure the achievement of specific objectives in support of increasingly challenging targets in an increasingly competitive market environment: only those banks that have invested the most in developing cost governance roles and capabilities have demonstrated the ability to maintain excellent levels of operational efficiency over time, hence stabilizing their cost-to-income ratio (CIR) at values below 60%.

The economic equilibrium in terms of cost-revenue ratio of the entire industry is being even more threatened by new competitive dynamics and especially by the recent market entry of new players, often digitally native fintech startups – thus asset-light companies with lean cost structures – that are able to offer low-cost services.

In addition, the macroeconomic dynamics of recent years have led to decreasing profitability margins, forcing banks to act on cost levers – rather than on revenue – to maintain adequate levels of profitability.

Furthermore, in the last years, regulators have also intervened numerous times by introducing new requirements and specific regulations for governing relevant outsourced activities with the aim of reducing risks and ensuring appropriate management practices (outsourcing framework). This has produced a broader division of governance structures, greater organizational complexity and, consequently, higher internal costs.

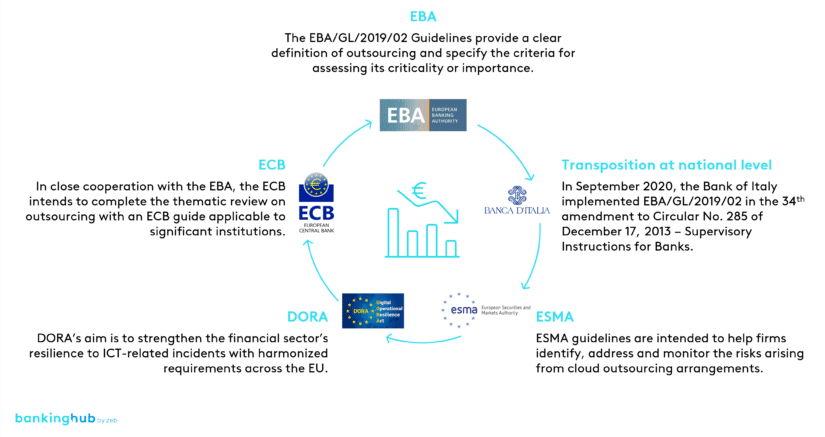

From the issuance of the EBA Guidelines (EBA/GL/2019/02), transposed at the national level by the EU Member States’ competent authorities, to the most recent ESMA guidelines and up to the further requirements under discussion in the Digital Operational Resilience Act (DORA), the supervisory authorities aim to establish a clear baseline for the end-to-end management of relevant outsourcing (in particular, ICT and cybersecurity) by harmonizing obligations at EU level and thus raising the Union’s standards in monitoring risks arising from technologies and digitalization.

The strategic relevance of cost governance structures

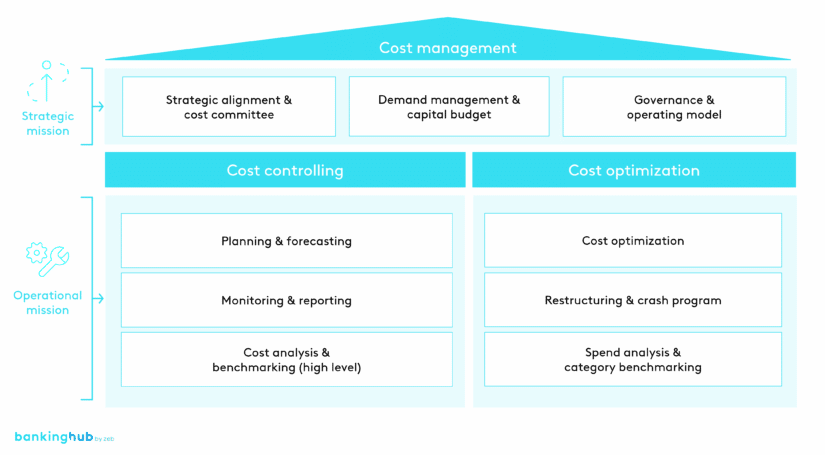

Considering the abovementioned market and regulatory pressures, a modern cost governance structure must be able to pursue relevant strategic objectives in line with current business dynamics. In particular, it must be able to ensure alignment with the short- and long-term objectives specified by the top management and in the strategic plan and therefore to act through a wide range of specific levers: direct or indirect intervention on all cost items, demand management in a forecasting perspective, advanced budgeting capabilities, direct monitoring of investments and project costs, optimization of the operating model (e.g. make-or-buy decisions).

With respect to the more directly operational objectives, the cost governance structure must pursue adequate cost control (e.g. through appropriate planning and forecasting models, monitoring and reporting, analysis and benchmarking) and (directly or indirectly) initiate cost optimization interventions (also through restructuring or crash program measures).

In summary, based on the experience gathered by zeb in over 10 years of operating in this area, the effectiveness of cost management activities derives from the right balance of skills, profiles, legitimization and role.

- Span of control: horizontal (categories, accounting items) and vertical coverage (governance of the entire cost chain, capability to intervene on need/demand, purchase, consumption) as extensive as possible for greater capability to intervene

- Organizational structure: inclusion in the organizational structure in order to legitimize the role and ensure an effective governing and directive capacity (even with a top-down approach, where necessary)

- Strategic approach: ability to optimize costs with respect to strategic objectives, intervene and predict business, market and supply dynamics (also in terms of digital transformation), and to define medium- and long-term targets (based on KPIs)

- Processes and tools: direct management of expense accounts, capital allocation, advanced short-term (forecasting), medium (t+1) and long-term (3-year target) planning capabilities, with a zero-based perspective, adequate tools for reporting and cost allocation

- Managerial skills: adequate qualitative and quantitative resources (sizing, people and tools) and (technical and managerial) skills that allow a constructive comparison with the budget owners and ensure an adequate level of coordination between various roles (integration management)

- Incentives: reward systems for achieving efficiency objectives also aimed at individual category managers / budget owners for greater accountability and a common effort to achieve efficiency targets

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

An organizational setup tailored to the mission

To allow the cost management function to operate effectively and achieve its objectives, it will be necessary to adequately embed it within the complex hierarchies that generally characterize the corporate organizational charts of banks and insurance companies.

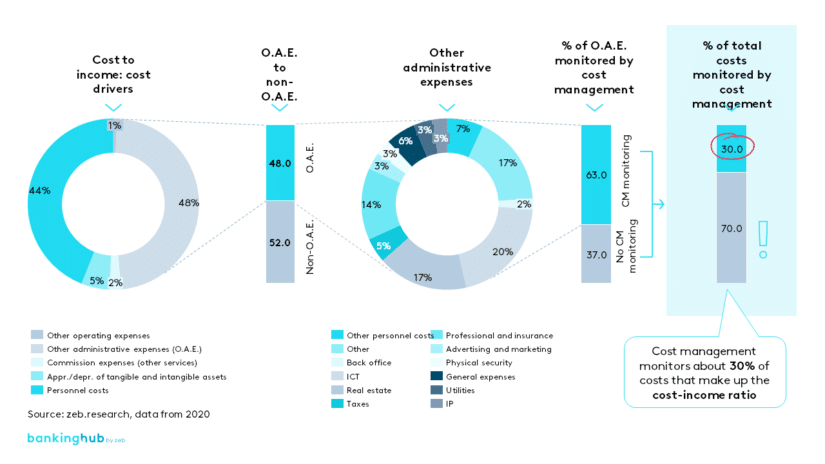

To date, the prevailing structures of cost management units in the market seem to be able to directly oversee only a part of operating costs, usually not exceeding 30%.

Compared to traditional models – which place the cost management function in the Finance division (CFO area) or Operations (COO area) – the setup that seems to guarantee the cost management function the greatest effectiveness and possibility to intervene is the one that positions it in a special governance area reporting directly to the CEO, in the role of Chief Cost Management Officer (CCMO) and by establishing a real center of governance. This center should incorporate most of the functions already indicated that insist on the cost management process. This setup can ensure a wide span of control, a top-down approach and the legitimization of the role.

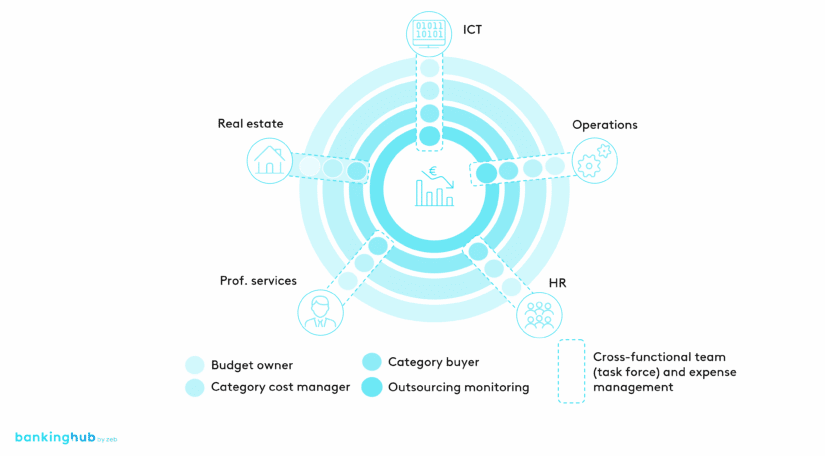

An effective model includes a coherent structure of the various organizational units involved in the cost management process based on high-level expense categories.

The creation of cross-functional teams (task forces) for each high-level cost category (e.g. ICT, Operations, HR, etc.) based on the close collaboration between budget owner, category cost manager, category buyer and – if applicable – outsourcing manager, is able to generate significant synergies of scope as well as spontaneous coordination.

A possible solution, which does not modify the organizational chart, is to align operating methods between different functions, with the clear aim of establishing consistent and homogeneous cross-functional collaboration areas in terms of ownership.

Innovation and digitalization in cost governance

Alongside the traditional intervention measures for refining the cost management role and the useful ideas indicated above, innovative disruptive elements have recently emerged which derive from the introduction of technologically advanced solutions and tools.

These methodologies are still a long way from a possible mass application in the short term; however, they already indicate important perspectives for defining the function’s right development road map.

Among these, full process automation in terms of an integrated order-to-pay cycle (procure-to-pay) represents a first solution to increase the level of effectiveness of the entire purchasing process. This solution can minimize operational impacts, increase transparency, ensure a high level of control and a consequent wide availability of data and information. Innovative analysis skills can also be obtained by introducing multi-dimensional cost allocation models that allocate each cost unit in real time to different perspectives, such as organizational units, divisions, channels, segments, customers, products. By applying dynamic reporting models, it is also possible to return personalized information to different stakeholders, thus increasing the level of transparency and accountability regarding the achievement of results.

Finally, new solutions around advanced analytics are also being adopted in the financial services sector in the context of costs and, in particular, their optimization: new software and advanced analysis capabilities can identify relationships between different cost determinants and indicate possible reductions. The collection of large data structures (e.g. invoices, requests, GPS tracks, sensors, databases, Web, comments, videos, IM chats, feed news and more) and their subsequent analysis process allow to create value by discovering hidden patterns, unknown correlations, market trends, user preferences, ideas for operational process optimization and other information useful for making increasingly effective decisions.

Conclusion on the cost management evolution

The efforts made over the last decade to contain costs have certainly produced important and significative results for a sustainable profit and loss account. However, we are convinced that a further push towards the evolution of cost management models can ensure greater governance capabilities, greater proximity to business dynamics and the achievement of a target efficiency level. Over time, the development of these capabilities has proved an excellent investment, able to ensure returns and avoid possible physiological “drifts” towards sudden cost growth.