|

Getting your Trinity Audio player ready...

|

Sustainability reaches funding of banks

In the wake of 7th MaRisk amendment, more and more requirements pertaining to ESG/sustainability are finding their way into risk management. There is already a method to assess a financial institution’s direct and indirect carbon emissions: so-called carbon accounting.

Moreover, the ECB has announced that it will make the disclosure of climate risks a possible precondition for the purchase of corporate bonds. On top of that, it has been clear since the end of 2022 that banks will have to publish the Green Asset Ratio of their balance sheets in the future.

The Paris Agreement requires its parties, i.e. almost every country in the world, to reduce their CO2 emissions to net-zero. This global development leaves banks with no choice but to position themselves in terms of climate protection. Their ESG or sustainability strategy should at least contain goals for the following areas:

- governance/business organization (e.g. climate-neutral company, risk management, disclosure),

- HR policy / social commitment (e.g. promoting families, political positioning),

- sales/processes (e.g. digitalization), products/services (e.g. sustainable products, exclusion criteria)

- and capital investment (e.g. impact investing).

Green funding as part of strategic ESG positioning

Furthermore, each bank should define when and how it wants to achieve net-zero emissions. Green funding plays a crucial role in this strategic ESG positioning, as the funding of green projects reduces indirect emissions (Scope 3[1]), i.e. the emissions of the customers in their portfolios. By cutting down the “CO2 concentration” of their balance sheets, banks contribute to achieving the net-zero target, to closing the billion-dollar gap in private climate financing, and to improving their public image in terms of ESG.

Thus, the topic has not only arrived in risk management, asset management or corporate banking, but also in treasury or related areas. This affects in particular the following ranges of tasks on both sides of the balance sheet:

- Proprietary trading account management: how sustainable is my investment portfolio?

- Funding through sustainable bonds or deposits: how sustainable is my funding?

In this article, we will focus on the funding aspect, using green bonds and customer deposits as specific examples.

Green bonds exemplify the increasing attractiveness of all types of sustainable bonds, including, for example, social bonds. In principle, sustainable bonds are interest-bearing securities where the funds are used to generate a positive impact on sustainability (pertaining to all three dimensions of ESG) or is at least intended to promote the development towards greater sustainability. Many banks voluntarily commit themselves to standards such as the Green Bond Principles established by the International Capital Market Association (ICMA), which define appropriate uses for issue proceeds as well as suitable reporting modalities.

Green (or social) deposits, in contrast, are associated with an explicit obligation towards the customers: they can only be used to finance environmentally friendly (or social) projects or investments. Both of these tools open up new funding opportunities for banks. Due to potential cost advantages, competitive pressures and new regulations, they must be integrated into the treasury strategy by all means.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Sustainable bonds are growing fast – and offer spread advantages

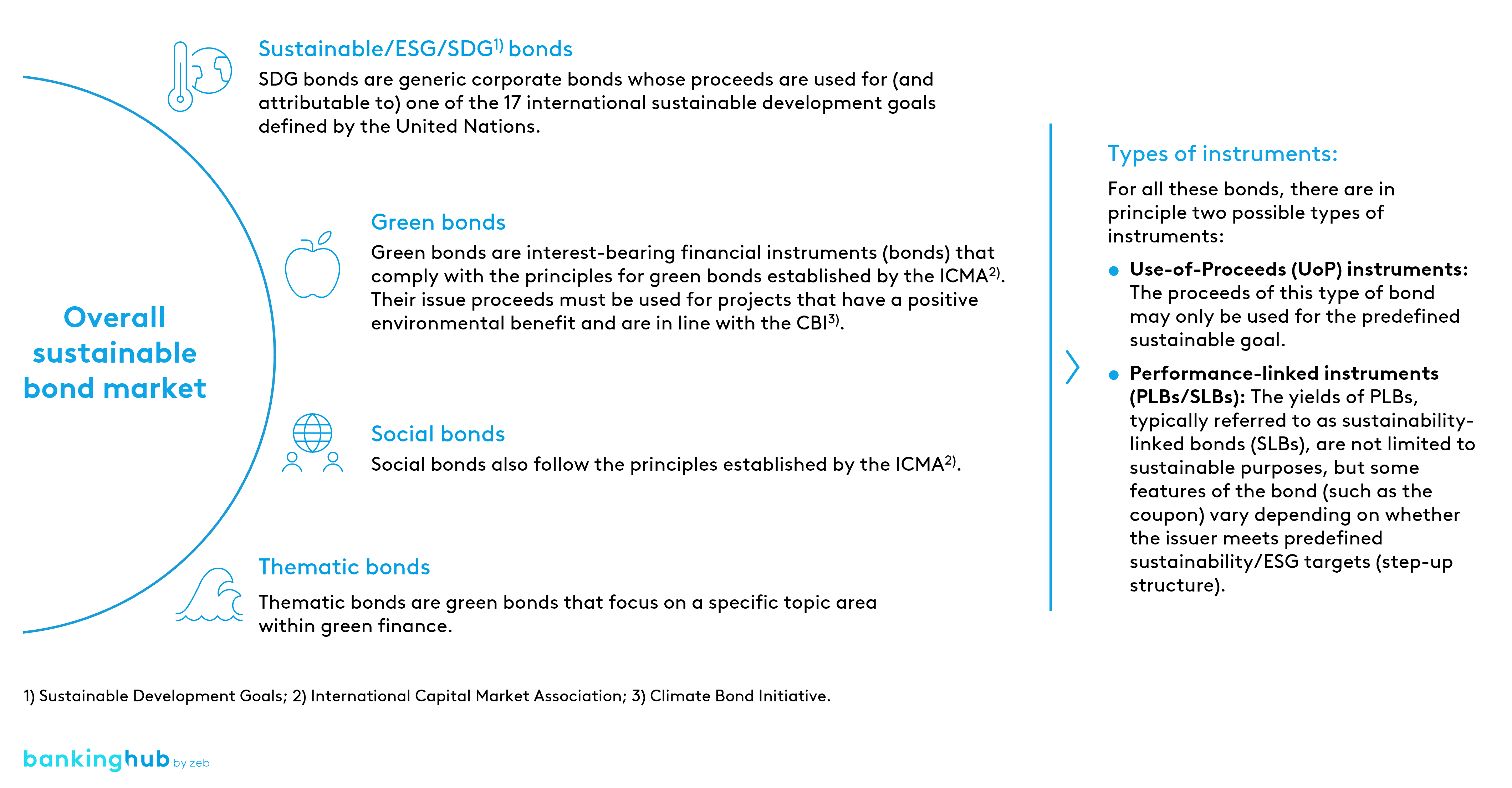

The market for sustainable bonds offers a wide variety of products with many different names. However, over the past few years, the different categorization systems have aligned into a mostly homogeneous taxonomy, which essentially distinguishes between three categories: sustainability bonds, also referred to as SDG bonds (SDG = Sustainable Development Goals), green bonds and social bonds (see Figure 1).

Another category – thematic bonds – comprises bonds that are focused on a specific topic. The process of standardization is mainly driven forward by international industry associations such as the ICMA, which has defined minimum standards, including specifications for the required reporting (further information on general ESG reporting for banks can be found here). On another level, the instruments can also be subdivided into use-of-proceeds (UoP) and performance-linked bonds (PLBs).

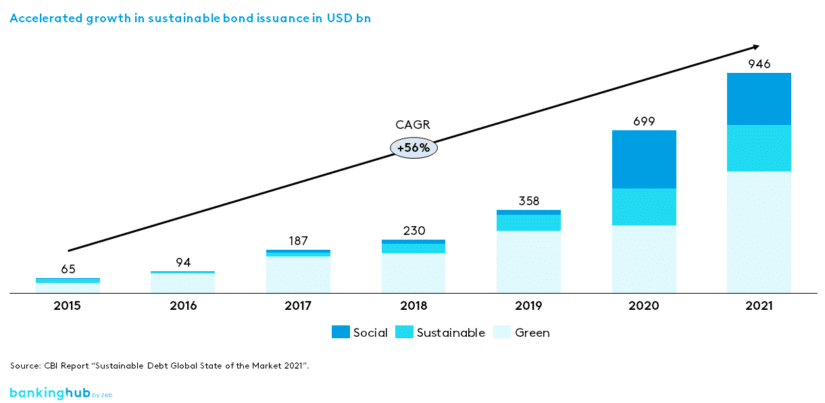

In 2021, the total issuance volume of green, social and other sustainable bonds continued to grow strongly in comparison to the previous year, amounting to about USD 950 billion (see Figure 2). This means that the issuance volumes of sustainable bonds grew by more than 50% per year from 2015 to 2021. However, the market disruptions resulting from the Russian war of aggression against Ukraine led to a temporary decline in issuing activity.[2] Investors are very interested in ESG bonds, as was impressively demonstrated in October 2021 by the European Commission’s first green bond issue, whose volume of EUR 12 billion was eleven times oversubscribed.[3]

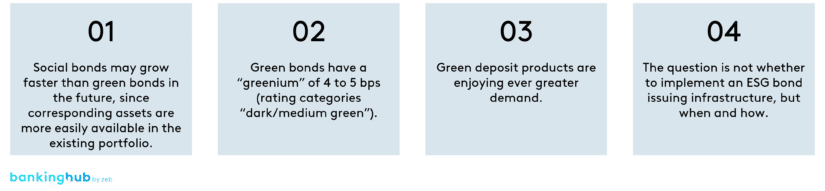

While green bonds made up the lion’s share of ESG bonds until 2019, the market for social and other sustainable bonds has been gaining a lot of momentum since then, especially in 2020 and 2021. What stands out here is the huge increase in social bond issuance within a single year from USD 22 billion in 2019 to USD 248 billion in 2020. This is, to some extent, due to the fact that these assets are easier to obtain as well as identify[4]. Therefore, not only green bonds, but also social bonds should be kept firmly in view.

“We consider the initial issuance of a social bond more likely than that of a green bond, since in comparison to green assets, social assets are a lot easier to identify in sufficient volume within the balance sheet of existing business.” (Client quote, anonymous)

Various studies have shown that while the increase in all types of sustainable bonds is accelerating, green bonds in particular can carry a so-called “greenium” (this corresponds to a spread cost advantage specific to this type of bond). One of the most recent studies (Dorfleitner et al.[6]) analyzes possible “greeniums” in correlation to a “green” SPO rating. According to this study, green bonds with no SPO at all have a “greenium” of 1 bps; those with a light green or brown SPO rating achieve 3 to 4 bps, and those with an SPO rating in the “dark/medium green” range have the highest “greenium” of 4 to 5 bps. The study confirms that green bonds are “rewarded” by the market; therefore the “greenium” of an institution-specific issue should accordingly be assessed on a bond-specific basis.

Green deposits rely on customers’ sustainability goals

Banks can achieve ESG-compliant funding not only via sustainable or green bonds, but also via their customers’ deposits.

The term “green deposits” is still less standardized than “green bonds” and comprises a significantly wider array of products. However, all products have one basic idea in common: to use the customer deposits exclusively for assets with a sustainable purpose. Essentially, providers of sustainable deposits follow three principles for investing or lending from these funds:

- Investment philosophy: customer deposits may only be invested in projects and companies that meet certain sustainability criteria (e.g. UN Sustainable Development Goals).

- Exclusion Criteria: customer deposits must not be invested in certain industries (e.g. armaments, tobacco, fossil fuels, etc.).

- Transparency: banks provide customers with information on what their deposits were used for and what environmental/social effect was achieved.

Market developments show that the demand for sustainable deposits such as sustainable current accounts is steadily increasing and customers are becoming more aware of the positive or negative impact their bank has on the environment and society. New players and fintech companies have already recognized the potential, and established banks are also trying to capitalize on this trend with specialized products.

Conclusion – advantages of sustainable funding sources

Sustainability is currently an omnipresent topic – the question is no longer whether, but how and when to address this issue, and banks are no exception. When it comes to their funding strategy, banks also have to deal with the growing shift in priorities within society as a whole and among the relevant stakeholders in particular. They have two main funding sources at their disposal to account for this:

- Issuing their own sustainable bonds

- Funding through sustainable deposits

As a first step, the institution should analyze which ESG assets and funding instruments fit into their strategy and promise the most success.

In summary, green funding offers the following key benefits:

- Funding cost advantage due to partially lower spreads for sustainable bonds

- Larger available market funding volume (sustainable volume will increase, conventional volume will decrease in the long run)

- Reduced CO2impact of the overall bank portfolio (if measured and managed accordingly)

- Funding diversification and stable long-term access to funding markets

- Reputational advantage through authentic positioning as a sustainable institution

- Good starting point for adapting to possible new ESG requirements imposed by the 7thMaRisk amendment (e.g. by already having prepared the data accordingly and done the necessary portfolio drilldowns)

“We do not primarily want to issue green bonds for the possible spread advantages; instead, one of our main drivers is the marketing aspect.” (Client quote, anonymous)

At zeb, we believe that there is no way around dealing with sustainable funding sources in the long term, as they will become increasingly important at all levels. This development is driven forward by investors, customers, regulators and employees, among others. In the medium term, there may even be a decline in conventional funding volumes, or new regulations may restrict the use of non-sustainable funding sources. Starting with the conceptual design and implementation as early as possible is therefore not a mere “nice-to-have” investment, but gives banks a decisive head start.

Our four key takeaways: