|

Getting your Trinity Audio player ready...

|

Crypto securities registers and electronic securities

As part of the Electronic Securities Act (Gesetz zur Einführung von elektronischen Wertpapieren, eWpG), the financial service of maintaining a crypto securities register was defined in Germany in 2021. Registers are maintained for electronic securities issued using distributed ledger technology (DLT).

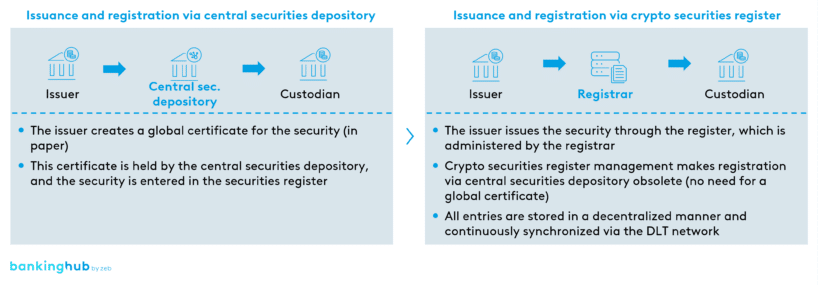

Apart from the new type of issuance, the main difference between traditional and electronic securities lies in their safekeeping. While traditional, certificated securities are physically held by a central securities depository as a global or collective certificate, electronic securities can be maintained in a crypto securities register[1]. Legally, electronic securities have the same status as traditional securities.

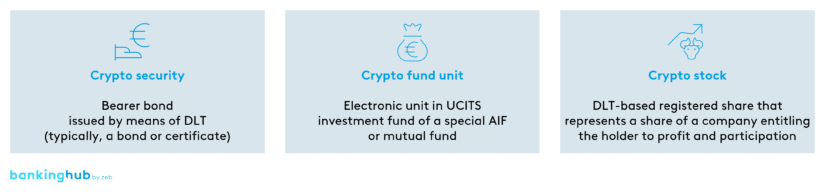

The following forms of electronic securities can be kept in a crypto securities register:

Crypto securities registers transparently record ownership of the electronic securities shown above and allow changes of ownership to be carried out by means of transfers.

The difference to central securities depositories is shown in the following illustration:

The key role of the register solution

One of the main advantages of implementing the register using a DLT: not only can securities be kept safe in this ecosystem, but life cycle management processes can also be automated. The register solution must therefore be designed from the outset to be flexibly integrated into existing systems and processes while remaining open to the automation potential of DLT.

The integrability of the register solution and its interoperability with other systems are basic prerequisites for leveraging efficiency gains in all phases of integration and market development. The register solution therefore plays a key role in the successful introduction of electronic securities.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Levers for a register solution’s successful market penetration

Infrastructure

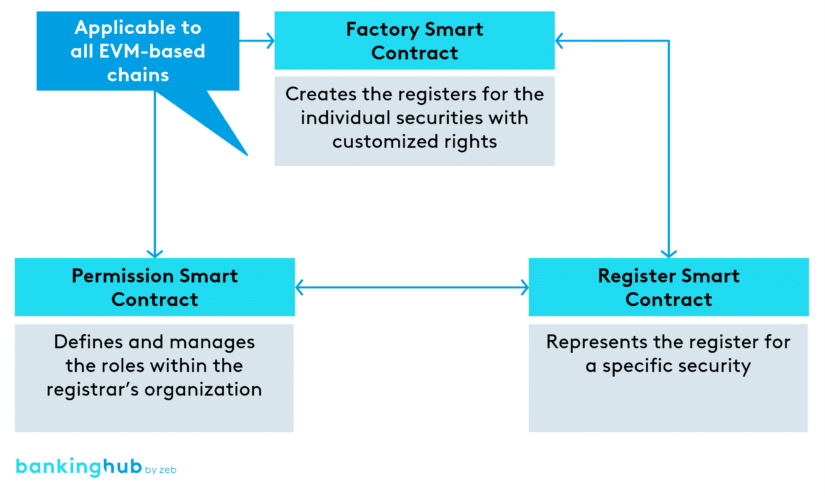

Even though the eWpG is fundamentally designed to be technology-neutral, the obvious technology for implementing DLT is a blockchain. Among the various blockchain protocols, market acceptance is highest for EVM[2]-based protocols, which allow for the implementation of smart contracts for tokens and business logic rules.

Therefore, EVM-based solutions currently offer the biggest potential for interoperability at DLT level. The following figure shows an example of a register solution from tokenforge that is eWpG-compliant and can be used interoperably with various EVM-based protocols.

Essentially, the selected infrastructure must fulfill the following three requirements:

- Serve as the basis for efficient, scalable and transparent rights management regarding access to the register and the registrar’s intervention capabilities

- Ensure interoperability with other systems based on DLT

- Safeguard confidentiality and investor protection.

In particular, confidentiality, which is a prerequisite for single entries in the register, poses a challenge under data protection law. This is especially true in the context of the potential visibility of transaction information for third parties when transactions are executed via public blockchains. To address this challenge, some financial institutions are starting to introduce collectively registered electronic securities.

A register solution based on a customized DLT infrastructure (public and private) ultimately combines the best of both worlds. It offers all market participants free access to smart contracts in the public register (public) on an interoperable basis. At the same time, interoperability is ensured based on a private rights and roles concept. Access to information and functionality in the public register is regulated by underlying roles in the associated private system (private in terms of permissioning).

In general, this register solution can be integrated with the standard banking systems via corresponding interfaces, eliminating any need for manual workarounds. This requires an advance analysis of the automation potential and a step-by-step approach to implementation. Over the next few years, parallel operation of the register solution based on decentralized technology and existing (legacy) systems will continue to take place, enabling institutions to successively drive forward the automation of their issuing business with electronic securities and their transferability.

Product range

It is generally advisable to start in a pilot phase with electronic securities that have a manageable level of complexity (e.g. without distributions) in order to gain initial experience with the new technology. As described above, the main focus is on collective entry naming a custodian instead of single entry naming an investor, as the latter is more complex than the collective entry of electronic securities.

The following assessments can be made regarding the three forms of electronic securities:

- Crypto securities: Plain-vanilla instruments such as zero-coupon bonds are best suited for piloting a crypto securities register since no coupon payments or complex product structures need to be implemented, as would be the case with certificates.

- Crypto fund unit: In the fund sector, settlement via a crypto securities register is inherently associated with a large number of processes, simply because the depositary function – which isn’t necessarily the registrar – must interact with the register. Typically, a dedicated user at the custodian must initiate or confirm unit transfers of electronic securities via the DLT network. It is also questionable how unit certificates are issued or redeemed via the register. This could be considerably more complex, especially for mutual funds, compared to special AIFs. It is therefore recommended to gradually integrate crypto fund units into the register after crypto securities and, if possible, to start by issuing special AIFs.

- Crypto share: According to the German Future Financing Act (Zukunftsfinanzierungsgesetz, ZuFinG), crypto shares are a novelty in the context of maintaining a register. Due to their form as registered shares and their lack of marketability, the use cases of crypto shares are currently limited to private equity. Crypto shares could open up exciting use cases in this area, but these will only become apparent once the crypto securities register is market-ready.

Transfer and custody capability

Fundamentally, a register solution based on an EVM-compatible blockchain enables the transferability and safekeeping of securities. One important factor here is how efficiently it can be integrated into the existing investor identification and anti-money laundering systems.

Another critical point is interoperability which enables efficient and scalable integration into marketplaces. As mentioned at the beginning, electronic securities are generally non-marketable when issued via a crypto securities register. This typically leads to a media break between the issuance of electronic securities via decentralized technology and trading via traditional systems.

To ensure that the register solution is not used exclusively to record ownership of electronic securities, the solution is forward-integrated via the tokenization of electronic securities. By means of tokens and their safekeeping using a wallet, a more efficient transfer via decentralized technology can be achieved and thus, in future, the connection of marketplaces, too.

Target operating model

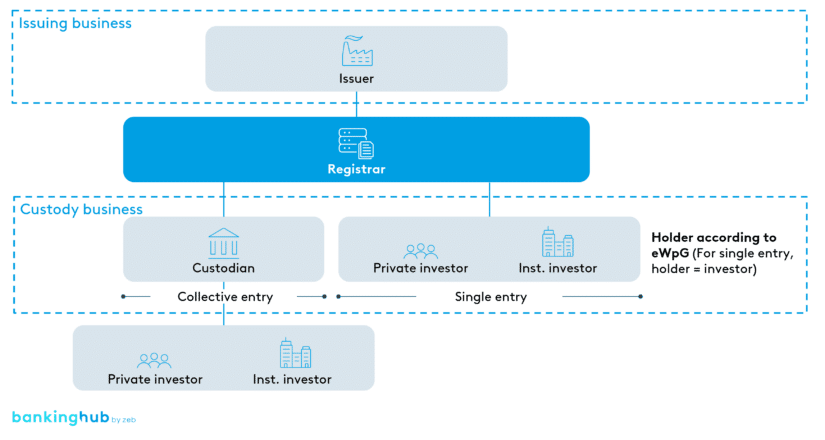

The crypto securities registrar has the task of creating a secure DLT ecosystem with the registry. This includes the responsibility of identifying and verifying register participants. The registrar is also responsible for the administration of the register processes, with a focus on the registration of ownership of electronic securities.

In a financial institution, register management usually falls within the responsibility of a product owner from a specialist department with expertise in documentation in the capital market business. Typically, the product owner takes on the centralized coordination of the register participants (issuers, holders, etc.). The role of the registrar in interaction with issuers, custodians and investors is depicted in the following diagram:

Reality check and outlook

The successful introduction of a crypto securities register must create added value for customers, making financial instruments more cost-efficient, more convenient to use and faster in settlement. These advantages can be leveraged in the future, but currently the crypto securities register is still a parallel system to the existing securities infrastructure.

Linking it to legacy systems does not necessarily have to be complex and time-consuming. The eWpG offers the possibility of initially linking the existing processes of securities account management with a crypto securities register via collective entry. In a second step, single entry can then be evaluated and integrated in the appropriate asset classes.

A large part of today’s business with bearer debentures and funds – and in future also shares – can certainly be addressed. However, there is a limited capability to handle this business via a crypto securities register, as electronic securities currently do not have central bank[3] and stock exchange eligibility.

In practical implementation, the lack of scalability due to manual processes and missing interfaces are currently limiting the volume that can be handled. Accordingly, the issuance of electronic securities via a crypto securities register does not yet offer any efficiency advantage, as investments in interfaces and processes are necessary first for volume stability.

From the perspective of tokenforge and zeb, an essential prerequisite for volume stability is the tokenization of electronic securities in order to enable trading and transfers in wallet infrastructures and thus significantly strengthen the market development of electronic securities. The advantages of the crypto securities register will probably only be leveraged when a uniform market standard has developed. For this reason, tokenforge, for example, is involved in the Federal Association of Crypto Securities Registrars and contributes to the development of such a standard as head of the standards working group.

Early strategic positioning of financial institutions now offers the opportunity to gain market share as an early mover and to be perceived by customers as an innovative institution.