|

Getting your Trinity Audio player ready...

|

Digitalization – five digital topics

From ecosystems to artificial intelligence

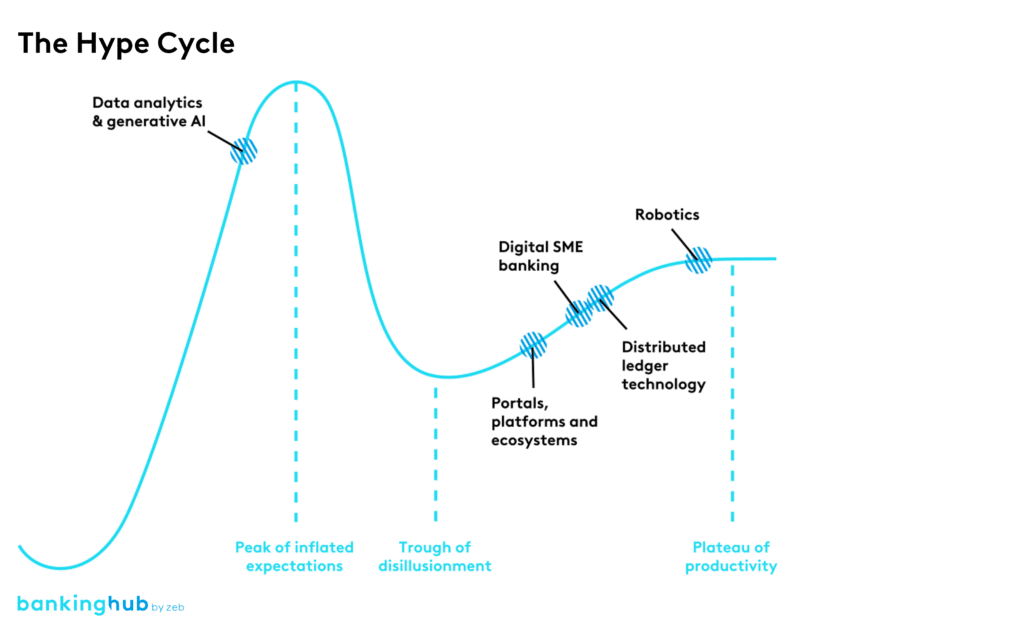

To better assess the status and potential of technological innovations, it is often helpful to keep in mind the “hype cycle” model developed by Gartner consultant Jackie Fenn. This is exactly what zeb has done for the area of “digitalization in corporate banking” – from portals, platforms and ecosystems to the much-discussed artificial intelligence and digital SME banking.

Platforms and ecosystems offer the most growth opportunities. For example, banks can pursue different strategic approaches: If they are able to process a lot of traffic, they can act as platform operators themselves. If their expertise lies in the area of products, they can market these via other providers’ platforms. Ecosystems linking banking and non-banking services are even less common than platforms.

AI can help keep customers engaged and drive new sales, ensure fast and efficient processes and make effective decisions, especially when combined with proven methods of data analytics. There are promising use cases for distributed ledger technology, such as smart contracts and tokenized securities. Banks are also using robots in a variety of ways to automate processes.

SME business is attractive to banks – and increasingly digital. A number of fintech companies have stirred up the market with all-digital banking and lending offerings. In this competitive environment, it may be well worth positioning one’s business with an ambitious strategy.

Sustainability – attractive offerings for corporate customers

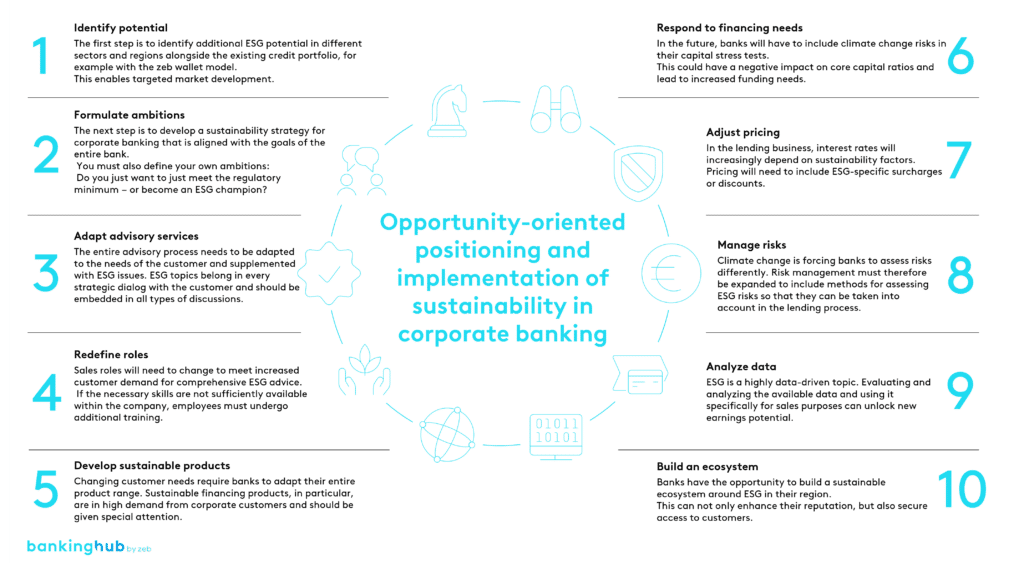

At EUR 322 billion per year, the need for ESG investment in Germany is huge. In order to implement the ambitious climate protection plans of the EU and Germany, the entire economy must be transformed. In this context, banks play a key role.

Four drivers can be identified in the corporate banking sector:

- customers ask for it,

- the competition is already on the move,

- the earnings potential is huge,

- and the regulator demands it.

The following chart shows the ten key steps zeb has defined for anchoring sustainability in a company’s business by repositioning oneself and implementing appropriate measures.

Personnel – maintaining clout as a bank despite staff shortages

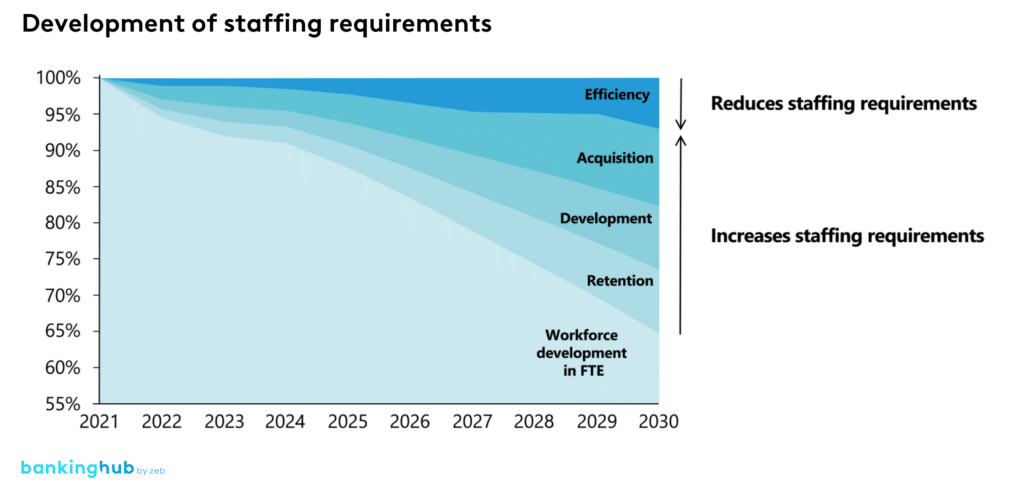

The shortage of skilled workers has been a topic of discussion for many years. Yet the extent to which it will affect competition in the future is still underestimated. The forecasts, however, are clear: by 2040, the German economy will have to get by with around five million fewer skilled workers. In such a world, human resources will become the decisive competitive factor.

For banks, the shortage of skilled workers is not only a major problem, but also an urgent one. If demand remains unchanged, they will face a shortage of around 30 percent by 2030. For reasons of efficiency, this assumption of unchanged demand will not hold, as the use of AI and robotics, for example, means that certain areas of activity will no longer need to be staffed in the future. Nevertheless, there will still be a huge workforce gap that needs to be filled. A holistic approach is needed to overcome the shortage of sales professionals in corporate banking.

Such an approach consists of specific measures that can be categorized into three operational fields of action:

- targeted employee recruitment,

- employee qualification,

- and, above all, employee retention.

In addition, banks need to consider their HR approach as a strategic field of action. The following figure shows the levers for closing the workforce gap by 2030[1] (in FTE).

What areas should banks focus on to optimally leverage their future earnings potential?

Find out our answers in the free whitepaper on zeb’s 10th Corporate Banking Study.