Steadfast island with income from private client business

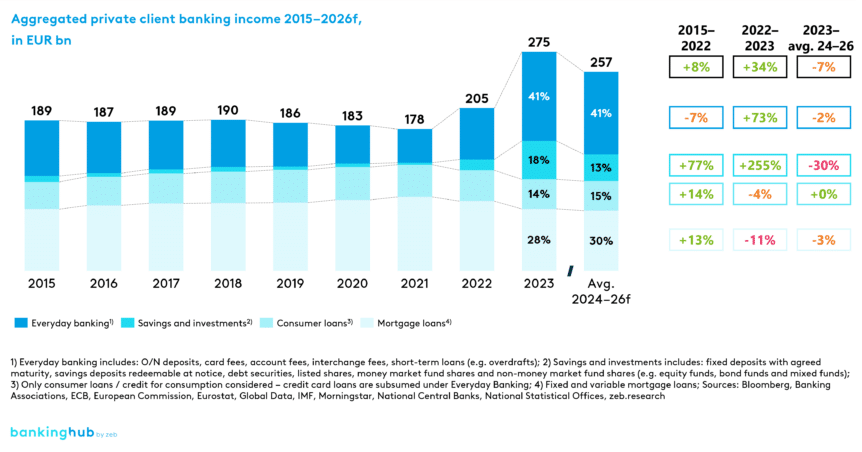

For too long, the European private client business was treading water. Looking at the balance sheets of households from eleven European core markets[1], the aggregated private client banking income amounted to around EUR 185 bn from 2015 to 2021, with a low of EUR 178 bn in 2021. This has changed significantly since the renormalization of monetary policy and the introduction of a new interest rate regime in 2022.

As a consequence of elevated rates, income pools increased to a whole new and higher level of EUR 205 bn (+15% year-over-year) in 2022 and EUR 275 bn (+34% year-over-year) in 2023. This surge resulted mainly from a year-over-year increase in everyday banking as well as savings and investments by EUR 33 bn (2022) and EUR 82 bn (2023).

In the coming years, European private client banking income will likely normalize on a new and higher level with a forecast average income pool of EUR 257 bn throughout 2024 to 2026 – thus a little lower than in the extraordinary year 2023, due to some transitory effects from legacy business activities and a normalization of monetary transmission, especially on the deposit side.

Despite the challenging environment and a modest decline compared to 2023, 2024–2026 income potentials are expected to be 38% higher than the 2015–2021 levels:

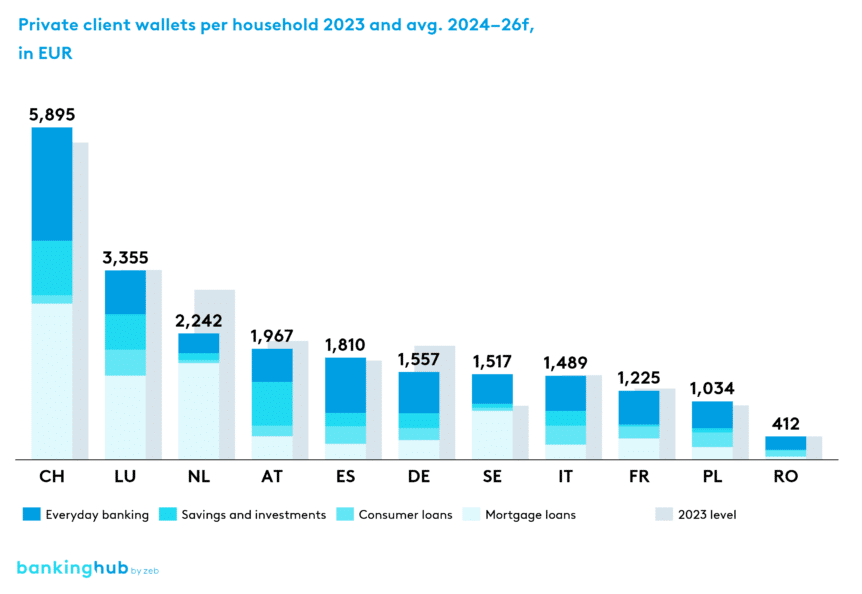

Each harbor has a unique entrance

Private client income wallets per household (HH) vary significantly in size and structure across markets. The expected unweighted average private client wallet per household for 2024 to 2026 stands at EUR 2,046/HH, while Germany takes the median value of EUR 1,557/HH. Romania as a small but growing market brings up the rear with EUR 412/HH in contrast to well-established and systemically and structurally advanced Switzerland with EUR 5,895/HH.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Hoist the sails! Value creation ahead!

The current top-line outlook is also indicating good news for the bottom-line value creation perspective. When applying country-specific averages, standard cost-income ratios, stable loan-loss provisions and risk densities as well as capital parameters, double-digit RoCET1 figures can be expected from the European private client business overall (average of ~14% for 2024–26). With an assumed average cost of equity for the private client business in the range of 10% to 11%, this implies substantial positive value creation.

This value creation is observable across market types – for mortgage and hence capital-heavy markets as well as for the less mortgage-dominated markets with lower average income, but also lower capital needs. While these results look very promising, they are also sensitive to parameter changes. A deterioration in economic conditions, with subsequent increases in risk costs and RWAs, can easily wipe out significant portions of value creation. Yet, the current operating cost situation in several markets is indicating a substantial potential to compensate such effects or to generate a respective cushion, especially when leveraging client behavior and technology trends.

Despite the strong tailwinds, banks have not entered the land of milk and honey that ensures attractive returns without requiring work on the business models.

Gaining the potential rewards of the new era requires efforts in a couple of areas critical to success:

We have set out additional forecasts and recommended actions in our zeb.focus paper “European private client business 2024–2026: steadfast island in the storm”.

You can download it here for free! (German version only)