Gen Z and the securities business

What characterizes Gen Z in terms of financial services and the securities business and what is particularly important to them?

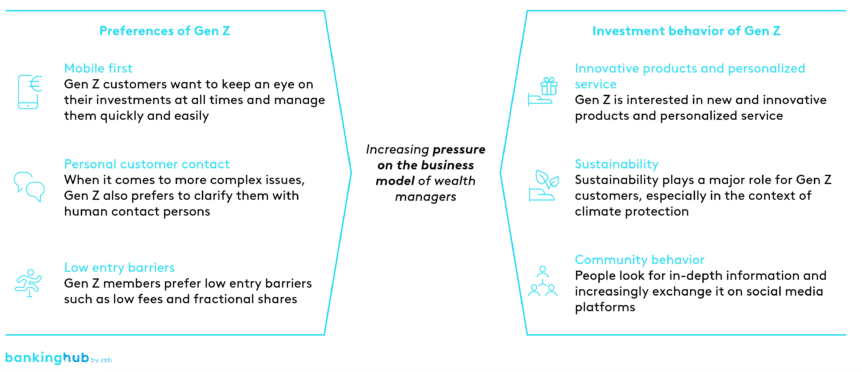

“Generation Z” (“Gen Z”) refers to people born between 1995 and 2010, the first generation that grew up with digital technologies. The use of mobile devices is closely associated with Generation Z. The commercial socialization of this customer group is strongly linked to the use of smartphones, apps, etc. Banks and wealth managers must therefore pay particular attention to these channels.

Incidentally, this applies not only to execution-only business models[1], but also to advisory use cases or portfolio management, which often does not yet take place in mobile channels.

Reaching Gen Z customers

Is a personal relationship still relevant for Gen Z customers, and if so, how can providers maintain this as digitalization increases?

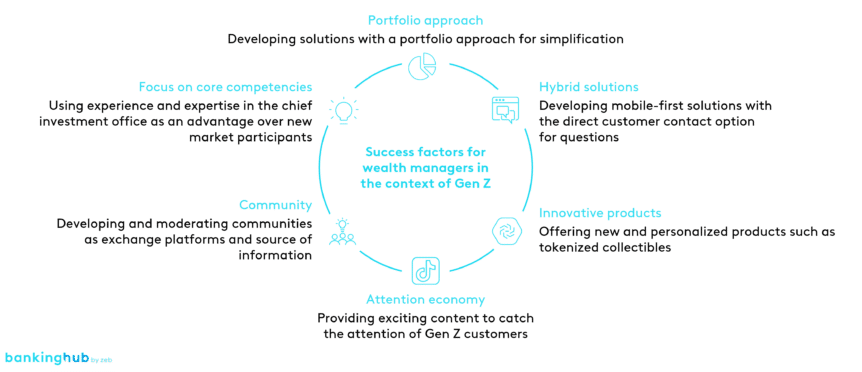

Despite all the developments towards digitalization, we can observe that customers of all ages still prefer to talk to a human contact person when it comes to complex financial issues. However, the banks’ contact offers must also be in line with economic aspects, so this is not always an option.

Furthermore, banks must increasingly ask themselves how they can catch the general interest of the younger generation in an ever more digital world. Amid the ever-increasing range of information and services on offer, banks must be guided by the concepts of the so-called “attention economy”. The aim is therefore to attract “attention” through exciting content, increase the level of customer activity through customized services and ultimately turn customers into advocates.

What innovative technologies are used in wealth management and the securities business to reach Gen Z customers?

Certainly, digital mobile access channels play a special role. However, corresponding offers are more of a must than an option. What’s important is a highly personalized service offering and content that is not exactly off-the-shelf.

In addition, banks can position themselves with innovative products that catch the particular interest of young customers. “Digital assets” are the key, as they allow for non-fungible assets to be traded. Take tokenized sneakers, for example, which can now be regarded as an asset class of their own.

Using fractional shares and massively reduced transaction costs, highly diversified portfolios can be built up with a low capital investment, but customers can quickly lose track of them. Digital solutions for portfolio analysis, portfolio structuring, etc. should therefore generate particular value for these customers.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Investment decisions of Gen Z

What characterizes the investment behavior of Gen Z and which investment strategies do you consider most attractive for Gen Z customers?

Many young customers make surprisingly sensible investment decisions. They not only read up on it, but also exchange information in forums and communities and seek the advice of other community members. ETFs and, in particular, individual shares are key here, as transaction costs are playing an increasingly minor role thanks to new business models.

Fractional shares also eliminate the need to buy entire shares. It can therefore be assumed that many portfolios exhibit an astonishingly high level of diversification. Investment approaches that focus on the right portfolio structure should certainly have a strong appeal to Gen Z.

Do Gen Z customers also take ethical and social aspects into account when investing? If so, which ones play a particular role here?

The so-called “Great Wealth Transfer” to the younger generations acts as a catalyst for ethical and social aspects. Aspects relating to the protection of the environment should be of central importance here. Against this backdrop, banks need to ask themselves whether they are simply aiming for the regulatory minimum when implementing the ESG guidelines or rather trying to go one step further.

Challenges and competition

What other challenges do wealth managers face when serving Gen Z customers?

Gen Z is strongly characterized by its community behavior. Investment ideas are discussed on social platforms such as Reddit. Community members advise each other on their portfolios, and their own portfolios are posted on the social platform. Banks must therefore think about ways to provide their young customers with technological support to meet this customer need.

They should also check whether they are in a position to organize, curate and moderate their own communities instead of leaving the field to others. Customer service with a community approach can meet the needs of the younger generation very well.

How can established wealth managers and banks stand out from neobrokers, robo-advisors and other fintech companies in the securities business?

Many neobrokers, fintech companies, etc. today often offer pure execution-only or brokerage services. Banks can offer young customers additional services relating to cards/credit, etc. and thus clearly set themselves apart from their very sharply positioned competitors.

In addition, established wealth managers usually have a powerful chief investment office with knowledge, research, market opinions, etc. that pure brokerage providers cannot draw on. This is an important ace that can make all the difference when played cleverly.