|

Getting your Trinity Audio player ready...

|

The key aspects in the paper of the Basel Committee are two alternative approaches for the identification of capital requirements for interest rate risks in the banking book (consultation phase ended on September 11, 2015):

- Pillar I approach: Calculation of regulatory capital requirements for the interest rate risk in the banking book based on a standard model defined by the BCBS.

- Pillar II approach: Identification of interest rate risks in the banking book based on an internal model which can be defined by the banks themselves. However, design will be assessed via a regulatory monitoring process as well as detailed disclosure requirements under Pillar III. For the internal model, an approval of the supervisory authority is required beforehand while the standard approach from Pillar I have always to be taken into account as a “fallback”.

The consultative paper is a reaction of the supervisory authority to the regulatory arbitrage by banks[1] and ensures sufficient capital backing in order to cover losses due to interest rate risks – in particular against the backdrop of a possible rise in interest rates. In addition, the presented approaches aim for increased consistency, transparency and comparability within the banking sector.

Apart from the BCBS consultative paper, the European Banking Authority (EBA) published the final guidelines on the management of interest rate risk arising from non-trading activities on May 22, 2015 becoming effective on January 1, 2016. This guideline is not contrary to the consultative paper of the BCBS, however there are some overlaps and contradictions (e.g. with regard to the parameter provisions for non-maturing deposits). Key aspects for specifying the requirements according to Pillar II include, amongst others:

- Adequate capital reserves pursuant to the interest rate risk in the banking book

- Determination of the risk exposure considering the change in economic value of equity (ΔEVE) and net interest income (ΔNII).

- Sensitivity of both parameters under different interest rate scenarios

- An adequately and explicitly documented internal interest rate risk management and measurement approach

- Reporting of the standard interest rate shock to the supervisory authority

However, in the following, we will concentrate on the standard approach presented in the BCBS consultative paper and the resulting implications for general banks and savings banks.

identification of interest rate risks in the banking book under the standardized approach (Pillar I)

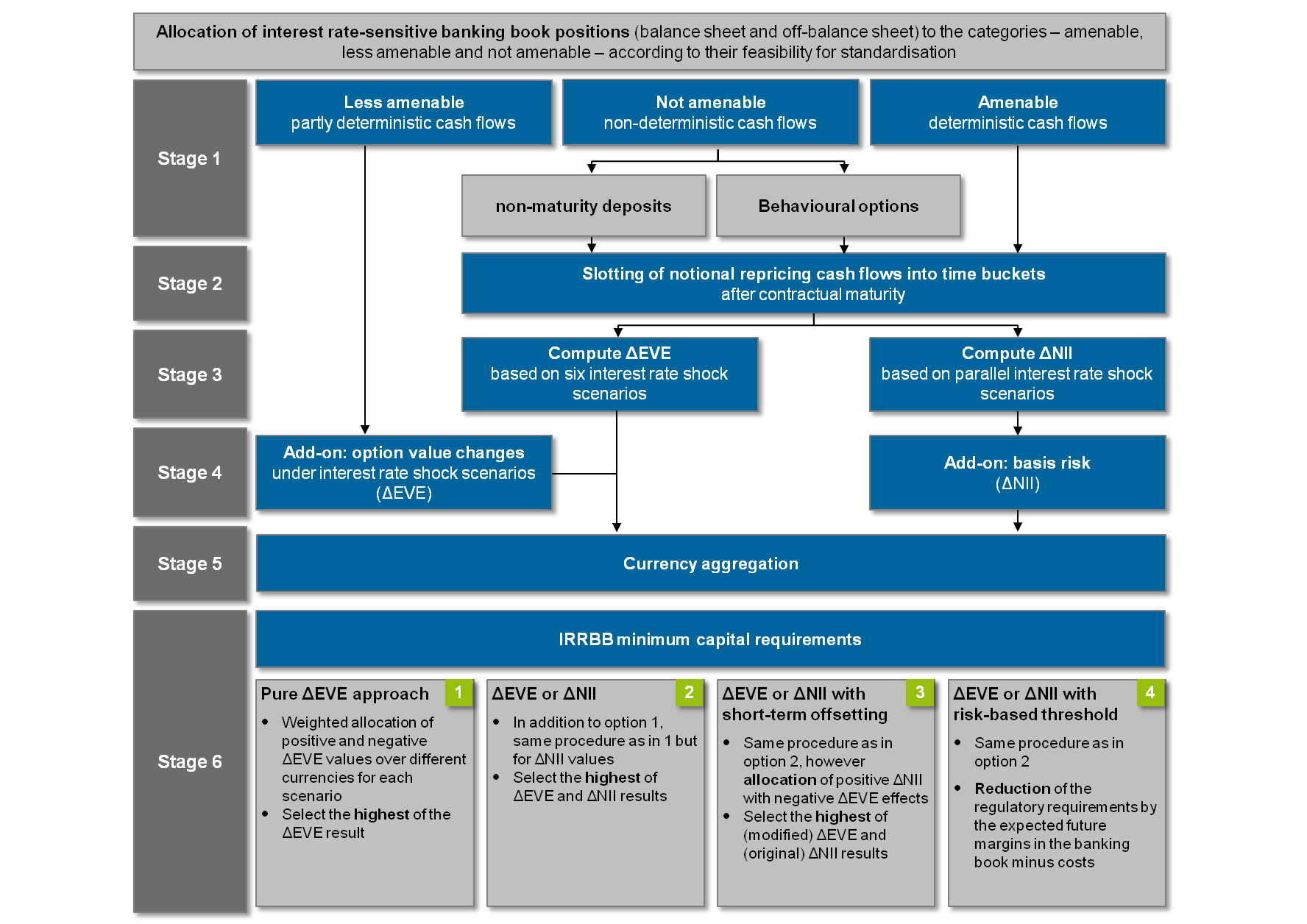

Since the current measures and calculation methods for interest rate risks highly vary, the Basel Committee defined a harmonized six-level process for the identification of the IRRBB minimum requirements under a so called standardized approach:

Stage 1: Allocation of interest rate-sensitive banking book positions (balance sheet and off-balance sheet) to the categories – amenable, less amenable and not amenable – according to their feasibility for standardization:

- Less amenable (partly deterministic cash flows): Products with a time to maturity until the end of contract / fixed interest rate with quantifiable uncertainties (e.g. explicit interest rate options, option rights embedded in securities, caps or floors, swaptions, callable bonds)

- Not amenable (non-deterministic cash flows): Products with a time to maturity until the end of the contract / fixed interest rate with high, only partly quantifiable uncertainties or specific customer behavior (e.g. non-maturing demand and savings deposits, term deposits with termination option, early redemption options, such as termination rights by German law (BGB §489) or unscheduled redemptions, non-drawn fixed interest rate credit lines)

- Amenable (deterministic cash flows): Products with a precisely defined time to maturity until the end of the contract / fixed interest rate (e.g. fixed-interest housing loans, term deposits, savings bonds, securities or swaps)

Stage 2: Slotting of banking book positions into 19 clearly defined maturity buckets. Products with deterministic cash flows are classified according to their fixed interest rate, whereas products with non-deterministic cash flows are allocated pursuant to the following standard approaches:

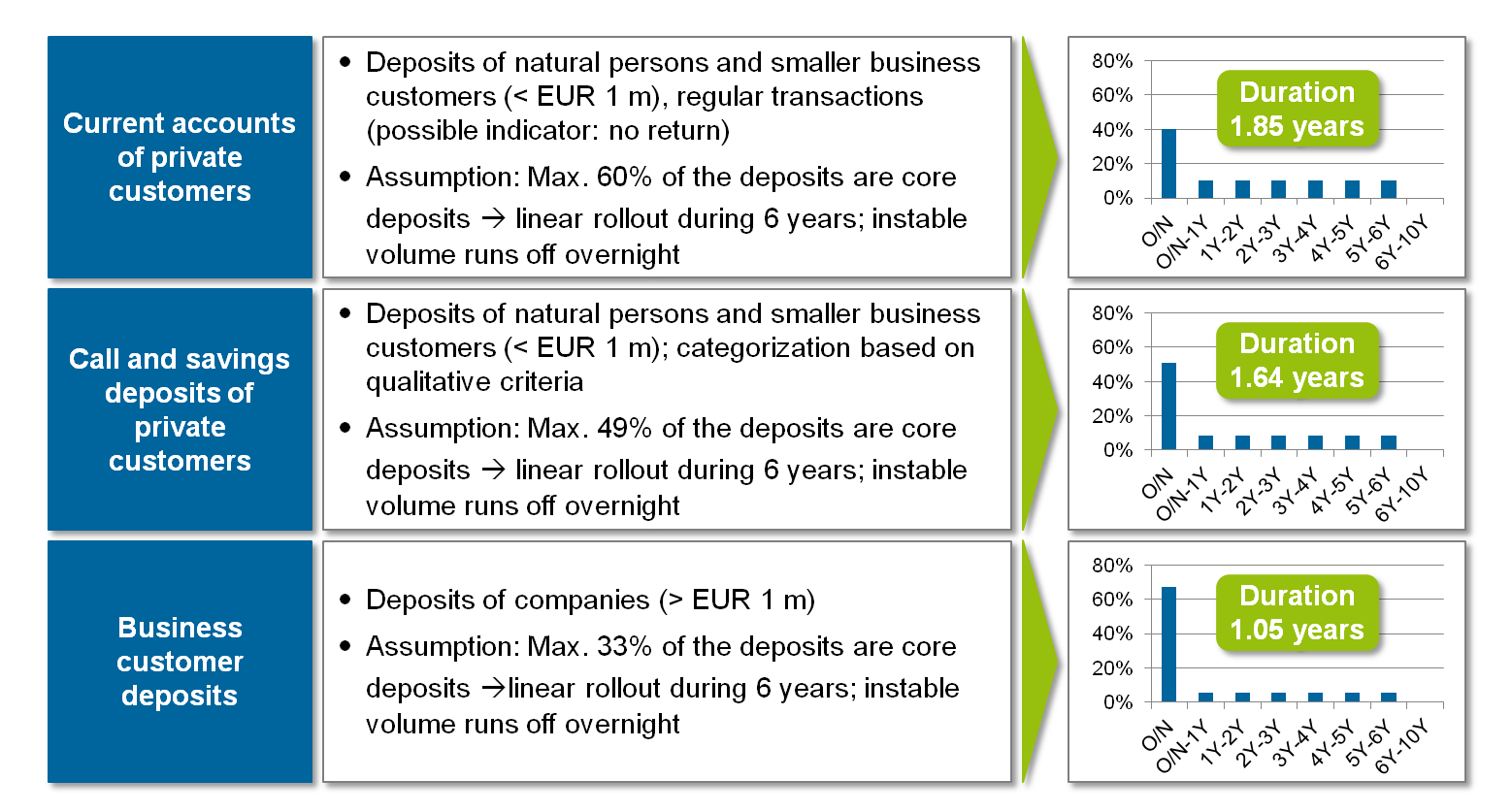

- Non-maturing deposits: Historical estimation of the stable and fluctuating part depending on the type of deposits (private current accounts, savings deposits) as well as a weighted proportional classification into the maturity buckets up to maximum 6 years

- Early redemptions: Historical estimation of the part of early redemptions as well as classification by the envisaged time to maturity (incl. adjustment of the cash flow)

- Non-drawn credit lines: Historical estimation of the drawing rate for homogeneous portfolios and maturity buckets as well as the generation of cash flows for each maturity bucket

- Term deposits: Historical estimation of the part of an early exit as well as classification of this part into the overnight bucket (otherwise according to the time to maturity)

Stage 3: Determination of each individual component of the capital requirement based on six (present value) or two (net interest income) newly defined interest rate shock scenarios. In doing so, the two following components are differentiated:

- ΔEVE: Change in the economic value of equity under the corresponding stress scenarios based on a present value approach

- ΔNII: Change in the net interest income under the corresponding stress scenarios (calculated based on the closing transactions for the statistical cash flow gap using a 1-year horizon without considering the portfolio maturities or new lending)

Stage 4: The changes of EVE and NII under different stress scenarios determined in stage 3 are supplemented by add-ons for automatic interest rate options and basis risks (for the net interest income) in stage 4.

Stage 5: Aggregation of the calculated results per currency (delta present values, net interest income changes).

Stage 6: Final aggregation of the calculated components for the minimum capital requirement pursuant to the following four options that are subject to discussion according to the Basel Committee:

- Pure ΔEVE approach

Weighted allocation of positive and negative ΔEVE values over different currencies for each scenario, selection of the highest result. - ΔEVE or ΔNII

Same procedure as in the first option, but for ΔNII values, selection of the highest of ΔEVE and ΔNII. - ΔEVE or ΔNII with short-term offsetting

Same procedure as in the second option, however allocation of positive ΔNII with negative ΔEVE effects, selection of the highest of (modified) ΔEVE and (original) ΔNII. - ΔEVE or ΔNII with threshold value

Same procedure as in the second option, reduction of the regulatory requirements by the expected future margins in the banking book less costs.

Implications of IRRBB regulation for banks

The initiative of the Basel Committee mainly aims at harmonizing the measurement of interest rate risks in the banking book and thus creating an increased comparability between the banks— based on the standardized approach pursuant to Pillar I. The methods described in this approach entail significant changes in the internal interest rate risk measurement and management for most of the credit institutions. Additionally, they affect required future levels of a bank’s own equity capital. In particular, the following groups of institutions are concerned:

- Institutions that are already performing a high level of maturity transformation (high interest rate risk coefficient, +/- 200BP interest rate shock scenario): It has to be assessed within this context whether the interest rate risk position is still bearable from regulatory perspective under the increased capital requirements due to the standard approach. Furthermore, it has to be assessed whether it is still strategically feasible on the different levels of the defined stress scenarios.

- Institutions offering many optional components in their housing loans, such as rights of redemption and termination, which they already have in their balance sheets: High, interest rate-dependent surcharges and reductions regarding the loan cash flows have to be taken into account that model the exercise behavior of the customers and thus significantly shorten or prolong the cash flow of these positions depending on the stress scenario. Therefore, also institutions with former neutral interest rate risks now have to deal with significant interest rate risks and thus capital requirements due to the new regulatory approach.

- Strongly deposit-funded institutions: Here, the parameterization of non-maturity deposits (NMDs) in long-term time buckets is restricted significantly deviating from the current internal models (cf. examples in Figure 2). Therefore, it can lead to significantly higher reports of the regulatory measured interest rate risk.

Figure 2: Sample calculation for indefinite deposit products using the parameters of the standard approach

Figure 2: Sample calculation for indefinite deposit products using the parameters of the standard approachHence it is not only important for these groups of institutions, but also for all other banks to analyze already today which implications the new requirements will have for the business model in the future. This is the only way to identify appropriate measures early on.

In a first step, an analysis of the interest rate risks according to the standard approach has to be made and the additionally required equity pursuant to the Pillar I have to be quantified. The publicly available information on the current quantitative impact study (QIS) of the BIS can serve as a calculation help even for institutions that have been asked to participate.

In a second step, the following potential implications for the business model should be examined in detail:

- Is the current level of maturity transformation still bearable regarding the necessary capital requirements according to the new regulation or should the Treasury management be adjusted (banking book lever, risk limitation, hedging strategy, etc.)?

- Is the Treasury business segment as a whole still profitable against the backdrop of the risk capital to be run?

- Is an overhaul of the own investment strategy against the backdrop of maturity mismatches between long investment and ever shortened modeling of the liable customer business (deposits) necessary?

- Should the funding strategy be reconsidered in addition? In order to compensate the short terms, a strategically shift to long-term funding tools with fixed interest rate (e.g. covered bonds) can be taken into consideration, if necessary.

- Should the term setting related to loan products (in particular housing financing) be adjusted with respect to redemption rights and long maturities? Is it perhaps recommendable to only assume a role as loan broker for long terms (> 10 years)?

While the IRRBB requirements of the EBA will come into force already from January 01, 2016 on, the standards of the BCBS 319 are still subject to consultation. However, it is already clear that the credit institutions will have to deal with significantly increased requirements for the risk management and a rise in terms of capital requirements. In addition to the already difficult low interest rate environment, thus another “classic” income source of banks is running the risk of restriction.

First sample calculations of zeb have revealed that the changes are material and will have a sustainable impact on capital ratios and profitability. The implications should be analyzed and assessed as soon as possible due to these major threats for the current business model of many banks.

zeb supports banks both in interpreting the new requirements and quantifying the implications as well as in assessing possible measures for the adaptation of the Treasury management, the product design as well as—if necessary—in adjusting the business model.

2 responses to “IRRBB – Consultative paper on interest rate risk in the banking book”

Mohammad Belgami

This web site is extremely useful, user friendly and most up to date with regards to Basel III regulations.

Mohammad Belgami

A simple illustrative example in Excel format would be more beneficial and easily understood. The two things I appreciate more explanation is – Prepayment risk on Mortgages and deposit withdrawal behaviour on NMDs.