|

Getting your Trinity Audio player ready...

|

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

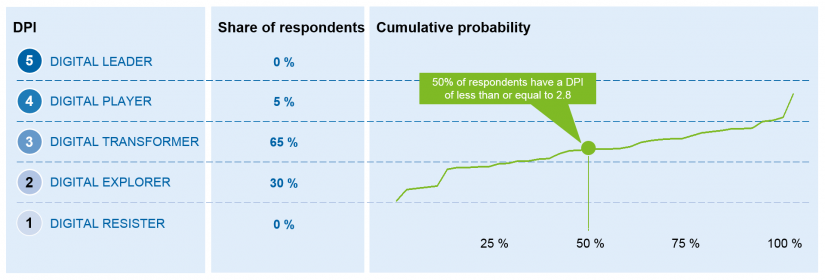

Overall, the sector documents in its self-assessment that the majority of insurers in Germany have initiated digitalization initiatives. However, most of the participants see themselves in the “lower medium range” with regard to their digital maturity and, with initial implementation projects, they are still at the beginning of digital transformation. “Digital leaders” covering all facets of a digital business and operating model have not emerged at all.

There is a high level of attention for digitally disruptive business models within the sector. Accordingly, a high level of readiness to invest and cooperate as well as a distinct willingness to digitalize can be perceived among insurance companies. This willingness, however, is only transferred into practice very hesitantly. Although most of the respondents have a digital agenda representing the total of various individual initiatives, only 50% of insurers have consolidated this to a road map with a strategically defined project portfolio. On top of that, only one in four companies demand responsibility for digital transformation and define it by means of digital KPIs.

Processes, data and IT systems of German insurers are also not yet geared towards digital business models and thus restrict the speed of transformation. Mostly, the companies are still trying to create the basic conditions required for digital transformation, such as the harmonization of their data formats and the flexibilization of their IT architecture. Any real-time consolidation of data remains a future scenario. The majority does not currently use artificial intelligence, but is examining the opportunities of this technology.

Furthermore, the principle of thinking from the customers’ perspective is not yet integrated in insurance practice. While most of the participating insurers claim to know the needs of customers, less than half of them involve their own customers in their product development. The product portfolio is digitalized in an evolutionary process. More complex digital offers, such as use-based insurance products or preventive insurance services, are mostly still in development, and disruptive approaches are almost non-existent in the product portfolio.

At the end of the day, a major aspect for the success of digitalization initiatives is embedding the required innovative strength in management and within the organization. Once more, the study indicates room for improvement. For instance, at almost 80% of participating companies, executives did not or at least not consistently act as “digital leaders” or role models to drive digital transformation. Also, traditional organizational structures with a clear separation between IT and business still prevail against agile alternatives. At least, most of the companies surveyed have identified the problem. 60% said they were working on overcoming cultural resistance. What is striking in this context is that especially the middle management regards the corporate culture in many German insurance companies as an obstacle to innovation and criticizes the low level of risk appetite and error tolerance.

On the whole, German insurers have basically understood the strategic importance of digitalization and have initiated numerous initiatives across all digitalization dimensions. However, from data, processes and IT systems as a basic prerequisite right through to the consolidation of a consistent road map including definitions and measurements of success, there is a lack of systematic implementation. If insurers are serious about packing more digital punch, they will have to systematically integrate digital transformation into corporate management and utilize management capacities in a targeted manner. Especially when considering globally operating Internet companies which are becoming ever more interested in the insurance business, they need to pick up speed. Now is the time to develop the organizational ability and the appropriate “toolkit” to design new approaches at higher speed and bring them to market.