|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

The regulatory treadmill of the banking industry

Banks spend an average of 70% of total annual project budgets for the implementation of new regulatory initiatives (see Figure 1).

To cope with this regulatory flood, banks focused on fulfilling regulatory requirements alone while exclusively considering compliance aspects. Implementing all regulatory initiatives one after another blew budgets and started the regulatory treadmill cycle.

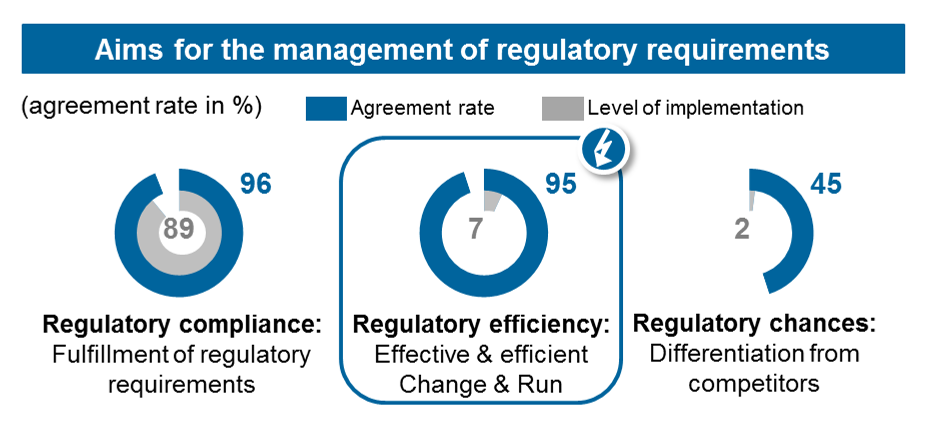

According to a zeb survey with domestic systemically important banks (D-SIBs) from the DACH region, only 7% of banks have implemented the idea of regulatory efficiency (see Figure 2).

Since other industries have adopted regulations as a natural part of their business, banks should start to view regulatory compliance as a core part of their business model and rethink the approach for the next years to find an efficient regulatory response.

To get off the regulatory treadmill, banks have to find answers for three key questions:

- Do the right things: How do I stay on top of the flood of regulations?

- Do things right: How do I make sure that regulatory changes are implemented efficiently?

- Support doing the right things right: How can the organization and governance be optimized?

Ten steps to increase regulatory efficiency

zeb believes that increasing regulatory efficiency can reduce the overall costs for regulation by approximately 20% in the short term and optimize the potential by up to 40% in the long term. Given these numbers, regulatory efficiency can turn into a potential competitive advantage.

The following ten steps provide a guideline on how to increase regulatory efficiency.

Improve regulatory analytics

Step 1: Achieve true top management buy-in:

Regulatory efficiency should not only be part of the CFO / CRO agenda, where most of operations are being done, but must also be understood and strongly communicated across the whole bank by the CEO and other board members. To achieve true management buy-in, regulatory impacts on the business, operating and finance & risk models of the bank must be holistically transparent. Best market practice in this field shows that management buy-in is substantially higher in banks where this responsibility is assigned to the CEO area.

Step 2: Centralize monitoring as far as possible:

As an essential part of regulatory management, the flood of regulations has to be monitored and prioritized in an efficient way. To achieve a holistic view of regulatory change and to improve the timing of CtB activities, a monitoring system needs to be installed that compiles all changes coming from different supervisory and legislative bodies. The most advanced banks have set up a monitoring system lead by a centralized regulatory office intended to support the entire organization (including business as well as compliance and legal departments) in developing a holistic regulatory roadmap. As a starting point for efficient monitoring, the screening of upcoming regulations could rely on comprehensive regulatory content from external providers. For this purpose, zeb has developed a tool helping banks with monitoring and summarizing upcoming initiatives to remain on top of regulations (see Figure 3 for zeb regulatory hub).

Step 3: Think in different regulatory scenarios:

Regulatory impact analyses typically suffer from three weaknesses: they are performed on a stand alone basis, they are based on a single scenario and they assume “business as usual”. Best performing banks overcome these weaknesses by analyzing different regulatory scenarios, understanding the dependencies across the regulatory landscape and the impact on the organization. There are two key success factors in this direction: a professional simulation tool is needed which goes beyond an Excel-based solution and a clear process has to be defined to involve the right skills at the right time.

Challenge regulatory change

Step 4: Identify synergies in the projects:

When setting-up regulatory projects, their peculiarities must be taken into account. Regulatory projects are usually characterized by a fixed timeline set by the regulator, require a specific set of skills and knowledge and impact several business units. Given these specialties, banks often struggle in setting up adequate project/program management structures; especially the identification of synergies between different initiatives seems to be hard to achieve. With regards to synergies, the best performing banks follow a three-step approach: first, they analyze the impact of every single initiative on time, people, IT infrastructure and business requirements, second, they identify overlaps and synergy potentials in the overall project portfolio and third, they evaluate different options to realize these synergies.

Step 5: Challenge budgets by thinking in alternatives:

Project budgets are often overstated when derived as a simple sum of estimated business and IT efforts and therefore leave room for improvement and potential for reduction. In order to increase regulatory efficiency, the project budgeting process should be based on two key aspects: first of all, project sponsors should always demand alternative implementation scenarios to reveal cost drivers and to understand the impact on the RtB organization. Moreover, zeb experience shows that efficiency can be increased when budgets are regularly reviewed by a neutral/independent team. As there are only limited opportunities for project managers to balance implementation costs and risks, they tend to include buffers and overestimate budget requirements. Therefore, a neutral function (e.g. a controlling or program management function) needs to be involved early on in the budgeting process.

Step 6: Go beyond traditional program management:

Traditional program management often focuses on formal standards and high-level tracking of milestones via traffic lights. Thus, the adding value of this function is very limited especially with regards to regulatory projects/programs. To actively steer the quality, time and budget of regulatory projects, a content-driven approach is needed. This requires a project management team which is able to quickly understand the key contents, success factors and dependencies of regulatory projects. One key challenge in this area is that requirements are typically not fully clear at the beginning of the project and can change over time. In this context, an agile approach to IT development can help to flexibly handle changing requirements.

Rethink the regulatory target operating model

Step 7: Renew your sourcing strategy:

By setting up an adequate sourcing strategy, banks can reduce production costs while focusing on value-adding processes. An adequate sourcing strategy requires the identification and analysis of alternative sourcing opportunities across the entire organization. For example, the relocation of regulatory activities to non-tariff service companies can substantially reduce labor costs.

In addition, regulatory activities that can be provided at lower costs by a third-party vendor are typical outsourcing candidates. According to zeb experience, there is a lot of potential in the regulatory area as the systematic analysis of outsourcing opportunities (e.g. in the field of regulatory reporting) has not been fully explored yet.

Step 8: Create centers of competence and overcome traditional silos:

Most regulatory reports, requests and recent initiatives require information from different departments and rely on close collaboration of the various functions involved. Hence, a traditional silo-oriented organizational structure—which is still widely spread among banks—often struggles to handle regulatory requirements and leads to highly complex processes. The creation of centers of competence, which go beyond traditional silos, can help reduce process complexity and coordination efforts. For example, best performing banks have implemented central regulatory affairs offices, which bundle all regulatory analytics functions and serve as a single point of contact to the supervisors and to internal departments.

Step 9: Use digitalization for regulatory process optimization:

Digitalization has become one of the key drivers of change in the banking industry. As substantial potentials have been easily identified in customer-driven business, digitalization can play a strategic role for optimizing regulatory processes at the same time. With the help of RegTech solutions, advanced banks have already started to use modern technology to automate repetitive and low value-adding processes as far as possible. Even when full automation is not feasible, technology can still support single phases of the overall process (e.g. data quality checks) in order to save time, resources and—ultimately—costs.

Step 10: Measure and continuously improve efficiency:

Defining a clear baseline and ambition level for regulatory efficiency is an important starting point. To achieve the targeted ambition level step by step, continuous tracking of the achieved progress is needed. For this purpose, zeb has developed a self-assessment tool to measure the regulatory efficiency level in banks and to identify potential weaknesses and strengths.

Regulatory efficiency will stay on top of the management agenda in many banks as huge potentials can be explored in this field. Following the ten steps outlined above, regulatory efficiency in banks can be substantially increased. Banks will thus not only save money in the short term, but are also better prepared for the regulatory challenges ahead.