|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

Creating a business case is complex—an end-to-end process overview is needed

Even though the benefits would be obvious, illustrating a reliable, and for the senior management comprehensible business case, often proves to be very challenging. This becomes especially obvious when a digitalization/automation of an end-to-end process, i.e. a straight through processing (STP)[3], is envisaged. Without a pre-study and field-proven approach models, the overall complexity of the process and its dependencies, and therefore the total effort and benefit, can only be derived indicatively. By conducting a more thorough analysis of the as-is processes, focusing on the applied IT systems and interfaces as well as the quantity structure and related process times, a valid estimation of the potential is feasible. Beside classical automation approaches, the application of bridge technologies such as Robotics Process Automation (RPA)[4] should be considered; an implementation is possible without complex system integrations, so that existing opportunities could be leveraged in reasonable time and effort.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Some pioneering institutions are using the current momentum and taking a corresponding integrated banking view: Instead of a selective implementation of new regulatory requirements or supervisory complaints, chances are taken to analyze and optimize processes. By doing so, for example, reporting latencies are reduced to a fraction of their previous period of time or the manual workload of processing financial products is minimized. At the same time, quality is improved, productivity is raised and costs are reduced. Lean, end-to-end automated processes are therefore not restricted to FinTechs, but are a precondition for institutions to leverage cost potentials and respond to competition.[5]

A case study shows the essential success factors

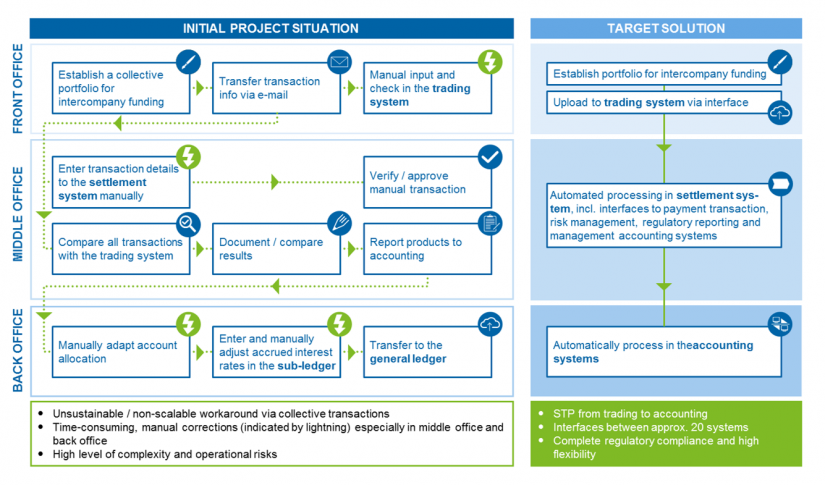

Potentials and critical success factors of an STP implementation can be demonstrated clearly by a project example. Starting with supervisory complaints regarding the intercompany funding process, our client has decided to solve the problem holistically and therefore to automate the respective product type across all IT systems—from deal capture into the trade system through the transaction processing and risk management to the downstream reporting and financial accounting processes—and by thus eliminating manual breaks. The project starting point and target solution are shown in the following figure:

The STP target solution was successfully achieved: the manual processes and workarounds were reduced to a minimum—simultaneously reducing operational risks and strengthening the internal control system. As a result, all money market deals with variable interest rates and durations are processed automatically end-to-end. Adding to that, a scalability beyond the intercompany processes is ensured. The supervisory requirements are fully met and medium to long term cost reductions are achieved at the same time. Most importantly though: the quality of the intercompany funding process and the respective steering in Treasury have been increased significantly—also allowing institutions to react faster and more flexibly to altered market situations

Based on the four major project phases of the case study, the success factors can be summarized as follows:

- Business case and as-is analysis

- Detailed analysis of the existing system landscape and the applied processes along the whole delivery chain, incl. documentation of the work efforts as solid basis for the business case and for the approval of the required budget.

- Buy-in of the key stakeholders right from the beginning of the decision making process and ensuring senior management commitment.

- Early choice of appropriate business and IT experts, including an experienced project manager with end-to-end banking process know-how.

- Apprehension of the regulatory requirements; this is not only part of the business case, it is also a crucial condition for implementation that must be strictly complied with.

- Target vision and business requirements

- An STP implementation is not necessarily equal to an introduction / replacement of new IT systems; rather those IT systems should be identified, which could be used strategically.

- Early buy-in of IT experts into the target definition process.

- Calling for a holistic perspective and breakdown of process barriers.

- Timely addressing of change management; regular updates of key stakeholders and their integration into the decision making processes.

- Technical implementation

- Despite the regulatory impact and the interfaces to e.g. risk management, financial accounting and reporting, the application of an iterative and agile development approach has to be examined in order to verify immediate user feedback and the achievement of quick wins—the implementation plan has to consider the regulatory compliance in every phase.

- Creation of awareness for the complexity of the topic; this also includes the budget cushion to realize additional profit drivers identified e.g. in the implementation phase.

- Usage optimization and better exploitation of existing systems and interfaces; STP implementation with simultaneous consideration of RPA potentials.

- Establishment of a transparent progress report; escalation at an early stage and development of an action plan, where necessary.

- Test execution and product deployment

- Business users from all affected areas have to be involved in test execution; this helps to uncover potential defects at an early stage as well as the appreciation of the new processes.

- Alternative or emergency planning (e.g. exercising a “Fastpath”) is necessary.

- Where possible, tests should also be carried out in the production system, this ensures the concluding evidence; respective test cases have to be defined and then aligned with the stakeholders.

The potential of such initiatives—as exemplified here—is vast, and institutions should therefore ask themselves how to identify and realize the most promising initiatives.

Cultural change as foundation for STP implementation

To benefit from and actively drive the technological progress, a cultural change is usually indispensable. A very strong focus on result periods only, paired with a silo mentality obstruct ongoing STP initiatives and prevent the uncovering of optimization potentials. Hence, cultural change is the foundation for every additional point of action and therefore has to be exemplified by senior management. Strategy guidelines have to be refined and operationalized in that respect. Essential levers in the implementation can be found in currently running large (regulatory) projects[6] as well as in the planning of a future project portfolio.

Increasing overall bank efficiency through strategic project choice and focusing

Besides simply checking off the regulatory requirements, current large regulatory projects (e.g. BCBS #239, IFRS 9, Basel IV) are to be assessed in terms of potential beneficial aspects regarding organization, processes and systems—it must especially be asked where manual efforts can be reduced. A business case should generally be obligatory also for regulatory initiatives. The aim is the distinct deduction of benefit aspects and the demonstration of optimization measures and options in accordance with the overall bank targets.

A future project portfolio should be clearly geared to the digital objectives of the institution. An assessment of the degree of digital maturity of the institution serves as the starting point for a prioritization of potential projects. This assessment should consider the bank’s individual requirements and regard the end-to-end process respectively. Next to classical optimization approaches, such as the exhaustion of existing system possibilities or this example, focusing on an STP implementation, additional automation potentials can be uncovered, e.g. by means of RPA.

Institutions should use the regulatory requirements as an opportunity and exceed their simple performance of duties by additionally reducing the size and complexity of their processes. A high automation or STP ratio simplifies and accelerates processes significantly, establishes new capacities for value creating tasks, and, ultimately, boosts profitability.

One response to “Straight-through processing: taking current opportunities and overcoming challenges”

Pingback: Payments are no longer a banks-only party - BankingHub