In recent years, the media have reported increasingly high losses incurred by the institutions, which have also had a negative impact on their reputation. These losses result from fines imposed by supervisory and other authorities as well as legal costs due to faulty contracts or the bank’s treatment of their customers – reflecting the increased pressure on bank advisors to sell products.

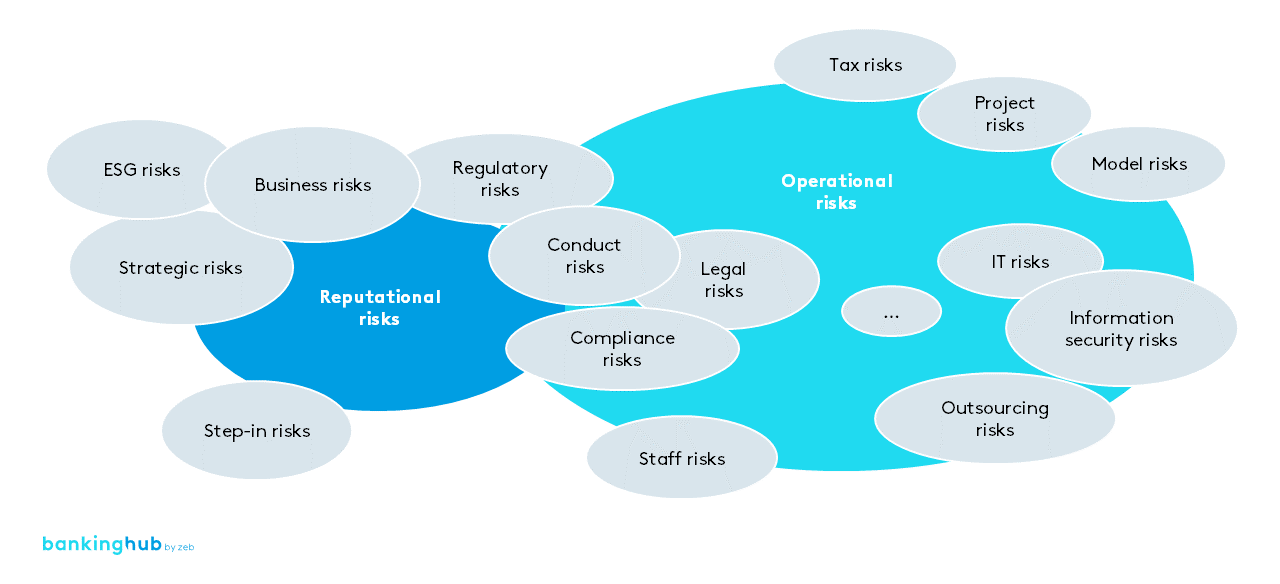

Institutions cannot allocate these losses to the traditional financial risks, such as credit, market price or liquidity risks; instead, they fall into the risk category of non-financial risks (NFR). NFR also comprise risks explicitly excluded from the supervisory definition of operational risks, such as strategic or reputational risk.