|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

From multichannel to omnichannel banking

Many banks have already made the transition from purely branch-centered single-channel selling to multi-channel strategies. They now offer information and sell products through a variety of channels, such as apps, phone and websites. What they often lack, however, is a link between the channels. Interruptions in the customer journey cause customers to experience the banking process as lengthy, overly complicated and frustrating. In contrast, new competitors, such as Apple and other tech giants, use their technological advantage to offer lean and easy-to-use banking solutions. This is what customers expect in our digitalized era. Banks must act now to transform their multichannel offerings into a truly omnichannel banking experience.

While most banks extensively discuss the general omnichannel concept, they often neglect its implications for internal steering and management practices. To determine the state of omnichannel readiness in the European banking industry, zeb conducted a survey among major European banks covering five dimensions: omnichannel strategy, customer focus, steering model & KPI, organization and technology & infrastructure.

1) Strategy—omnichannel banking has reached the boardroom

Given the high strategic significance of the topic, omnichannel banking is extensively discussed in most banks’ boardrooms. As a fundamental prerequisite, a channel strategy has to define clearly and specifically, which channels to serve in which way. Best practice examples put the customer at the center and start with analyzing customer preferences and behavior. Based on this understanding, banks should define a suitable channel management framework. This framework should consider the interplay between different channels and provide the right incentives within the organization to foster collaboration among channels and ensure a smooth and seamless experience along the customer journey.

Our study revealed that 88% of the banks surveyed have defined a branch network strategy. The vast majority of 76% have also defined an online/digital strategy. In contrast, only every second bank (49%) has a specific omnichannel management strategy in place.

When realizing their strategies, many banks have already launched initiatives that contribute to omnichannel banking. However, these are very often isolated and cover only specific parts of the topic. They are mostly driven by the goal to increase the share of digital offerings or improve the user experience for a specific product. One aspect that is often missing, but crucial for successful implementation, is the alignment between different dimensions and a central coordination of the various initiatives.

2) Customer focus—banks invest heavily in expanding their digital offerings

Following their strategic ambitions, most banks have already expanded their online banking and mobile app development. According to our survey, we expect digital offerings to continue to grow in the future, thereby overtaking traditional personal banking channels. In particular, mobile banking via apps, social media channels as well as new technologies such as chatbots will increasingly gain importance.

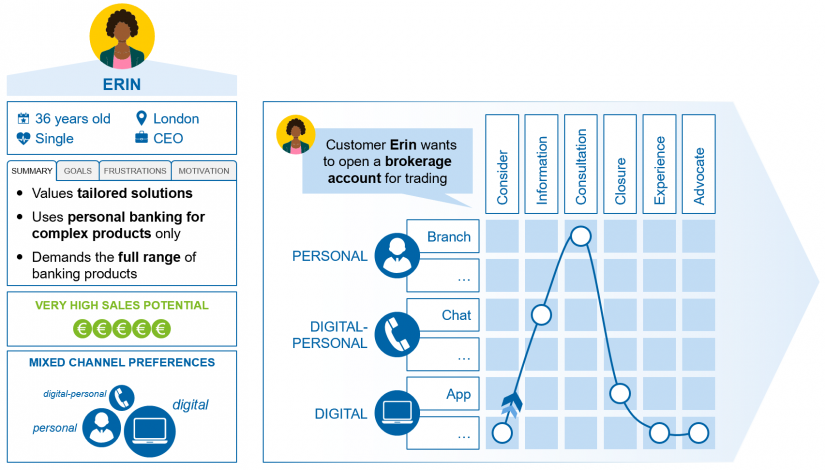

However, realizing true omnichannel banking requires much more than simply expanding the channel offering. Ideally, banks should design a customer journey that reflects their customers’ specific needs. Best practice examples of customer segmentation go beyond purely demographic and monetary factors, such as gender, age and sales potential. Rather, they carry out a description of customer segments or personas on a multi-dimensional basis, which also covers customers’ goals, frustrations, motivations and behaviors. This includes considering specific banking habits and preferences for certain products as well as channel usage. To reconcile this customer-oriented view with the bank’s economic targets regarding efficiency and profitability, a steering model that balances these requirements should be in place.

3) Organization and 4) Steering model & KPI—omnichannel banking requires new organizational setup and steering approaches

When adapting their operating models to the omnichannel world, banks need to review their organizational setup and transform both their steering model and KPI set accordingly. These two organizational dimensions as well as the steering model & KPIs are deeply interwoven. Banks must assign clear responsibility for the customer and accountability for results within the steering model. This affects the organizational setup of the bank as well as internal revenue and cost allocation frameworks.

We can outline three steering approaches linked to different organizational setups. Within the most traditional approach, typically found in classical branch-based banks, customer ownership lies with the sales force in the branch. Subsequently, they allocate revenues and costs to the branch as a primary profit center. The second type of banks considers further channels in addition to the branch as revenue generating and defines these as profit centers. In this case, revenues are shared or split between all originating or contributing channels based on a defined allocation key.

In the last and still least common management approach, banks take their transformation to fully omnichannel-capable organizations as an opportunity to fundamentally rethink the way they approach profitability management. This approach centers on the customer and defines them as primary and leading dimension. To make the omnichannel management approach work in practice, banks need to set up a comprehensive set of key performance indicators to measure channel performance and customer journey effectiveness. The KPI set should measure channel interactions along the entire customer journey and give insights into customer behavior for each step.

With this set-up, the KPIs ensure effective performance measurement across all channels. They support the management of channels from an overarching perspective and enable comparisons between channels—ingredients that are critical to providing the customer segment responsible with the right data to make effective decisions.

Our survey results indicate that most banks have not yet developed a comprehensive omnichannel management framework, but are in the process of including selected omnichannel features. The predominant approach to measuring channel success are input-based efficiency KPIs (39%). However, another 37% of banks has no channel success measurement in place at all. Most banks manage the customer (76%) and product dimensions (75%) as profit centers. 37% of banks have joint channel and customer management responsibilities. This reveals a lack of clear separation between relevant management dimensions, which is necessary to ensure equality between channels and promote collaboration. Approximately half (51%) of the observed banks manage all of their channels in a uniform way, indicating that there is no predominant steering approach in the market.

5) Technology & infrastructure—banks have to build up omnichannel capabilities

When implementing an omnichannel strategy, banks require a suitable technical infrastructure and enhanced data capabilities. Key aspects of omnichannel banking, such as the possibility of switching between channels and real-time interaction, require a high level of system integration and performance. To realize customer journeys across different channels, banks need to facilitate data exchange between them. In an omnichannel world, the bank needs to track every interaction with a customer. As a result, they need to process exponentially more data as a management basis. Various combinations of customer, channel and product along the customer journey need to be stored and retrieved in real time—including the respective historical data. The availability of data and infrastructure ensures a seamless offering and communication process and is a key ingredient of omnichannel banking.

According to our survey, only 27% of banks have a unified customer record that tracks all interactions with the bank via all channels, including key results of customer inquiries. A successful management framework should enable the measurements of all interaction points of a customer during the customer journey, as this is key to understanding the value creation of individual channels along the interaction path. Our study revealed that only a minority of 24% of banks have the technology and data capabilities that are required to enable omnichannel steering.

Next steps—the way forward

Overall, our study shows that most banks have an intermediate maturity level of omnichannel management, with a handful of outliers leading the group and a few banks lagging behind the overall market. Depending on their individual omnichannel management maturity level, as displayed in Figure 6, banks need to focus on different areas to improve.

Banks that are lagging behind in their omnichannel management maturity (“laggards”) typically need to build the foundations of omnichannel management by starting to define a general channel strategy and anchoring the essential customer centricity principle within their organization.

In the “followers” cluster, which comprises the largest group in our maturity assessment, the highest priorities are to reflect defined steering principles in their organizational model, implement KPIs in a consolidated reporting cockpit and ensure a unified customer record.

Finally, in the group of “leaders” in omnichannel management, we see significantly improved maturity of these banks in terms of strategy and customer focus. These banks focus on improving their steering model by defining a KPI set that enables effective cross-channel management impetus and ensures that all relevant customer interaction points can be measured and evaluated.

By improving their omnichannel capabilities, banks can better meet their customers’ expectations and remain competitive with newly emerging players in the financial services industry. Our maturity assessment shows that becoming a “leader” in omnichannel management requires more than just expanding one’s channel offerings. Rather, it is of paramount importance to also rethink the bank’s organization and steering model and adapt both to the new era of banking.

2 responses to “Omnichannel banking and its implications for bank management”

sara

Digital channel Thank you for the sharning information This article is so great, will be very much useful for Thank you sharing

Parag

Great Article…..Omni-Relevant !!