|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

Role of fintech startups

Driven by the digital revolution, fintech startups have been shaking up the traditional banking sector with new and frequently disruptive business models for several years now. Thanks to modern technologies, customer needs can be met more effectively while ensuring a scalable cost structure.

But there are notable differences between fintechs and traditional banks: owing to their size, banks have other means at their disposal than fintech companies (e.g. to grant large loans), but they sometimes lag behind in updating their IT infrastructure and in changing inefficient processes. Fintechs know how to systematically exploit these disadvantages and old legacies by offering a strong customer focus and products based on new technologies. Therefore, banks and private equity firms are very keen to buy fintech startups.

Mergers & Acquisitions activities during the coronavirus pandemic

Since early 2020, the world economy is facing a crisis following the economic impact of the coronavirus pandemic. Declining profitability and turnovers are putting margins under pressure and making it difficult to ensure sufficient liquidity.

While the coronavirus pandemic is increasing the level of uncertainty in the M&A market and forcing buyers to be more cautious, it is also creating new opportunities. Weakened companies with interesting valuations are attractive takeover targets. In addition, many fintechs are benefiting from the growing importance of digital business models as a result of the coronavirus pandemic.

Segmentation and overview of current M&A activities in the fintech sector

In general, the fintech market can be divided into different segments. The payments segment is of major relevance, especially in relation to mergers and acquisitions. This segment, which includes the giant payment service providers PayPal and Klarna, has a share of approx. 80% – as measured by revenue[1] – in the total fintech market.

Although payments is the largest segment in terms of turnover volume, the margin of companies in this segment is often low due to the intense competition. For this reason, size matters in this segment and increasing consolidation is to be expected. Currently, a large number of consolidations and takeovers, or M&A activities, are taking place; for instance last year the payments company Wordline bought its French peer Ingenico for approx. EUR 7.1 bn.[2]

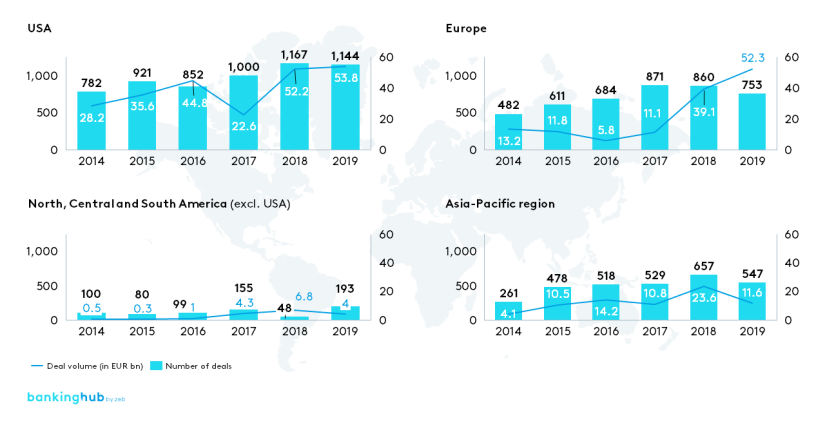

The overview in fig. 1 demonstrates that, by comparison, the number of transactions in the European market has increased at a lower rate or has even stagnated recently, while the deal volumes have risen significantly. This indicates that the market has become much more attractive especially for major financial institutions and investors with sufficient liquidity.

Globally, in the year 2019, there were about 2,700 fintech mergers & acquisitions transactions with a total deal volume of about EUR 122 bn. The USA is by far the largest market for fintech M&A activities; about 43% of all deals took place there. For instance, a group of investors (including Iconiq, Capital G, Sequoia Capital, and Kleiner Perkins) invested EUR 326.8 m in Robinhood Markets, Inc., a U.S.-based brokerage firm that is very popular at the moment. In the burgeoning Asian market, fintech M&As are also increasingly playing an important role: although the absolute share in worldwide transactions was only 21% in 2019 and thus relatively low, the number of transactions over the last five years has risen more than in any other economic area in the world. This is reflected in the number of transactions in 2019 which is more than twice that of 2014.[3]

The segmentation into economic areas reveals that especially in emerging markets and countries fintech transactions are not yet as common at present as they are in the USA. This offers enormous potential for growth and opens up the opportunity for foreign institutions to gain a foothold in these markets. The transactions of the last years show that fintech companies are increasingly entering into global networks.

Key market players: fintech M&A market

The fintech market is composed of three relevant types of key players: firstly banks and financial institutions, secondly fintech companies, and thirdly financial investors.[4] The activities of these distinct groups of investors differ in many respects.

1. Strategic goals of each type

- Banks and financial institutions

Mergers & acquisitions by banks and financial institutions are mainly driven by changes in customer needs. Over the last years, the use of digital technologies, most of all in payments, has rocketed. In order to be better able to meet customer needs, fintechs are growing in importance as a strategic investment for banks and financial institutions. Commerzbank’s Main Incubator is a good example in this context; it buys a share of up to 24.9% in fintech startups in their early stages and, for instance, has a minority interest in Candis, an accounting tool for SMEs.

In addition, by buying fintech companies, banks and financial institutions aim to be better able to comply with regulatory requirements, to transform existing business models more rapidly, or to acquire IT know-how or specialist knowledge. Regarding the acquisition of specific skills, banks and financial institutions are frequently faced with make-or-buy decisions. Organic development not only entails high costs, but it is also risky and takes time. Since strategic acquisitions, sometimes due to high valuations, require major investments too, it makes sense to cooperate with others. DZ Bank, for instance, has partnered with a large number of fintechs. Another successful example is the cooperation of the Finnish bank Nordea with ReceiptHero, enabling the former to offer customers digital receipts in the Nordea Wallet app. - Fintech companies

Owing to their progressing entrepreneurial experience, fintech companies themselves are acting as buyers. Acquisitions by fintechs are chiefly motivated by inorganic growth opportunities, allowing the companies to reach a critical size as quickly as possible. Other motives for merger & acquisitions are international expansion, the targeted improvement of technical solutions, the increase of the range of offered services, and the development of new customer segments. The open banking platform operator Deposit Solutions, for example, has bought the fintech Savedo in order to strengthen its B2C business internationally. - Private equity firms

Private equity firms are increasingly active in the fintech market, especially in the payments industry. The strategic goal of these investors is to participate in the exponential growth of fintechs in the medium or long term by investing early on and to generate profitable returns when selling them. An example of such a transaction is the investment of the private equity firm Permira in the payments company Klarna.

2. Investment phases

The phase of investment is determined largely by the above mentioned motives, the willingness to take risks, and the characteristics of the investors. In this respect, there are notable differences between banks and financial institutions, fintechs, and private equity firms which are revealed in their dissimilar purchasing behavior. Fig. 2 shows the purchasing behavior of the key players in relation to the life cycle phase of the fintech that they are taking over.

- Banks and financial institutions

This group predominantly invests in fintech companies in the later stage of their life cycle. Banks and financial institutions in general pursue a rather conservative strategy which is confirmed by their preferred acquisition of established fintechs in their post-startup or expansion phases. This behavior of banks or financial services providers is primarily determined by their aim to expand their own range of products in a targeted way through sophisticated new technologies. This is exemplified by the acquisition of Axioma – one of the world’s leading providers of index, risk, and portfolio analytics solutions – by Deutsche Börse in 2019. - Fintech companies

In contrast to traditional financial intermediaries, fintechs buy startups in an earlier phase (generally in the post-startup phase). These transactions thus take place before banks and financial institutions show interest. Fintechs in a later phase of their life cycle are more established and offer more sophisticated processes and services, but they are also much more expensive then and are therefore often beyond the financial capabilities of other fintechs. Small, highly specialized fintechs are interesting targets for other fintech companies as a means to increase their portfolio or as a chance for inorganic growth. - Private equity firms

Private equity firms take more risks in the fintech M&A market and mainly invest during the expansion and growth phase. Their investment decisions are made principally on the basis of fintechs’ short or medium term potential for high returns. In some cases, they also invest in major and highly developed fintech companies, for instance OMERS Ventures led the funding round for the wefox group, raising a volume of about USD 235 m.

Major challenges in the fintech mergers and acquisitions market

All key players involved in fintech M&A transactions are presented with the crucial challenge of assessing their target correctly. If the target is a young company, there is a high degree of uncertainty in assessing the business model and the informative value of key figures. Even in the case of established fintechs, a reliable forecast of future cash flows is difficult to make due to high technological and regulatory dynamics. In light of this situation and in consequence of the rapid transformation of the financial services sector, the fintech market has seen high valuations in the past. But, following the coronavirus pandemic, it is to be expected that the figures will be adjusted. Aside from this overall challenge, there are additional challenges specific to each key player.

- Banks and financial institutions

One of the essential challenges banks and financial institutions have to deal with in the context of fintech M&A transactions is the cultural integration of the new company. This aspect is frequently overlooked and judged to be of secondary importance. zeb’s experience, however, shows that takeovers often fail as a result of insufficient cultural integration. Fintech companies are normally characterized by flat organizational structures, an informal style of communication, and streamlined processes. After their acquisition, they are faced with long-established bank processes and strong hierarchies. This can result in conflicts creating barriers to successful collaboration. The “cultural fit” is therefore an important but often underrated success factor in takeover decisions. - Fintech companies

For fintechs, the main challenge lies in complying with regulatory requirements. As companies with a focus on technology, they often do not have the necessary experience in dealing with regulations. It is imperative to examine in detail the specific requirements in order to prevent obstacles in the regulatory review of the transaction. - Private equity firms

Both the correct assessment of fintechs and the due diligence process are challenges faced by private equity firms when considering potential takeovers. The small size of companies, and accordingly the difficult “proof of concept” of their not yet fully developed business models, can cause problems in commercial due diligence. In addition, the valuation of digital assets is very tricky and requires a high level of technology and industry expertise.

Conclusion: Fintech Mergers & Acquisitions

To sum up, the global fintech market that has already been witnessing strong growth at an average annual rate of about 32.7% over the past few years will continue to grow in significance in future – especially owing to the payments segment which is becoming increasingly important.

In addition to the current coronavirus pandemic and its consequences, such as growing economic uncertainty, the key players in the fintech market face different challenges with regard to M&A transactions. As “partners for change”, zeb supports banks and financial services providers, fintech companies, and investors, such as private equity firms, in defining their strategy and in implementing it. A holistic approach to consulting and a thorough understanding of the market for fintechs and mergers & acquisitions offer unique opportunities – ranging from the strategic analysis of potential targets, commercial due diligence, IT due diligence, to the assessment of regulatory requirements, and finally the successful cultural integration.