|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

How did BNPL emerge?

Deferred payment is a useful solution for consumers, especially in times of substantial financial uncertainty such as the current COVID-19 pandemic. It is no coincidence that in the history of financial credit products, installment payments became widespread in the United States in the 1930s[1], at the height of the economic turmoil known as the “Great Depression”. At that moment in history, merchants had to respond to the needs of clients with a sustained need to purchase consumer goods, but without the financial means to do so.

Thus, well before the introduction of credit cards, the “layaway” financing method allowed consumers to secure the acquisition of a particular good and merchants to secure an income while waiting for the actual sale and handover of the purchased item. Hence “layaway” financing consisted in a plan to purchase goods by means of installments to be paid over a defined period, at the end of which, providing all payments were made, consumers actually took possession of the products bought.

Almost a century and many financial innovations later, the world economy has gone through a decade of difficult recovery from the 2008 global financial crisis and is still struggling with the effects of the COVID-19 pandemic. In this prevailing climate of economic uncertainty, a form of deferred payment such as “buy now, pay later” seems to be finding fertile ground, with adoption rates continuing to rise.

Especially for younger consumer groups, BNPL offers a practical solution that is perceived as a low-risk method. The survey conducted by the National Retail Association (NRA) of Australia, one of the first countries to experience a significant growth of the BNPL phenomenon, provides a fairly clear picture of the typical user of this form of payment.

What is BNPL?

As already briefly mentioned at the beginning the acronym BNPL (buy now, pay later) refers to a form of payment on credit that allows you to obtain a good by paying for it in a series of installments, or simply at a future date (deferment), in most cases interest-free, therefore at no additional cost to the buyer. BNPL can be selected as a payment option at retail stores, via app on the SmartPOS, or as an online version when offered as a payment option directly at checkout.

There is no denying that the volume of online purchases, which have increased significantly during the pandemic, is the real driving force behind the rise of BNPL. In fact, what distinguishes the value proposition of this type of solution is the promise of a seamless payment experience, without the red tape of a traditional consumer loan, and possibly with less regret about the amount spent.

The psychological mechanism behind the equation is simple: all online retailers are committed to increasing their shopping cart conversion rate, i.e. the percentage of goods added to the cart by customers and then actually purchased. Quite often, however, after adding many different goods to their shopping carts, customers are faced with extensive ticket sizes, which discourage them from completing the purchase. The possibility of deferring payments quickly, safely and, above all, free of charge, offers an effective solution to this problem.

What is the underlying business model?

So how do BNPL solution providers earn money, or in other words, who bears the cost of deferring payments and, not least, the associated credit risk?

Most BNPL solutions do not pass on the costs for these service to end users, neither in the form of an interest rate nor as a one-time fee. It is actually the merchants who pay a fee to offer their customers the possibility to benefit from BNPL. In the cases analyzed, the merchant’s transaction fee has a variable (% of the amount of goods sold) and a fixed component. At least this is the case for mere BNPL solutions, which do not provide for the issuance of new financing, but only for the splitting of the payment.

Some operators, on the other hand, charge an interest rate to offer an additional payment deferment to end customers, while still trying to differentiate their offering from traditional consumer credit products through a more agile and faster (and typically online) onboarding experience. Eventually, a final revenue stream for these service providers comes from late fees that, by contrast, are charged to consumers. These fees usually have a fixed amount, which may increase if the payment is delayed even further.

Another relevant issue is the assumption of credit risk associated with deferred payments. On closer inspection, the players active in BNPL can be divided into two main groups:

- The first group consists of those players who bear the credit risk. To do this, they need to conduct a risk assessment during the customer onboarding phase. This fast-track inquiry process is based on proprietary scoring systems fed by information that is readily available for each customer, such as personal details and credit card information, and can be even enhanced by inquiries to credit bureaus.

- By contrast, the second group consists of operators who do not assume the credit risk. It has to be borne by the institution that issued the credit card which guarantees the payment. In this case, for customers to be able to select the BNPL option, they have to prove that the purchase does not exceed their credit card limit. The entire amount is pre-authorized and gradually scaled down as the amounts of the individual installments are debited.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

What is the current situation and outlook?

To give an idea of the rapid spread of this payment method, in 2021, 56% of US consumers state to have used a BNPL service at least once[2], a 48% increase compared to the results of the previous year’s survey. The percentage is even higher for consumers aged 18–24 (Gen Z), who have adoption rates of over 60%.

Another interesting aspect revealed by the same US survey is that 28% of users (40% among Gen Z) do not perceive BNPL as a form of debt. Australia, another country where BNPL has rapidly spread especially among younger people, counted 5.8 million individual BNPL users by 2020[3].

According to the Reserve Bank of Australia, the extensive use of this form of payment was linked to the disinclination towards more traditional means of payment, such as credit cards, which apparently were only used by 41% of Australian millennials, with an 8% drop in current accounts with dedicated credit cards between 2019 and 2020. As to the transaction volume, a note from Bank of America estimates that this could amount to around 600 to 1,000 billion dollars by 2025.

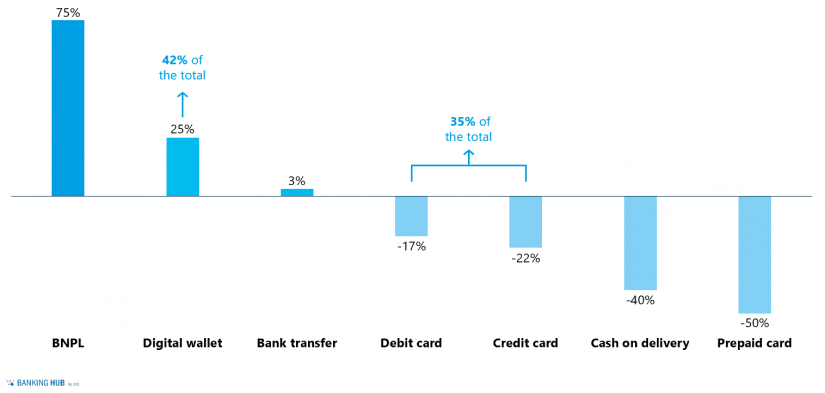

On a global scale, Worldpay has estimated that the number of transactions processed as BNPL will grow by 75% during 2019–2023, making it the fastest growing payment method among those surveyed.

The trends described above are extremely attractive to many operators, including traditional financial services providers, who are trying to dominate the market to the disadvantage of specialist players. Hence the BNPL competitive environment is made up of specialized fintech companies, such as Klarna, Afterpay, or Affirm, which listed on the New York Stock Exchange in January with surprising results, but also of established financial and payment intermediaries.

In March this year, proximity payment giant PayPal announced the launch of its BNPL service – hardly surprising – in the Australian market. Big payment card networks haven’t been indifferent about the BNPL topic either, with VISA launching a BNPL pilot in the US in July 2020, following the implementation of an installment-based payment product in Russia.

In Italy, the market still lacks sufficient maturity, due to limited volumes and an as yet not fully achieved market penetration of this type of solution. It is, however, worth noting that here, consumer credit operators seem to have acknowledged the evidence obtained from other markets and are now offering BNPL solutions through networks of affiliated merchants (e.g. PagoLight by Compass, SimplyPay by Sella Personal Credit and PagoDIL by Cofidis). In addition, there are active industry start-ups that are receiving more and more attention of funders, as proven by the 40 million euros seed round conducted by Scalapay earlier this year.

Conclusion about buy now, pay later

Ultimately, “buy now, pay later” is the payment method of the moment, with huge growth potential while satisfying retailers and consumers at the same time.

However, the model’s sustainability both in terms of revenues for industry-specific operators and risk management capacity and in terms of customer indebtedness remains to be seen. The signs are encouraging, but the unsolved challenges remain important, even for established financial operators: how will banks react if BNPL erodes significant market share in consumer credit? Will they try to develop in-house solutions by leveraging their own risk assessment expertise? Or will they look to acquire the winning fintech companies?

One thing is certain, though: nowadays, deferred payment is more relevant than ever, and BNPL schemes can no longer be ignored.