|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

Year-end capital markets rally for Western European banks

+15.7% QoQ TSR performance of Western European banks

- Global capital markets continued to move sideways in the fourth quarter of 2022 – Basic Materials and Industrials were the best-performing sectors.

- Western European banks’ strong capital market performance lifted global top 100 banks (TSR +2.3% QoQ) above MSCI World performance (+0.9% QoQ).

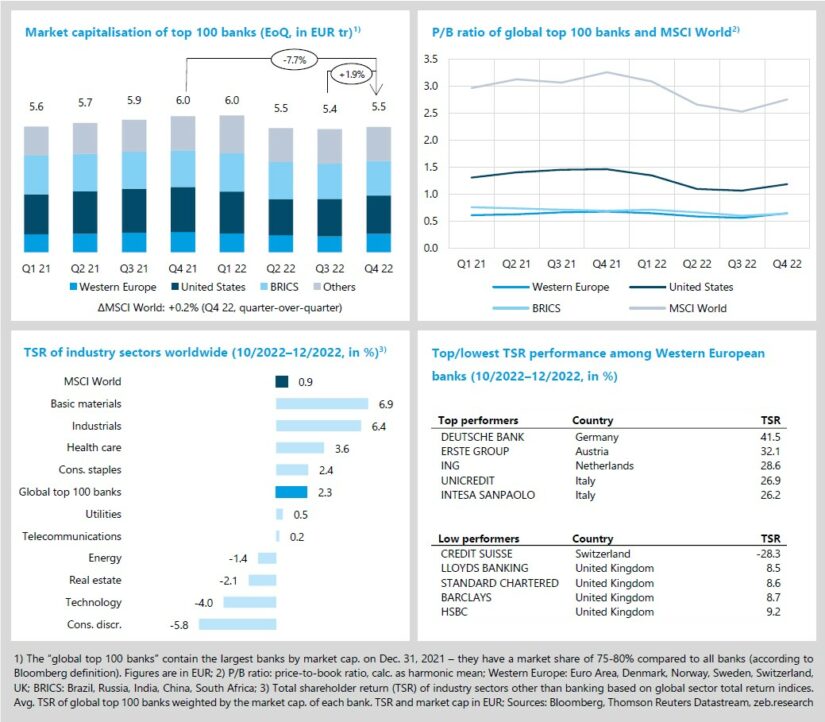

Global capital markets continued to move sideways in the fourth quarter of 2022 (MSCI World TSR +0.9% QoQ, market cap. +0.2% QoQ). Global top 100 banks performed slightly better than the overall market with a TSR performance of +2.3% QoQ – however, across the different regions, performance varied significantly. Western European banks rallied in Q4 2022 with a TSR performance of +16.4% QoQ, while U.S. banks were only slightly ahead of overall markets with +3.2% QoQ and BRICS banks’ TSR even decreased by -1.9% QoQ.

- Market capitalisation of global top 100 banks came in at EUR 5.5 tr at the end of Q4 22 and is thus still not back to pre-COVID-crisis levels. After three quarters of steadily declining market capitalisation in 2022 (Q1 22: -5.9%, Q2 22: -10.3%, Q3 22: -6.0%), Q4 22 marked a conciliatory end of the year for Western European banks (+15.7% QoQ), which make up 13% of the top 100 sample (U.S.: 30%, BRICS: 29%, Others: 28%).

- Average P/B ratios showed a slight recovery in Q4 (MSCI World +0.23x QoQ to 2.75x). European banks’ average valuation increased by +0.09x QoQ to 0.65x and is now slightly above BRICS levels (0.64x) again – for the first time since Q2 17. U.S. banks’ average P/B ratio increased most strongly with +0.12x QoQ to 1.18x.

- Western European banks’ lowest performer in Q4 22 – as in the previous quarter – is Credit Suisse. Investors still lack faith in the bank despite the greenlighted plan of a capital increase and the planned reductions in investment banking. Deutsche Bank is the top performer among Western European banks (TSR of +41.5%) as it significantly exceeded analyst expectations (again) with the highest third-quarter profit since 2006. However, for FY 2022, analysts still do not expect Deutsche Bank to achieve its 8% post-tax ROTE target (average consensus estimate as of January 17, 2023: 7.8%).

Banks start to brace themselves amidst bleak economic outlook

+9.6% YoY Western European inflation rate in Q4 2022

- China ending its “zero-Covid” strategy and opening to the outside world raises modest hopes for a boost to the global economy.

- Overall, despite declining inflation rates, moderate inflationary recessions in Western Europe, Germany and the U.S. continue to appear inevitable in 2023.

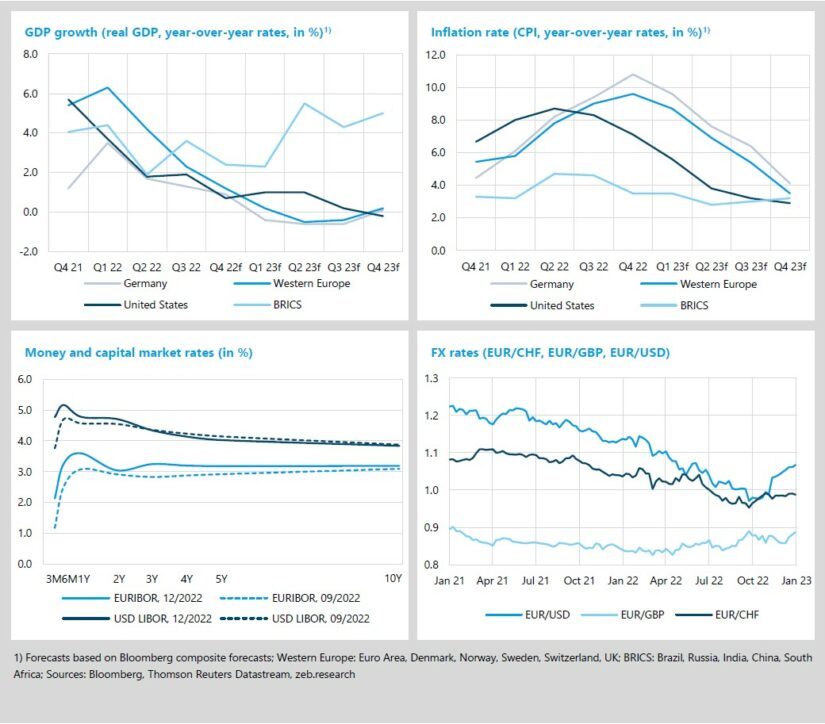

Prospects for global economic development are still cheerless indicating an inevitable moderate inflationary recession in Western Europe and Germany in 2023. China ending its “zero-Covid” strategy and opening to the outside world again – albeit at the expense of the virus being rampant in the country – gives hope for a boost to the global economy. Inflation rates are expected to have peaked in Q4 22 YoY in Germany (10.8%) and Western Europe (9.6%). In the U.S., the trend of declining inflation rates continued in Q4 22 YoY (7.1%), while the BRICS region remains at a comparatively low inflation level (3.5%). With the ECB turning a bit more hawkish, the EUR/USD FX rate has climbed to 1.06 in Q4 22 after falling below parity in the previous quarter.

- Economic growth forecasts predict the recessionary peak for Western Europe and Germany in Q2 23f

(real GDP growth of -0.5% YoY and -0.6% YoY, respectively). The U.S. economy is likely to experience an increase in GDP growth of 1.0%/1.0%/0.2% YoY in the first three quarters of 2023. However, continued U.S. Fed tightening is expected to culminate in a mild economic retraction in Q4 23 with -0.2% YoY GDP growth. - The moderate recessions in the U.S. and Western Europe are expected to assist in the steady decline of inflation rates throughout 2023 with estimated inflation levels below 4% by the end of the year.

- The S. yield curve further increased its inversion with recent increases in 3M–2Y rates (3M: 4.8%; 2Y: 4.7%; 10Y: 3.8%), while the euro area yield curve flattened slightly more compared to the end of Q3 22, but still provides a positive spread of ~100bp for 10Y–3M (3M: 2.1% vs. 10Y: 3.2%) and ~30bp for 10Y–2Y (2Y: 2.9%). Both Fed and ECB slowed the pace of raising rates in December 2022 (U.S. Fed: +50bp; ECB: +50bp). Analysts expect the Fed (ECB) to raise rates by 25bp (50bp) in February and by 25bp (50bp) in March and that both central banks will reach their terminal rates in the first half of 2023 with just over 5.0% (Fed) and 3.0% (ECB).

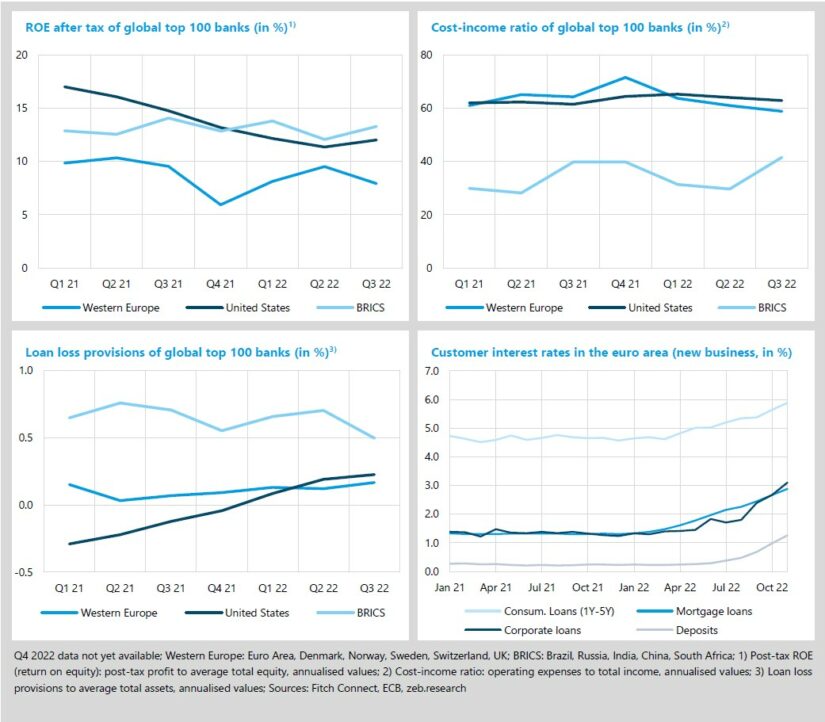

In Q3 2022, profitability of Western European banks declined by -1.6%p both YoY and QoQ. U.S. banks reported a modest increase in ROE compared to the previous quarter (+0.7%p), which, however, cannot compensate for the sustained drop in profitability in the recent past (-2.8% YoY). BRICS banks’ average quarterly ROE amounts to 13.3% (-0.8%p YoY), thereby outperforming both Western European and U.S. banks in Q3 2022. The prospect of an upcoming recession materialises in an increase of both Western European and U.S. banks’ loan loss provisions (+10 bp and +35 bp QoQ, respectively).

- The improvements in Western European banks’ cost-income ratio continued in Q3 2022, reaching an average CIR of 58.8% (-2.2%p QoQ; U.S. banks: -1.2%p, BRICS banks: +11.9%p). However, the decrease is not driven by higher revenues (-4.8% QoQ; U.S. banks: +11.4%, BRICS banks: +12.0%), but rather by a disproportionate reduction in costs of -8.1% QoQ (U.S. banks: -9.4%, BRICS banks: +56.7%).

- As expected, Western European banks further raised loan loss provisions in Q3 22 (+5bp QoQ) in light of the looming 2023 recession. After a strong increase by +10bp QoQ in Q2 22, U.S. banks again raised provisions, albeit at a lower level (+5bp QoQ). Banks remain in a cautious “wait and see” positioning.

- In reaction to ECB’s further tightening monetary policy, customer interest rates proceeded to rise as Corporate loans experienced the strongest increase of +1.8%p YoY to 3.1% by the end of November 2022. As outlined in our previous zeb.market.flash, competition for deposits increased significantly as well, leading to average household deposit rates of 1.3% for November 2022 (+1.02%p YoY) – further increases, in line with ECB’s rates hiking, can be expected.

Special topic – essential value drivers in banking

- The current and imminent banking environment poses plenty of challenges requiring banks to focus on the right value drivers and to find a balance between risk, return, growth and resilience.

- We studied the influence of 45 different value drivers on banks’ objectives by using different and innovative statistical approaches and analyzing an extensive dataset of the 50 largest banks in Europe, considering 16 years of data.

Over the last zeb.market.flash editions, it became obvious that the economy and banks in particular are facing a turn of the tide. A look at the new banking regime reveals numerous challenges that need to be overcome. Firstly, we are entering a phase of persistently low economic growth combined with a high risk of recession for individual economies and regions. Secondly, inflation will likely remain above ECB’s 2% target, even if a slow decline from the extremely high current levels is anticipated. Following the real “Basel II interest rate shock” in 2022, we expect generally elevated but flat interest rate levels going forward. After the COVID-19 crisis and the persistent current crisis, many companies have had to tap into their own funds, so that an increased need for financing on the corporate side can be expected – giving rise to the issue of credit risks. In addition to these short-term effects, there are further geopolitical shifts and risks as well as initial steps towards a diversification of international supply chains. All these issues contribute to persistently high market uncertainty and volatility.

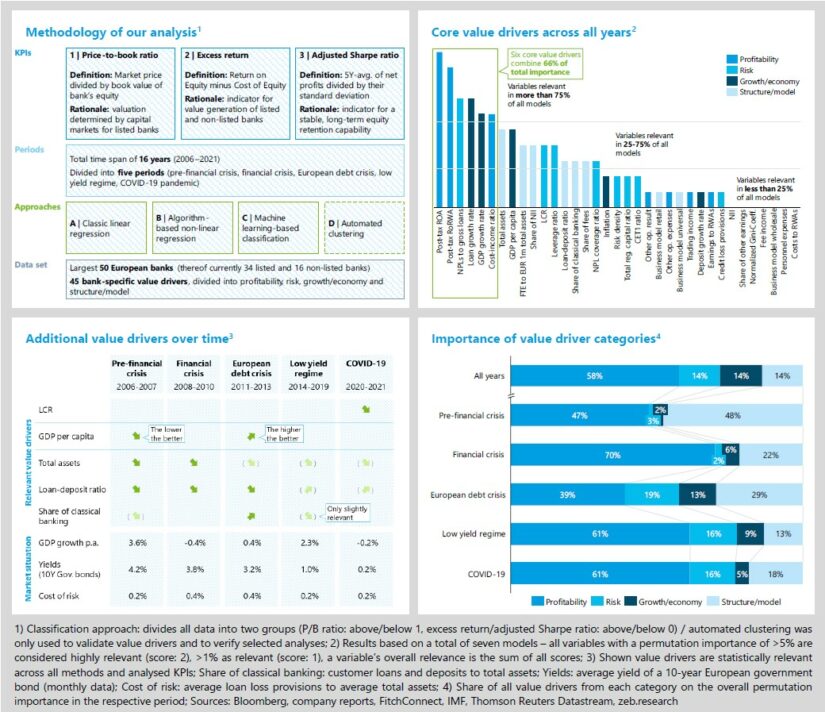

Historically, the spread of performance across banks increased in such challenging times. The question going forward is whether there is a universal framework of value drivers consistent over time that essentially explains a bank’s value generation and additionally provides an anchor point for bank management in a dramatically changing environment with enormous uncertainties. To answer this question we utilised a comprehensive, long-term analysis of the development of the 50 largest banks in Europe. The analysis and results are the product of our annual European Banking Study – please find further information and our study team’s contact data here. Using several state-of-the-art statistical approaches, the influence of 45 different value drivers on a bank’s objectives was investigated. We analysed a full credit cycle of 16 years (2006–2021), which includes not only economic ups and downs but also several fundamental crises and upheavals and can thus certainly serve as an indicator of the current situation. Figure 1 details the methodology of our analysis – further details upon request.

Six value drivers can be singled out as particularly crucial for a bank’s performance: return on risk-weighted assets (RoRWA), return on assets (ROA), cost-income ratio (CIR), non-performing loans as a percentage of total loans (NPL ratio), loan growth rate, and average GDP growth in the bank’s markets. With the return on risk-weighted assets (RoRWA), the return on assets (ROA) and the cost-income ratio (CIR), the focus is on three classic profitability and efficiency indicators. They are supplemented by the non-performing loan ratio (NPL ratio) as a measure of a bank’s credit risk and by two growth/macroeconomic parameters: the growth rate of loans and GDP growth in the bank’s markets.

So, most of the value generation observed over a long period of time can be traced back to a few very classic banking KPIs. It is interesting to note that structural factors such as the size of a bank, its basic business model, or the ratio of lending to deposit business (measured, for example, by the loan-deposit ratio) are less relevant. Nor does a bank’s risk appetite, measured for example by risk density (risk-weighted assets in relation to total assets), matter in the final analysis. For banks, the focus is much more on achieving high margins on a risk-adjusted basis. From an overall perspective and over the entire period, the size of the leverage effect – an important lever often mentioned after the financial crisis – also tends to be more of a risk parameter and is therefore not a value driver in itself. The core levers also underscore the importance of growth and general economic conditions for the banking business. An environment with strong macroeconomic growth rates has been essential for a bank’s success in the past. So, a recession and weak growth rates in the countries of Europe in the coming quarters will make it much more difficult for the institutions to generate value.

Additional insights are provided by splitting the full period into several smaller ones (pre-financial crisis, financial crisis, debt crisis, low yield regime, COVID-19 pandemic). Doing so shows that depending on the macroeconomic environment and the current “zeitgeist” (as expressed in new regulations, for example), certain value drivers temporarily gain additional relevance – and also lose it again. This is particularly evident in typical, frequently used balance sheet structure ratios of banks. For a long time, for example, a balanced loan-deposit ratio was considered to be particularly advantageous. However, since the start of the low-interest rate regime in 2014 and the associated decline in margins in deposit-taking business, which in some cases even turned negative, this has reversed. For example, Scandinavian institutions, which are heavy on lending, have significantly gained in value since the low-interest phase. The size of a bank is not a stable value driver over time either. When looking at the share of growth markets in a bank’s geographic mix, we come to a similar result. Before the financial crisis, a high share was advantageous, but during the debt crisis and the associated macroeconomic risks, it was institutions in stable, mature markets that generated above-average value growth.

This explains why, over the past few years, typical structural KPIs of banks have been less relevant. As the macroeconomic environment changed, so did the assessment of business models and their value-adding properties – without any clear outcome. By contrast, the aforementioned “classic” profitability value drivers are of consistently high importance. Moreover, in an intertemporal comparison it is striking that other risk drivers (e.g. regulatory capital ratios) only gained importance in the years following the financial crisis, also because some of these drivers were only introduced as part of extensive regulatory adjustments in response to the financial crisis.

For banks, these results have consequences not only for operational management, but also for corresponding strategic decisions. Knowing the individual value drivers is essential at any rate. It also means, however, that any fundamental change in the macroeconomic or regulatory environment requires a re-adjustment and a dedicated analyses of the bank’s managed value drivers/KPIs and the associated decisions.

Our analysis shows that one of the most important anchor points for bank management which is relevant across all periods is the risk-weighted return on assets (RoRWA). This also applies to the years ahead. Accordingly, banks should continue to focus on RoRWA as the key value driver for profitability and manage it accordingly at the product-customer level. The cost-income ratio will also remain a key driver in the future but will be given a secondary condition: banks will also have to think about their operational resilience, i.e. secure structures and supply chains, and therefore accept higher costs in some cases. However, the focus on efficiency must not be lost in the process. Credit risk management is regaining importance. Banks need to be able to absorb elevated levels of risk costs on a permanent basis and manage both non-performing loans and credit losses efficiently. As regards the alignment of the balance sheet structure, the increased interest rates are a clear game changer. Because of the deposit business revival induced by the interest rate turnaround and the resulting competition for deposits (see our previous edition of the zeb.market.flash), a reassessment of the target balance sheet and target funding is becoming vitally important.