Current situation and challenges for regional banks

To avoid falling behind, regional banks must be proactive in the way they manage their deposit business. The savings products business, previously marginalized by zero interest rates, is already under attack from aggressive market players (e.g. Trade Republic). As a result of the rekindled competition for customer deposits, bank products from the liability side will become even more expensive for regional banks. We also expect customers to become more price sensitive, which will intensify competition.

In addition, the steady growth of customer deposits has changed the funding situation of regional banks. Currently, (variable) demand deposits are still their main source of funding, accounting for more than 50%.

You can find out more about the resulting comprehensive challenges for sales, treasury, risk control and accounting in our article “Regional banks after the interest rate turnaround – seizing opportunities, avoiding risks”. The focus of this article is on the sales challenges faced by savings banks and cooperative banks.

Regional banks must rethink and reshape their deposit business

To ensure that product and pricing policies do not remain stuck in old paradigms and to not counteract the successes achieved in expanding the commission business, it is essential to strategically rethink the deposit business and transform it into a strategic deposit agenda.

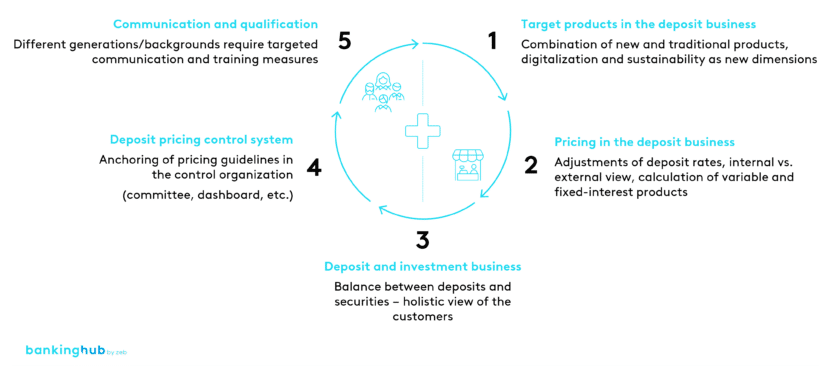

This agenda comprises five key topics that need to be addressed in the wake of the interest rate turnaround. We have outlined these below, along with some initial key questions for management.

1) Target products in the deposit business

We recommend using the tailwind of positive interest rates to modernize the liabilities side and its products. In this context, it is important to avoid the careless mistakes of the past and to make adjustments in the liability business prudently, as these obviously have a direct impact on interest expenses. Customers and regional banks appreciate simple and transparent products. Traditional demand deposits, time and overnight deposits with short and medium maturities, as well as savings bonds and certificates for longer-term investment periods are available to satisfy this demand.

Depending on the yield curve, a roll-over investment concept with savings bonds of different maturities can be used to meet customers’ needs in terms of both attractive interest rates and liquidity. For shorter maturities, deposits at notice supplement the product portfolio, especially for large investors, and can also have a positive effect with regard to LCR recognition. The product range is complemented by combined deposit and investment products.

Product design must also consider digitalization and sustainability as new design dimensions. In addition to digital (conclusion) processes, fintech companies, such as the WeltSparen by Raisin brokerage platform, are being used and in some cases even technically integrated to better leverage the customer interface. Sustainable interest rate products (such as those offered by Sparkasse Hannover) are still relatively rare among regional banks – but offer opportunities for future positioning and differentiation.

Key questions for the regional bank:

- What are the needs of the different target groups?

- Which deposit products should be offered?

- Where do you see gaps or redundancies?

2) Pricing in the deposit business

It is becoming apparent that the cooperative and savings banks as market leaders are unlikely to be able to maintain their initially passive stance on deposit pricing this year, given that the magic two percent threshold for money market accounts had already been crossed at the beginning of the year and competition is becoming even more dynamic.

So if a regional bank sits on the sidelines for too long, sooner or later it will lose deposits: in a comparable interest rate environment in 2008/2009, regional banks suffered an average loss of about 4% of demand deposits, and the bottom quantile even lost about 8%. It is important to avoid such a scenario in the coming months and years so as not to burden the funding side of regional banks.

Our project experience shows two main challenges when it comes to securing deposits:

- Fewer customers hold a large proportion of demand deposits, which poses an enormous cluster risk. If they were to withdraw even a part of their liquid assets, this would have a direct impact on the bank’s earnings. Therefore, it is necessary to individually identify these customers (e.g. institutional investors) using a scoring model and to target them with tied agent solutions.

- The remaining deposits are widely spread in the retail business, therefore, in contrast to the approach under point 1, it is not possible to establish an individual and personal customer approach. In this case, it is necessary to develop centralized and standardized processes and offerings to secure deposits.

For regional banks, deposit pricing depends on the right timing, i.e., how quickly changes in terms and conditions are passed on to their customers. To better manage this proactively, transparency of price caps and floors depending on interest rate and competitive scenarios is relevant for sales management. In addition to the competitive and market perspective, the regulatory view (LCR, etc.) must also be taken into account when calculating prices.

Key questions for the regional bank:

- How are deposit rates calculated and how quickly are they passed on?

- Is there a differentiation in pricing for existing funds that customers have shifted within the bank and for “fresh money” that has been transferred from other banks?

- Are there volume-based pricing scales per product group?

- How do you identify customers with significant deposit volumes and a high risk of churn?

3) Deposit and investment business

During the period of low interest rates, investing in securities was the only way for many customers to achieve a positive (real) return. In recent years, securities and mutual funds have almost replaced the traditional savings book. Thanks to the interest rate hike, customers are once again attracted to savings products.

However, appearances are deceptive, as high inflation has resulted in high negative real returns despite the rise in interest rates. Moreover, inflation has a massive impact on the households’ ability to save. Due to the uncertain times, many retail customers are reducing or stopping their current savings plans. They often fail to consider the implications for long-term wealth accumulation and retirement security.

It has always been the role of regional banks to educate and advise their customers so as to ensure that their assets remain secure in such times. The experience of the past few weeks shows that advisors often lack the tools to respond adequately to rising interest rates and uncertain securities markets. Without a balanced deposit strategy and managed process, the securities business runs the risk of being cannibalized by the deposit business, to the detriment of regional banks and customers.

Coordinated deposit and securities strategies can help meet customer expectations for interest rate products while simultaneously expanding the securities business.

Key questions for the regional bank:

- How must the banks align their product offering in order to meet customer expectations?

- What (earning) target should be achieved in the securities business?

- How can the bank prevent the interest-related business from crowding out the securities business?

- What support services (e.g. sales story) does the sales force need?

4) Deposit pricing control system

A dynamic control organization is required to manage the aforementioned topics. Therefore, we recommend the implementation of a terms and conditions committee whose responsibilities go beyond the deposit business. This committee should be composed of representatives from sales, sales management, treasury and general bank management, and operate according to clear rules and guidelines. It should, for example, meet on a regular basis (e.g. weekly) in order to anticipate current developments.

We believe that cross-divisional collaboration and management of the deposit portfolio will be a key success factor in the deposit business of regional banks in the future.

A dashboard or uniform control tool serves as the basis for collaboration. Embedded in a management information system, it provides regular information on the current interest rate and competitive structure, the impact on the pricing of the bank’s own products, as well as on key regulatory figures (e.g. interest rate risk, BFA 3, net interest income), and supports the performance of target/actual comparisons. For this to succeed, zeb has created a tool-supported, practical solution that can be customized for regional banks.

Key questions for the regional bank:

- How often and in what format does the terms and conditions committee meet?

- What are the rules and priorities?

- How can deposit management be supported by IT systems?

- What information is communicated to managers and customer advisors?

5) Communication and qualification

Especially in retail sales, many (younger) employees have had little contact with the deposit business so far. This is where a revised sales story is called for, one that summarizes the new success factors in a way that fits the target group and translates into concrete actions. Internal communication and employee empowerment are critical to the success of a new sales story.

As with any change, appropriate communication is extremely important. Therefore, we recommend using communication formats such as a weekly meeting and video clips of board members and executives. This allows for instant communication of success stories and news. A customer-oriented storyboard and supplementary information on the intranet complete the picture.

Ultimately, leveraging the new sales story and achieving a successful customer relationship requires direct empowerment of managers and employees. We recommend that this be promoted through workshops and on-the-job training so that, as a result, managers take on the role of leader and coach while advisors apply the sales approach to the customer.

Key questions for the regional bank:

- Is the current sales story up to the challenges of the interest rate turnaround?

- What communication and training formats should be used?

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Conclusion on deposit business after the interest rate turnaround

In summary, regional banks face complex challenges in exploiting the emerging potential of the deposit business and securing market leadership. Deposit business is both the new driver of earnings and the Achilles’ heel.

The ambitious business conditions in the context of the interest rate turnaround can be actively used as a sales approach to differentiate the regional bank from price-oriented direct providers. Advising customers on their savings and investment behavior is thus becoming one of the key success factors for regional banks.

All in all, the interest rate turnaround offers regional banks the opportunity to restore their net interest spreads on deposits to earlier levels and thus make (retail) customer business more attractive. The key to success is to act now, assess the individual situation of the regional bank, and implement the identified approaches quickly and with high priority in sales.