|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

Background situation and challenges at a glance

The pace and extent of the interest rate increases pose a particular challenge for German regional banks. In combination with a German fixed-interest rate culture in lending business and strategic maturity transformation, regional banks initially have to process high present value losses and an increased need for depreciations in the securities portfolio.

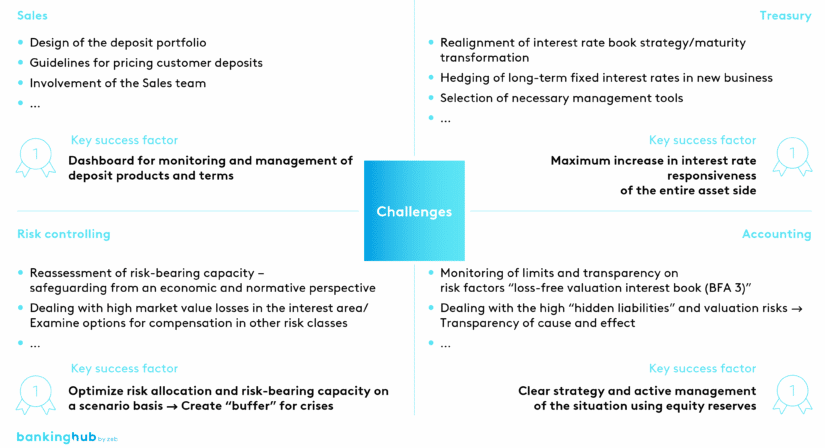

In addition to tapping into new earnings potential, it is also important to keep an eye on the effects in Treasury, Risk Controlling and Accounting. From zeb’s experience, cross-divisional cooperation in regional banks is important to obtain a clear view of the success factors as well as the interactions among them.

The degree of impact varies widely among regional banks and divides the sector into three types. In particular, factors such as balance sheet structure, fixed-interest rate periods on the assets side and volumes or modeling of demand deposits as well as the equity situation influence whether individual regional banks are strongly affected or can participate in opportunities arising from the rise in interest rates.

- For institutions that benefit from the developments (“type A banks”), the responsive assets side increases with market interest rates. Short durations in their own securities accounts and, in particular, the interest rate hedges concluded in the low and negative interest rate environment are having a highly positive effect.

- By contrast, banks that have logged long maturities in their lending business with low terms and have pronounced open maturity transformation positions feel clearly negative effects in their business performance and now have to compensate for increased interest rate risks at high costs (“type C banks”).

- In between are institutions that are more neutral to developments overall or can still cushion the valuation risks well with a solid equity buffer (“type B banks”).

For all banks, it is important to correctly assess the individual challenges and, in particular, to adequately manage the variable-rate deposit portfolio in the future.

In the following, we are going to present the challenges as well as success factors of the individual divisions of a regional bank.

Sales challenge

The turnaround in interest rates has caught many regional banks off guard, especially at the customer interface. The task now is to quickly gain an overview of the earnings opportunities in the deposit business and to transfer this potential to medium-term and Sales planning.

We recommend using the tailwind of positive interest rates to modernize the liability side and its prices, but without making the same stock mistakes of the past (e.g. premium savings). Customers and regional banks want simple and transparent products that can be administered in the IT systems. These include demand deposits, time and call deposits for short and medium terms, as well as savings bonds and certificates for a longer investment period. With shorter maturities, call money complements the product portfolio, especially for large investors, and can also have a positive effect with regard to LCR recognition. A rolling investment concept with savings bonds of different maturities can be used to meet customer requirements in terms of attractive interest rates and liquidity.

To ensure that product and pricing policies do not remain one-off and ad hoc, the deposit business must be transferred to a control loop. We recommend a terms committee made up of Sales, Sales management, Treasury and total bank management, which acts according to clear rules and guidelines and meets regularly (e.g. weekly). A key success factor is a dashboard for monitoring and management.

In addition to an adjusted deposit strategy, regional banks are called upon to strike a good balance between deposit and securities business in their Sales activities. Looking at the rapid inflation of more than 10%, you don’t have to be a prophet to realize that focusing purely on fixed-income securities will quickly lead you into the real interest rate trap. With the investment processes in regional banks and the emerging securities culture of customers, the chances are high. However, the task now is to equip the product offering with further interest rate securities and to sensitize the Sales force to this.

Many advisors who have had little contact with the interest rate business work with private customers in particular. Here a new Sales story is required that summarizes and translates the above success factors in a way that is appropriate for the target audience. In addition to innovative communication tools (e.g. weekly), new training concepts (e.g. customer journey deposits) are now also necessary.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Treasury challenge

The tasks of Treasury are linked to the aspects of Sales. It is important to promptly identify regrouping and outflows in the deposit portfolio and to derive the consequences for interest rate risk and refinancing. Large regrouping from demand deposits to short-term time deposits, for example, can have a significant impact on an institution’s interest rate risk coefficient.

The interest rate book strategy and the associated effects on the extent of maturity transformation must also be reviewed at the end of the negative interest rate phase and adjusted to the changed market environment. If an “adequate level” of strategic maturity transformation was still considered a source of success in recent decades when interest rates were falling, with a compensatory effect against the pressure on margins for customer deposits, this position is now under scrutiny, and too much transformation can become a burden factor. A comprehensive evaluation of current positions from a present value and P&L perspective and a transparent inventory of suitable management and hedging instruments are a first step here. There may be a need to hedge long fixed-interest periods (e.g. >10 years) in new business more directly than in the past. The burdens on interest and valuation results originating from the change in Treasury strategy are to be recorded, and potential measures for optimization are to be examined. In this context, monitoring the effects of control measures on the loss-free valuation of the interest book (in accordance with BFA 3) will also be a decisive aspect for Treasury in the future.

Impact and scenario calculations provide important impetus for deriving countermeasures in the event of regrouping and outflows of funds. Also, when (re)introducing deposit rates, the current opportunity rates as well as the resulting margins and the applied mix ratios have to be kept in mind. If significant changes in total deposits are planned, it is also advisable to integrate these effects into the margin considerations (e.g. by means of a dynamic replication portfolio).

If the interest rate turnaround continues, it will be essential for the success of a regional bank to determine the extent to which the interest rate sensitivity of the entire asset side can be increased as best as possible through balance sheet structure measures.

Risk Controlling challenge

Risk Controlling is primarily concerned with reassessing the risk-bearing capacity and ensuring it from an economic and normative perspective. Depending on the institution’s position, the interest rate increases have led to large declines in the fair value of interest-bearing assets and equally impact earnings and the risk-bearing capacity.

The first step is to take stock of the current utilization of the allocated limits for the risk types and to evaluate which coverage capital has already been used or is still available. Changes in the risk-bearing capacity situation may necessitate reallocations of limits or coverage capital.

Impacts and adjustments must also be examined with a view to asset allocation: burdens on the risk-bearing capacity due to the rise in interest rates can also affect the feasibility or holding intent in the case of interest-free positions. Changes in the risk/return ratios of individual asset classes make it necessary to adjust the strategic allocation. On the one hand, the sharp rise in interest rates reduces the advantageousness of interest-free assets; on the other hand, the rise in interest rates also imposes a different burden on the risk-bearing capacity.

High inflation and the current crises are leading to high uncertainty in bank management. Consequently, scenario calculations are significantly gaining more importance. The central planning premises are to be reviewed on a regular basis and adjusted if necessary. It is crucial to design the risk allocation and risk-bearing capacity with the aid of appropriate scenarios in such a way that sufficient buffers are available even in the event of further unfavorable developments or crises. The bank must ensure its ability to act at all times.

Accounting challenge

According to the effects of the current interest rate turnaround on bank management, there are also related implications for Accounting that should be considered by institutions in the short and medium term.

In the short term, the effects of rising interest rates in connection with the calculation of the liability surplus in accordance with the BFA 3 requirements will be felt here in particular. Accordingly, an anticipated loss provision must be made if a hidden liability exists in the interest book. While there were always sufficient reserves in the interest book during the period of low interest rates, these are steadily dwindling as interest rates rise due to the decline in present value. Institutions should analyze their calculation logic for BFA 3, identify the particularly sensitive positions in the interest rate book, and exploit any methodological leeway to counteract the adverse effects from the rise in interest rates. In Accounting, it is also necessary to simulate interactions from future pricing and product policies in managing deposits and to include these with their consequences for the valuation according to BFA 3.

In the medium term, the scope of current hedge accounting methods is also expected to be expanded. Due to the interest rate turnaround, new portfolios are increasingly being included into interest book management and hedging instruments are being concluded accordingly. Accounting should be aware of how to handle these instruments and make adequate arrangements in consultation with Treasury.

Conclusion: holistic view of consequences required

In the short term, the interest rate turnaround is causing considerable pressure on earnings at many banks and savings banks – depending on how they are affected – as a result of valuation risks, and is presenting institutions in all areas with a wide range of challenges. In particular, the future management of the deposit portfolio will play a key role.

In the medium to long term, the turnaround in interest rates is a blessing for regional banks. It holds the opportunity to bring the net interest spreads in deposit business back closer to the profitable times before the low interest phase. From zeb’s point of view, the key success factor is to include the interactions between the four fields of action in the decisions and to manage them in an integrated manner. To this end, it is necessary to become active, assess the regional bank’s individual situation, prioritize management measures and start implementing them in a timely manner.