|

LISTEN TO AUDIO VERSION:

|

Tokenization, tokens … What’s it all about?

Tokenization describes the process of creating a digital representation of the rights to an asset as a fungible token (usually a security token) or a non-fungible token (NFT). This article focuses on security tokens.

A “digital twin” in the form of a security token is created by documenting the token parameters in a smart contract, i.e. a code that is automatically executed when certain conditions are met in a blockchain transaction. These conditions can be derived from the characteristics of the underlying financial instrument and processed accordingly.

A security token is thus a digitally securitized asset that exists on a blockchain and is subject to applicable securities regulations. Unlike conventional securities, a security token is not held in a securities account but in a wallet. A wallet is a software application or physical medium that allows users to securely store, manage and transfer digital assets.

The value proposition of tokenization

“Tokenization of asset classes offers the prospect of driving efficiencies in capital markets, shortening value chains, and improving cost and access for investors.”

(Larry Fink, CEO of BlackRock, in his 2023 letter to investors)

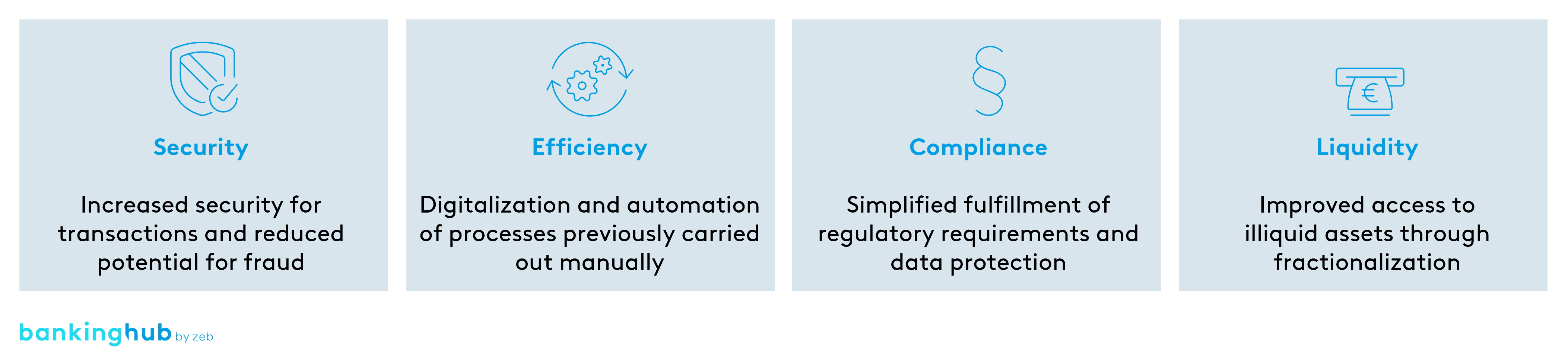

The quote from Larry Fink shows that big players like BlackRock are considering the use of tokenization and are convinced about the technologies’ impact on the capital markets. From zeb’s perspective, the value propositions of tokenization can be summarized in four sections:

- Security: Tokenization offers a high level of security, as a blockchain records all transactions in a tamper-proof and transparent manner. Hence, ownership can be traced reliably and quickly. For financial institutions, the blockchain therefore serves to mitigate fraud risk.

- Efficiency: By digitalizing and automating processes, significant efficiencies and, in the long term, cost reductions can be achieved. This is mainly accomplished by reducing manual process steps and utilizing solutions to scale the DLT infrastructure. In addition, financial institutions can save fees incurred for involving additional intermediaries in the context of issuances or asset servicing, as smart contracts automate these processes.

- Compliance: Financial services providers must comply with regulatory requirements, especially regarding anti-money laundering, which includes ongoing business and transaction monitoring. The hallmark of transactions using security tokens is that they are always documented in a transparent and tamper-proof manner on a blockchain network. If financial services providers synchronize their current processes with a blockchain, the aforementioned tasks can be automated in the future.

- Liquidity: Tokenization creates new business opportunities for financial institutions by allowing them to offer illiquid assets, such as infrastructure or private equity investments, to a broader range of customers. The reason is that security tokens can divide ownership of assets into smaller shares than previously possible. This makes asset classes that require high capital investments accessible and easier to trade for private investors, which also supports the development of liquid secondary markets.

In our reality check at the end of the article, you can find out how far banks have already come regarding their tokenization efforts and which value propositions have already materialized.

Digital securitization as an enabler for securities 2.0

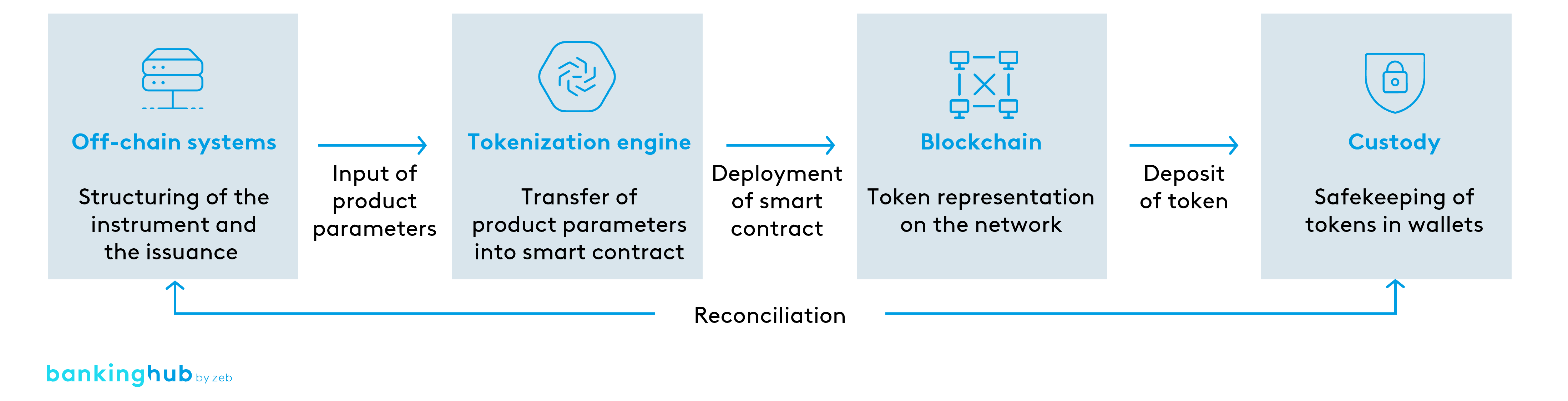

New tokens are issued in so-called security token offerings (STOs). In a first step, the characteristics of the financial instrument and the issuance are defined by the issuer together with the issuing agency and typically stored in its off-chain systems (mainly securities master data), which serves, among other things, as a starting point for asset reconciliations.

Next, a technical tokenization solution (also known as a tokenization engine) is used to transfer the instrument properties and terms of issue into a smart contract using decentralized applications (dApps) as parameters.

Once the smart contract is uploaded and executed, it is deployed on the blockchain. This makes the smart contract available to all network participants and the conditions and features it contains usable. For deployment, a consensus mechanism is used that prevents counterfeiting and ensures trust in the authenticity of the tokens and associated rights.

After successful deployment, a token is created that digitally represents the rights to the tokenized asset, making it tradable. The token is then deposited into a wallet held by a crypto custodian. In addition, a reconciliation with the off-chain systems and, if necessary, an update of the data basis are carried out.

What types of assets are suitable for tokenization?

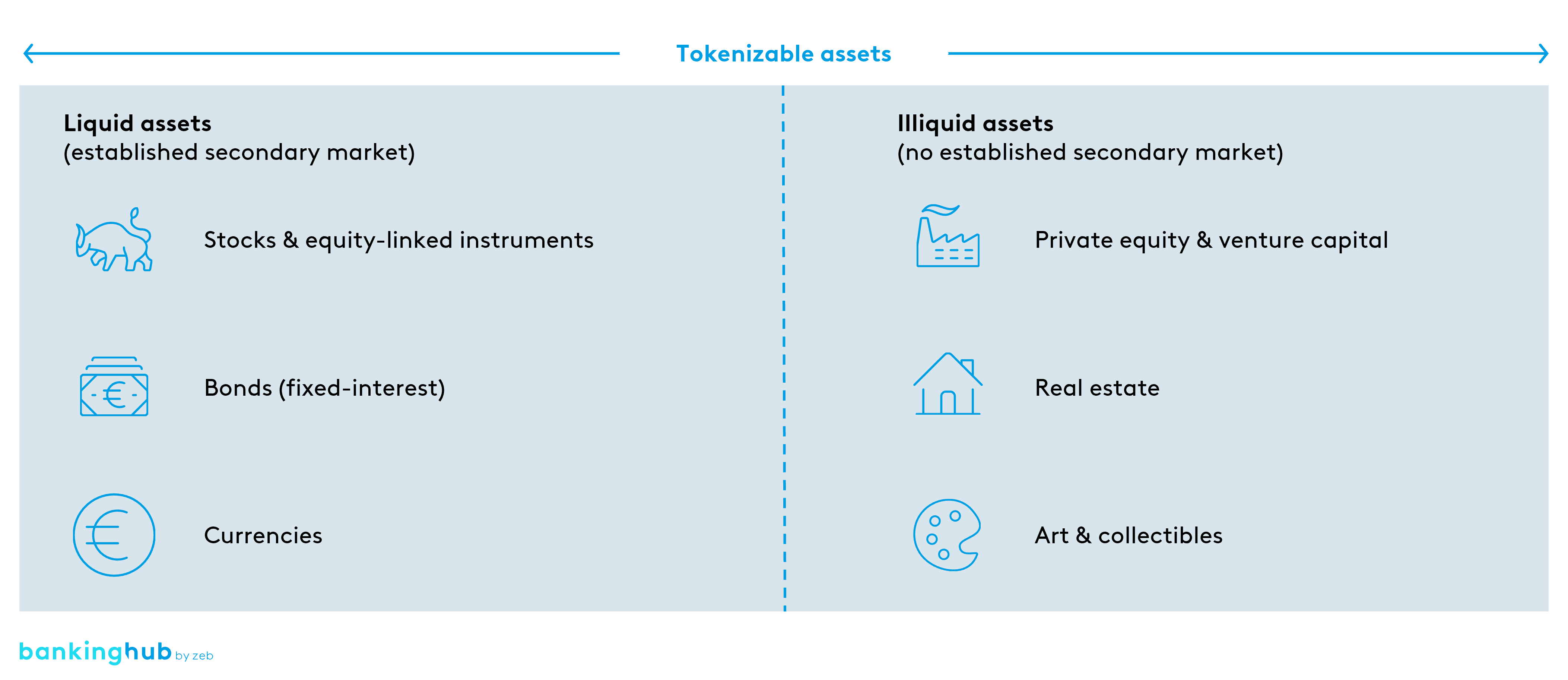

Security tokens can represent both liquid and illiquid assets. Liquid assets such as stocks, bonds and some investment funds are converted into security tokens to attract crypto-savvy investors. Since liquid assets are already traded through established secondary markets, tokenization does not create any new retail investment opportunities here. Long-term benefits of tokenizing liquid assets therefore result from cost savings and efficiency boosts in processes such as asset reconciliations, stock buybacks, and voting rights distribution.

In contrast, tokenization of illiquid assets offers greater potential to appeal to retail investors by providing broader access to investments previously reserved primarily for institutional investors or high-net-worth individuals. This includes private equity investments, real estate and infrastructure projects, as well as art and collectibles. Fractional ownership allows financial services providers to offer their customers ownership of part of an asset. This enables trading in fractions of assets so that investors can buy and sell small shares in assets at any time.

What business models does tokenization enable?

There are many opportunities for financial institutions and fintech companies to position themselves as intermediaries or infrastructure providers in the tokenization value chain. Possible business models can be divided into pre-trade, trade and post-trade business models based on their role in the value chain. Here are three examples:

- Pre-trade:To prepare a token issuance, issuing agenciesstructure the terms of issue or investment together with issuers, prepare contract documents and securities prospectuses, and support the distribution to investors.

- Trade: For investors and issuers to trade tokens, trading venues are required on which tokens can be listed. These are multilateral trading venues that allow buyers and sellers to agree on transactions. The so-called DLT pilot regime includes regulatory requirements for market infrastructures that enable tokenized asset trading.

- Post-trade: Crypto custodians play a key role in the tokenization value chain, as they are technically and legally able to hold tokens in wallets for investors.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

zeb reality check: have the value propositions of tokenization materialized yet?

Security of tokenized assets

The blockchain provides a high level of security by design. To fully leverage this potential, however, all network participants must follow the same rules. Uniform contractual frameworks and standards can minimize potential security gaps and further strengthen trust in tokens. These security aspects are currently being evaluated by numerous institutions and brought into line with existing risk management and compliance requirements.

Efficiency in the context of tokenization

Banks are currently primarily occupied with setting up technical DLT infrastructure and gradually implementing their DLT strategies. Therefore, their focus currently lies on potential efficiency gains of DLT infrastructure, which must be assessed individually depending on each institution’s target state.

When building their tokenization offering, banks must decide whether to use a public or permissioned blockchain. While public blockchains, such as the Ethereum network, are open and transparent to third parties, permissioned blockchains allow tighter control, as only authorized participants can access the network. Against this background, the scalability of the blockchain used is a particularly important factor to consider, as it can limit efficiency. Moreover, cost efficiencies require uniform market standards as well as a broad and collaborative adoption of tokenization by financial services providers.

Compliance in handling tokenized assets

Efficient use of DLT for compliance and anti-money laundering is complex and, from zeb’s point of view, involves enormous implementation effort. In this regard, banks must develop capabilities that enable the establishment of a regulatory compliant and efficient transfer of tokens. The German Crypto Asset Transfer Regulation is a first and meaningful push by the regulator to create a uniform market standard for the transfer of crypto assets. In addition, the application of travel rule protocols ensures that the anonymity of transactions with security tokens is reduced. For more information on this topic, see this article.

Liquidity of the market for tokenized assets

The market for tokenized assets is currently still suffering from liquidity problems due to a lack of supply and demand. Trading efficiency is to be improved through so-called DLT MTFs[2] in accordance with the DLT pilot regime. Significant efficiencies need to be realized before the market for tokenized assets can gain depth and spur the adoption of tokenization.