|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

Objective of the DLT pilot regime

The DLT pilot regime includes exemptions from existing regulatory obligations for multilateral trading facility providers, market operators and central securities depositories so that initial pilot projects can test the use of DLT for trading and settlement of financial instruments in a regulated environment.

The goal of the DLT pilot regime is to create a new and innovation-friendly regulation that provides market participants with justified exemptions from existing regulations to encourage the use of DLT on the financial market. The DLT pilot regime is part of the EU’s digital finance strategy, which has been pursued since 2020 and also includes the Markets in Crypto Assets Regulation (for short: MiCAR) and the Digital Operational Resilience Act (DORA).

Apart from their objectives, the MiCAR and the DLT pilot regime differ in another key respect: the type of financial instruments to which they apply. While MiCAR focuses on e-money tokens, (non-)value-referenced tokens and utility tokens, the DLT pilot regime is limited to those crypto-assets that constitute financial instruments as defined by MiFID II. Accordingly, only DLT financial instruments may be issued and traded on a DLT market infrastructure.

DLT financial instruments are defined in the regulation as “crypto assets that qualify as financial instruments [under MiFID II] and that are issued, transferred and stored on a distributed ledger”[1], i.e. security tokens. Consequently, in addition to the crypto-assets encompassed by MiCAR, the DLT pilot regime will add the last missing piece of the puzzle in regulating crypto-assets.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

DLT financial instruments and infrastructure solutions

For the “sandbox approach” of the DLT pilot regime, the volume of DLT financial instruments that can be traded on one DLT market infrastructure will be limited in volume for the time being, with supervision explicitly reserving the right to any adjustments. Thus, only shares whose issuer has a market capitalization of less than EUR 500 million (small caps), and bonds or other debt instruments or money market instruments with an issuance volume of less than EUR 1 billion (except for corporate bonds where the issuer has a market capitalization of less than EUR 200 million) will be admitted to trading on a DLT market infrastructure. In addition, only units of UCITS[2] funds are admitted if the market value of all assets under management of the fund is less than EUR 500 million.

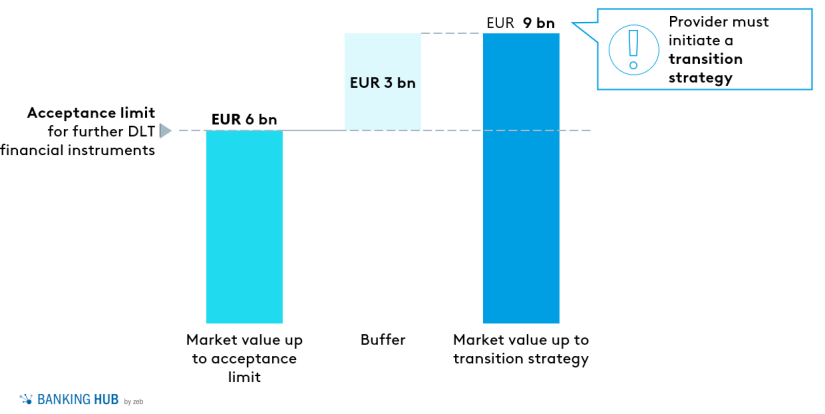

A DLT market infrastructure may not admit additional DLT financial instruments to trading if the total market value of all DLT financial instruments already traded on it exceeds EUR 6 billion. If the total market value of all DLT financial instruments admitted for trading (or booked) on a DLT market infrastructure exceeds EUR 9 billion, the market infrastructure provider will have to initiate a transition strategy. Above this threshold, the facilitations under the DLT pilot regime are no longer applicable, so that the products must be transferred or migrated back from the DLT to a conventional market infrastructure and offered for trading and/or settlement there.[3]

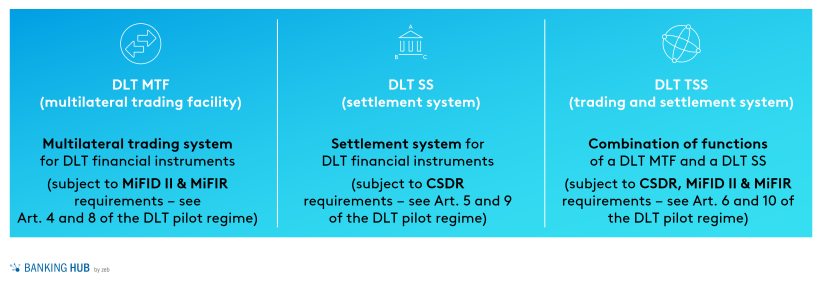

The DLT pilot regime differentiates between three different infrastructure solutions:

Requirements and time horizon for licensing as a DLT market infrastructure provider

The applicant company requires licensing by the national authority in order to operate any of the three DLT market infrastructures. If an integrated service offering in the sense of the DLT TSS is to be provided from the outset and the trading and settlement platforms are thus to be combined, the applicant company must fulfill both the regulatory requirements for a DLT MTF and a DLT SS.

In order to be licensed as a DLT market infrastructure provider, various organizational requirements must be met, and appropriate evidence and documentation (including a viable business plan) must be provided to the supervisory authority, including:

- the roles and profiles of employees directly or indirectly involved in service delivery,

- the technical functioning, participation criteria and purpose of the DLT network used, the DLT financial instruments on it and related services,

- documents defining rights, obligations, responsibilities and liabilities of involved parties,

- robust IT systems as well as IT security measures,

- evidence that the applicant has made adequate provisions to meet obligations and compensate customers,

- evidence that the applicant company has adequate KYC and AML procedures in place,[4]

- the safe-keeping arrangements for the DLT financial instruments and a transition strategy if the limit described above is exceeded.

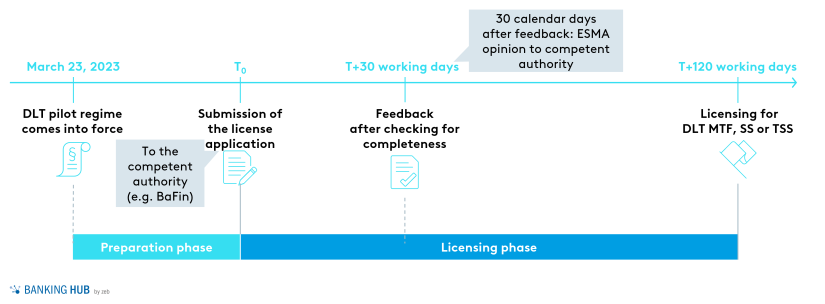

The time horizon targeted by the supervisory authority for the licensing process as a provider of a DLT MTF, DLT SS or DLT TSS is as follows:

Exemptions from existing regulatory frameworks

In the context of a licensing procedure for a DLT market infrastructure, various exemptions have to be taken into account, which can be requested by the applicant company from the competent authority in order not to have to comply with the full scope of regulatory requirements of a conventional trading or settlement infrastructure (MTF or CSD, respectively).

Multilateral trading facilities and the DLT MTF are both governed by Regulation (EU) No 600/2014 (MiFIR) and Directive 2014/65/EU (MiFID II). For CSDs planning to operate a DLT SS as a securities settlement and delivery system, Regulation (EU) No 909/2014 (CSDR) still applies. The licenses and exemptions are temporarily valid across the EU for a period of up to six years from the date of license issuance and only for the duration of the DLT pilot regime. The exceptions are outlined below.

Exceptions for DLT MTF

A DLT MTF enables investors to trade DLT financial instruments. Compared to conventional multilateral trading systems, the exemptions to be requested are:

- the exemption from the intermediation obligation under MiFID II, allowing operators of a DLT MTF to grant retail investors direct access and thus trading for their own account[5],

- a limited applicability of the reporting obligations for transactions according to Article 26 MiFIR (reporting of a reduced data set).

Exceptions for DLT SS

The DLT SS is a system used to process transactions, payments and delivery of DLT financial instruments. If the settlement of real-time transactions of DLT financial instruments using central bank money proves impractical, the DLT pilot regime allows transactions to be settled via a DLT SS using e-money tokens or tokenized bank money.[6] Other exceptions include:

- the exemption from the use of a securities account and requirements on book entries,

- exceptions for measures to prevent failed settlements and for measures against failed settlements,

- the possibility of outsourcing core services to a third party and

- the exception from establishing a branch.

Exceptions for DLT TSS

A DLT TSS combines the functions provided by a DLT MTF and a DLT SS. This has far-reaching advantages for market infrastructure providers and could, on the one hand, lead to a strong streamlining of the value chain, as activities for which intermediaries are currently needed can be performed decentrally by the DLT TSS. On the other hand, operators of a DLT TSS must comply with all regulatory requirements of a DLT MTF as well as those of a DLT SS. Nevertheless, operators of a DLT TSS may request the same exceptions as operators of a DLT MTF or a DLT SS.

Opportunities for DLT market infrastructure providers

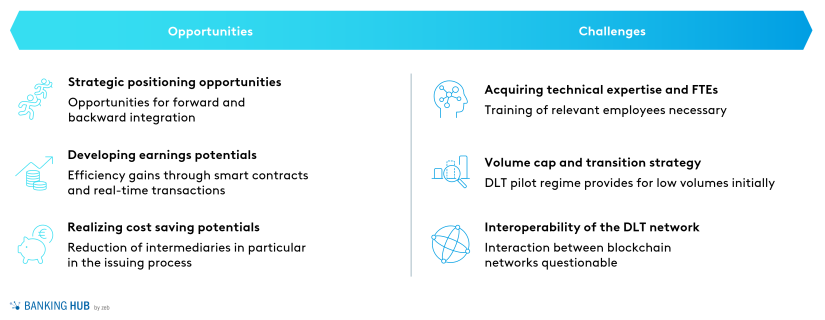

1) Strategic positioning opportunities:

The entry into force of the DLT pilot regime creates various strategic positioning opportunities for both established and new market participants as they can establish themselves as DLT market infrastructure providers. The possibility of operating a DLT TSS furthermore, enables a forward or backward integration particularly for existing providers of multilateral trading systems or settlement systems, whereby trading and settlement systems can be merged and thus an end-to-end infrastructure solution with direct end customer access can be generated.

2) Developing earnings potential:

Trading in security tokens is currently only possible to a limited extent, which still hinders the market development of this promising asset class. The reason for this is that buying and selling a security token is currently only possible with the issuer itself, but there are no regulated trading platforms for security tokens from different issuers. A DLT MTF will close this gap and significantly improve the tradability of security tokens, which may result in increased market liquidity and market reach through better bid-ask spreads.

3) Realizing cost savings potentials:

The use of smart contracts and DLT-based (account) reconciliation routines can lead to huge efficiency gains and consequently cost savings due to eliminated manual interventions. This can be seen in the ability to conduct real-time transactions via the DLT and settle trades on a same-day basis – without the usual value date difference of conventional settlement systems. The possibility of issuing DLT financial instruments via a DLT MTF without an intermediary, i.e., without the intermediation of a financial institution accompanying the issuance, also goes hand in hand with a significant reduction in costs.

Challenges for DLT market infrastructure providers

1) Acquiring technical expertise and increasing employee capacities:

Specific needs for action for potential DLT market infrastructures exist in acquiring the necessary know-how to operate such a DLT market infrastructure, but also in setting up the technical platform. Moreover, additional FTEs are often required for developing and operating DLT systems. Training measures and perhaps the purchase of corresponding competencies are required here. The need to act quickly is reinforced by the fact that the DLT pilot regime will come into effect as early as March 2023.

2) Volume cap and transition strategy:

At the outset, the potential of DLT market infrastructures is limited by the limitations in the volume of DLT financial instruments that may be traded and settled through them. On the one hand, the focus will be on rather small issuances and pilot projects; on the other hand, this means that future market participants must already be able to develop and, if necessary, implement the transition strategy mentioned above when applying for a license.

3) Interoperability of the DLT network:

Ultimately, the interoperability of DLT market infrastructures will also be a challenge for market participants. For example, it is not yet clear how and whether trading and settlement systems with different technical platforms (e.g., Ethereum or private blockchain) can communicate with each other.