Missed open banking opportunities … for banks

In the Information Age, the ability to securely share one’s own financial data with external providers, known as “open banking”, has become essential. This is why the European Union introduced the Payment Services Directive 2 (PSD2), published in 2015 and in force since 2018. The directive aims to achieve two main objectives: to foster growth and enhance competitiveness within the financial sector, while also mitigating risks for users.

Despite the noble intentions underlying it, the impact of open banking fell short of initial expectations, as the associated products and services struggled to achieve widespread user adoption due to various limitations. From a market dynamics perspective, use cases primarily focused on basic services and grappled with interoperability issues between different systems. Meanwhile, customers remained largely unaware of open banking products and services, with solutions mainly catering to multi-banked customers, thus limiting broader acceptance and uptake.

Regulatory factors also played a significant role. Limited involvement of banking participants and the absence of adequate incentives hindered the seamless integration of open banking practices. Inhibiting factors include substantial compliance costs without corresponding revenue streams, heightened competition between incumbents and emerging fintech players as well as an overall erosion of the traditional monopoly status of banks over their customer base.

However, not all stakeholders have been negatively impacted. The revelation of discontinuity in the “closed” banking model has led to a surge in the number of third-party providers (TPPs) registered in Europe. The number of registered TPPs more than quadrupled, from 133 to 559, between 2018 and 2023.

And, by now, at least about half of the almost 90 million open banking users globally are expected to be resident in Europe. Customer numbers have been increasing on average by 50% per year so far and significant double-digit growth rates are expected for the next few years, with new regulations aiming to further stimulate growth across the EU.

New regulations stimulate growth + unlock innovation across the EU

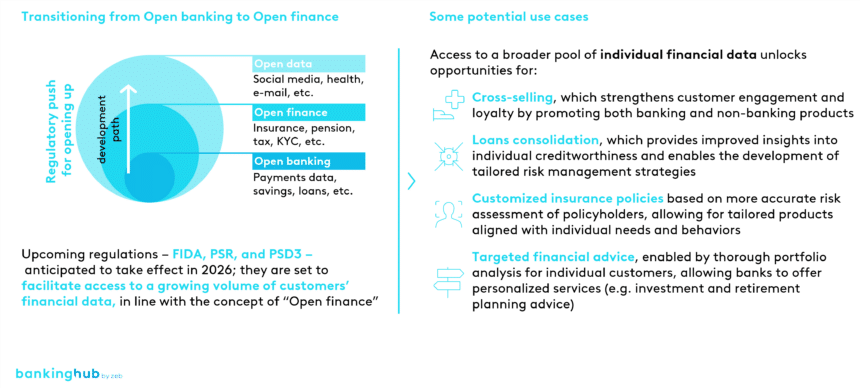

These forthcoming regulatory adjustments stemming from the “Financial data access and payments package” primarily consists of three pillars:

- the third Payment Services Directive (PSD3),

- the Payment Services Regulation (PSR),

- and the Financial Data Access (FIDA) Framework.

These initiatives, expected to come into effect in early 2026, hold significant importance in maintaining Europe’s competitiveness and driving forward its innovation agenda.

Of these pillars, the FIDA Framework stands out by aiming to establish extensive regulations governing data sharing within the financial industry, including insurance, pensions, payments, etc. Once implemented, this regulation is projected to stimulate innovation, enhance consumer offerings and foster competitive dynamics, thereby bringing about a significant shift from the concept of “open banking” towards “open finance”.

Indeed, FIDA presents a multitude of opportunities for stakeholders in the industry. These range from optimizing cross-selling strategies and broadening distribution channels to enabling comprehensive financial wealth management through holistic 360-degree financial profiles.

Furthermore, it unlocks innovative possibilities such as personalized financial advice, loans consolidation, customized insurance policies, efficient wealth management, etc. (see Figure 1)

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Adapting to rapid changes in customers’ demand

The upsurge of tech-driven businesses and tech-adopting challenger banks or fintech companies, providing innovative services alongside traditional banking offerings, has significantly altered customer expectations in recent years.

As the surge of e-commerce and e-services has transformed how individuals conduct their daily transactions, reliable and seamless digital transactions have become the default expectation. Consequently, today’s customers expect banks to provide user-friendly interfaces and seamless journeys supported by state-of-the-art tech, along with a range of non-financial features that facilitate their daily lives. These features can span personalized shopping deals, integrated cashback, access to public administration, AI-powered assistants, and travel and mobility solutions.

This change is driven not only by changing competitive dynamics but also by generational changes. It is anticipated that by 2029, millennials will have the largest portion of disposable income, while the wealth share of baby boomers and Generation X is expected to decline progressively. Today’s “young adults”, i.e. millennials and Generation Z, are accustomed to handling their needs, especially financial matters, using digital platforms provided mostly via mobile apps. The preferences of these tech-savvy generations will play a pivotal role in shaping the direction of global financial systems and influencing the fortunes of traditional financial institutions. In addition to a mobile-first approach to financial management, younger generations expect banks to broadening their offerings beyond traditional financial services.

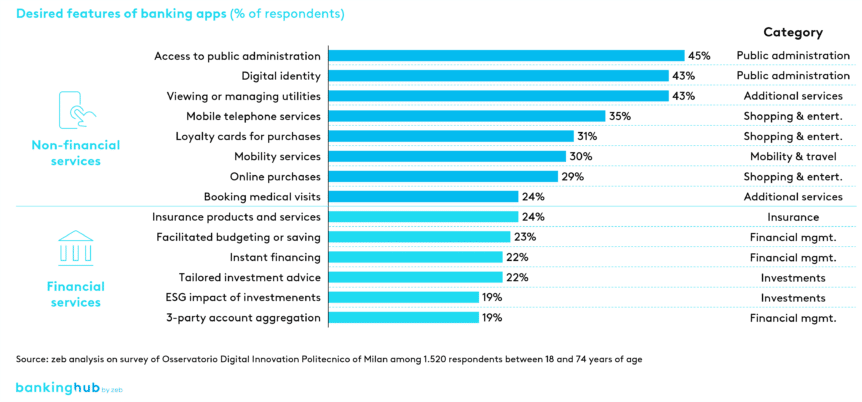

As per a recent consumer survey on the Italian market, a very significant share of customers wishes to have at least one non-financial service embedded in their main banking app while some services are favored by almost half of the respondents (see Figure 2).

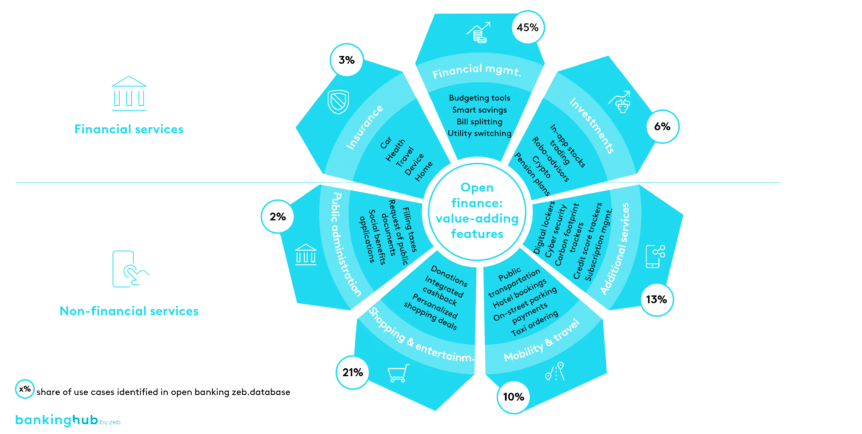

Banks, hence, should leverage the open finance ecosystem to enhance and broadening their offerings by seamlessly integrating third-party providers’ value-adding features (see Figure 3), particularly for the integration of non-financial services as listed above. A pan-European survey has documented a vast array of such services that can serve as illustrations of potential solutions.

How traditional banks could further leverage open finance

Incumbents now have two choices: simply being compliant, as most of them did when the PSD2 was first adopted, or leveraging the new regulatory requirements to their advantage through open finance.

In its early phases, open finance might have appeared as a model that requires banks to make big expenses without receiving much back. However, banks that refuse to (re)act might become vulnerable to their competition in the long run, which, combined with changing customer needs may lead to losses in market share and control over their customer base. Indeed, the true potential of open banking is unfolding now, with most of the ecosystem being interconnected, enabling participants to enjoy the shared advantages of consent-based open data flows. At this stage, banks can transition from being mere data sources to leveraging information from non-bank networks to create personalized products for their customers.

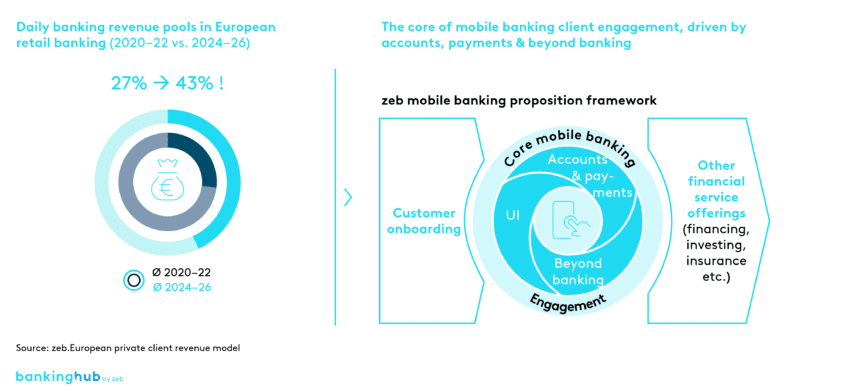

Tailored and extensive solutions provided by open finance are even more crucial when considering that the daily banking revenue pool in Europe is projected to increase by 16 percentage points in the next 2 years, with the majority being captured by payments and beyond banking services (see Figure 4).

With a passive approach, traditional banks risk becoming mere utilities and simple data providers for other players acting as orchestrators in the market. To avoid this, it is essential for banks to take an active approach and become orchestrators themselves.

In 2024, traditional banks should definitely step up their digital game by tapping into open banking potential. The road map for this year should include:

- Reflecting on the categories of value-added services they could implement, focusing on customer engagement and the benefits it brings

- Conducting a thorough market screening looking at both the solutions already offered by their peers, as well as any novelties offered by third-party providers

- Prioritizing additional services to be integrated into their digital channels considering both the specifics of the bank and the already available fintech solutions

- Testing partnerships and launching collaborations