Selected core fields of action for banks

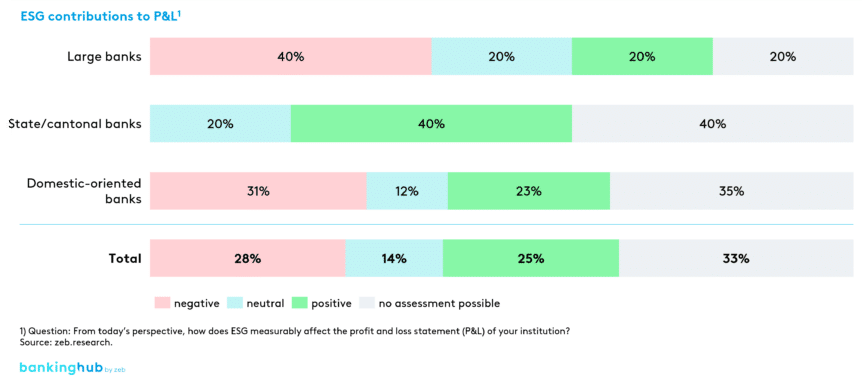

Our ESG Study results show that banks recognize the high importance of ESG. For the foreseeable future, however, there are not sufficient business successes. Only 25% of the banks surveyed have measured positive ESG contributions to their P&L, while 75% of the banks surveyed see some negative aspects for their own profits or cannot conclusively assess them.

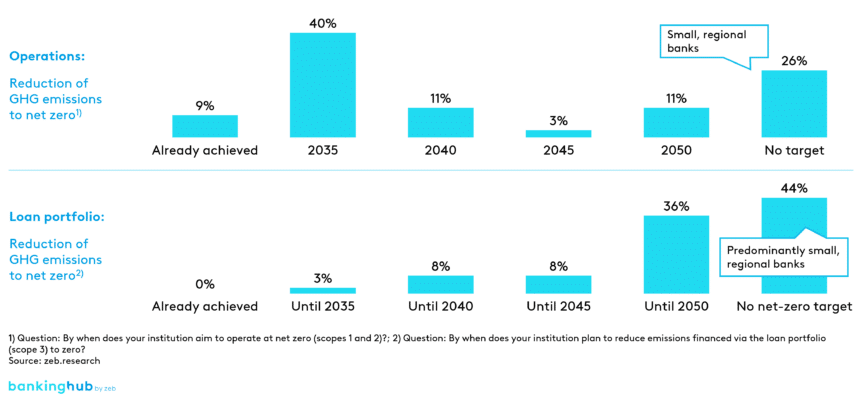

The “net-zero target” is undisputed for many banks. However, there are significant differences regarding the operating model and business portfolio. A full 44% of all institutions have not yet defined a net-zero target for their loan portfolio, while the figure for their operations stands at only 26%.

The consideration of ESG risks is still in its infancy. According to our ESG Study, ESG risks are seldom quantified with adequate specificity concerning their characteristics and impact. This is particularly due to the lack of availability of ESG data – a full 75% of institutions face major challenges in this area. Consequently, banks typically rely on external providers.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Recommended actions from the study for greater ESG maturity

Our study reveals that collaboration with internal and external stakeholders in setting and achieving ESG targets will be crucial for the competitive positioning of banks. In the area of risk management, physical and transition risks should be better integrated into the risk models, supported by advanced ESG data management. To this end, banks need to expand their capacities and skills.

Banks must therefore consistently focus on improving their ESG data skills, firmly integrate ESG in management processes and governance structures, and involve all stakeholders. Adequate ESG maturity will soon be just as important for Europe’s banks as good Wi-Fi in a hotel – not a USP, but a basic requirement for competitiveness.