|

LISTEN TO AUDIO VERSION:

|

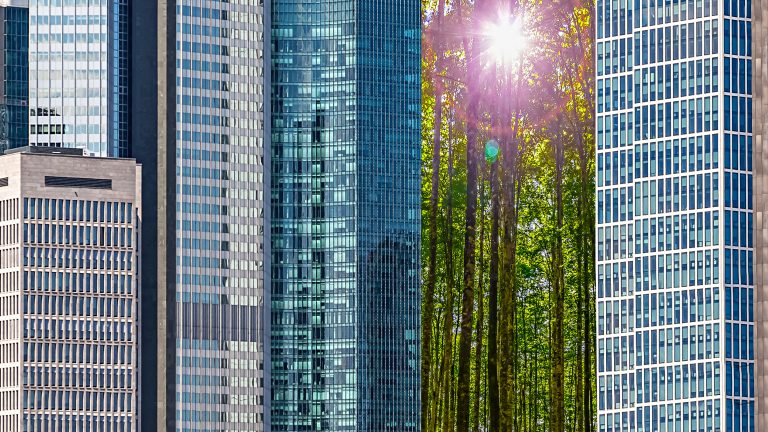

ESG: Overview of criteria & impact

ESG requirements are becoming a fundamental challenge for banks to overcome in an environment of low interest rates, rising external operating and capital costs due to regulation and massive headwinds from the COVID-19 crisis. After all, the financial services sector is ascribed a crucial role in the sustainable transformation of the economy. The first institutions in the financial sector have already positioned themselves clearly.

For a taste of our ESG topics on BankingHub, see the questions linked below:

- What are current ESG trends and future challenges for financial institutions?

- What might an ESG-focused approach look like for banks?

- What influence does ESG have on the value chain in asset management?

What impact do ESG (environmental, social and governance) criteria have on banks?

It is true that sustainability goals and thus also environmental, social and governance (ESG) principles have already been increasingly pursued in global capital investments in recent years. Despite the rapid growth of this global phenomenon, many issues remain to be addressed by the financial sector, as standards for ESG investments have not yet been fully defined by regulators and investors.

Financial institutions should start to assess the implications that ESG factors may have on their business model and core operations in order to map and prioritize the key functions to be addressed (e.g. investment processes, product governance, risk controls, etc.) based on already publicly available regulatory guidelines and market trends.

How financial institutions should proceed further in terms of an ambition level for their transition to an “ESG-ready” organization, you can read more here.

Answers to questions relating to ESG investments and other interesting contributions in the ESG context can be found in the articles and items linked below.