|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

Final approach

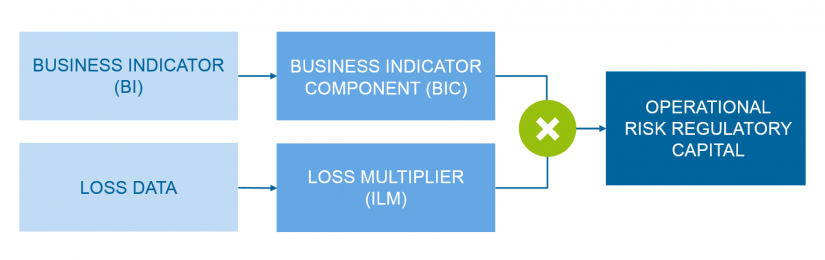

The Basel Committee on Banking Supervision (BCBS) has finalized the Standardized Approach (SMA) for calculating the capital charges for operational risk.[1] Compared to the consultation paper, the approach has mainly stayed the same: the SMA consists of the two components Business Indicator Component (BIC) and Internal Loss Multiplier (ILM for short), which are multiplied by each other.[2]

Ad 1 Business Indicator Component (BIC)

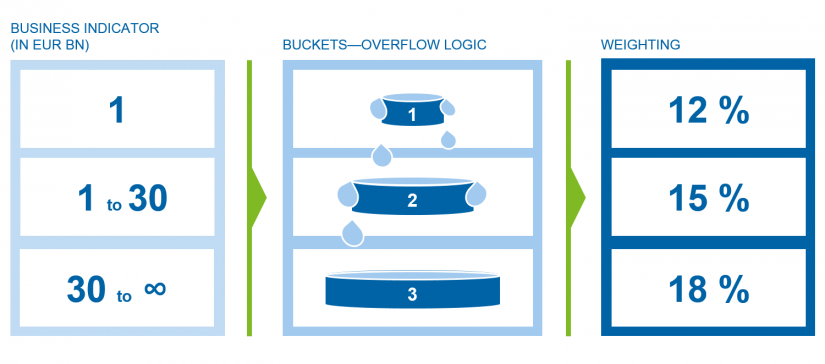

Compared to the consultation, the number of buckets has been reduced from five to three. The thresholds from the lower and upper bucket have been adopted: the threshold from bucket 1 to bucket 2 remains (unchanged) at 1 billion euros. The threshold from bucket 2 to bucket 3 amounts to € 30 billion and thus equals the threshold between bucket 4 and bucket 5 in the consultation paper.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

The weighting of the business indicator in the three buckets has been heavily adjusted. The weighting in bucket 1 has been increased from 11% to 12%. The weighting in the higher buckets has been significantly reduced. Bucket 2 (for a business indicator between € 1 billion and € 30 billion) is weighted at 15%, bucket 3 (for a business indicator greater than € 30 billion) is weighted at 18% (see figure 2). In the consultation, a weighting of 29%, for example, was proposed for a business indicator greater than € 30 billion.

Figure 2: Bucket logic for calculating the business indicator component. Compared to the consultation, the number of buckets and weighting were adjusted.

Figure 2: Bucket logic for calculating the business indicator component. Compared to the consultation, the number of buckets and weighting were adjusted.Furthermore, the service component which is integrated into the business indicator component, has been simplified and the financial component slightly modified.

Ad 2 Internal loss multiplier (ILM)

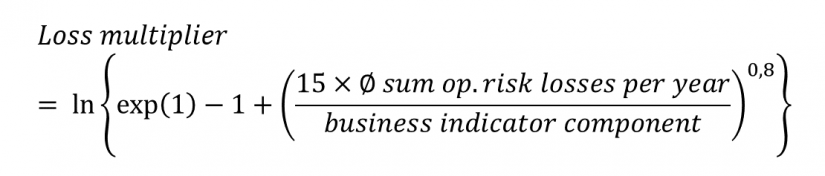

Parameters of the loss multiplier were adjusted. In the final version, the loss multiplier is calculated as follows:

As a result of the exponent 0.8 (in consultation 1), the above-average losses are weighted less in the loss multiplier (on the other hand, the reduction of capital requirements for banks with below-average total losses is also comparatively lower). In addition, the weighting of losses on the amount of losses is eliminated! I.e. all losses from past operational risk events are considered equal in the loss multiplier, regardless of the individual loss amount.

National discretions

The Basel Committee on Banking Supervision allows national implementation options in the design and application of the loss multiplier:

- On the one hand, it is left to the national legislator to also stipulate the application of the loss multiplier for bucket 1 banks (provided the banks meet the requirements for loss data collection).

- On the other hand, national legislators can suspend the use of the loss multiplier for all banks, so that even the capital requirements of larger banks with buckets 2 and 3 are only determined by using the business indicator component (BIC). However, the final paper clarifies that limiting the determination of the capital requirement to the business indicator alone does not exempt banks from disclosure requirements for accumulated loss data. Therefore, loss data from “larger” banks (with a business indicator greater than € 1 billion) must be collected, even if this data is not used to determine the loss multiplier.

Capital impacts

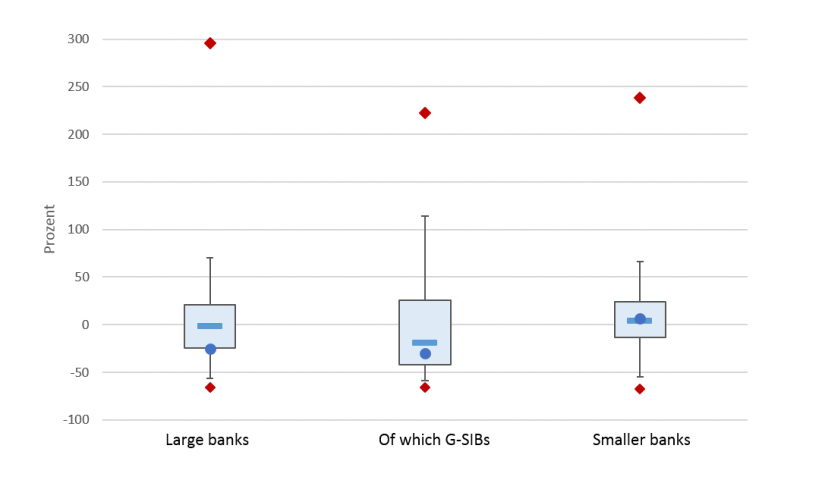

To assess the impact of the new SMA on capital requirements, the Basel Committee published the results of its Quantitative Impact Study simultaneously with the finalization of the new approach.[3] The analysis considered data from about 150 banks (thereof 28 G-SIBs) and simulated changes in minimum capital requirements by introducing the new OpRisk SMA. Differentiation was made between “large banks” (banks with Tier 1 capital > 3 billion EUR, which are internationally active) and “smaller banks” (all other banks). Among the large banks, the G-SIBs were again considered separately. The results are illustrated in the following figure:

Figure 4: Box plot of the capital requirements impact by the SMA. The first and third quartiles mark the boundaries of the box, i.e. 50% of the observations are within these limits. The antennae are limited by the 5th and 95th percentile, so that 90% of the observations are within the antennae. The blue line marks the median: 50% of the observations are below and 50% above this value. The weighted average is represented by the blue dot. Minimum and maximum are shown as red diamonds.

Figure 4: Box plot of the capital requirements impact by the SMA. The first and third quartiles mark the boundaries of the box, i.e. 50% of the observations are within these limits. The antennae are limited by the 5th and 95th percentile, so that 90% of the observations are within the antennae. The blue line marks the median: 50% of the observations are below and 50% above this value. The weighted average is represented by the blue dot. Minimum and maximum are shown as red diamonds.On average, the results of the BCBS show a moderate impact on capital requirements by the new SMA. The median capital impact is -3% for large banks and +0.6% for smaller banks. Hence, the capital requirements of about 50% of the banks will increase and decrease for the remaining 50%.

Removed from the median / mean analysis, figure 4 shows that the impact on capital requirements for the individual bank will in many cases be severe:

- The box in the box plot shows that the capital requirements of 50% of smaller banks may decrease by up to 15% and increase by up to 25% (-25% to + 20% for large banks). I.e. for half of the banks, the spread of the capital impact is already high.

- In order to make a statement about possible capital effects (the spread), which is valid for the majority of the banks, the range of the antennae in the box plot is to be considered. 90% (that is, the majority) of the banks are in the area spanned by the ends of the antennae. 90% of smaller and larger banks can therefore hope for a reduction of capital requirements of up to 50% or expect capital requirements to increase by up to 70% (G-SIBs may even expect an increase of up to 115%).

- In extreme cases, capital requirements will increase by 300% for large banks and 240% for smaller banks (see maximum values in figure 4). In individual cases, the capital effect can therefore be dramatic.

Need for action

The SMA will be mandatory as of January 1, 2022. Despite the obligation for application, which from today’s perspective is very late, timely measures are required to prepare for the implementation of the SMA:

- For banks from buckets 2 and 3 (with a business indicator > 1 billion euros), the supervisory authority requests the collection of loss data with high data quality, the establishment and documentation of corresponding processes as well as the validation of these data and processes. If an institution has not yet established a corresponding loss database, it must be set up immediately, since the loss multiplier needs to be calculated for the first time from 2022 on a data history of at least 5 years. And this loss data needs to be reported. If the bank does not have a loss history of at least 5 years and the loss multiplier calculated on this shorter history is greater than 1, in individual cases the bank may be required to use this “higher” loss multiplier. In addition, supervisors may request a conservative loss multiplier (ILM greater than 1) if a bank does not meet the quality requirements for loss data and data collection.

- Furthermore, a timely trial calculation is recommended because (as described above) the capital effects may be extreme. Therefore, an arising capital requirement must be planned and implemented in good time.

Summary

The finalized SMA replaces the three existing approaches to determining capital charges for operational risk. Compared with the consultation, adjustments have been made to the approach, which make the increase in capital requirements more moderate than was “feared” in the consultation phase. Nonetheless, analyses show a very strong impact on capital requirements for many banks. To avoid unpleasant surprises, it is recommended that preparations (data history, calculation of capital requirements, adjustments to internal processes) should be made early on. The SMA is applicable as of January 2022.

One response to “Basel IV: approach for determining the capital charges”

Laura Urbano

Collection of loss data history with high data quality and adjustments to internal process would help to new capital requirements calculation, to avoid surprises. This demand a long time process and granular quality data collection. As soon as the Managers recognize this as axpriority, and support: the teams to work on this, the better prepared the bank will be.