|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

Results of the outreach

The IASB conducted its core model outreach with participating institutions between October 2020 and February 2021. Because of the requirement for DRM to be closely linked to risk management, experts in both accounting and risk management were consulted. The outreach aimed to assess not only the general applicability of the model, but also certain risk management requirements, e.g. how to measure its performance or what parameters to use for deriving a risk management strategy.

The following points summarize the key results of the outreach which have also been the focus of further developments of the model ever since:

1) Compatibility of DRM with the application of risk limits in risk management

The original core model intended the result of risk management, and thus the DRM’s effectiveness, to be measured by a stable target value for net interest income. In operation, however, this approach proved impractical, as interest rate risk was managed on the basis of risk limits that often allowed for a range of results. Thus, it would have been possible for a result to be perfectly acceptable and desirable from a risk management perspective, but to be ineffective in DRM as this approach requires a precise target value. This situation conflicts with one of the basic premises of DRM, namely that risk management performance be reflected in the financial statements.

2) Compatibility of DRM with various interest rate risk management approaches

The core model only provided a target value for net interest income, which had to be kept stable over the model’s application period. Such an approach requires a periodic management view. In day-to-day operations, however, many institutions use not only periodic management but also present value management or a hybrid approach that combines the two. There are interactions between the two approaches, meaning that in practice a stable net interest result over a longer period would not be achievable.

3) Equity fluctuations due to DRM posting logic

The original DRM posting logic clearly resembled the already well-known cash flow hedge accounting. Analogous to the cash flow hedge reserve, changes in the value of the hedging transactions would have been posted to OCI as a DRM reserve. The resulting equity fluctuations represented an undesirable effect of the model for many institutions.

Based on this feedback, the IASB published further discussion papers in the months following the outreach, proposing a revised version of the DRM. In this context, the DRM once again underwent a significant transformation, in the course of which the methodology was almost completely renewed.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Solutions proposed by the IASB

The DRM model in its current form includes, for example, revised approaches to the definition of the target model, underlying transactions, effectiveness measurement and posting logic. In the following section, we will explain the main changes along the dimensions listed in the previous chapter:

1) Compatibility of DRM with the application of risk limits in risk management

One of the findings of the outreach was that many institutions had difficulties in precisely understanding the target model, which is why its definition was redefined in the course of the revisions. In the original core model, the target model had a broad range of functions, including the basic premises of the model (risk management strategy), parts of the designated underlying transactions (liability portfolio) and effectiveness measurement (target value for net interest income).

The current model redefines the target model and introduces additional key model parameters:

- Target model: While the target model is still an aspect of the risk management strategy, it is represented by the risk limits applied in the institution, rather than by a precise net interest income target.

- Current net open position: In contrast to the original core model, the revised DRM does not represent asset and liability portfolios based on gross amounts, but instead bases its management on the open interest rate risk position existing at the beginning of the period, which results after netting the asset and liability portfolios.

- Risk mitigation intention: The risk mitigation intention (RMI), a new key DRM parameter, represents the extent to which the existing current net open position should be mitigated in each period. The RMI is derived in the model by a benchmark derivative that perfectly closes the current net open position in accordance with the management intention.

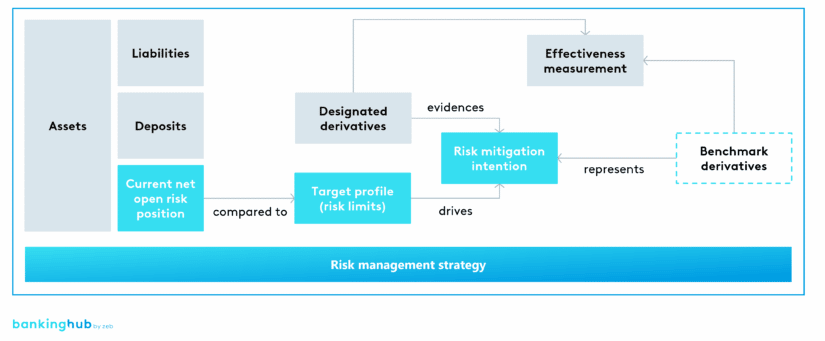

To fully comprehend the new DRM model, it is essential to understand the interaction of the model parameters shown[1]:

The open interest rate risk exposure must not be outside of the specified risk limits at any time. Consequently, risk management must include at least those management actions that are necessary to ensure compliance with the limit. Hence, there is a certain management intention in each period, which is influenced by the limits. In each period, risk management decides to what extent the open risk position is to be mitigated using derivatives (RMI).

The RMI to be determined for the DRM can be derived accordingly with the help of the designated derivatives. In the event of unexpected changes within the portfolio at period end, the designated derivatives are compared with the benchmark derivative that would ensure compliance with the RMI for the purpose of measuring effectiveness in the DRM.

2) Compatibility of DRM with various interest rate risk management approaches

In revising the model, the IASB proposed two key changes to ensure compatibility with periodic and present value interest rate management:

- The DRM model’s management object is an aggregated, residual risk position that is managed holistically in risk management with regard to present value and P&L changes (current net open position). Individual transactions are not considered.

- A new posting logic has been developed that combines elements from the current fair value hedge logic of IAS 39 and the logic of a cash flow hedge:

- The designated derivative is recognized at fair value in the balance sheet

- A DRM adjustment / DRM line item is recognized in the balance sheet as the lower of the:

- cumulative change in value of the derivative

- cumulative change in value of the risk mitigation intention

- Unwinding of the DRM adjustment / DRM line item in the profit and loss statement

- Changes in the value of the derivative in the case of over-hedges are recognized directly in the profit and loss statement

In this context, the recognition of a DRM adjustment / DRM line item is comparable to the recognition of the hedge adjustment in accordance with IAS 39, Fair Value Hedge Accounting, while the lower-of test for determining the same can be compared to the derivation of the cash flow hedge reserve for cash flow hedges.

The proposed approach reflects both the outcome of the present value hedge and the periodic hedge of net interest income in accounting. The DRM adjustment corresponds to the extent to which the designated derivatives were able to fulfill the risk mitigation intention. The lower-of test thereby prevents changes in the value of the derivative that exceed the RMI from being capitalized as part of the DRM adjustment. This avoids over-hedging in the methodology. Unwinding the DRM adjustment in net interest income over time offsets the interest payments of the hedged transactions and achieves a smoothed result.

3) Equity fluctuations due to DRM posting logic

The previously proposed logic of creating a DRM reserve in OCI is no longer consistent with the IASB’s intention to use DRM to represent the results of both present value and periodic management in accounting. The reserve in OCI merely reflects fluctuations in the value of the hedging instruments and neglects fluctuations in the value of the hedged item (risk mitigation intent).

The proposed approach (see point 2) promises to better capture the economic intent behind the management results and to faithfully represent their outcome. The posting logic developed as a result provides for the creation of a DRM adjustment / DRM line item in the balance sheet, while the derivatives are also recorded there at fair value. An equity fluctuation from the OCI reserve therefore no longer exists.

Next steps and recommended actions:

While not all aspects of DRM have been resolved in detail at this stage (e.g. evidence of risk mitigation intent or the mapping of other hedging instruments), the IASB believes that the project is sufficiently advanced to produce an exposure draft. Consequently, this has officially been in the “standard setting” phase since May 2022, although there is still no final date for the new standard. Its release is expected in the first half of 2023, therefore, assuming a normal two-year implementation period, the first application is likely to be in 2025. The new DRM standard replaces the application of IAS 39, Portfolio Fair Value Hedge Accounting.

Feedback from the banking industry on the revised model is generally positive. However, there is an overall desire for a detailed test calculation to verify the validity of the model. Current portfolio and market data should be used to reflect the effects of the prevailing interest rate environment.

zeb recommends all future users of the model to closely monitor current developments and to include them in the overall project planning once the standards have been defined. In this context, it is important to not only analyze the impact of the model in the finance/accounting area, but also to involve the risk management/treasury areas on a cross-disciplinary basis. Furthermore, we advise seeking exchange with other market participants in order to share experiences and impressions regarding the new model and to establish a common standard for test calculation. Possible collaboration approaches could include:

- Round tables with risk managers and accountants to share experiences

- Collaboration with consultants, software developers and auditors to strengthen a common understanding of the model

- Joint dialog with banking associations

- Where appropriate, collaboration on academic studies dealing with the impact of DRM