|

Getting your Trinity Audio player ready...

|

The Fundamental Review of the Trading Book (FRTB), a highly controversial paper issued by the Basel Committee on Banking Supervision (BCBS) in order to provide a coherent market risk framework, will have a huge impact on institutions’ capital requirements.

This concern is based on comments from the industry regarding the calculations during the third Quantitative Impact Study (QIS) on the new FRTB requirements. Most recent industry comments can be found here. This article will both have a look at specific implementation challenges and analyze aspects that still show room for improvement according to recent comments and recommendations from the industry.

While the industry urges for more time to validate the numbers and clarify certain aspects, the BCBS is planning to stick to the December 2015 deadline for finalizing the FRTB framework

The motivation for the Basel Committee’s announcement to publish a final paper by the end of 2015 is linked to the urgent necessity for a revised market risk framework and the already extended consultation process. Looking at the history of the market risk capitalization framework and its shortcomings during the financial crisis[1], the BCBS emphasizes a strong need for harmonization and enhanced methods to more accurately capture market risk, especially in stress periods. Still, the realization of these intentions with the final publication in December 2015 might need to be postponed due to the concerns raised about the disproportionate capital requirements based on the FRTB approaches.

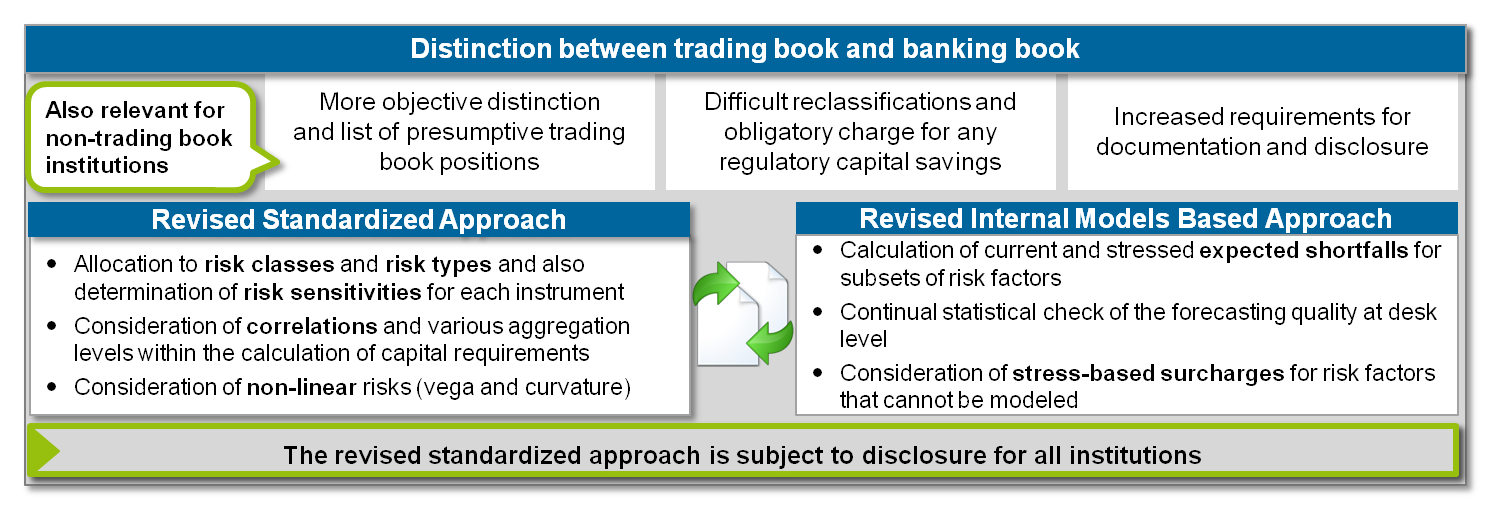

The currently discussed draft of the FRTB, which has been strongly influenced by the industry, proposes a clear boundary between trading and banking book positions, a revised Sensitivity-Based Standardized Approach (SBA) and a shift from Value-at-Risk to Expected Shortfall in the internal models based approach.

The BCBS moreover considers introducing the SBA as a capital floor as part of the BCBS consultative paper on “Capital floors”. This paper introduces the idea of permanent capital floors to replace the current Basel II transitional floor.[2] The BCBS presented two alternative ways to either define a single aggregated RWA-based floor for all considered risk categories (credit, market and operational risk) or to determine individual capital floors for each major risk category.

One main group lobbying for changes and providing large input to the Trading Book Group of the Basel Committee of Banking Supervision[3], is a cooperation of the International Swaps and Derivatives Association, Inc. (“ISDA”), the Global Financial Markets Association (“GFMA”), and the Institute of International Finance (“IIF”). Due to their ongoing dialogue with the Trading Book Group, insights from their latest response to the current consultation paper will also be examined in this chapter.

Revised Boundary Definition and Internal Risk Transfers

The boundary between banking and trading book should be adapted in a way that should lead to a more objective allocation of positions. Therefore, in addition to transparency requirements and reclassification burdens, a presumptive list for each book was published. This list contains products the supervisor deems to be allocated to the respective book. Any deviation will have to be explained by the bank and approved by the supervisor. For most of the banks, compliance with those allocation requirements will lead to a reallocation of products from the banking to the trading book (e.g. equity investments in funds with daily look-through), resulting in larger trading book exposures. Together with an unchanged trading book threshold (Art. 94 CRR)[4], a reclassification of banking to trading book institute might be required.

Looking at the comments from the industry referring to the new boundary definition, industry members advocate a solution that allows for post-trade rather than pre-trade approval for instruments deviating from the presumptive lists. Otherwise, the process for new product activity will be a lot more cumbersome and make short-term decisions almost impossible.

In response to the objections raised by the industry, a new chapter regarding Internal Risk Transfers (“IRT”) between banking and trading book was included in the latest FRTB consultative document. This does indeed make the transfer of risks between both books possible, i.e. to hedge risks from the banking book with positions from the trading book, but it still includes relatively strict requirements for the recognition of such transfers. This change was highly welcomed as it opens up the opportunity to continue to manage hedge transactions within the trading book. Still, there is widespread discussion about the technical requirements for such IRTs.

The revised Standardized Approach

The outlined criticisms of the FRTB framework mainly refer to the revised standardized approach. This discussion is intensified by the fact that the Sensitivity-Based Standardized Approach (SBA) will affect almost all institutions regardless of the application of a standardized or internal models based approach. For institutions applying an internal model a yet to be defined percentage of SBA capital charge is intended to serve as a floor to the internal models’ capital charge. Moreover, due to the requirements to incorporate banking book foreign exchange (FX) and commodity risks into the SBA calculations, even institutions without any trading book position will be affected.

The proposed Sensitivity-Based Standardized Approach allocates positions to risk factor types (general interest rate risk (GIRR), credit spread risk (CSR), equity, commodity and FX risks) and calculates their specific risk weighted sensitivities for each risk type the position is exposed to. The risk types are the delta risk for all positions and the non-delta risks (vega, curverture) for options and positions with embedded options. In addition, the default risk based on PD/LGD must be calculated for all positions. The total capital requirements then equal the sum of all delta, non-delta and default risk.

Although the current SBA was already highly influenced by the industry, there are still several issues that cause the industry to urge for more calibration time to asses different SBA aspects.

The main reason for deciding on the Sensitivity-Based Standardized Approach rather than on the previously proposed cash flow based approach was the idea that institutions already calculate sensitivities for pricing matters. First pre-studies have shown that one of the main difficulties in connection with the introduction of the SBA is the effort to acquire all required information and granularity, especially those on non-delta sensitivities.

Furthermore, results of both QIS and first pre-studies have shown a need to clarify the definition of the risk factors. Although some improvement has been achieved, there are still certain issues, such as the double count of cross currency risk in the calculation of the GIRR and the FX risk.

The current SBA includes the calculation of two correlations for each pair of risk positions to capture the risk of diversification and hedging, especially during stress periods. Although the industry welcomes this approach there are still some facts that need to be calibrated since diversification and hedging can be much more complicated in practice than pairwise correlations might suggest. This might also lead to unintuitive results causing impacts on portfolio management and prudential capital forecasts.

Major criticisms, in addition to the issues mentioned, are the increased complexities by incorporating non-linear components, the missing recognition of capital benefits for institutions using a long gamma strategy and inconsistent outcomes due to independent determination of delta and curvature charges. Furthermore, a high degree of overlap between credit spread and default risk charges as well as an overestimation of the empirical losses stemming from securitization positions could lead to high impacts on capital requirements.

The revised Internal Models Based Approach

The new regulations regarding the internal models based approach affect both the methodology, i.e. switch from VaR-based calculations to Expected Shortfall, and the requirements regarding the approval of internal models, e.g. change in backtesting requirements or the establishment of a Model Independent Risk Assessment Tool (MIRAT). Moreover, for the sake of comparability, as described above, the standardized approach is mandatory for every institution. Therefore, institutions will face an even higher burden due to the parallel implementation of the new standardized approach and the adaption of the existing internal model to the changed requirements.

Within the ongoing consultation phase, the Trading Book Group of the Basel Committee on Banking Supervision has already addressed some concerns expressed by the industry, for example regarding the handling of “broken hedges”[5] and the reduction of liquidity horizons for certain product types.

Still, there are quite a few unaddressed issues and widespread discussions within the industry. The most important ones will be summarized within this chapter. Regarding liquidity horizons, there is still concern about the large gaps between the buckets containing the different horizons. This might lead to a sharp increase in capital requirements if, for example, several products are downgraded at the same time. Apart from the proposed alignment of neighboring buckets, the industry also proposes a review of the length of liquidity horizons in general. One concern would be the relative length of liquidity horizons for credit risk products in comparison to equity products.

The Model Independent Risk Assessment Tool (MIRAT) is also of some concern as presumably neither the regulators nor the industry have enough experience with this model and the outcomes of the assessment process.

Another major area of concern is the current regulation regarding the non-modellable risk factors (NMRF). A risk factor is treated as non-modellable if certain aspects are not fulfilled. These aspects are described as following: there is “[..] a sufficient set of representative transactions in relevant products to allow for an appropriate historical data series for the factor. Sufficiency relies on the prices being both “real” and “available at an acceptable frequency.”[6] The industry thinks that this classification is too restrictive. It is for example still unclear what will be accepted as “real prices”. Some institutions are also concerned that their providers of prices are uncertain regarding the compliance of their pricing models with the FRTB standards.

Moreover, the criterion described above, i.e. continuous availability, can rapidly change and therefore the capital calculations would have to be adapted resulting in discontinuity.

In the light of the difficulties described above, the main question will be if it is still profitable or even reasonable to maintain internal models alongside the number of new regulatory guidelines. This is also mainly due to the fact that the standardized approach will be mandatory for each institution and capital requirements resulting from it will be used as floors (see above).

Summary and outlook

This broad spectrum of comments shows that there is still quite a lot of room for improvements to the current set of rules and regulations. An implementation of the FRTB standards as proposed in the most recent paper will lead to considerable complexity; especially for smaller banks with less technical and methodological capabilities.

Together with the specific comments on each part of the current consultative paper, the industry also recommends a delay of the publication of the final paper. This is both due to the ongoing extensive changes in the consultative document and the poor calibration of the standardized approach in its current version. The industry recommends leaving sufficient time for tests and analyses of the new requirements and accurate calibration of the parameters for the SBA.

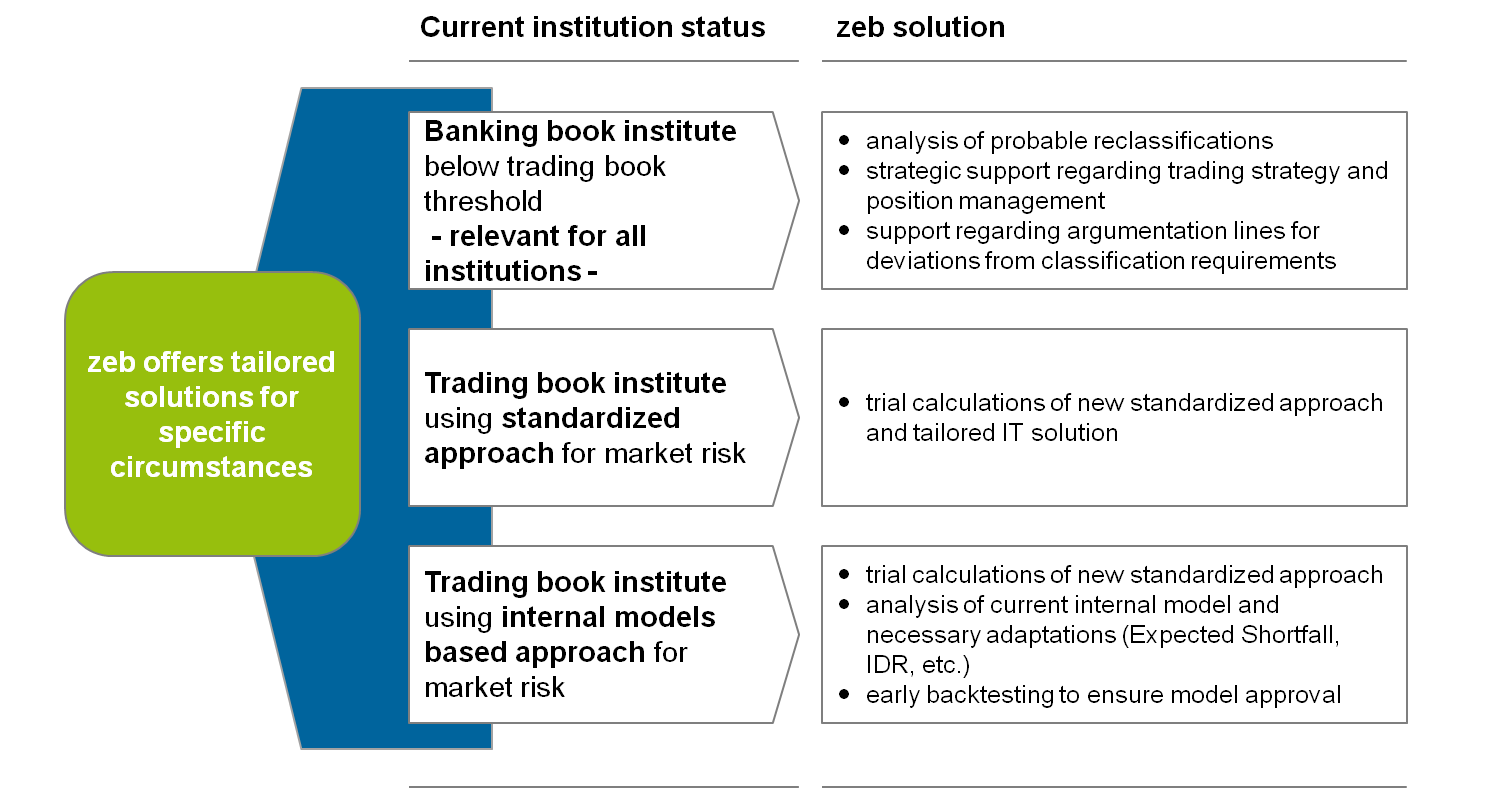

Keeping in mind all the above aspects, it is important for all institutions to have an early focus on the new FRTB requirements. An early focus will open the opportunity to analyze institution-specific impacts especially on capital requirements and systems and will enable you to participate in the ongoing discussion.