|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

Interest Rate Risk Study 2020 – key data and approach

The zeb.Interest Rate Risk Study 2020 was initiated as an online survey. A total of 31 financial institutions took part, all of which are based in the DACH region (Germany: 19, Austria: 10 and Switzerland: 2). About one third of the institutions (10 out of 31) are subject to direct supervision by the European Central Bank (ECB), the remaining institutions are supervised by national competent authorities (so-called NCAs).

A large proportion of the participating institutions (22 out of 31) belong to the retail segment. The “other” business models include wholesale banking, specialized lending and leasing companies.

In terms of total assets, the sample of participating institutions includes six small banks (total assets of up to EUR 5 billion) and seven large banks (total assets of EUR 30 billion or more). The majority of the sample (18 out of 31) comprises medium-sized institutions with total assets of EUR 5 to 15 billion or EUR 15 to 30 billion.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Interest rate risk remains highly significant – especially for retail banks

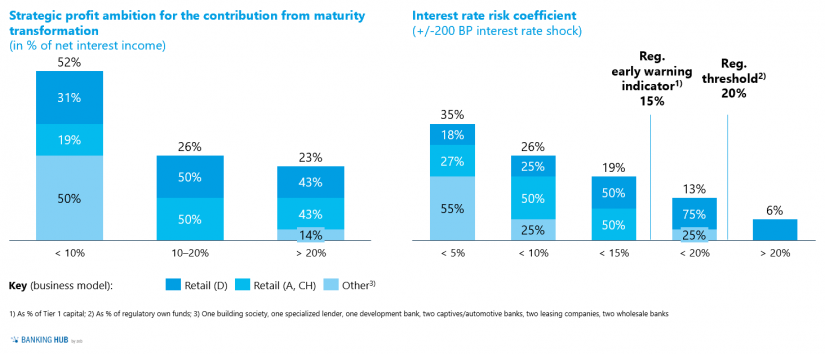

The zeb.Interest Rate Risk Study 2020 shows that taking interest rate risks in order to generate profit from maturity transformation is still an integral part of the business model of many banks. In the current market environment too, generating profit from maturity transformation is of major importance to many banks. Almost half of the participating institutions have defined a profit ambition of >10% in profit from maturity transformation in relation to total net interest income.

It is striking that almost all institutions that define a significant profit ambition for maturity transformation are retail banks, whereas in the case of other business models, such as wholesale banks, the achievement of such profits is of secondary importance.

The defined profit ambition depending on the business model is also reflected accordingly in the interest rate risk coefficient. Here, higher risks tend to be apparent in retail banks’ figures. Higher utilizations of the interest rate risk coefficient are to be highlighted at most German retail banks (compared with retail banks from Austria and Switzerland), which have built up natural maturity transformation positions on the basis of historically high customer demand for long-term fixed-rate products.

Figure 1: Strategic profit ambition for the contribution from maturity transformation and interest rate risk coefficient

Figure 1: Strategic profit ambition for the contribution from maturity transformation and interest rate risk coefficientMethods and models: need for action remains in a few areas

Under the buzzword of IRRBB, the significance of interest rate risk has received increasing regulatory attention since 2015. The EBA/GL/2018/02 in particular, which have had to be applied from the end of 2019 at the latest, illustrate the high supervisory focus on interest rate risk in the banking book.[1]

Against the background of the economic importance and the supervisory focus, approx. 70% of the institutions stated in the context of the zeb.Interest Rate Risk Study 2020 that they had already been compliant with the EBA/GL/2018/02 according to their own assessment as of December 31, 2019. This means, however, that 30% of participants still need to take action to ensure full IRRBB compliance. The main conceptual challenges for achieving IRRBB compliance are the integration of the economic value and earnings perspective on the one hand and the simulation of net interest income on the other.

In the sample of participating institutions, modeling plays a major role. The modeling assumptions for non-maturity deposits (so-called NMDs) is of particular importance. These represent by far the most important modeling (>90% of participants use models for NMDs). In addition to the modeling assumptions for NMDs, modeling of the exercising behavior regarding implicit options also plays an important role. So far, almost half of the participating institutions also measure and report the model sensitivities associated with the modeling. In order to fully comply with the requirements of the EBA/GL/2018/02, almost half of the institutions in the sample need to take action.

In addition to the various kinds of modeling, the EBA/GL/2018/02 also focus strongly on the disclosure of the so-called IRRBB sub-risks. What is striking about the answers to the questions aimed at IRRBB sub-risks is that, despite the high proportion of retail banks in the sample, option risk is considered material for only about 46% of the banks, and not all banks measure and report IRRBB sub-risks. Against the background of the high priority given to IRRBB sub-risks in the EBA/GL/2018/02, the results of the survey indicate a need for action for those institutions that classify sub-risks as material but do not yet measure and report them separately.

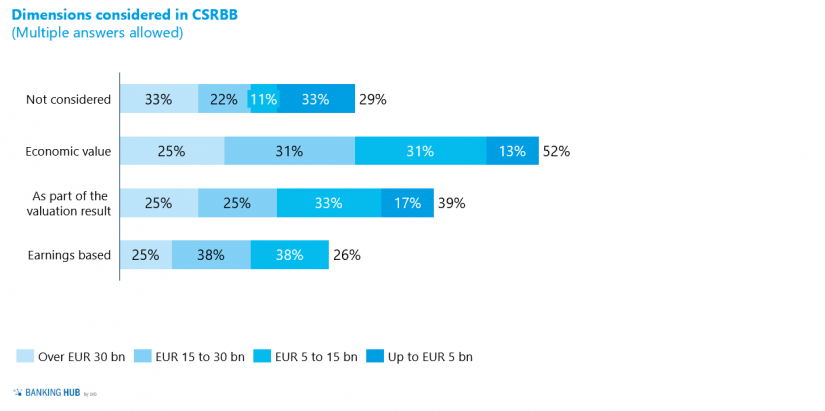

In addition to the requirements regarding IRRBB, the EBA regulations also include requirements regarding credit spread risk in the banking book (CSRBB). These are currently formulated much less concretely by the supervisory authorities, but consideration is nevertheless explicitly required. The results of the survey show that 71% of the participating banks already measure CSRBB in at least one dimension, i.e. in terms of economic value, in terms of net interest income or in the valuation result. The majority of the participating institutions take CSRBB into account from an economic value perspective (52%), while 16% stated that they take CSRBB fully into account, i.e. from all three of the above mentioned perspectives.

We would be happy to present the results of our study to you in person.

Audits in the IRRBB context

The IRRBB audit “wave” is approaching – also for smaller banks

Of the participating institutions, 30% have already undergone a supervisory audit in the IRRBB context. These were mainly ECB-supervised institutions (total assets > EUR 30 billion) and medium-sized institutions (total assets EUR 15–30 billion). It is to be expected that the “wave” of audits will increasingly “roll in” on the smaller institutions as well. Looking at the contents of the audit, it becomes clear that the main focus is on methods and models as well as data quality and IT.

IRRBB audit experiences made by zeb

The high importance of models and methods in the audit context, which can be derived from the results of the zeb.Interest Rate Risk Study, is also in line with zeb’s project experience gained in the context of IRRBB audit and on-site-inspection support as well as audit preparation and follow-up activities to close identified gaps and shortcomings. In particular, the following audit findings have been observed:

- Risk identification: lack of quantitative thresholds and limits to assess the materiality for IRRBB sub-risk types such as basis risk and option risk.

- Risk modeling: lack of validation of underlying (distribution) assumptions for the derivation of ‘core’ balances in NMD modeling or in the context of the derivation of prepayment rates – insufficient set of arguments for the selected parameters.

- Risk measurement: lack of consideration/mapping of optionalities in risk measurement (prepayment rights, caps, floors).

- Risk measurement: incorrect methodological assumptions in the simulation of valuation effects in the context of the earnings simulation.

- Risk limitation: inconsistencies in the set of risk limitations for IRRBB in the individual sub-risk types (gap, option and basis risk) and the aggregation of risk values at group level.

- Reporting: inconsistencies in the aggregation of risk values/cash flows in group reporting.

- Validation: lack of an overall validation framework for IRRBB and lack of separation of functions between model development and validation unit.

- Governance: insufficient segregation of duties between the management/steering unit (in general Treasury) and the monitoring/risk unit (in general Risk Controlling), especially with regard to the earnings perspective (NII).

- Data consistency: use of different, inconsistent data sources for risk calculation in the different IRRBB perspectives (NII vs. EVE).

- Documentation: insufficient written documentation of IRRBB-relevant processes, e.g. for the regular identification of IRRBB-relevant group units.

Preventing SREP capital charges for IRRBB

The topic of IRRBB is also relevant for Pillar 1 via the Supervisory Review and Evaluation Process (SREP).[2] A capital charge is derived from a combination of quantitative and qualitative criteria. For example, in addition to the level of interest rate risk, deficiencies in IRRBB governance, risk modeling, or processes can also lead to direct additional capital requirements. This is also illustrated by the audit observations in the previous section.

Looking at the correlation between quantitative interest rate risk measures (here: interest rate risk coefficient) and the IRRBB capital charge in pillar 1 from the SREP allows two major conclusions to be drawn for the sample of the zeb.Interest Rate Risk Study 2020:

- Not surprisingly, the positive correlation between the actual interest rate risk and the SREP capital charges for IRRBB becomes transparent: institutions with relatively high interest rate risk tend to have higher IRRBB capital charges.

- At the same time, however, it also becomes apparent that other aspects besides the quantitative interest rate risk measures play a key role and determine how high the IRRBB capital charge will be: it is striking that on the one hand, there are institutions with moderate interest rate risk but relatively high IRRBB capital charges, and on the other hand, institutions with comparatively high interest rate risks but relatively low IRRBB capital charges.

This underlines the importance of the qualitative IRRBB score. High quality IRRBB management has a direct impact on the IRRBB capital charge. Closing methodological gaps should therefore be prioritized, especially against the background of minimizing additional and costly capital requirements in pillar 1.

Conclusion: IRRBB continues to be in the focus of supervisory authorities and banks

Some five years after the publication of the first EBA guidelines (EBA/GL/2015/08) and the Basel standards on IRRBB (BCBS #368)[3], the topic of IRRBB continues to be in the focus of supervisory authorities and banks. This is underlined by the current discussion lead by the German supervisory authorities with regards to the modeling of NMDs on the basis of moving averages using maturities of more than ten years.[4]

The zeb.Interest Rate Risk Study shows that the institutions are already well advanced in implementing the requirements of the EBA/GL/2018/02, but that there are still areas that require action, especially with regard to the overarching issue of integrating economic value and earnings based risk measures. At the same time, the supervisory authorities have already started to examine the implementation status in the banks, as the identified audit priorities and findings show.

However, the applicable regulations are also constantly evolving. Through the amendment of the Capital Requirements Regulation (CRR II) and the Capital Requirements Directive (CRD V), the last elements of BCBS #368 that are still outstanding are currently being implemented or addressed. The extension of the previously purely economic value based outlier test to include a procedure for the earnings perspective is of particular relevance here. Furthermore, the topic of CSRBB is also attracting more attention and is to be further detailed in terms of regulatory requirements compared to the existing requirements pursuant to EBA/GL/2018/02. The necessary specifications by the EBA in the form of so-called Regulatory or Implementing Technical Standards (RTS and ITS) or a comprehensive update of the EBA/GL/2018/02 are to be published in consultation papers in the course of 2021 – at the latest by March 2022.[5] In addition, the EBA is testing the first methodological approaches for the earnings based outlier test and the standardized approach, which is also planned, as part of a quantitative impact study (QIS).[6]

Thus, it is important to think ahead in terms of functional and technical issues at an early stage and to close existing gaps as quickly as possible, also with a view to the (new) regulatory requirements. This is the only way to ensure continued compliance with IRRBB regulations and to minimize potential IRRBB capital charges.

We would be happy to present the results of our study to you in person. Please feel free to contact us here.