Recent changes to MiFID II and MiFIR

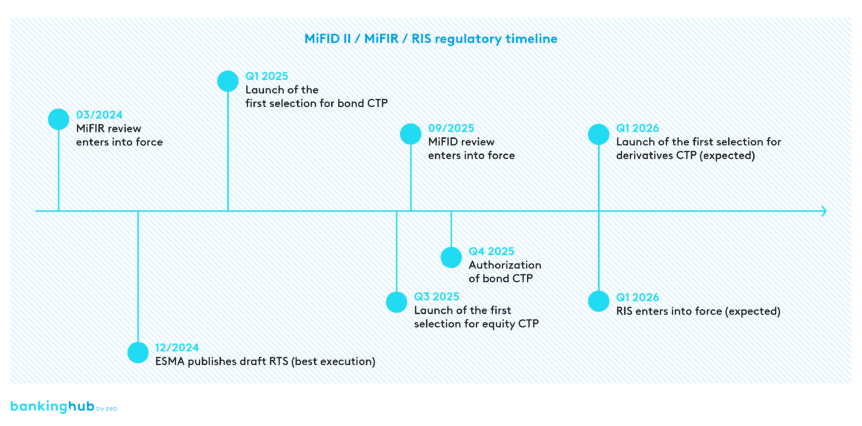

On Thursday, March 28, 2024, the amendments to MiFID II and MiFIR came into force. The main goal of the introduced changes is to increase transparency, facilitate investors’ access to market data on financial instruments, as well as to strengthen the competitiveness of EU financial markets while deepening the integrated European Capital Markets Union (CMU).

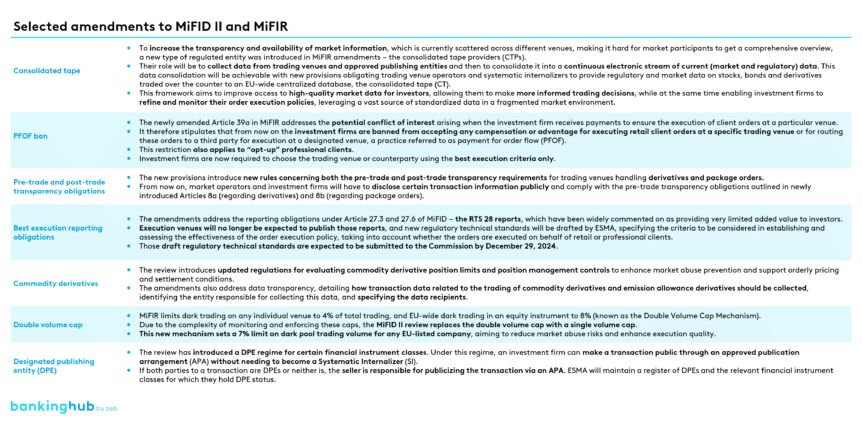

The key amendments to MiFID II relate to best execution requirements as well as the rules for the classification of investment firms as ‘Systematic Internalizers’, while the main changes to MiFIR concern the transparency and availability of market information. Investment firms will have to comply with the new MiFID provisions by the end of September 2025, while the changes in MiFIR took effect immediately after their publication in the EU Official Journal.

Upcoming regulatory amendments enhancing retail investor protection

But these are not the only changes awaiting the capital markets. In May 2023, the European Commission submitted its proposal for a retail investment package aimed at deepening the CMU. The package consists of two legislative proposals: one for an omnibus directive amending MiFID, the Insurance Distribution Directive (IDD), Solvency II, the Undertakings for Collective Investment in Transferable Securities (UCITS) directive and the Alternative Investment Fund Managers directive (AIFMD); and a second one for an amendment to the Packaged Retail and Insurance-based Investment Products regulation (PRIIPs).

As the rules for investor protection and information currently spread across multiple sector- specific laws, the package aims to standardize transparency and information requirements across EU legislation to prevent overlaps while also adapting to the digital environment and new consumer preferences. Key aspects include updating disclosure rules, ensuring investment products offer real value to retail investors, addressing conflicts of interest from inducements, preventing misleading marketing, maintaining high professional standards and enhancing supervisory cooperation for consistent rule application across the EU. Additionally, the package will introduce changes to suitability and appropriateness assessments, revise regulatory disclosures and make specific changes to Key Information Documents (KIDs) to provide clearer details on investment products and their performance.

In June 2024, the EU Council has agreed on its position regarding the package. Among the main changes proposed by the Council is the removal of the previously announced ban on ‘inducements’ received for execution-only services. However, the Council agreed to strengthen the safeguards accompanying the inducements in order to limit potential conflicts of interest. Even though there will be no ban at EU level, member states will be allowed to introduce (or maintain) inducement bans locally. This position will be reviewed again five years after it comes into force.

Another point on the agenda will be the introduction of a new ‘value for money’ concept. With this new requirement, manufacturers and distributors will be required to determine if the costs and fees related to a product are reasonable and aligned with its performance, benefits, features, goals, and, where relevant, their strategy. The National Competent Authorities (NCAs) will be able to review and detect any potential investment products failing to offer value for money through a new supervisory benchmarking tool to be developed by the European Securities and Markets Authority (ESMA) and the European Insurance and Occupational Pensions Authority (EIOPA). Manufacturers and distributors, in turn, will have to evaluate their investment products against a peer group of similar investment products within the EU to determine if they provide value for money. The benchmark will be based on information contained in databases managed by ESMA and EIOPA. The value for money framework will be reviewed seven years after the start of its application.

With the previously reached agreement within the European Parliament, the interinstitutional negotiations can start soon. Based on the timeline of the second-level legislative process, the Retail Investment Strategy is likely to become applicable in 2026.

There are new requirements on the horizon, but are we compliant with the already applicable ones?

Even though MiFID II and MiFIR have been in force since 2018, many institutions are still far from being fully compliant. Common Supervisory Actions (CSAs) and mystery shopping exercises conducted by ESMA over the last couple of years have highlighted potential areas for improvement.

In 2022, the exercise focused on MiFID II requirements on ex-ante and ex-post information on costs and charges. ESMA concluded that despite an overall adequate level of compliance with ex-post costs and charges requirements, the level of compliance differs across the countries, and several shortcomings were identified, such as cost allocation between service and product costs, inducement disclosures, cost presentation as a percentage, or illustrations showing the cumulative effect of costs on return. In general, the exercise revealed that the format and content of ex-post disclosures differ widely both between the member states, as well as between different firms within the same member state. The need for a standardized format for the disclosures was once again stressed by the NCAs. In terms of ex-ante information, only in half of the cases was proper MiFID II ex-ante information on costs and charges provided. In other cases, the information was either incomplete, presented too late in the decision-making process, or was not presented in a durable medium.

In 2023, a similar mystery shopping exercise was conducted on the application of MiFID II disclosure rules with regard to marketing communications. In its final report, ESMA highlighted a list of observations divided into two sections: one on the organization and procedures related to marketing and one on the content of marketing communications, including advertisements, to clients and potential clients. The identified areas of non-compliance included, among others, a lack of adequate review and approval processes for the use of third parties for activities related to marketing communications, a lack of specific processes and procedures in place for sustainability-related claims in marketing communications, marketing communications that are not clearly identifiable as such, marketing communications that do not present the risks and benefits of the products or services in a balanced manner, or marketing communications that do not provide clear and accurate information on costs and charges, or that use misleading claims such as “zero costs” without specifying the exceptions or conditions.

With intensified scrutiny from the European regulator, the NCAs in some member states have recently launched broad MiFID II compliance audits. We are currently supporting our clients – mainly large universal banks – from various European countries in closing gaps related to best execution, costs and charges disclosures and policies, appropriateness assessments, product governance strategy, and cross-selling requirements, among others.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Regulatory changes: next steps

We believe capital markets teams still have a lot of work ahead of them. While waiting for the amended regulatory requirements to enter into force, banks and other investment firms should start identifying any potential gaps they might have. These may refer to the new provisions, as well as to the existing ones. While defining a roadmap to close the gaps, the main challenge will be to develop compliant solutions that fit into the overall business strategy.