|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

Optimizing the branch network

Effects of shifting customer habits on existing (physical) branch networks

In the first period of infection and diffusion, when many countries were still in lockdown, some countries (China and Italy in the first instance) recorded an increase in the use of remote services and transactions (via smartphone or computer) by 10% to 20%.

However, this is probably only the beginning of an even more radical evolution of banking that will affect many other service companies and industries. Expert forecasts and some surveys as well confirm that this change will be stable and permanent, not temporary and indeed destined to further development over time.

This evidence leads the main banking players to question the effects of shifting customer habits on existing (physical) branch networks, in many cases still based on outdated service models or features and tools no longer in place.

As a first effect, taking into account the current and forecasted intensity, frequency and preference when using remote channels, in the light of the changes outlined above, a consistent and direct decrease in the use of physical networks can be expected. Secondly, it seems necessary to also think about a modernization of the formats, in-store features and services in order to rebalance the economic returns of the branch channel.

Basically banks will have to quickly run to repair and identify new solutions able to rebalance decreasing volumes and restore better economic results (P&L) generated by the branch. In other words, it will be necessary to close branches (and transform them) according to changed customer needs.

As evidence of some projections made by zeb Research, a reduction of -10% of the number of branches can be foreseen. This target must be considered in addition to existing targets and plans. After some years of significant system-wide downsizing on physical networks (in Italy –28% in the past ten years, equal to about 9,300 fewer branches) it seems now necessary to further relaunch plans and raise targets (about -2,430 additional closures for Italy only).

Another point of attention will be the ability to identify and select (with advanced and correct criteria) not only how many but also which subsidiaries to close (and where): specific software (e.g. “zeb branch-analyzer”), but also analytics and (big) data-based approaches offer good functionalities and the possibility to combine (internal) business data with (external) market references, competitive and behavioral information, thus allowing to carefully evaluate the different cases and to predict the impact on the respective customer base.

New “smart” branches

Responding to the local markets

A second consequence will be a strong transformation of remaining branches. Not only a lay-out renewal but a radical change aiming at better responding to new customer needs: diversified formats, advanced features and interfaces to be able to deliver advanced services and generate an improved customer experience but also to guarantee distinct sanitation and health measures.

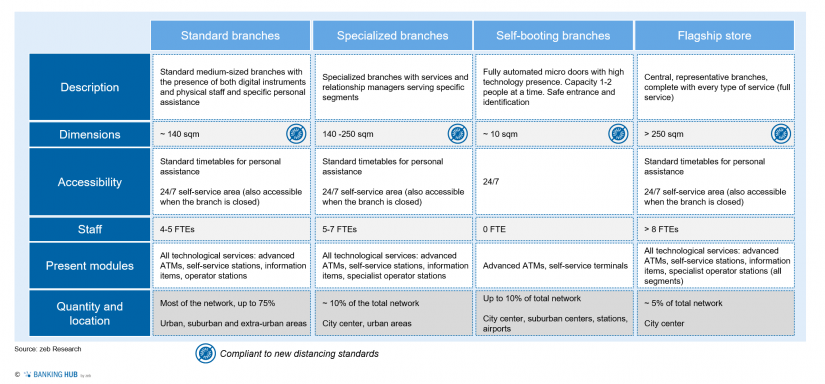

From the point of view of formats it is possible to foresee a wider diversification and in particular a focused rightsizing (locally adjusted on the base of local customer profiles) for standard branches: redefining local presence (with a possible target of -10% of closures), overall rightsizing and simplified service models able to restore P&L’s balance.

Further possible evolutions come from the introduction (or increase) of fully automated branches and self-booting branches.

Specialized branches and flagship stores complete the mix of suggested formats.

Those multiple formats provide different and determined arrangements (modules) based on the specific needs and responding to the local markets. Some features, however, characterize multiple formats: great attention to digitalization but also solutions able to minimize infection risks, maintaining and indeed enhancing the customer experience and service quality. Extensive dissemination of tools for remote conversations (including through ITM, dedicated conference rooms and self-service terminals), less direct contact between people, limited manual cash management, appropriate distancing obligations, structured in-store traffic management (possibly with virtual concierges).

New devices and innovative solutions are designed today in order to improve the service level provided to customers and at the same time to ensure socio-health protection (the same equipment will be properly and periodically sanitized according to the most stringent regulations applied).

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Urgent and effective transformation

New branch networks: Lower running costs and higher sales

Network adaptation to changing customer needs and new sanitation constraints can be approached also as a solution for rebalancing costs and revenues. This scope as well as reference to health standards and given market projections are now urgent.

New (smart) branches are more convenient in terms of lower running costs and higher sales: it has already been measured (zeb Research) that “smart” branches are altogether more affordable, with lower costs combined with increased selling and delivering capacity. The combination of lower costs (FTEs first, -60%) and higher revenues (sales, +30%) can generate an impact on profitability by up to +50%.

Conclusion on branch networks: Tranformation triggered by the COVID-19 crisis

More profitable solutions and bridging the gap

In summary, the advent of the COVID-19 pandemic will push banks to further revise their distribution models, pushing the banking system towards safer and more profitable solutions and bridging the gap: advanced service and business models today delivered through old-fashioned distributions branches, often poorly structured in terms of technologies and functionality.