|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

What does Request to Pay mean?

Request to Pay is a SEPA feature which has been defined by the European Payments Council and has come into effect in June 2021. It allows the exchange of messages in XML format between two parties.

What’s special about it is that the messages can trigger a payment after successful authentication and confirmation of the payer.

How does Request to Pay work?

To trigger a payment, the payer must first transmit an R2P identification token to the payee. Payments are then processed via the respective banks or EBA R2P Clearing.

So when the payee hands over a product or renders a service, the payee can automatically generate an invoice and an R2P message within their ERP system, for example. While the invoice goes directly to the payer (service recipient), the R2P message is transmitted to the payee’s bank. In addition to the payer’s R2P token, this R2P message contains the amount of the requested payment in euros, a message, an expiration date and an invoice number. If required, further meta information can be transmitted as well.

The bank uses the R2P token to determine the payer bank and forwards the R2P message to it. The payer bank determines the payer based on the R2P token and informs them that a payment has been requested. The payer can accept, reject or postpone the payment.

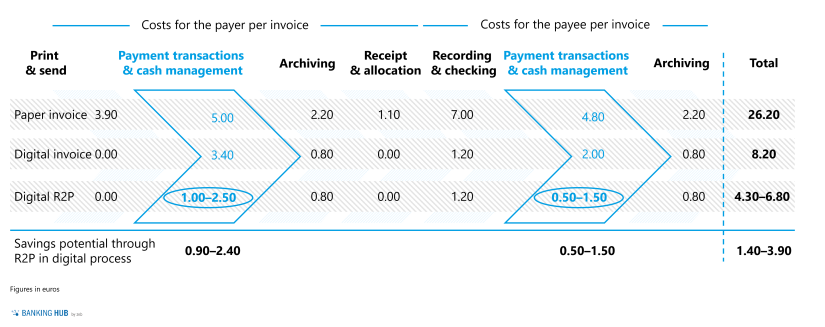

The payer bank transmits the respective status of the payment to the payee bank and, in case of payment acceptance, triggers the payment (e.g. as instant payment). The payee bank forwards the status to the payee who can then automatically allocate the payment in their system and mark it as paid. Without any manual effort. This allows companies to save up to EUR 3.90 for each processed invoice. If you still work with paper invoices, the savings are even greater.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Savings potential through end-to-end automation with R2P

Assuming that “payment transactions & cash management” is outsourced to banks with the help of R2P, banks can price a corresponding service with EUR 1.50 to EUR 4.00 for each processed invoice. They can thus tap into significant earnings potential.

Figure 2: Schematic cost statement for payer and payee, and derivation of savings potential per invoice

Figure 2: Schematic cost statement for payer and payee, and derivation of savings potential per invoiceTo automate these processes end-to-end, the bank needs to be integrated into the supply chain of the companies. For example, as briefly discussed above, banks could use interfaces to access companies’ ERP systems and handle payment transactions via R2P.

When an order is placed with a company, the R2P token stored for this buyer, the invoice amount and other meta information, such as the invoice number or the due date, are automatically transmitted to the bank. The bank processes the payment according to the procedure explained above – and the company transfers the current status of the payment to the ERP system.

Combining R2P with additional services

Aside from mere payment transactions, banks also have the opportunity to get closely involved in the customers’ supply chain by offering dunning, factoring or other invoice-related services and to generate earnings through continuous and low-threshold services.

As digital partners, banks can even offer their customers value-added services that go beyond mere banking. In this way, they have the chance to build their growth on a new and wider basis. Offers such as financing or installment purchases (“Buy Now Pay Later”) are equally possible for private and business customers.

R2P through end-to-end automation is therefore not only the key to decisive cost advantages. In combination with value-added services, it will become an important component in the product portfolio of banks and payment service providers and will become the standard for many retailers.