|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

State of the banking industry

- The global banking sector benefited most from positive news about COVID-19 vaccines and a new U.S. administration which boosted capital markets in the final quarter of 2020.

- In Q4, market capitalization of the global banking sector jumped by +17.6% and TSR of global top 100 banks outperformed the market significantly – +25% qoq, the strongest value across all industry sectors.

After a long time marked by increasing infection rates, political and economic turmoil, the final quarter of 2020 brought some long-awaited positive news. The availability of effective COVID-19 vaccines as well as increasing clarity about a new U.S. administration and a Brexit deal reduced uncertainty and boosted capital markets. Global banks benefited most from these developments and market capitalization surged by +17.6% qoq but remains below last year’s level (-18.9% yoy). The TSR of global top 100 banks outperformed the market and with +25.0% qoq (-5.9% yoy) achieved the strongest value across all industries.

- After the collapse in Q1, global top 100 banks’ market capitalization recovered in Q4 2020 and jumped by +21.4% qoq. However, market cap of global top 100 banks is still far below the peak value in Q4 2019 (-17.2% yoy) while the overall market managed to fully digest the losses from the first three quarters (MSCI World: +9.6% qoq and +5.6% yoy).

- Banks’ average P/B ratios increased significantly across most regions. U.S. banks’ ratio rose by 0.31x, once again above the hurdle of 1.00x, but Western European banks’ P/B ratio improved relatively moderately by 0.13x to just 0.56x on average.

- Despite a strong TSR performance in Q4, for the full year 2020 the banking sector lost shareholder value while other industries fully recovered over the year. Especially Western European banks showed a negative average TSR in 2020 of -21.2% yoy (U.S.: -5.1% yoy, BRICS: -3.0% yoy, MSCI World: +16.5% yoy).

- After being among the worst-performing European banks in the last quarter, the two Spanish banks Banco Santander and BBVA achieved a disproportionately high rebound and the best TSR performance among European but also global top 100 banks. The announcement of BBVA to sell its U.S. subsidiary additionally boosted the stock price to +70.1% qoq in total.

Economic environment and key banking drivers

- Western Europe has been hit hard by the second wave of coronavirus cases and further lockdowns in several European countries will delay the economic recovery.

- ECB expanded its monetary stimulus program PEPP in December 2020 by a further EUR 500 bn, keeping the euro area yield curve on an ultra-low and flat level.

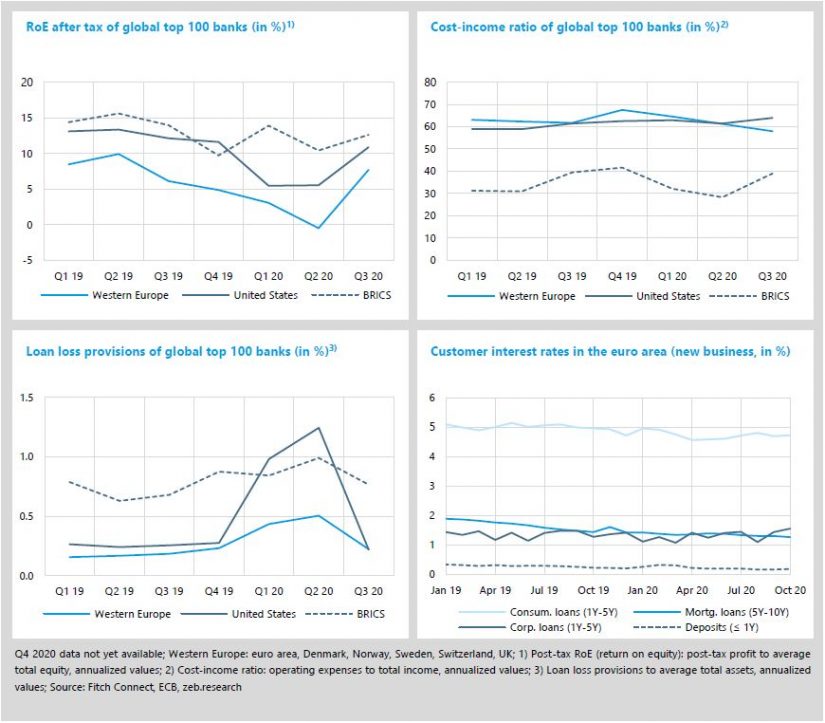

- In Q3 2020, global banks’ profitability improved significantly as risk provisions returned to pre-pandemic levels. However, the real test for banks’ financial resilience will come in the first half of 2021.

Europe has been hit hard by the second wave of coronavirus cases and additional strict lockdowns in several Western European countries will delay the economic recovery. While GDP growth in the U.S. and BRICS countries is expected to continuously improve, Western European countries’ GDP growth is expected to remain clearly negative in Q4 2020 and even Q1 2021. However, the rollout of the COVID-19 vaccine increases the hope for a corresponding stronger rebound in European growth in Q2 21 and going forward.

- The Western European inflation rate continued the deflationary trend, reaching its low point (-0.1%) in the final quarter of 2020 but slowly picking up again in 2021. Consumer prices in Germany further declined and will remain on deflationary levels in Q4, mainly driven by lower demand and the temporary reduction in VAT rates.

- To limit the economic impact from the second COVID-19 wave, the European Central Bank expanded its monetary stimulus program PEPP (Pandemic Emergency Purchase Program) in December 2020 by a further EUR 500 bn, keeping the euro area yield curve on an ultra-low and flat level.

- The U.S. yield curve steepened slightly compared to the previous quarter after the U.S. Fed decided to maintain benchmark rates near zero as well as its current bond buying program but without extending the duration of these bonds.

- Low U.S. yields in line with significantly higher U.S. inflation rates put further pressure on the U.S. dollar development. The EUR/USD exchange rate increased by +4.4% qoq (+9.6% yoy) and exceeds the value of 1.2 – for the first time since April 2018.

Bank results of the first two quarters were mainly impacted by significantly increasing loan loss provisions (LLPs). In Q3 2020, risk provisions normalized which clearly pushed global banks’ profitability. In addition, European banks were able to slightly increase their earnings (+1% qoq), thus achieving an average quarterly RoE of 7.7%, +1.6%p above Q3 2019. However, these promising figures are unlikely to be sustainable as the current aggravation of the COVID-19 pandemic across Europe could lead to an uptick in LLPs again. The real test for banks’ financial resilience will come in the first half of 2021 after the end of the moratoria and state aid programs for corporates.

- In Q3 2020, reported LLPs returned to pre-pandemic levels indicating that banks have reached sufficient provisions for the time being to balance future losses. U.S. banks’ LLPs slumped by -82% qoq (-14% qoq) and Western European banks reduced LLPs by -56% qoq (+16% yoy). However, based on the current dynamic of the pandemic, further, much higher LLPs could be required in the coming quarters.

- Profitability of U.S. banks increased by +5.4%p to 10.9% (-1.3%p yoy) in Q3. Although U.S. banks were not able to keep up previous earnings growth (-10% qoq), normalized LLPs and lower costs (-6% qoq) boosted Q3 profits (+90% qoq).

- European banks were able to further reduce costs (-2% qoq) and improve operational efficiency. In Q3, the cost-income ratio reduced for the third time in a row to 59%.

- At the end of Q3 2020, corporate loan rates reached the highest value in two years. While most of the customer rates in the euro area were mainly unaffected by the COVID-19 pandemic, a higher demand for corporate loans as well as risk-adjusted pricing lead on average to increasing interest rates for corporate business over 2020 (+44bp since January 2020).

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Special topic: European banks’ capital market performance

A valuation conundrum?

- Although global banks’ valuations have generally been low since the global financial crisis, especially European banks seem to be traded at a significant discount.

- Some European banks are, however, able to show a relatively adequate capital market valuation and performance.

- The differences can be explained by analyzing fundamental bank KPIs focusing on profitability, risk and growth – which has also been evident in the current crisis period.

Even long before the COVID-19 pandemic, the European banking sector had been struggling with a weak capital market valuation. Of course, the overall valuation of global banks has been low since the global financial crisis, however, especially European banks seem to be traded at a significant discount. Unfortunately, one important goal of listed banks is clearly defined by the creation of shareholder value. But is this even possible or is banking in Europe simply a bad investment?

In recent years, the capital market performance of the largest European banks has been clearly disappointing, and the COVID-19 induced recession has made things worse. Between 2017 and 2020, the average total shareholder return of Europe’s top 50 banks was negative with an average of -6.5% p.a. – far below the market (+14.0% p.a.) and the global banking industry (+6.1% p.a.). Consistently, European banks’ market valuations in terms of Price-to-Book ratios have continuously decreased since mid-2017. However, looking at the quartiles of this P/B ratio development, there is a high heterogeneity across European banks. During the last four years, 25% of the considered banks only showed values of around 0.5x on average or below (1st quartile), while 25% of the banks also reached values of around 0.9x or higher (3rd quartile) – even this gap has also narrowed in recent years.

Focusing on the top valued European banks, defined by the 25% highest average P/B ratios between 2017 and 2019, these banks showed substantially better capital market performance than the low valued (25% lowest average P/B ratios) as well as the medium valued banks (middle 50% average P/B ratios). Between 2017 and 2019 (pre-pandemic period), these banks were able to reach an average P/B ratio of 1.24x – above 1.0x and close to global banks’ average of 1.36 – as well as a positive TSR of 1.7% p.a. Although there is still a gap to international peers and the market, European banks have obviously been able to achieve a relatively adequate capital market valuation and performance in recent years. Furthermore, these banks have also performed better since the outbreak of the COVID 19-pandemic and the corresponding crash on capital markets at the end of February 2020. During the last 12 months, top valued banks have still reached an average P/B ratio of 0.87 – which is more than twice the value of the lower valued banks – and incurred lower losses. Which banks are these and what made the difference?

The cluster of top valued banks mainly consists of banks from the Nordics – like SEB, Swedbank, Handelsbanken, Nordea and DNB – but also includes some Northwestern European banks like KBC, UBS, ABN Amro, Erste Bank and HSBC. To analyze possible determinants that could drive the different market valuations, we looked at several KPIs from different value dimensions such as profitability, growth and risk of Europe’s top valued banks compared to the other valuation clusters.

Analyzing the average KPIs between 2017 and 2019, top valued banks on average showed a much higher profitability (return on equity: 11.1%) as well as efficiency (cost-income ratio: 55.7%) compared to the medium and low valued banks. Behind efficiency, the main driver is the cost base, as the top banks show a lower share of operating costs (1.3% of total assets vs 1.5%/ 1.7% for medium/ low valued banks). From a risk perspective, top valued banks show a higher asset quality, as measured by a lower non-performing loan (NPL) ratio, and higher CET1 ratios. Interestingly, top valued banks show stronger growth in operating revenues (1.8% p.a.) while low valued banks show a much stronger performance in cost reduction (-3.0% p.a.). However, if cost reduction is not reflected in profitability or efficiency, it seems not to be rewarded by capital markets. A similar picture emerges when looking at the crisis period 2020. Based on Q3 figures, top valued banks were able to record better profitability, lower risks and more resilient operating revenues.

Finally, we used a statistical model to further analyze the impact of fundamental bank KPIs on the P/B ratio and to prove the significance of our findings. As explanatory variables, our approach considers a total of 10 banking KPIs for the listed top 50 banks in Europe over the period from 2017 to 2019: besides the variables described above, we included the leverage ratio, the liquidity coverage ratio and the growth in total assets.[1] Overall, the estimation results confirm most of our findings as return on equity, cost-income ratio, CET1 ratio, NPL ratio, the share of operating costs but also growth in costs are significant and show the assumed impact on the P/B ratio development. Moreover, 67% of the variance in banks’ P/B ratios can be explained by the model.

Although banks’ market valuations are also driven by further determinants like global macro-financial conditions or the regulatory environment, large parts can be explained by fundamental KPIs focusing on relevant value dimensions: profitability/ efficiency, risk and growth. In order to sustainably manage TSR/ value creation, bank management teams should therefore consistently focus on such a set of KPIs. In recent years, these values have not been favorable for most of the top European banks, which has been reflected in market valuations. However, looking at the top valued European banks, good operational execution across all relevant value dimensions will be rewarded by capital markets.

For more information please visit our European Banking Study 2020 homepage.