|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

The emergency induced by the Sars-CoV-2 virus has taken everyone (citizens and business operators) by surprise and forced different sectors to make sudden adjustments, unforeseen and deriving from a totally unknown phenomenon that has never occurred before.

Get an overview of the core contents of the zeb.research (September–October 2020) about the adjustments and effect of the COVID-19 crisis

New emergency measures in an unexpected COVID-19 context

As in other industries or even more so, players in banking have reacted by introducing immediate and urgent initiatives aiming to manage and prevent the risk of infection. But many decisions have been taken without specific competence in this field and within a regulatory framework that is not always clear and unambiguous. In the first instance, therefore, the role of Prevention Manager has been involved and specific temporary committees for crisis management have been established.

Among early measures adopted, some have been immediately applied, such as the immediate increase in flexible working (to be precise, working from home or remote work) and the reduction of opening times for branch networks.

Banks made use of these solutions with differing levels of intensity: partial closure of the network, reduction of opening hours, e.g. only in the morning, or reduction of on-premise staff. In general, access to the branch is only allowed by appointment.

In the short term, the widespread use of flexible working patterns and the restriction of opening hours for branches have generated reductions in certain cost categories (e.g. travel, canteen, energy and office equipment). However, these savings were completely offset by the increase in expenditure in other categories and new COVID-specific investments.

Impact on costs has been significant, mainly in ICT, H&S and RE categories

In recent months, zeb has conducted focused research (September–October 2020) about the effect of the COVID emergency on the costs composition for commercial banks, investigating the dynamics pursued by banks both in the operating expenses dimension and from the investments point of view (capital expenses). The survey covered a panel of 8 large banks (representing almost 50% of the overall market share in Italy) and tracked the impact on all major cost categories.

As a first result the research confirmed a relevant increase in general expenditure (calculation standard using the “cash out” formula, in other words the sum of operating expenses and investments overall): on average there was an increase of around 3.5% in OAE (Other Administrative Expenses), corresponding to about EUR 1,600 per employee and about EUR 20,000 per branch and composed of 58% OPEX and 42% CAPEX.

At the same time, such extra charges have an impact on CIR (Cost Income Ratio), which will be negatively affected by about +1%, reversing, in some cases, the positive downward trend recorded in recent years by many market players.

In more detail, some specific cost categories are directly affected by extra costs: in addition to H&S (Health & Safety), extra costs had the greatest impact on ICT (Information and Communication Technologies), followed by RE (Real Estate), security, etc.

A large part of these extra costs is expected to apply throughout 2021. However, given the expectations of the rapid evolution of the current pandemic environment, banks do not seem to have defined budgets and forecasts for 2021 yet. Difficulties in planning make the financial management of the crisis even more laborious.

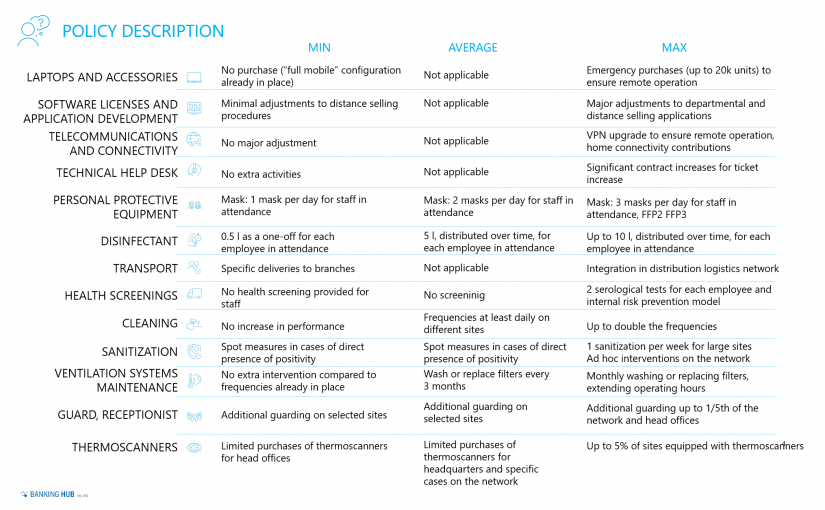

In addition, an analysis of the choices and policies put in place by banks reveals a high level of variability, both with regard to the amount of expenditure and the effectiveness of solutions for preventing and mitigating the risk of contagion.

Looking at the individual macro-categories of expenditure and the variability of the underlying choices (or policies) it is possible to distinguish different approaches.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Upcoming developments towards greater management capacity in times of the COVID-19 crisis

Clearly, the absence of uniform schemes combined with local regulations (often imprecise or contradictory) has led to a high variability of choices made by banking institutions. However, the industry is organizing itself, thanks to the role of the banking association and the contributions of external professionals, in order to identify more reasoned solutions and clearer schemes at a sector level.

It seems reasonable to expect that current developments will ultimately prompt the banks to review and redefine decisions taken so far, replacing them with more advanced models and processes. Even the general accountability should evolve from current “interim” solutions (also through the “crisis committees”) to more stable (ESG, Health & Safety) supported by specific solutions from operational risk management.

Finally, we should all remember that the costs related to healthcare, for the prevention of contagion risks, must be viewed as “productive” and “qualifying” costs, in particular regarding the level of sustainability and social responsibility of the bank.