|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

Arising opportunities for banks

Consistently with governments purposes, it emerges that there is an increasing awareness of ESG-related topics and the need to integrate them into banks’ strategies, processes and products. Clearly, these come along with increasing costs and regulatory compliance (e.g. Guide on climate-related and environmental risks by ECB) but opportunities are worth the effort.

Conservative estimations – based on the zeb research published on the last European Banking Study – reveal that about €1,100 bln of yearly investments are needed by both European companies and private customers to fulfill the GHG targets. In order to address such investments, roughly €28 bln per year – for the next 10 years – will be added to European banks’ revenue pool with most of the revenues ascribable to financing solution, in particular corporate loans.

Given such scenario, banks can certainly play a leading role in helping customers in their “transition to green”.

In order to accurately set their ESG strategy, banks have to answer the following questions:

- Which are potential sectors/companies that will face a transition towards a greener business? How to prioritize the addressable market?

- What are the main financing needs to be satisfied? How to innovate existing offerings to fulfill the ESG needs?

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Potential target clients

Being able to accurately identify the target companies or even the sector most exposed to ESG trends is be a fundamental factor to effectively understand, seizing and promptly identify the new opportunities linked to the support and financing the green transition.

Based on a zeb research, about 90% of European companies belong to the so called “transition business” cluster, namely businesses with a high potential given their need for transition towards a more sustainable model. According to the study, such cluster constitute the main addressable market for banks to exploit new opportunities in terms of volumes and margins linked to the need of new investments to reach ESG objectives.

The remaining share consist of “dark green business”, activities which are already cutting-edge in terms of sustainability (e.g. wind power plants), and “brown business”, activities that will remain brown in any case or that cannot turn into green (e.g. mining companies).

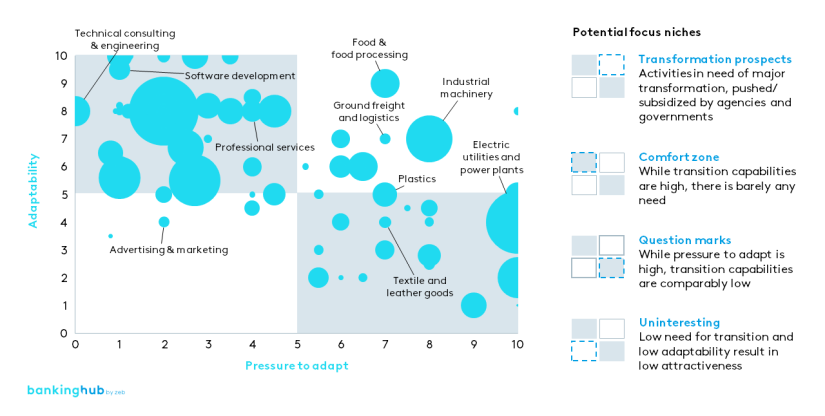

Within the addressable market, the prioritization for the definition of the offering should start from the analysis of two main variables: the “pressure to adapt” – pressure for the climate transition by both governmental institutions and the marked demand – and the “adaptability”– promptness and capability to adjust business and operations in response to the changing ESG requirements.

Current trends in ESG offering

Banks are steadily investing in developing new ESG-dedicated products, such as, among others, green loans, sustainability-linked loans (SLLs) or green bonds. Further, banks are also innovating existing offering by providing products such as mortgages, investments, saving and current accounts that can be easily converted to include ESG-compliant characteristics.

In particular, green loans and SLLs, as defined by the principles issued by the Loan Market Association (LMA) and promoted by the International Capital Market Association (ICMA), play a central role in the financial market: according to Bloomberg, companies have raised more than €165 bln of green and SLLs globally in 2020, compared to around €42 bln as of 2017.

Such growth trend is particularly relevant for SLLs, which growth exponentially over the last few years, mainly driven by the product flexible margin incentives. Such incentives are bound to the achievement of the borrower’s ESG goals in terms of sustainability that should be verified by an independent and external rating agency/auditor, even if there is lack of uniformity and standardization in ESG evaluation metrics. The growth of such ESG financing products will continue to soar in popularity; this contributes in encouraging companies to improve their ESG profile while supporting Europe to achieve the carbon-neutrality goals.

Additionally, taking inspiration from non-banking sectors, banking players started offering ESG advisory and scoring products, such as tools which can support improving sustainable habits by recommending greener improvements that could be made to buildings – hence suggesting the most appropriate financing solutions – or by tracking GHG emissions based on current account transactions.

ESG potential: a step further

Although several key ESG topics are still under discussion, leading to high uncertainty in the market, ESG can certainly not be considered a “trend”, given both the world-wide resonance around it and the long-term objectives.

ESG has the potential to “bring a breath of fresh air”, with new revenue opportunities for the banking business: strategic priorities for banks should focus on how to position themselves as key players in supporting the transition to a sustainable economy through the definition of a proper commercial proposition and complementary services without, of course, changing their DNA.