|

Getting your Trinity Audio player ready...

|

Generation of heirs: Initial situation

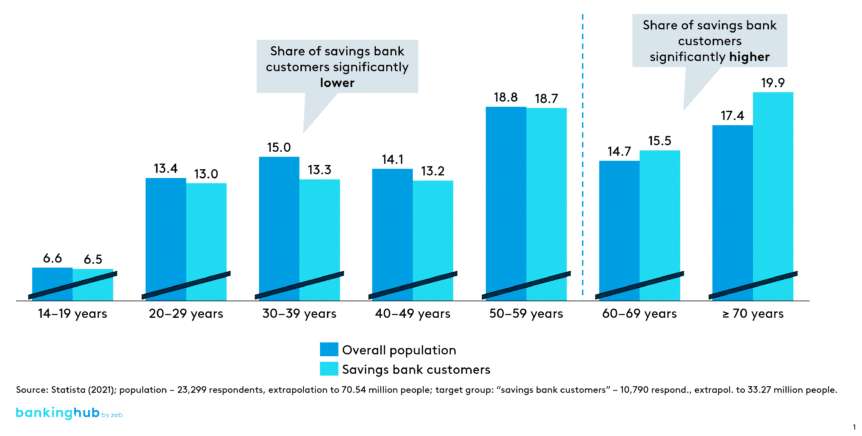

If we compare the age distribution of the German population as a whole with that of German savings bank customers, we see that the latter has a higher proportion of people from older age groups.

The chart shows a deviation from Germany’s overall demographic structure – German savings banks have a disproportionately high number of customers in the older age segments. In the coming years, a particular focus will be on the 60+ years age groups.

Not knowing a decedent’s descendants becomes even more of a problem considering that on average, older customers hold significantly higher deposits. Their median assets amount to around EUR 120,000. As there are 11 million households in this age group in Germany, this adds up to over EUR 1 trillion of assets at risk of migration.

If the heirs have their main bank account with the same regional bank as the decedent, the estate can usually be redistributed. However, according to current figures, 23.1% of heirs live more than two hours’ drive away from their parents. This indicates that a significant proportion of heirs may not have the same main bank as their parents.

Special challenges for regional banks

Regional banks are particularly vulnerable for two reasons: their business area is regionally limited, and their older customers are very loyal. The latter represents a risk insofar as younger age groups are much more willing to switch banks, as there is ever more competition.

Regional banks can therefore no longer “rely” on the loyalty of their customers. The regional principle also makes it more difficult for regional banks to retain the assets they manage.

Focus on heirs: our zeb.estate forecast

The magnitude of the risk for individual regional banks is made transparent by the zeb.estate forecast. The analysis is carried out in three steps. Let’s have a look at the example of a regional bank with average total assets of around EUR 4 billion to see how it works.

A) Forecasting the market development

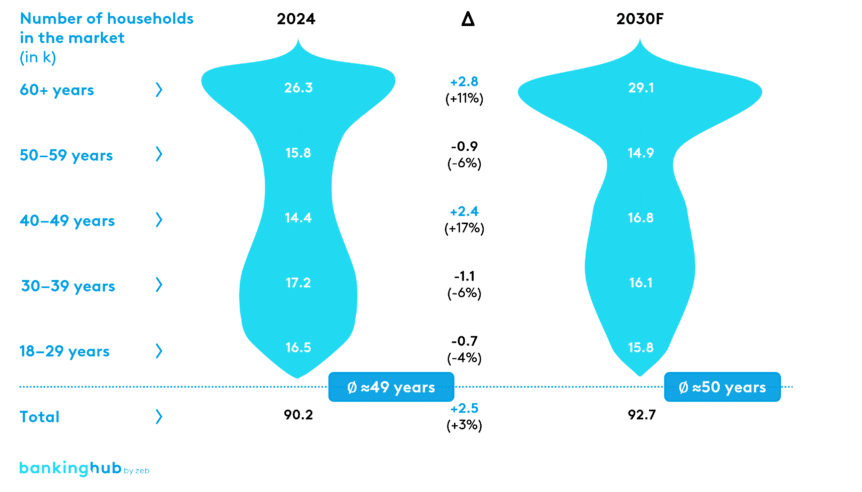

First, the future age structure of households in the business area is forecast and compared to the status quo.

The forecast predicts an increasing average age and a decline in the 18–29 and 30–39 age cohorts from 2030 onwards. By contrast, the age cohort of over 60-year-olds is growing the fastest.

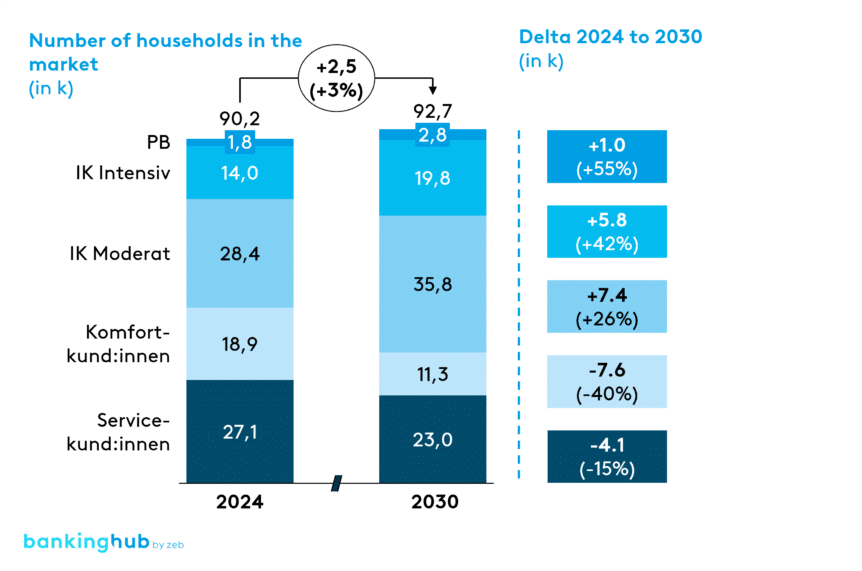

Based on this analysis, the development of households by segment is also forecast, which allows us to draw conclusions about a future distribution of households.

In this context, the development of assets over time, which is based on the assumptions regarding interest rate trends and returns on the capital market, is also taken into account. For example, we can observe a shift in the market structure “from bottom to top”, with a particular increase in the number of customers in the private banking segment.

B) Analyzing the customer structure and determining heirs

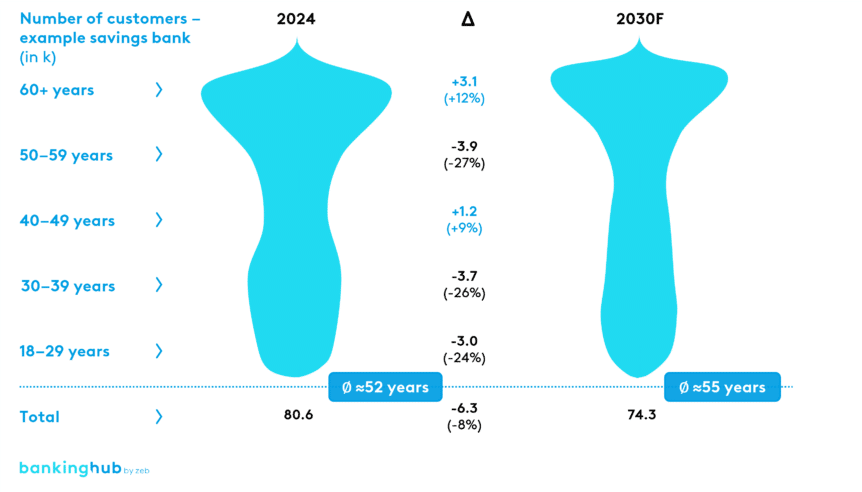

The next step is to analyze the customer structure of the regional bank. To this end, we first need to determine the status quo regarding the age cohorts and segments and compare them with the forecast.

The age cohorts show a structural shift “from young to old”. Step B also allows for an analysis of the reasons behind migrations and shifts. Based on historical data, the quotas for new customers, terminations, deaths and segment shifts are calculated and extrapolated for the future.

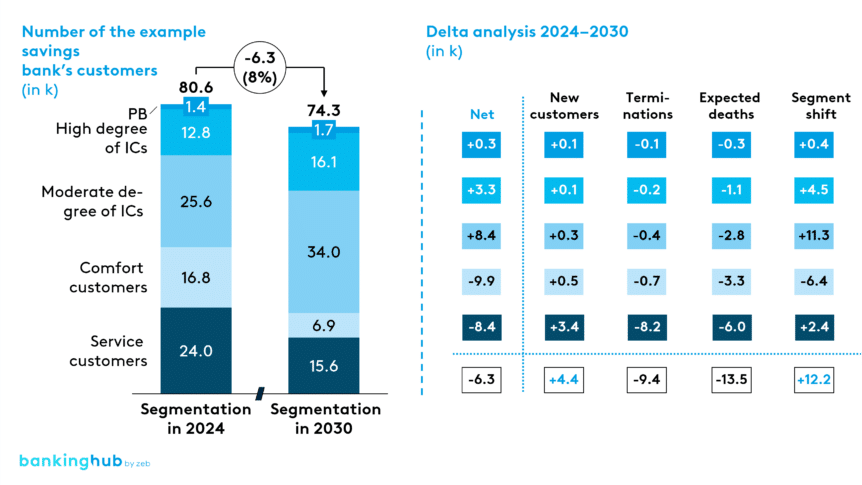

Besides the age analysis, this step contains another forecast that pertains to the different segments according to the respective institution’s segmentation criteria. The current segment structure is then compared to the forecast for 2030, as shown in the figure below.

This comparison enables a detailed perspective on the reasons for customer shifts and migrations within the segments. Overall, the forecast predicts an 8% decline to around 74,000 customers, which is largely due to the expected terminations and deaths.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

C) Quantifying assets at risk of migration

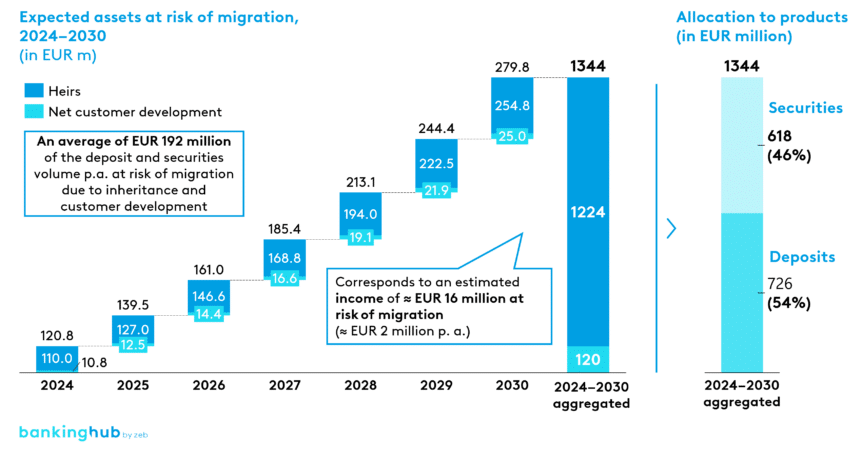

All this ultimately culminates in step C, in which the expected assets at risk of migration are calculated. The assets at risk of migration are subdivided into inheritances and net customer development. EUR 1,344 million in the institution’s assets are expected to be at risk of migration between 2024 and 2030. In addition to the total amount, the assets at risk of migration are calculated per year, which allows for a more graduated analysis.

According to an estimate, the assets at risk of migration until 2030 would generate income to the amount of EUR 2 million per year. By categorizing the different assets, we can determine certain focal points with regard to the assets at risk of migration. In the example below, deposits account for slightly more than half of the assets at risk of migration (54%).

Estate forecast: conclusion

Regional banks in particular are faced with the challenge of determining their customers’ heirs and acquiring or retaining them for the future. The zeb.estate forecast creates transparency and thus offers starting points for deriving recommendations for action in order to retain assets – as a source of income – in the long term.

Potential measures to retain the assets at risk of migration can include, for example, addressing potential heirs in a target group-oriented manner or establishing and expanding a comprehensive generations management scheme. However, the individual measures should be tailored to the respective institution and based on a previous analysis.