|

Getting your Trinity Audio player ready...

|

Market situation and challenges for real estate fund managers

For years, the global real estate market benefited from low interest rates, persistent population growth and the general trend towards urbanization, thus soaring to ever new heights. Under the impact of geopolitical developments from 2022 onwards, however, the phase of sustained upswing initially came to an abrupt end.

The real estate asset class came under considerable pressure in 2022, particularly in comparison to the market performance of other asset classes, namely bonds and commodities. This was primarily due to the turnaround in interest rates and the difficult global supply chain situation caused by Russia’s war of aggression and the resulting price increases.

A look at the development of German real estate prices in recent years reveals a heterogeneous picture in a comparison both between the different types of real estate[1] and within them. Particularly noteworthy are residential properties (+20 percent since 2019[2]), whose above-average price development is mainly due to the strong price increases in metropolitan areas, while structurally weaker areas were unable to benefit to the same extent. The losers include retail properties, which have recorded price falls of almost 19 percent[3] since 2019, and office properties (-4 percent[4]).

We have identified three main factors that summarize the current challenges facing the real estate market.

- Construction costs:The sharp rise in construction costs is mainly due to strict building regulations (in the context of ESG factors), a lack of building plots, a shortage of skilled workers as well as high energy and material costs. Driven by the aftermath of the coronavirus pandemic and increased inflation, higher construction costs are having a negative impact on the profitability of investments due to higher transaction and project development costs as well as maintenance costs.

- Financing costs:The profitability of real estate is falling due to the rise in interest rates and the banks’ increased capital requirements. This has a particular impact on new buildings or properties in need of modernization.

- Trend reversal in types of use:The current developments affect office properties in particular, which make up a significant share in open-ended mutual funds. The proportion of vacancies in office properties has risen sharply in recent years, not least due to new work modes (trend towards working from home) and expiring leases following the coronavirus pandemic. Some properties are now being transformed into residential properties in order to meet the new needs of society. This downward trend can also be observed in the retail sector, as the online retail boom has changed consumer behavior and thus the demand for retail properties in the long term.

As a result of these three challenges, asset managers are facing outflows of funds, particularly from open-ended mutual funds that previously experienced net inflows over several years. In addition, institutional investors were confronted with passive non-compliance with limits of their real estate investments due to the – at least apparent – stability in the value of real estate in the face of volatile stock and bond markets, which led to further outflows of funds.

Owing to the minimum holding period of 24 months and a notice period of 12 months for private investors, the full impact of this trend reversal will only become evident with a time delay. As a result of the aforementioned interest rate increases, other asset classes (including bonds) have become more attractive in recent years, which has led to an investment strategy adjustment, turning away from alternative asset classes and towards traditional/liquid asset classes.

Currently, however, there are increasing signs that after bottoming out, real estate prices may be on the road towards recovery. At the same time, the number of real estate transactions on the market is gradually rising again, and the recently announced turnaround in interest rates is raising hopes of more attractive financing conditions in the medium term. Against this backdrop, a repositioning now makes strategic sense so as not to miss out on the imminent turnaround.

The current situation therefore requires real estate fund managers to take decisive action with the aim of seizing current opportunities in selected types of use and at preferred locations in order to ensure a competitive and viable business in the years ahead. To this end, it is crucial to comprehensively evaluate and potentially realign the current business and investment strategy.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Opportunities for competitive realignment

With regard to successfully implementing the realignment of the business and operating model of real estate asset managers, we have identified key levers that we believe they should consider in the process.

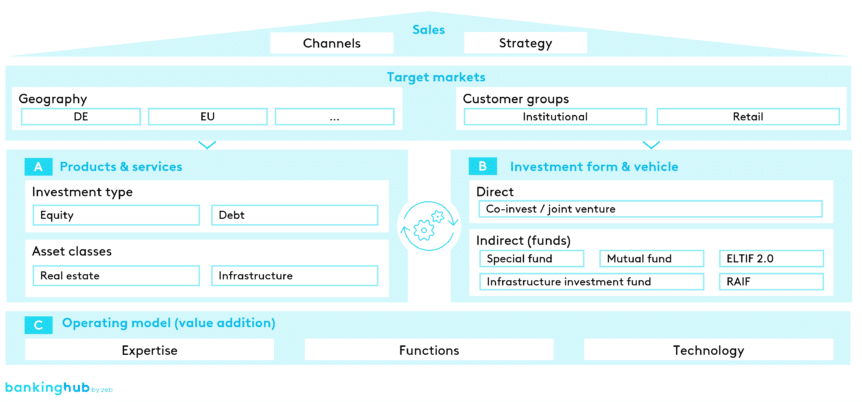

We group these levers thematically into the following three dimensions (see Figure 1):

- Products and services include the exploration of diversification opportunities in the context of both investment types and asset classes. For several years now, in addition to traditional investments in real estate equity, the focus has increasingly been on tapping into debt instruments and investments in (real estate-related) infrastructure in order to expand the existing business model. Against this background, it is also increasingly important to exploit the potential of geographical diversification into emerging growth markets. When considering investment types and asset classes, it is also advisable to comprehensively scrutinize one’s investment strategy, weighing up the potential return against the risk profile, and realigning it if necessary.

- Investment forms and vehicles describe the product bundle in which the respective investments are marketed and brought to potential investors. Various direct and indirect investment opportunities need to be evaluated in order to best meet the needs of investors in line with the sales strategy. A particular focus in this context is on the Luxembourg RAIF and the new ELTIF 2.0 as promising investment vehicles.

- The operating model supports the alignment of the business model and therefore, depending on the repositioning, requires an expansion of existing expertise (resources) and the creation of new functions and IT systems in order to efficiently map a new product range in the value chain. The focus should always be on value-adding activities, whereby outsourcing should be considered, particularly in the back-office area. In the case of holding structures in the area of infrastructure investments, for example, particular attention must be paid to the operating model due to their special requirements.

Conclusion and continuation of our series of articles on real estate investments

In the current volatile environment, the future of the real estate market is characterized by a variety of challenges, but also opportunities. Real estate fund managers who are prepared to comprehensively scrutinize their business and operating model and adapt it to current and future circumstances can benefit from the emerging recovery. Our zeb.solution framework, which identifies the three key levers – products & services, investment forms & vehicles, and operating model (value addition) – provides orientation to support this dynamic process.

As part of our comprehensive overview, we will take an in-depth look at one dimension of the zeb.solution framework in each of the upcoming articles in this series. The second part starts with dimension A) Products & services. For example, we analyze promising types of use that are likely to benefit in particular from long-term socio-demographic, technological and social developments (so-called megatrends). Furthermore, we will take a look at core, core plus, value-add and opportunistic investment strategies. We will examine the advantages and disadvantages as well as the characteristic requirements and necessary capacities of these traditional and riskier investment strategies in the context of both changing market conditions and sustainable developments.