|

Getting your Trinity Audio player ready...

|

Challenges for banks

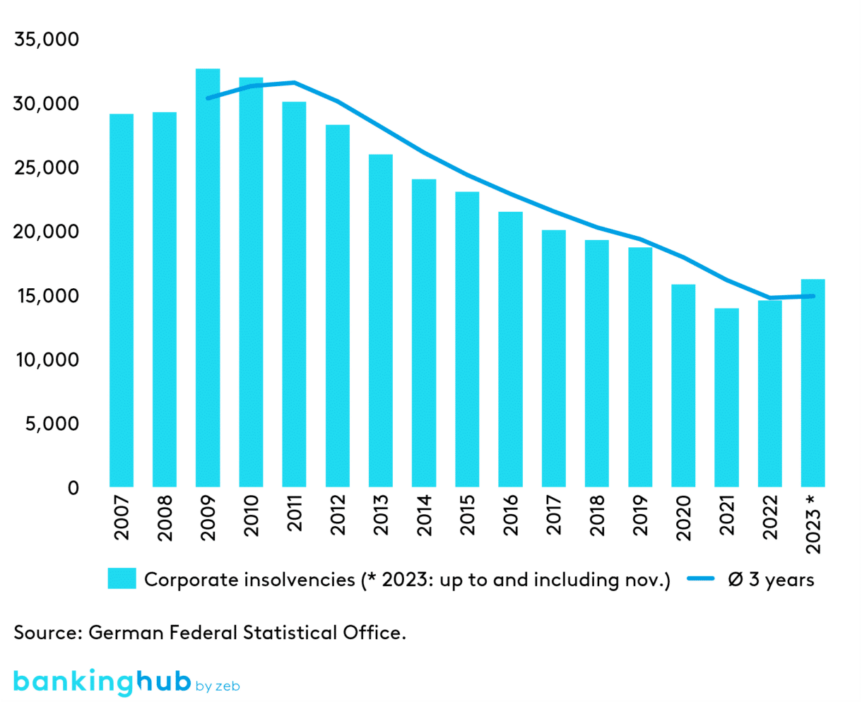

The upward trend in corporate insolvencies during 2023 indicates that companies are increasingly affected by crises, albeit not yet at pre-coronavirus levels. A mix of geopolitical upheavals, such as the wars in Ukraine and the Middle East, disrupted supply chains, rising energy costs, significant price increases, higher financing costs and an increase in cybercrime is taking a toll on companies.

Not only the complex causes of the current crises, but also increasing regulatory requirements are adding to the challenges in the banks’ lending business. Last year, as part of its supervisory priorities, the ECB meticulously began to assess the forbearance measures implemented by banks.

Banks’ forbearance processes must clearly prioritize providing sustainable solutions to customers who are in financial distress but remain viable. Successive unsustainable solutions or measures aimed at non-viable debtors should be avoided, as they merely postpone the adoption of appropriate measures and ultimately result in unnecessary higher losses for both the individual banks and the economy as a whole. The increasing complexity of the crisis situation and regulatory requirements is compelling banks to conduct more rigorous audits of their exposures, carried out by auditors and overseen by the banking supervisory authorities[1].

Both banks and their restructuring specialists must therefore enhance their organizational setup and processes for early risk identification and problem loan management and align them more effectively with regulatory guidelines (in particular the MaRisk and EBA Guidelines). In a complex and dynamic environment, it is important to assess the (future) viability of the borrower’s business model and to ensure highly efficient processing. In crisis scenarios, the significance of necessary restructuring concepts becomes particularly pronounced.

New S6 specifically considers ESG factors and digitalization

In recent years, a uniform standard has emerged for the structure and content of such a restructuring concept. The Institute of Public Auditors in Germany (Institut der Wirtschaftsprüfer, IDW) developed such a standard under the name of “S6”, which has since gained recognition from both banks and courts. S6 incorporates all relevant decisions of the German Federal Court of Justice (Bundesgerichtshof, BGH), detailing them in relation to business management requirements and creating a “conclusive and promising restructuring concept”, as also mandated by the BGH.

In 2023, the IDW revised S6, emphasizing the significance of ESG aspects and their impact on restructuring reports, although these updates clarify existing, rather than impose new, requirements. When ESG aspects significantly affect a company’s business model or development, they must already be considered in restructuring concepts. The assessment of the business model includes not only the traditional key figures, but also considerations related to digital transformation and compliance with environmental, social and governance (ESG) standards. These aspects play an increasingly critical role in long-term competitiveness.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Effectively managing problem loans

Correctly understanding the stages of a corporate crisis in accordance with IDW-S6

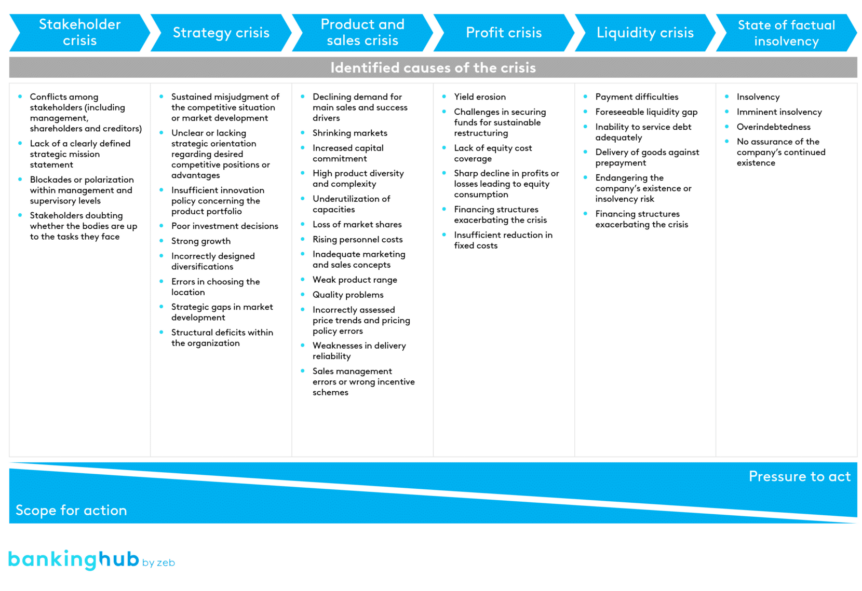

In order to evaluate the business model, the creation of a restructuring concept first necessitates a comprehensive grasp of crisis stages and their underlying causes. Various crisis types – ranging from stakeholder, strategy, product, and sales crises to success and liquidity crises through to insolvency – all exhibit distinct characteristics.

A comprehensive restructuring plan must therefore address the challenges at all stages of a crisis to enable a well-founded assessment of the company’s ability to restructure. Unidentified or unresolved causes of crisis can continue to impact the company, leading to apparent successes in overcoming short-term profit and liquidity crises without ensuring long-term restructuring success.

Therefore, it is crucial to thoroughly analyze the future viability of the business model. This analysis serves as the foundation for achieving long-term restructuring success and is essential for restoring the company’s stability and competitiveness. Banks recognize the importance of restructuring plans to objectify decision-making and support only promising restructuring projects.

Viability of the business model and restructuring strategies

Depending on their assessment of the viability of the (future) business model, lending banks may have different options for action.

If the business model remains viable (possibly after adjustments), determining capital requirements becomes a crucial part of the restructuring process. Comprehensive corporate planning with sensitivity analyses helps the identification of potential risks and opportunities, enabling lenders to make a more informed assessment of future capital requirements and improving decision-making thanks to the transparency created.

When a bank decides to support a restructuring, the capital requirements to adjust the business model, as determined by the business plan, often cannot be met without equity contributions. In such cases, in addition to the usual restructuring contributions from equity providers, the spin-off and sale of non-core or non-performing business units offer various financing options through:

- reducing existing debt,

- increasing the profitability of the core business

- and generating sales revenue.

Strategically separating business units can significantly contribute to financing. This necessitates early preparation for the M&A process.

In cases where the bank believes that a company can overcome a crisis on its own through a robust restructuring concept, it may prefer to pursue a passive restructuring strategy while maintaining the status quo. This approach involves not only waiving contractual or statutory termination rights but also, for example, maintaining credit lines, extending roll-over loans, or allowing the utilization of undrawn credit lines.

If, however, the lenders consider the situation to be hopeless, they may swiftly opt for an exit, i.e. they withdraw from the loan commitments. Most banks now include transfer clauses in their loan agreements, allowing for the resale of loans upon origination. This exit strategy may involve selling the loan commitment on the secondary market, albeit often at a discounted price. As a last resort, insolvency proceedings can be initiated to restructure the borrower.

Keeping experts on hand

In addition to the complex business and legal challenges involved in handling individual cases, banks face a particular challenge in the current situation: ensuring the availability of well-qualified employees. Recent positive economic conditions and the associated low number of insolvencies and defaults have led to job reductions at many banks. The task now is to proactively address the impending shortage of skilled workers. This requires timely staff recruitment and qualification efforts, as well as retaining existing skilled employees.

Conclusion: challenging environment for managing problem loans

The increasing demands on problem loan management at banks are intensified by a challenging environment characterized by diverse and complex causes of corporate crises. In view of these challenges and the constantly changing parameters, e.g. with regard to ESG requirements, the validation and, if necessary, the adjustment of the business model become a decisive factor for long-term restructuring success.

An essential component of an efficient process in problem loan management – one that conserves resources on the part of the banks – is a restructuring concept that objectively, reliably, and transparently assesses capital requirements and the chances of restructuring success. This ensures that only promising restructuring plans receive support. At the same time, there is a need to (re)establish or strengthen well-positioned teams for problem loan management in the banks.