|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

State of the banking industry

- Global top 100 banks were not able to keep up with overall capital market recovery and showed the lowest TSR performance across all industry sectors (-1.7% qoq).

- Western European banks are particularly hard hit – average P/B ratio continues to drop, approaching the 0.40x mark end of Q3 2020.

Global banks are not able to keep up with the overall capital market recovery. In the third quarter of 2020, shares of global banks have come under renewed pressure, reflecting ongoing uncertainty about the economic consequence of the COVID-19 pandemic, falling interest rates as well as upcoming new money-laundering allegations. Whereas the global market was able to make up for the losses from Q1 2020 (MSCI World +8.0% qoq, +2.1% for 2020), the banking sector again lost shareholder value (-1.7% qoq, in total -23.0% for 2020).

- Contrary to the general market movement (MSCI World: +3.3% qoq), the recovery of banks’ market capitalization stopped in the third quarter of 2020. All banks’ market cap decreased by -2.2% qoq while global top 100 banks even lost all gains from the second quarter reaching a new low point of EUR 3.8 tr (-5.8% qoq, -26.9% yoy).

- Banks’ average P/B ratios remain below the 1.00x-hurdle across all regional clusters. Western European banks’ P/B ratio continues to drop, approaching the 0.40x mark end of Q3 2020 (0.41x, -0.06x qoq).

- In Q3 2020, global top 100 banks showed the lowest TSR performance across all industry sector (-1.7% qoq). Whereas U.S. banks were able to keep TSR nearly constant in (+0.6% qoq), Western European banks have been additionally burdened by the ECBs’ extended dividend ban for euro zone banks and the TSR declined by -11.7% qoq.

- Negative TSR among the European top performers again highlights the precarious situation of the banking industry. The Spanish banks Banco Santander and BBVA are particularly affected as they suffer from the severe situation in Brazil and Mexico, which amount to around 30% of their profits.

Economic environment and key banking drivers

- The full extent of the COVID-19 crisis was shown in economic growth in Q2 2020. Despite an aggravating second COVID-19 wave, the economic situation is expected to continually improve over the next quarters.

- Inflation rates across all regions dropped and the Western European rate is expected to slow to deflation – devastating news for anyone hoping for higher euro area yields.

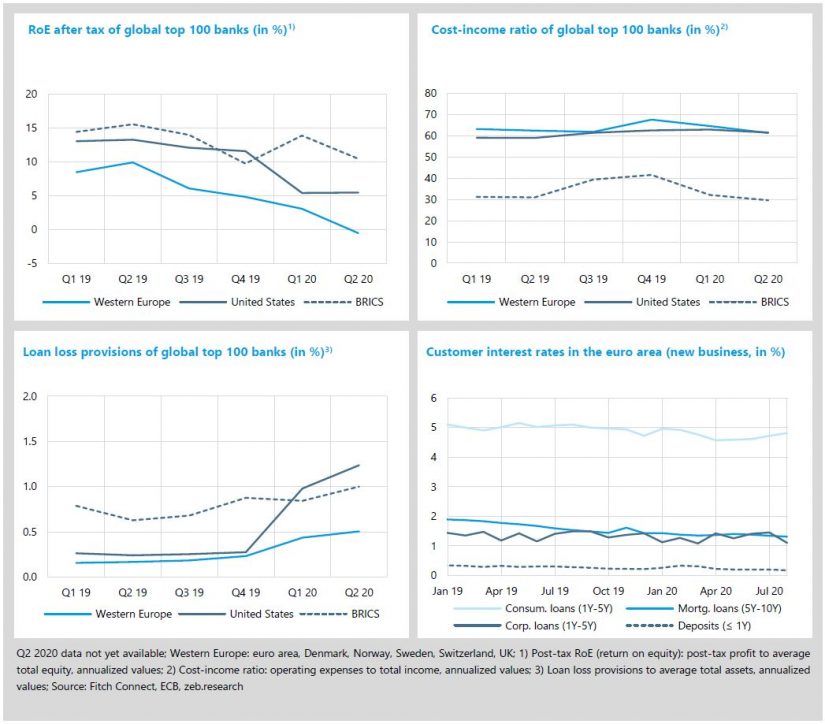

- Global top 100 banks reported further increasing cost of risk in Q2 2020. European banks also had to deal with lower earnings resulting in a RoE of -0.5%.

In Q2 2020, GDP growth in Europe and the U.S. shows the full impact of the COVID-19-related lockdowns and reached a historic low point. Despite an aggravating second COVID-19 wave, the economic situation supported by massive state aid programs is expected to continually improve over the next quarters. Inflation rates across all regions dropped in Q2 2020. While U.S. inflation rates are expected to slowly move back to regular levels, the Western European rate is approaching deflation. This is devastating news for anyone hoping for higher euro area yields.

- After a dismal Q2 2020, latest GDP growth forecasts indicate that economies are beginning to recover. GDP growth is steadily increasing but remains negative for most countries until Q1 2021. However, current estimations are still very volatile, essentially depending on the development of infection rates and are therefore not very reliable, of course.

- Due to the economic crisis, customer prices dropped clearly and are expected to decrease in Germany and Western Europe even further in the next quarters nearly reaching zero and increasing the risk of deflation in the next months.

- As the U.S. Fed confirmed it plans to keep interest rates in a range between 0.00%-0.25%, the U.S. yield curve remained at a remarkably low level and became even flatter compared to June 2020.

- The euro area yield curve shifted downwards, stayed super-flat and now matches the previous low at the end of Q3 2019, negating all yield improvements of the past. Lower pressure from U.S. yields along with massively increasing government debt, the further need for economic stimulus and now even the possibility of deflation destroys all hopes for higher yields in Europe for the next months and even years.

After taking a first huge hit in the first three months of 2020, global banks reported further significantly increasing loan loss provisions (LLPs) in Q2 2020. Yet, the overall development and the ability to cope with massively increasing costs of risk was regionally quite different. U.S. banks were able to compensate higher LLPs through higher earnings (especially in securities business) and to keep their profitability stable. European banks, however, had to deal with a fatal combination of higher LLPs and also lower earnings even resulting in a negative return on equity in Q2 2020.

- U.S. banks again faced strongly increasing loan loss provisions (+27% qoq) in Q2 2020 but managed to keep their profitability stable and above 5% (Q1 2020: 5.4%, Q2 2020: 5.5%). Key to this were clearly increasing earnings (+10%) with only moderately increasing costs. The cost-income ratio improved in the second quarter from 63% (Q1 2020) to 61%.

- European banks showed a quite different picture: LLPs increased by 16% qoq but as earnings decreased in addition (-6% qoq), profits were negative for the first time leading to a return on equity of -0.5% in Q2 2020. Strongly decreasing costs (-11% qoq) offset these negative effects to some degree but were not able to keep profits in the positive.

- The recent development of customer interest rates, especially declining rates in the corporate business, might surprise to some degree. From our perspective, this is more driven by lower credit lines and early repayments of loans from Q1 2020 instead of a trend reversal. We still think that, on an overall level, the pandemic should lead on average to higher customer interest rates in the next quarters continuing the trend that started in April 2020.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Special topic: A deceptive calm?

European banks still need to be vigilant!

- European banks have on average reported significantly higher loan loss provisions in order to capture the potential economic fallout from the COVID-19 pandemic.

- Risk provisioning differs significantly across banks which cannot only be explained by obvious and clear criteria, thus also indicating a high level of uncertainty.

- The still volatile and uncertain COVID-19 situation requires banks to reassess the situation at shorter and shorter intervals and act decisively and fast upon the derived information.

Almost eight months after the COVID-19 pandemic hit Europe, the crisis has left a very deep and fundamental mark – companies from all industry sectors and their employees were affected. For European banks, the consequences are twofold: banks are – together with governments and central banks – an essential part of the rescue team trying to mitigate the economic damage by giving out new loans or increasing credit lines. However, due to the massive economic downturn, banks also have to deal with significantly increasing credit loss provisions in their P&L.

The fundamental question is how much will loan loss provisions (LLPs) finally increase and eat up banks’ already low profit cushions? We addressed this question in our European Banking Study published in September by analyzing the current LLP developments of Europe’s largest 50 banks.[1] Looking at these institutions, two aspects are observable. In the first six months of 2020, most of the banks have reported significantly higher loan loss provisions in order to capture the potential economic fallout from the COVID-19 pandemic. Furthermore, LLP increases differ clearly across the top 50 banks. A deeper view of current figures underlines this. Postings of loan loss provisions of Europe’s top 50 banks for the first six months of 2020 are already higher than the FY 2019 value – in total, approximately EUR 60 bn at the end of Q2 2020 vs. EUR 47 bn in FY 2019. However, while some European banks reported in H1 LLPs more than 10 times higher than previous year’s levels, other banks have made almost unchanged or just slightly increased provisions.

This raises some further questions: are there concrete or obvious criteria which can explain the very different ways in which risk provisions are formed by the institutions? Or are these current differences rather the result of complete uncertainty in the banking sector about the severity of impacts from the COVID-19 crisis? Based on the latest available reports of Europe’s top 50 banks we analyzed the heterogenous COVID-19 induced risk provisioning by testing the impact of different factors that could be used as explanatory variables. The COVID-19 induced risk provisioning is measured by the percentage change of LLPs in the first half of 2020 compared to the first half of 2019. As an explanatory variable we used 25 factors in total, including geographical information (country or region of domicile), the fundamental basic business model, the financial resilience of the bank (profit and capital cushions), the historical risk provisions and reserves (e.g. coverage of non-performing loans), information on the pre-pandemic loan portfolio quality (measured by portfolio PDs and LGDs) and the estimated impact of the crisis across industry sectors.

The overall result of this analysis is clear, but perhaps unsatisfactory. Altogether, from all these variables studied, only two variables – profit cushion and the level of LLPs before the pandemic – can provide any information on the increase in risk provisioning. Institutions with a previously high profit cushion generate significantly higher provisioning than banks with a lower cushion. At the same time, institutions with a historically higher risk provisioning build up further reserves to a lesser extent than banks with a very low starting point (see Figure above). However, considering these two variables in a multiple regression model, only about 22% of the variance can be explained. Beyond this, none of the geographical characteristics, the general business model, the initial portfolio quality and the exposure split across industry sectors can significantly increase the explanatory power of the model.

There is currently a deceptive calm. The economy has begun to recover in Q3 2020 and many expect no further total lockdown leading to a somewhat speedy recovery towards the end of 2022. However, European banks are by no means operating in a normal environment. Large parts of the economy are supported by the expensive intervention of the European states – a lot of bankruptcies have seemingly been avoided, but many might only have been postponed until later. Whether the situation will worsen in the next few months or even weeks will strongly depend on the handling of the current “second wave” of the COVID-19 pandemic and the corresponding further economic development towards the end of the year. This rather volatile and uncertain COVID-19 situation requires banks to be vigilant, that is, to reassess the situation at ever shorter intervals and act decisively and fast on the information derived.

Please visit our page #zebFutureProof where we present detailed additional information, materials and specific offers.