|

Getting your Trinity Audio player ready...

|

Analysis and simulation: the private banking market in Germany

At 12%, the volume of liquid assets (securities) held by German private banking customers only played a minor role in 2022. The main drivers of asset growth were real estate and equity investments. This clearly indicates the potential for advisory services and earnings that asset managers can tap in these asset classes.

The analysis of the private banking market in Germany conducted as part of the study identifies several focus topics as key challenges and opportunities.

In Germany, private banking and wealth management clients represent only about 1.8% of all private customer households. Nevertheless, the associated market is growing steadily. The wealth management customer segment[1] in particular offers strong growth potential, with an annual growth rate of 5 to 7%.

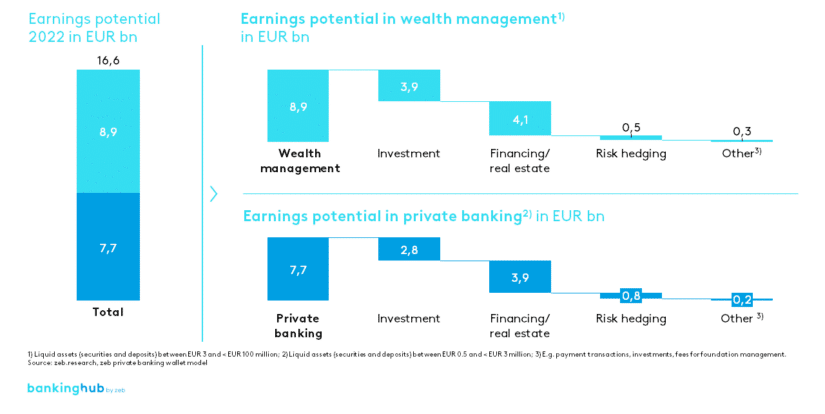

These assets represent a wallet with an earnings potential of EUR 16.6 billion. Of this figure, EUR 8.9 billion can be attributed to the wealth management market and EUR 7.7 billion to the private banking market. The traditional investment business accounts for only about 40%, thus underscoring the importance of offering complementary services that meet the needs of private banking and wealth management customers. The financing and real estate business segments offer even greater earnings potential than the traditional investment business.

And the German private banking market is on the move, undergoing constant re-evaluation due to the market presence of foreign private banks. Regional banks, such as savings banks and cooperative banks, have a broad customer base with long-standing relationships in retail and corporate banking and are therefore well positioned to extend these relationships into private banking. They can capitalize on this advantage by winning market share from competitors. The key factors in this context are the individual strategic positioning of the providers and their perception in the market. Traditional private banks often struggle with outdated infrastructures or can no longer operate independently as a result of changes in ownership. Large banks, by comparison, have a high degree of brand awareness and positive brand connotations. However, despite having a high level of product expertise, only some of these institutions pursue a holistic approach.

Not one of the nine traditional private banks in the sample analyzed managed to convert the annual AUM[2] growth of 10.8% into sales revenues. Weaknesses in pricing combined with costs exceeding the inflation rate prevent systematic monetization. On average, the cost/income ratio is 77%. In the last five years[3] , profits were mainly driven by capital markets and inflation.

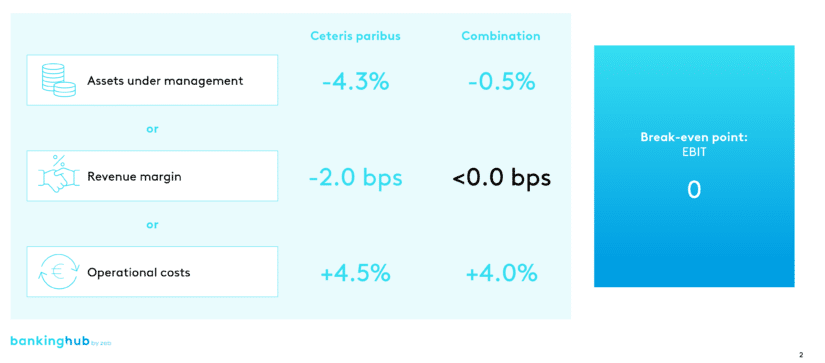

Profit margins in Germany, Austria and Switzerland remained largely stable. However, revenue margins are declining. With ongoing macroeconomic tensions due to the COVID-19 pandemic, the war in Ukraine, and rising inflation, costs are expected to continue to grow disproportionately, resulting in declining profit margins. From zeb’s point of view, there is scope for improving profit margins in the short term by increasing revenue margins, provided that the increase in revenue exceeds the increase in costs. Rising customer expectations in terms of service and returns, coupled with lower capital market-driven AUM growth, are putting private banking providers under increasing pressure to deliver results, while costs continue to rise.

The surge in interest rates reduces the market value of bonds and, combined with a general stock market slump, causes high volatility in customers’ securities portfolios. In the long run, high inflation raises the nominal return expectations customers have of their portfolios. Positive price increases triggered by central banks (quantitative easing), for example, can generate a positive real return on investments after deducting bank fees and adjusting for inflation. The COVID-19 pandemic has led to a growing interest in digital services and an increased need for high-quality advisory services. At the same time, higher inflation and more intensive customer care result in increased costs that should be passed on.

Uncertainty in the capital markets and rising interest rates are slowing capital market-driven AUM growth and increase the pressure on providers to generate sustained positive net new money growth. A simulation of the next five years clearly shows that even a slight deterioration in the three parameters of AUM, revenue margin and costs could result in losses for banks.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Focus topics of our Private Banking Study 2022

Since the interest rate turnaround, interest book management from a value-based cash flow perspective has become a powerful tool for maximizing returns on customer investments. Revenue-driven management of a bank’s interest exposure book – i.e. all interest-bearing or interest-sensitive positions on the assets and liabilities side of the balance sheet – makes it possible to maximize revenue from customer deposits while at the same time justifying the controlled and deliberate acceptance of risk. This is based on the design and implementation of an integrated risk/return management system that takes into account the bank’s risk-bearing capacity, business policy and regulatory requirements.

ESG requirements represent an additional operational burden for banks. In practice, the introduction of new regulatory requirements has led to uncertainty among customers and has complicated sales for banks. Although MiFID II stipulates that as of August 2022, financial advisors must ask their customers about their sustainability preferences, zeb’s project experience shows that less than 5% of customers opt for sustainability-related products.

What are the reasons for this? Firstly, inquiring about sustainability preferences is not ideally anchored in processes and advisory services. Secondly, suitable or sufficiently diverse product offerings are often unavailable, so that the sales strategy does not explicitly include sustainable investments. As a result, the lack of detailed information provided in advisory sessions and the limited expertise of the advisors are not conducive to arousing the customer’s interest.

A lack of knowledge about the overall asset structure of high-net-worth customers often limits attempts to fully exploit their wallets. This is due to the nontransparent structure of the total assets of (U)HNWIs across different asset classes. zeb has developed the private banking wallet model to equip financial service providers with a tool that ensures the necessary visibility and transparency. It is based on holistic financial plans in the private banking and wealth management segment including UHNWIs > EUR 50 million.

The distribution of the earnings potential clearly shows that the prevailing focus of investment advice on liquid assets leaves 60 to 70% of the earnings potential untapped. Real estate, as well as other tangible assets, are also important tools for generating additional returns, be it through supporting the buying and selling process or through financing. Similarly, hedging risk plays a much greater role than is generally assumed. It is therefore important to analyze the asset structure of one’s own private banking clientele.

There is significant earnings potential in areas that are rarely targeted in practice. The aim should therefore be to address the various customer groups according to their needs and provide them with tailored support. There are significant differences in how institutions actually implement these measures in a systematic manner, resulting in clear competitive differentiation.

Digitalization offers providers the opportunity to better understand customer needs while improving their own revenues and margins. In traditional private banking, face-to-face interaction usually takes place at the provider’s premises, and less often at the customer’s home or office. The path to digital transformation leads to different levels of physical and digital interactions. When applied to the day-to-day operations of financial services providers, they expand the possibilities for both customer acquisition and penetration of existing customers’ wallets.

Digital assets are digital representations of assets that are not issued or guaranteed by any central bank or public authority and do not have the legal status of currency or money.

The underlying distributed ledger technology (DLT) is a special form of electronic data processing and storage. It refers to decentralized databases that provide members of a network with shared read and write permissions. Digital assets and distributed ledger technology act as a catalyst in the evolution of financial markets. Barriers to entry into this high-margin market are currently low. Integration across different stages is recommended. Currently, however, only a few private banking providers have a comprehensive strategy.

Outlook: is the crisis the new normal?

The past three years have been characterized by volatility and market uncertainty. After a decade of low interest rates and securities purchase programs by central banks, inflation jumped to record levels. As a countermeasure, central banks raised key interest rates, which temporarily depressed the valuation levels of equities and bonds, for example. For banks’ interest exposure book management, however, this heralds the beginning of a new era with great earnings potential.

Regulators increased the pressure on financial institutions across the EU with the introduction of the EU taxonomy – looking ahead, individual ESG criteria will continue to evolve in line with societal change. Digitalization is no longer a new topic – but there is still a lot of potential in Germany. Regardless of the recent turbulence in the crypto market, distributed ledger technology is likely to establish itself in the next few years.

As the world evolves, the needs of high-net-worth individuals (families) will also change, and providers will need to respond with appropriate holistic support in order to become “advisors for all life situations”.

So there is still a lot of work to be done.

2 responses to “Private Banking Study Germany 2022”

Garces Alfredo

Alfredo Garces, head of Wealth Management strategy by Targobank, woud appreciate to exchange on the study regarding private banking in Germany

Best Regards

Gaelle

Gego Gaelle

Your insight on your study on Private Banking sector & Wealth Management in Germany in very interesting .

I contact you on behalf of Alfredo Garces, who is the head of Wealth Management department by Targobank and would appreciate to read your study and be in contact with you .