|

Getting your Trinity Audio player ready...

|

Analysis and simulation: the private banking market in Austria

As a result of the recent capital market turmoil, total customer assets stagnated at around EUR 870 billion at the end of 2022 but are expected to grow to over EUR 1.07 billion within the next five years. Investments and real estate serve as the primary growth drivers. At 14%, liquid securities assets only played a minor role at the end of 2022.

Our Private Banking Study Austria provides an overview of the market situation, analyzes challenges, and shows possible courses of action to seize opportunities.

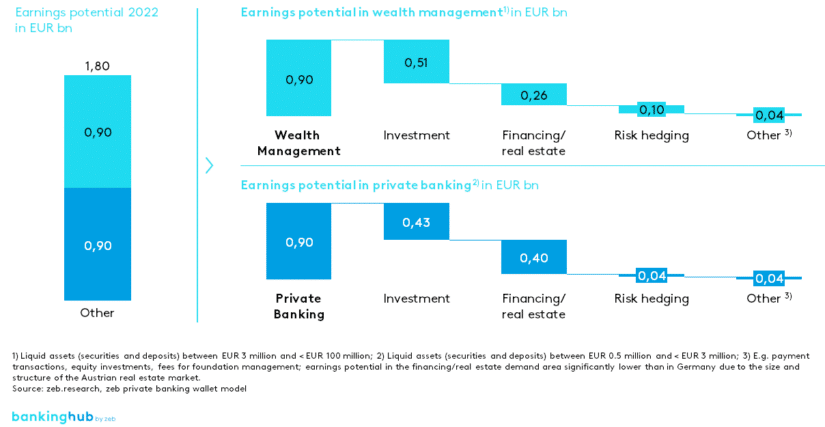

These assets represent a wallet with an earnings potential of EUR 1.8 billion at full capitalization in the Austrian private banking and wealth management market. This wallet is equally divided between private banking and wealth management clients. In this context, it is particularly exciting to note that around 50 to 60% of the earnings are derived from traditional asset management. Financing and real estate revenue ranks second in terms of earnings potential. This underscores the importance of broadening the range of products and services to include topics outside traditional asset management, in line with customer needs.

A competitive analysis shows that all market participants are increasingly investing in private banking activities, thereby adding to the competitive pressure in an already crowded market. Private banking providers differ from one another primarily in terms of the focus of their product offering and their approach to customer service. The range of products offered by independent asset managers and foreign private banks is particularly distinctive when compared to rival market participants. Multi-family offices compete with private banks. The distribution of market shares is dominated by independent private banks and subsidiaries of large banks.

Due to disproportionately high earnings growth, the results of all banks in the sample developed positively. This was mainly made possible by strong capital market-driven AUM growth. In comparison, however, revenue increased only slightly in 2022, mainly due to lower prices. On the other hand, costs have risen at a lower rate than AUM growth, albeit above the average inflation rate. Overall, the strong AUM growth combined with a moderate increase in costs amounted to a positive earnings performance.

In Austria, Germany and Switzerland, profit margins remained largely stable. With ongoing macroeconomic tensions due to the COVID-19 pandemic, the war in Ukraine, and rising inflation, costs are expected to continue to rise disproportionately, resulting in declining profit margins. From zeb’s point of view, there is nevertheless scope for improving profit margins in the short term by increasing revenue margins, provided that cost increases are outweighed. The persistence of higher inflation also raises customer expectations in terms of returns and service in the medium term and puts private banking providers under pressure due to low capital market-driven AUM growth.

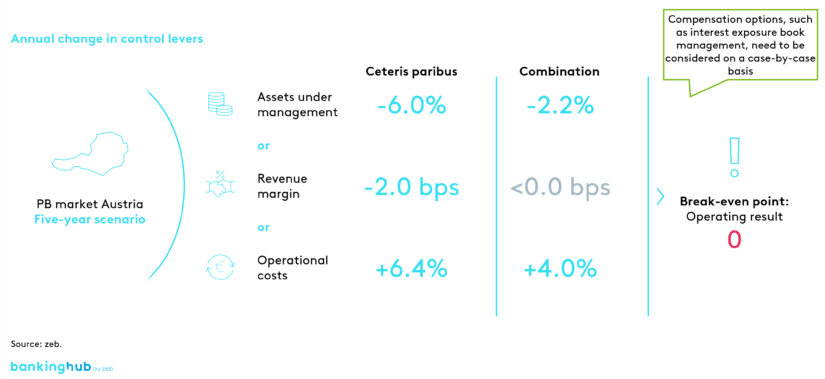

The surge in interest rates has led to a decline in the market value of bonds and, combined with a slump in equity markets, ultimately caused high volatility in customers’ securities portfolios. Many private banking clients prefer to preserve the real value of their money. Higher inflation raises the nominal return expectations. In addition, as portfolio volatility grows, so does the expected level of customer service, which ultimately leads to higher asset management fees due to inflationary increases in personnel costs. In the medium term, this will put greater pressure on private banking providers to generate positive net new money independently of capital market-driven AUM growth. A zeb simulation clearly shows that even a slight deterioration in the three parameters of AUM, revenue margin and costs could result in losses for banks.

Focus topics of our Private Banking Study 2022

Since the interest rate turnaround, interest exposure book management from a value-based cash flow perspective has once again become a powerful tool for maximizing returns on customer investments. Revenue-driven management of a bank’s interest exposure book, i.e. all interest-bearing or interest-sensitive positions on the assets and liabilities side of the balance sheet, makes it possible to maximize income from customer deposits while at the same time allowing to take calculated risks. This requires integrated risk/return management that takes into account the bank’s risk-bearing capacity, business policy and regulatory compliance.

ESG requirements represent an additional operational burden for banks. In practice, however, the introduction of new regulatory requirements has led to uncertainty among customers and has complicated sales for banks. Although MiFID II stipulates that as of August 2022, financial advisors must ask their customers about their sustainability preferences, zeb’s project experience shows that less than 5% of customers opt for sustainability-related products. Why is that? Firstly, processes and advisory services aren’t optimized for inquiring about sustainability preferences. Secondly, there are often no suitable, or sufficiently diverse product offerings, so that the sales strategy does not explicitly include sustainable investments. The lack of detailed information provided in advisory sessions and the limited expertise of the advisors are not conducive to arousing the customer’s interest.

The often nontransparent structure of the total assets of (U)HNWIs across various asset classes frequently limits attempts to fully exploit their wallets. zeb has developed the private banking wallet model as a tool for financial services providers that ensures the necessary visibility and transparency. It is based on holistic financial plans in the private banking and wealth management segment including UHNWIs with assets of more than EUR 50 million.

The distribution of the earnings potential clearly shows that a focus of investment advice on liquid assets often leaves up to 70% of the earnings potential untapped. Real estate, as well as other tangible assets, can also be important tools for generating additional income, be it through supporting the buying and selling process or through financing. Similarly, hedging risk plays a much greater role than is generally assumed. It is therefore important to analyze the asset structure of one’s own private banking clientele in order to tap into the key earnings potential in areas that are rarely targeted in practice. Various customer groups should be addressed according to their needs and provided with tailored support to ensure consistent implementation and differentiation from competitors.

Digitalization gives providers the opportunity to better understand the needs of their customers while improving their own revenues and margins. In traditional private banking, face-to-face interaction usually takes place at the provider’s premises, and less often at the customer’s home or office. Digital transformation allows for various levels of physical and digital interactions. When applied to the day-to-day operations of financial services providers, they expand the possibilities for both customer acquisition and penetration of existing customers’ wallets.

Digital assets are digital representations of assets that are not issued or guaranteed by any central bank or public authority and do not have the legal status of currency or money. The underlying distributed ledger technology (DLT) is a special form of electronic data processing and storage. It allows for decentralized databases that provide participants in a network with shared read and write permissions. Digital assets and DLT act as a catalyst in the evolution of financial markets. Currently, however, only a few private banking providers have a comprehensive strategy for integrating this technology, even though entry barriers into this high-margin market are low. It is advisable to engage this market in a step-by-step manner, through different stages.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Outlook: growth opportunities for Austrian private banking providers

What are the future growth opportunities for Austrian private banking providers? In the past three years, the markets have been characterized by a high degree of volatility and market uncertainty. After a ten-year bull market with low interest rates, the global economy experienced an abrupt change in direction. Extensive securities purchase programs by the central banks fueled the “price rally” of the past few years, but at the same time have also led to a rise in inflation. As a monetary countermeasure, central banks raised key interest rates, which in turn caused share and bond prices to plummet – how will this development continue on the capital market?

However, in an era of rising interest rates, new earnings potential is opening up for banks and their interest exposure book management tools. Sustainability is a hot topic in today’s society, and regulators are putting pressure on financial institutions across the European Union with new rules.

For Austria, digitalization is not new territory – but nonetheless, still has a lot of potential to offer. Regardless of the recent turbulence in the crypto market, distributed ledger technology is likely to establish itself over the next few years. As the world becomes more complex, so do the needs of high-net-worth individuals and/or families. Private banking providers should proactively respond with targeted advisory services for “all life situations”.