|

LISTEN TO AUDIO VERSION:

|

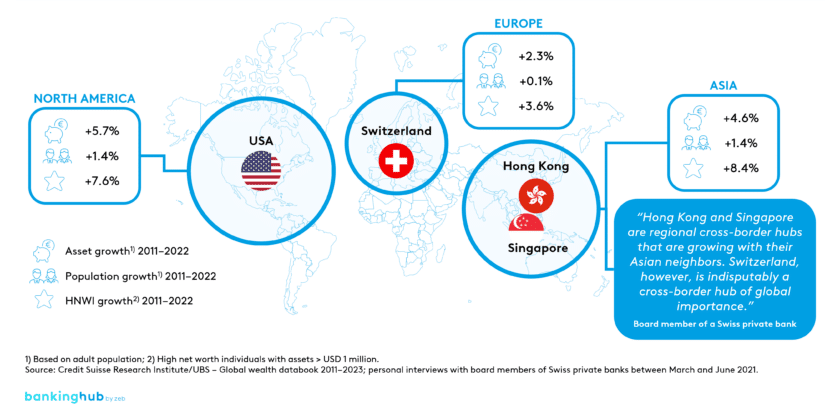

The most important cross-border asset management centers in the world

Compared to onshore markets such as Germany, Switzerland benefits more from demographic developments and asset growth in the rest of the world. While the number of millionaires in Europe is currently growing by only 3.6%, it is increasing by 8.4% in Asia and by 7.6% in North America. Thanks to their position as globally operating asset managers, Swiss banks, which manage CHF 2.4 trillion for foreign private clients, can practically “insource” some of this growth. As the total private assets managed by Swiss banks amount to approx. CHF 3.7 trillion, client deposits from abroad account for around two-thirds of the total.

Dominance and fields of action in foreign client business

The board members interviewed by zeb shared the opinion that Switzerland enjoys undisputed dominance as a cross-border asset management center – and will continue to expand this position. Clients particularly appreciate the dedicated and high-quality wealth management offering. For many of them, this is characterized in particular by a broad international diversification of investments and a holistic approach to wealth planning. In addition, several Swiss private banks are still family-owned to this day, which creates a basic attitude and mentality shared by many entrepreneurial clients.

In terms of client segments served, Swiss asset managers have established a dominant and virtually unrivaled position in serving so-called “ultra-high net worth” families, or UHNW families for short, i.e. those with total assets between CHF 10 and 50 million. The traditional Swiss value propositions are intact and still attractive for this demanding clientele, which manifests itself not least in significantly higher profit margins of Swiss banks compared to pure onshore providers: while the profit margins of traditional private banks in Germany have shrunk to an average of 9 basis points in recent years, those of Swiss banks have for years been hovering around a stable 20 basis points.

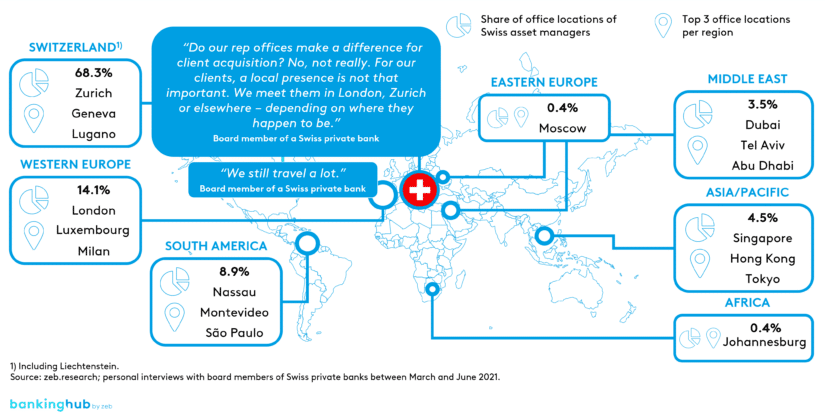

The geographical focus of the activities of many established private banks continues to be Switzerland: for foreign UHNW clients, the availability of local market access tends to play only a minor role. Many foreign clients appreciate the possibility of booking in Switzerland itself, especially for reasons of asset protection, and combine their banking transactions with trips outside their home country.

At the same time, client advisors follow the geographical preferences of their clients and meet them in Zurich, London or elsewhere. To this day, Swiss private bankers travel extensively. So it is perhaps not surprising that the majority of Swiss asset managers’ office locations, around 80% to be precise, are in metropolitan areas in Switzerland (including Zurich, Geneva and Lugano) and Europe (including London, Luxembourg and Milan).

And yet, despite a highly optimistic assessment of the future viability of the Swiss model, the interviews also revealed doubts as to whether Switzerland would be able to keep up with the fundamental changes in the industry.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Can Switzerland keep up with the fundamental changes in the industry?

Shift in expectations of “NextGen” clients

One field of action relates to the shift in expectations of “NextGen” clients with regard to established private banks. Young clients in particular are showing more confidence in managing family wealth and are increasingly challenging asset managers thanks to symmetrical information, a good education and the intuitive use of technology. Compared to the older generation, they are both better informed and less loyal, react more sensitively to performance and costs, and want to be actively involved in the investment process, even in the case of delegated mandates.

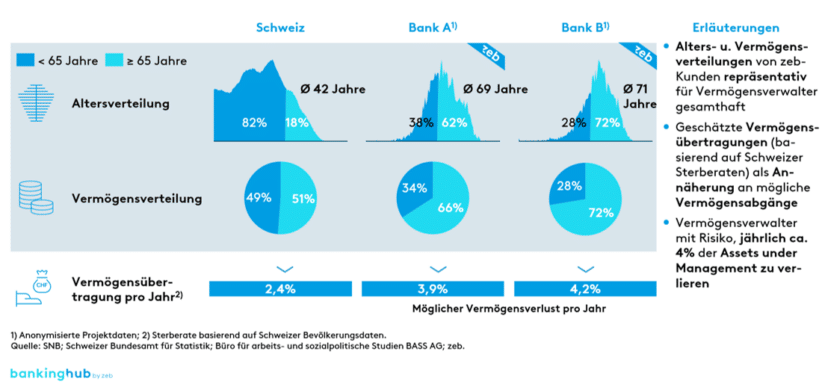

Against the backdrop of an aging client structure in many established private banks, this results in a pressure to act. In Switzerland, about 25% of UHNW clients’ assets stem from inheritances. At the same time, zeb’s projections show that established private banks in particular could lose 4% of their assets under management annually due to clients deceasing if they fail to retain the generation of children and grandchildren early on.

Digitalization

Another field of action, which has received a noticeable boost from Covid-19, is that of digitalization. Many established private banks are still lagging well behind client demands in this respect. The interviews revealed that, to date, small private banks in particular have mainly relied on personal client access and used a “smart follower” approach to implement market trends that have proven to be successful.

This hesitant approach may yet turn out to be a mistake. Gradually, successful hybrid advisory models can be observed in the market, which are not only used in the area of low-complexity client needs. In the interviews, almost all board members indicated that the added value of technology decreased with clients’ complexity. At the same time, broad digital support in client care is unlikely to decline again but is expected to become established as a longer-term trend.

Conclusion on the cross-border business of Swiss asset managers

Despite the abovementioned fields of action and others discussed in detail in the study published by zeb, the board members consider the growth opportunities of cross-border business – and thus the role of Switzerland as a whole – to be very positive and the associated market opportunities to be highly attractive.

For German private banking providers, this in turn means that the battle for local market share is likely to intensify further.