|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

Transparency about the target group

For years, private banking providers have been facing the challenge of attracting new customers in order to counter industry-wide cost pressures, margin erosion and market dependency on AUM growth. To acquire new customers, the focus so far has been on personal recommendations and analog channels (golf tournaments, horse shows, cooking events, concerts, etc.). These marketing tools are sometimes very costly. However, they do build trust and promote a positive brand perception.

It only takes a quick look at the private customer segment in retail banking to realize that digital advertising has been very effective in attracting new customers for some time now (examples include Revolut, N26 and Comdirect). However, most private banking providers have not yet tested any digital approaches for addressing potential new customers, as they often assume that this would make their products seem less exclusive and not appeal to an older and less digitally savvy target group.

Which media are particularly suitable for approaching private banking customers digitally?

The evaluation of various studies on digital usage behavior in Germany shows that almost the entire target group relevant to private banking is actively using the Internet. An online survey conducted by the German public broadcasters ARD and ZDF reveals that around 95% of the 50–69 age group and around 78% of the 70+ age group use the Internet regularly.

Based on a daily Internet usage of more than 15 minutes, four relevant media for digitally addressing private banking customers can be identified:

- social networks,

- online news,

- shopping websites

- and search queries.

It should be noted that digital individual communication channels (e-mail/instant messaging services) are not included in this list, as they are less accessible and therefore not suitable for commercial advertising purposes.

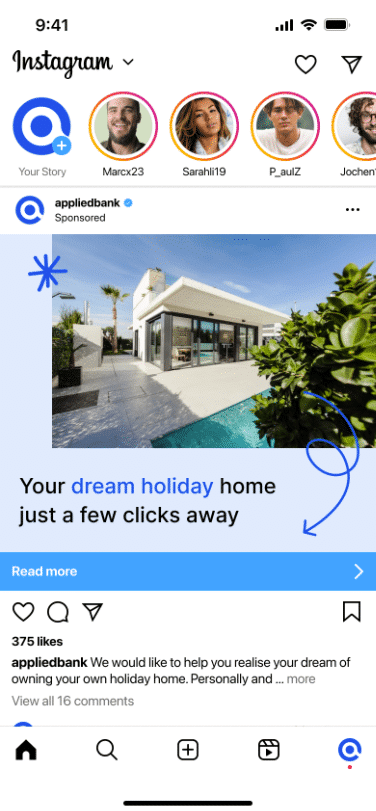

Due to the high number of daily users and the possibility to identify target groups, social networks are particularly suitable for digital approaches. Due to their large, intergenerational reach, social networks such as Facebook and Instagram are particularly attractive and should be preferred over career networks, such as LinkedIn, with a smaller and less diverse target group. Moreover, Facebook and Instagram allow for the target group of the advertisement to be adjusted based on selection criteria such as age, place of residence, etc. It is also important to consider the image and the target audience of the respective platform (TikTok and Twitch, for example, have rather specific target groups).

Based on the assumption that the target group follows the behavioral patterns of its comparable age cohort and has an average of two people per household, the analysis of usage rates suggests a daily reach of around half a million users in Germany. This corresponds to around 50% of the total private banking target group. It becomes clear that potential customers can be approached in numerous ways in the digital environment that many of them already use.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

Methods and effectiveness

Digitally savvy private banking customers can be identified through ad targeting. This can be followed by a targeted approach via selected media. Digital media have several advantages over analog media: they allow highly accurate measurement of campaign effectiveness, real-time optimization of individual advertising campaigns (change of medium, time, frequency and content) and effective targeting. The latter is characterized by high cost efficiency as there is hardly any waste circulation: the target group can be defined, delimited and targeted very precisely.

But where exactly is the sweet spot for digital customer communication to unlock its full potential?

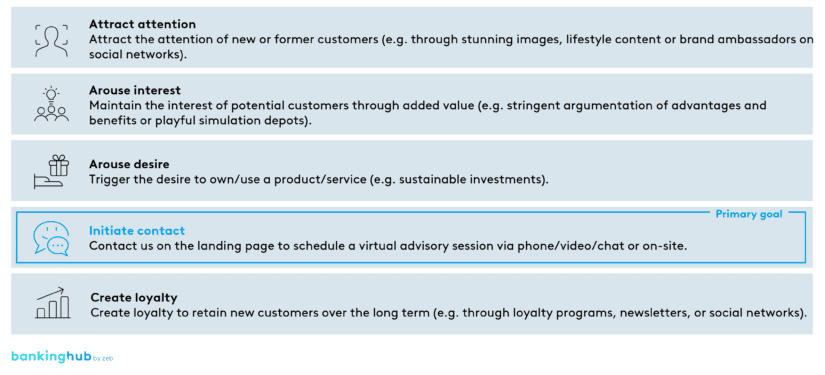

The prototypical decision-making process of customers often follows the so-called AIDA approach. AIDA stands for the individual decision-making phases, namely attention, interest, desire and action.

Digital advertising follows this schematic decision-making pattern and is therefore suitable for addressing private banking customers. The primary goal should be to initiate contact and generate traffic on the provider’s landing page, which should contain relevant information and enable direct contact via phone/video/chat with relationship managers as well as digital contract conclusion. The added value of digital communication and the landing page for private banking providers therefore mainly results from spontaneous conversations and product sales.

Use cases

What might a successful use case for digital customer acquisition look like for private banking providers? Answers to this question can be derived from successful D2C (direct-to-consumer) approaches from other industries. Products that can be successfully advertised and sold through digital channels are characterized by the following attributes: high emotionality, positive connotation of terms (well-being, health, fitness, environmentally friendly means of transportation, etc.), high utility/quality, and online availability.

The needs of private banking customers, such as investment, family, passion or retirement, can be translated into a wide range of products that are suitable for meeting customer needs in the digital environment. In particular, Internet banking products, such as robo-advisors, thematic (e.g. sustainable) investments or a financing plan for the dream vacation home abroad, meet the above attributes. So does digital communication about exclusive investment opportunities, such as private equity or onshore wind farms.

What are the key success factors of the digital customer approach?

In the past, zeb has helped many of its clients leverage the success potential of the use cases described above by supporting the development of digital application processes that generate traffic on the landing page and thus enable conversion rates in the high single-digit percentage range.

Key success factors were zeb’s expertise both in banking and in technical solutions. For one thing, these projects required a deep understanding of competitively differentiating customer experiences and broad expertise in all relevant banking topics. For another, the ability to fully implement digital solutions with professional UX design (see Figure 2), from development to operation and scaling, was a crucial factor.

Summary

Internet usage by the private banking target group has increased very strongly in recent years. Digital channels are therefore the ideal solution for addressing and attracting new customers. Products with strong emotional appeal, clear benefits and full online availability are particularly suitable for this purpose.

When it comes to implementation, it is important to combine banking knowledge with technical solution expertise. And to make the whole thing even more successful, it should not be the sole aim of digital communication to address today’s private banking customers, but also attracting future ones.