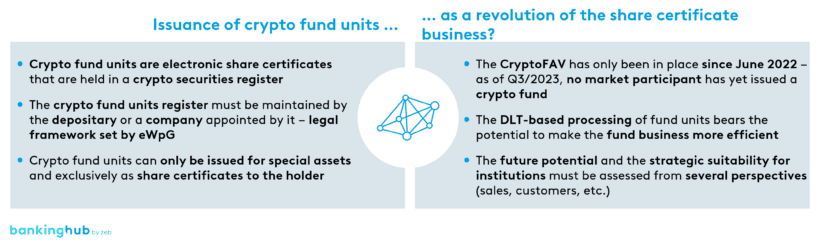

What are crypto fund units?

Crypto fund units can be issued by asset managers – either as unit certificate classes for mutual funds or as special AIFs. Just like crypto securities, they can be registered both collectively and individually. With regard to their tradability, they are subject to the same restrictions as crypto securities.

German regulation on crypto fund units (KryptoFAV)

The German regulation on crypto fund units (Verordnung über Kryptofondsanteile, KryptoFAV) allows investment fund providers to issue crypto fund units in order to further promote Germany as a fund hub. As per the new regulation, they are allowed to hold electronic share certificates as crypto fund units in a crypto securities register.

The provisions of the Electronic Securities Act are thus extended to electronic share certificates. Usually, the registrar for crypto fund units is the respective depositary. Alternatively, the depositary may appoint an external registrar with a KWG license to operate a crypto securities register.