|

Getting your Trinity Audio player ready...

|

|

LISTEN TO AUDIO VERSION:

|

Global top 100 banks start 2024 with record market capitalisation

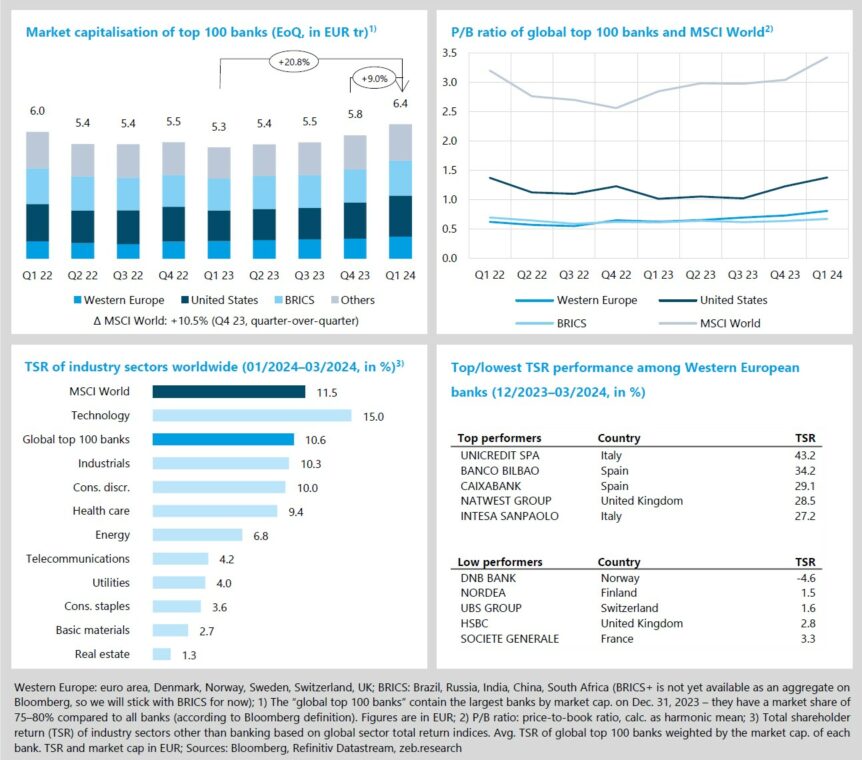

- Western European (+12.8% QoQ) and U.S. banks (+15.4% QoQ) led the global top 100 banks to a strong overall TSR performance in a bullish market.

- U.S. banks were able to widen the P/B ratio gap to their Western European peers again, despite solid further improvements by the latter (+0.08x QoQ).

The unabated technology boom and the strong U.S. economy ensured that global capital markets continued to soar in Q1 24 (MSCI World market cap. +10.5% QoQ, TSR +11.5% QoQ). For the global top 100 banks, the year started even better than 2023 had ended: at EUR 6.4 bn, they recorded their highest market capitalisation to date (+9.0% QoQ). While all markets performed excellently, this was again most notably due to U.S. banks, whose TSR performance of +15.4% QoQ was driven by the resilient U.S. economy and the Fed’s signal to cut interest rates later in 2024 (Western Europe: +12.8% QoQ; BRICS: +6.5% QoQ).

Even the threat of a commercial real estate (CRE) crisis did not slow down the further rise of global top 100 banks – see this issue’s special topic on current CRE market dynamics and their effects on banks.

- Despite a continuation of the positive P/B ratio trend of Western European banks (+0.08x QoQ to 0.81x – best P/B ratio since Q2 18), the gap to U.S. peers (+0.15x QoQ to 1.38x) has widened for the second consecutive quarter. BRICS banks also recorded a P/B ratio increase of +0.03x QoQ to 0.67x.

- Due to the continuing AI boom and the expected increases in productivity, the technology sector exhibited the best TSR performance (+15.0% QoQ) in an industry sector comparison for the fourth time in the past five quarters. Bringing up the rear is the real estate sector, which has been hit particularly hard by the prospect of delayed interest rate cuts (+1.3% QoQ).

- UniCredit is the top performer among Western European banks (TSR +43.2%) in Q1 24 after reporting an unexpectedly high record profit of EUR 8.6 bn for 2023 and the plans to give all the money to its shareholders. From 2024 onwards, UniCredit aims to pay a dividend of 90% of total profits. Reporting profits below the previous year’s quarter, DNB ranks last among the major European banks while also being the only institution with a negative TSR performance (-4.6% QoQ).

Markets expect ECB to start rate-cutting cycle before the U.S. Fed

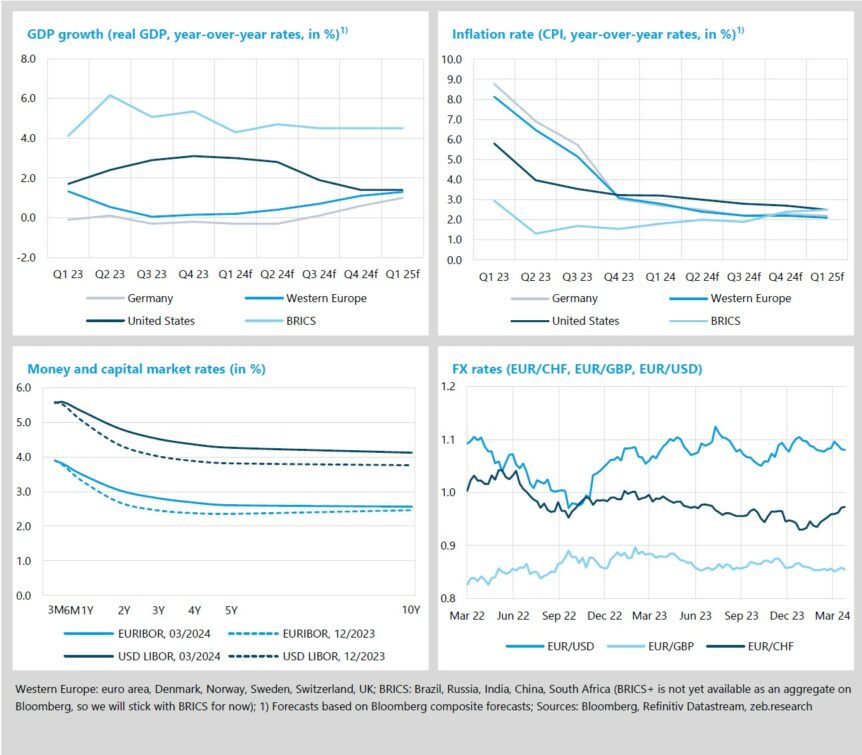

- In Q1 24, inflation in Western Europe fell more than expected to 2.8%, while in the U.S. it remained sticky at 3.2% instead of the previously expected 2.9%.

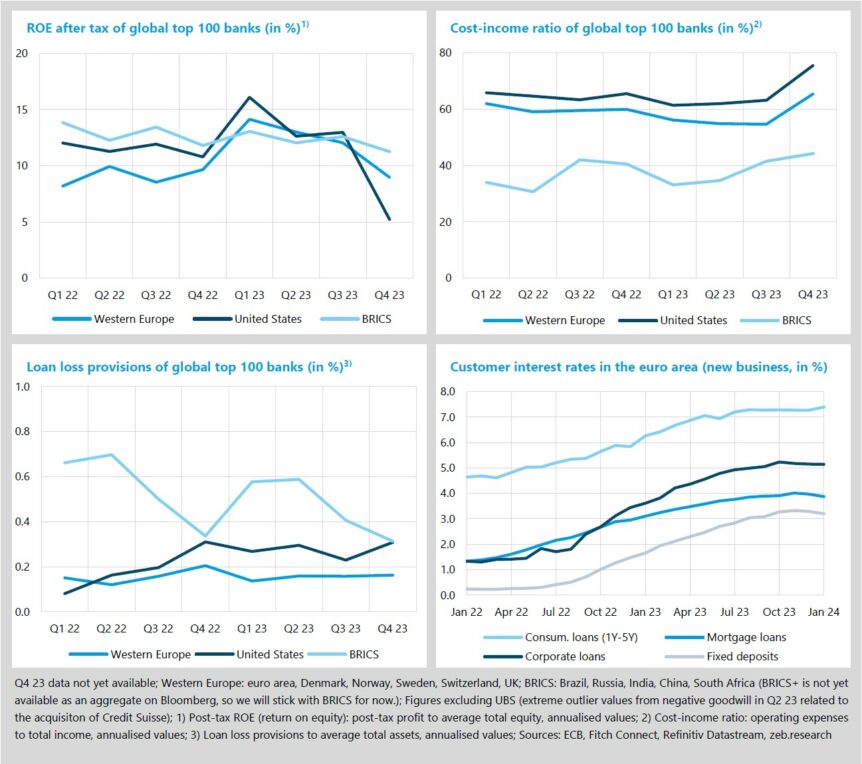

- The special assessment by the U.S. FDIC to cover the rescue costs of the aftermath of Silicon Valley Bank’s collapse caused record-low Q4 23 U.S. ROEs.

While the economic outlook for Western Europe has hardly changed recently, the prospects for Germany have once again deteriorated. After zero growth was initially forecast for the first half of 2024, analysts now expect two consecutive quarters of negative GDP growth for Germany (Q1 24f: -0.3%; Q2 24f: -0.3%). In contrast, the forecasts for the U.S. have improved significantly. After predicting 2.2% GDP growth for Q1 24 in the previous quarter, analysts now expect a growth rate of 3.0%.

At the same time, inflation turns out to be stickier in the U.S., so that forecasts for Q1 24 have recently been revised from 2.9% to 3.2%. By contrast, inflation fell more sharply than expected in Western Europe and Germany in Q1 24, meaning that the target value of 2% will probably be reached within the first half of 2025 as opposed to the U.S. Against this backdrop, the ECB might start cutting interest rates before the U.S. Fed.

- In Q1 24, inflation further decreased in Western Europe and Germany, reaching levels of 2.8% YoY and 2.7% YoY, respectively. While U.S. inflation remained at 3.2% YoY compared to the previous quarter, the BRICS are likely to exhibit a lower-than-expected inflation rate in Q1 24 with 1.8% YoY.

- After the yield curves in both the euro area and the U.S. had shifted downwards in the previous quarter, the hawkish communication from both Fed and ECB now showed an effect by causing the reverse shift in Q1 24. Especially in the U.S., early interest rate cuts seem unlikely considering persistent inflation and a strong economy. Consequently, medium- to long-term interest rates have risen more sharply in the U.S. than in the eurozone, with 1-year rates increasing by 28bp and 19bp, respectively.

- After the EUR/CHF exchange rate fell to a record low of 0.93 in the previous quarter, it recovered somewhat in Q1 24 and rose to 0.97, which is partly due to the Swiss National Bank having stopped reducing its balance sheet and already having started to cut rates at their March 21, 2024 meeting.

After three extremely strong quarters in 2023, Western European and U.S. banks ended the year with significantly higher cost-income ratios and a decline in profitability – in the U.S. this decline was a dramatic -5.6%p YoY drop to an unprecedented ROE of 5.2% in Q4 23. The special assessment by the U.S. FDIC to cover the rescue costs of the aftermath of Silicon Valley Bank’s collapse was due in Q4 23 and primarily paid by large U.S. banks. FDIC estimated that 70% of the decrease in the net income of commercial banks and savings institutions was caused by “specific, nonrecurring, noninterest expenses at large banks, which include the special assessment, but also goodwill impairments, legal, reorganization and other one-time costs”.

In addition, U.S. bank Truist Financial – also part of the top 100 sample – reported a USD 6.1 bn non-cash goodwill impairment charge in addition to a USD 0.5 bn FDIC special assessment charge, cumulating in a net income loss of USD 5.2 bn in Q4 23 alone. Excluding Truist Financial and Citigroup (which also reported a net income loss), the ROE of U.S. banks still would only have been a mere 8.4%.

- While Western European banks again managed to increase their total revenues by +13.9% YoY, in Q4 24 their costs also skyrocketed by +24.3% YoY, resulting in a considerably higher CIR of 65.4% for the quarter (+5.5%p YoY). The prior surge in inflation finds its way into the cost base of banks, bonus pools were increased due to the stellar year 2023 and banks often book one-offs in Q4. The average CIR of U.S. banks even increased by +10.0%p YoY to 75.6% as revenues declined by -5.6% YoY and costs increased by 8.8% YoY (CIR of BRICS banks: +3.7%p YoY to 44.2%).

- Considering CRE market developments in the U.S. (see chapter 3), it is no wonder that S. banks increased their loan loss provisions in Q4 24 by +8bp QoQ (Western European banks: +1bp QoQ, BRICS: -9bp QoQ). Overall, global top 100 banks did not utilise 2023 windfall profits to boost provisioning.

- With the prospect of interest rate cuts by the ECB and a stable long-term outlook, deposit products and long-term financing products are starting to see first small reductions in customer interest rates.

Special topic: CRE in turmoil and vulnerability of Western European banks

- High interest rates, “New Work”, and the rise of e-commerce cause significant turbulences in certain asset classes of the commercial real-estate (CRE) market.

- What does this mean for banks that are active in these areas? How exposed and susceptible are Western European banks towards increased risks in CRE and how significant do we expect the impacts to be?

Since the autumn of 2023, alarming reports from various financial newspapers have kept appearing. According to these reports, vacant office spaces in the U.S. are expected to lead affected banks into a real estate crisis, unlike anything the financial world has experienced since 2008. However, a closer analysis reveals a more complex situation in which the proclaimed crisis appears to be milder and more concentrated.

In the following discussion, we will firstly examine the spheres of influence of the post-pandemic way of working, the continuous rise of e-commerce, and the overarching, rapidly changing interest rate landscape on the different asset classes in the CRE business and accordingly what this means for banks that are active in these business areas. Secondly, we will take a detailed look at European banking markets’ exposure and susceptibility towards increased risks in CRE and, finally, deep-dive into the vulnerability of Western European banks in the global top 100 sample.

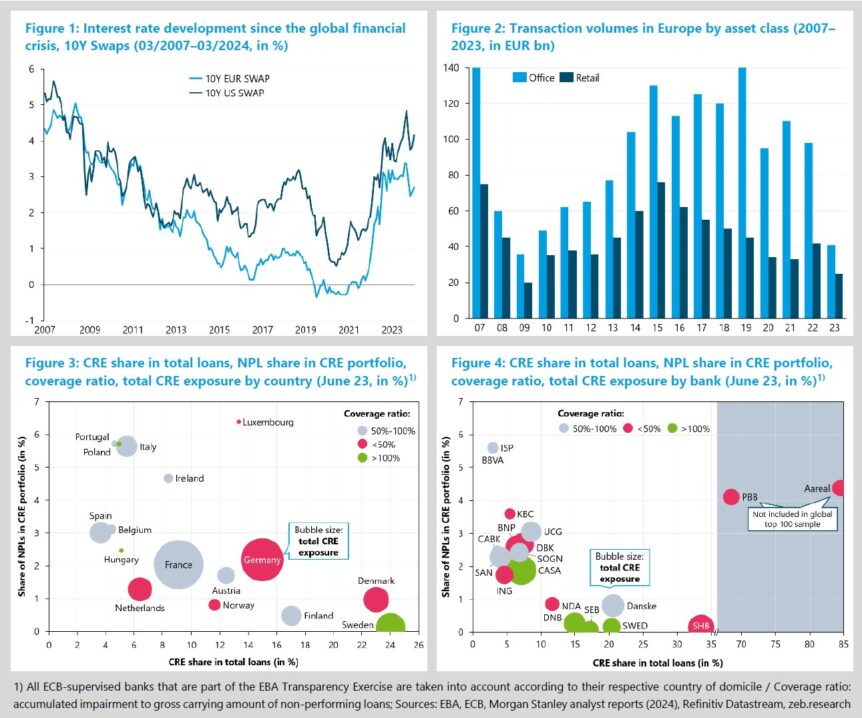

The development of interest rates (see figure 1) immediately affects all asset classes. The recent surge in interest rates above 3% for both the U.S. dollar and the euro makes financing CRE activities and refinancing existing loans more expensive, posing financial challenges for borrowers and consequently increasing the risk of default for banks. When considering European transaction volumes in the retail and office asset classes (see figure 2), a clear inverse relationship to the interest rate curve in figure 1 becomes apparent. The relative increases and decreases are similar in both types of real estate highlighting the overarching impact that interest rates have on all asset classes.

However, longer-term structural trends also come into play, affecting individual asset classes. Firstly, since the beginning of the pandemic in 2020, the trend towards higher rates of remote work (“New Work”) has intensified. This phenomenon is much more widespread in the U.S. than in Europe. Consequently, compared to the already high 2019 pre-pandemic level of 13%, office vacancies in the U.S. increased by approximately 60% to 21% by 2023 (Europe: +60% from 5% to 8%). American cities with particularly expensive and exclusive office locations (e.g. San Francisco, New York, etc.) even exhibit vacancy rates of over 30%.

Secondly, the retail sector is affected, suffering from the rapid e-commerce boom. The pandemic also acted as an exacerbating factor here, with U.S. e-commerce sales increasing by almost 80% (Europe: +60%). Traditional stores potentially struggle to keep up with this trend and some may even face bankruptcy. Cumulated, rising vacancy rates in office and retail spaces lead to rental losses for owners, potentially putting them in financial distress and making it difficult to service debts, ultimately resulting in a decline in value for banks.

Finally, the remaining asset classes in the CRE business (e.g. industry, logistics, hospitality, and residential apartments) have so far remained significantly less affected by the outlined structural drivers – there are even some positive effects, such as fewer vacancies in the logistics sector due to the rise of e-commerce or a strong recovery in tourism.

Knowing which CRE classes and regions are most affected, namely office and retail in the U.S., we turn to European banking markets and single financial institutions and their overall susceptibility towards increasing risks in the CRE business.

Figure 3 displays the set of deterministic factors for European banking markets that can be deferred from the EBA transparency exercise (TE) 2023 (all figures represent June 2023 bank-level data) and are crucial indicators for assessing how affected banks may be in case of a widespread CRE crisis: the coverage ratio[1], the proportion of non-performing CRE[2] loans, and the CRE share in total lending. While the Nordic countries, and Sweden foremost, display high total CRE shares and are therefore potentially highly impacted, they also have extremely low NPL quotas, indicating that general economic resilience is very high and a devastating fallout is unlikely. In contrast, the vulnerability of Southern European institutions appears to be elevated as their NPL quotas are much higher due to their sovereign debt crisis driven legacy portfolios, but the total effects would be much more manageable as their overall CRE share is low.

On aggregate, German credit institutions look most susceptible with a relatively high CRE share of around 15%, a modest NPL quota of around 2.2%, a low coverage ratio of ~45% and the second highest total CRE exposure value. This assessment is compounded when considering the Q4 2023 EBA Risk Dashboard numbers released on April 04, 2024. Aggregate CRE NPL quotas of German banks increased significantly by 150bp from Jun. 2023 to Dec. 2023 (AT: +180bp, FR: +40bp), while they even decreased in Italy (-70bp) and remained (fairly) stable in Sweden (+0bp) and Denmark (+10bp).

Examining individual Western European banks of our global top 100 sample in figure 4, the conspicuous features of Southern European and Nordic bank aggregates (see figure 3), show up again on an individual level. Going beyond our sample and including two German mortgage banks, pbb and AarealBank, we can identify two institutions that are significantly more vulnerable to CRE market disruptions than our sample banks. Both are monoliners that can only diversify risk through the choice of region and CRE asset classes they are active in. Vulnerability is evidenced by CRE shares above 65%, NPL quotas over 4% and coverage ratios below 50%.

Notably, and as outlined above, the exact CRE asset classes and regions in which a given bank is active play a crucial role – at least for the vulnerability assessment of the currently observable market turbulences. Investor relation reports of individual banks suggest that most Western European top 100 banks have a very limited U.S. Office/Retail exposure in relation to their total loan book. Again, pbb and AarealBank are different in this regard with ~8% and ~11%, respectively – indicating a significant challenge in coping with current market conditions. This also explains why overall capital market and rating agencies’ reactions have been relatively relaxed when considering the Western European top 100 banks. pbb, AarealBank and also New York Community Bank, however, have seen significant drops in their capital market valuations and most notably have been downrated by rating agencies (pbb: BBB+ to BBB- / AarealBank: BBB+ to BBB / NYCB: BBB to BBB-).

Overall, we do not see an increased structural risk that could lead to a financial crisis similar to the one in 2007/8. Even in case of moderate spillover effects to European CRE markets, most European institutions would likely be able to absorb expected losses through excess profitability. For a handful of institutions, such a scenario could imply manageable capital impacts as well – but we do not see creditworthiness at risk. Of course, sound risk management, state-of-the-art portfolio analysis capabilities, risk diversification, solid capital buffers and good customer relations are prerequisites for success.