|

LISTEN TO AUDIO VERSION:

|

Stabilisation of the successful start into 2024

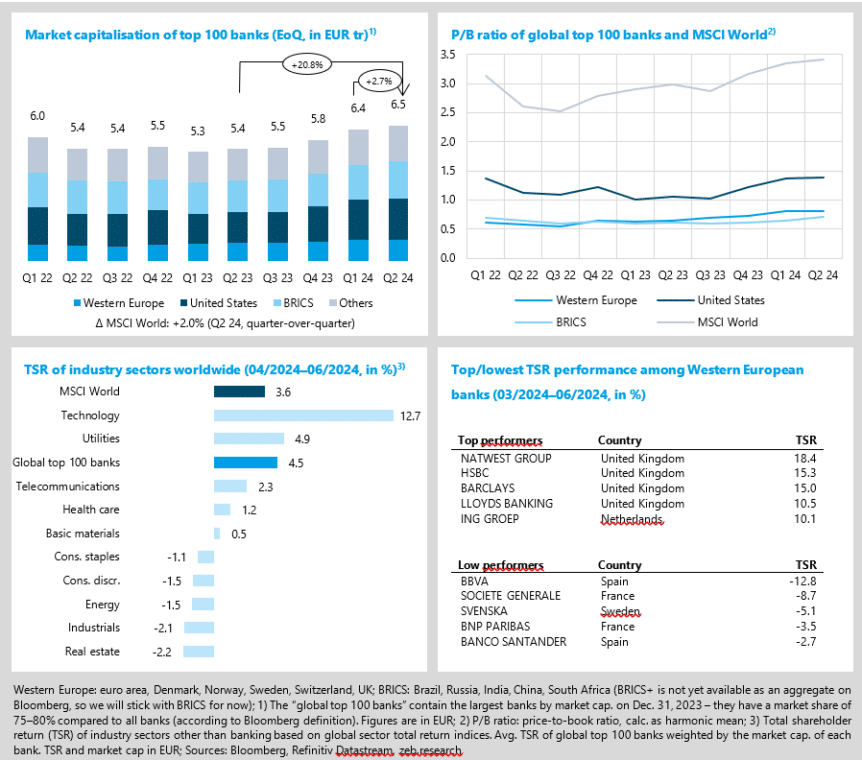

- With EUR 6.5 bn, the market cap of global top 100 banks stabilises slightly above the previous quarter’s record value.

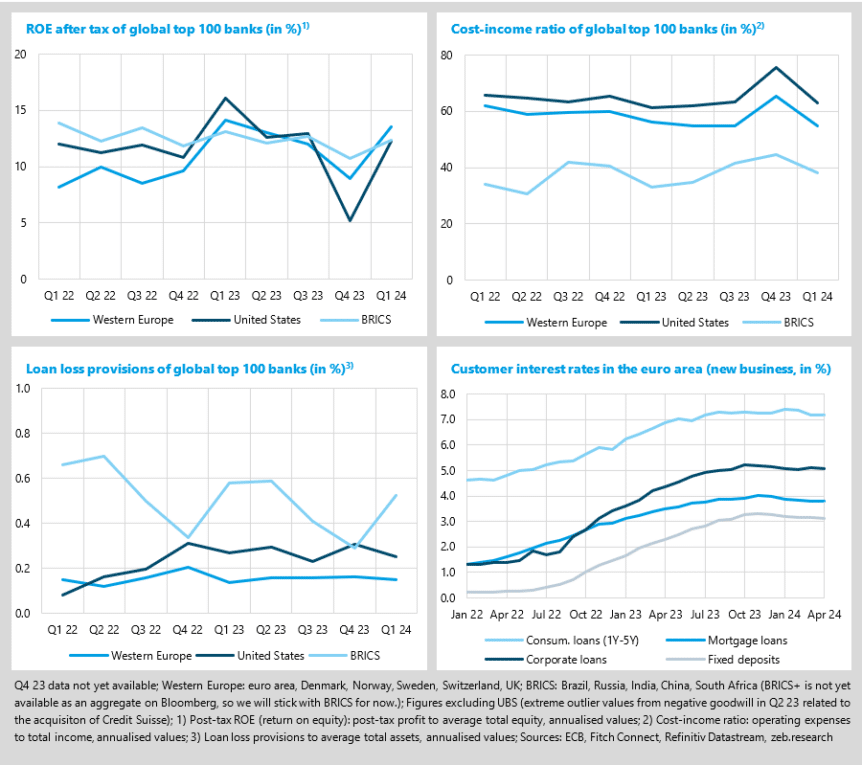

- Western European credit institutions once again outperformed their U.S. peers in terms of profitability, exhibiting an ROE of 13.5% in Q1 24.

Following a strong performance at the start of the year, global capital markets stabilised in Q2 24 (MSCI World market cap. +2.0% QoQ, TSR +3.6% QoQ). The record market capitalisation of global top 100 banks in the previous quarter was even slightly surpassed in Q2 24 (+2.7% QoQ, TSR +4.5% QoQ). In terms of TSR performance, Western European (+4.2% QoQ) and U.S. banks (+2.8% QoQ) were outperformed by BRICS banks (+11.4% QoQ), reflecting the strong performance of emerging markets.

With central bank rate cuts initiated by the ECB and also expected soon by the U.S. Fed, banks’ record profits from 2023 might come under pressure. A potentially exacerbating factor can be, e.g., rising insolven-cy rates and hence risk costs, and, in the long-term, major topics like digitalisation and carbon neutrality – see this issue’s special topic on the ESG transformation of banks.

- Western European banks’ P/B ratios stagnated in Q2 after nearly two years of consistent growth, holding steady at 0.81x, whereas BRICS banks saw the greatest increase in PB ratios (+0.07x QoQ to 0.71x).

- Primarily due to the continuing AI boom, the technology sector keeps riding high, exhibiting a TSR performance of +12.7% QoQ in Q2 24. The real estate sector ranks last in an industry sector comparison (TSR -2.2% QoQ) as it has been hit by rising long-term interest rates and the recent turbulence in the (predominantly U.S.) corporate real estate market.

- Top performers from Western Europe in Q2 24 showed a strong Anglo-Saxon focus, led by NatWest with an +18.4% QoQ increase in TSR. In contrast, BBVA saw a negative performance (TSR: -12.8% QoQ) following merger talks with Banco Sabadell in April 2024. The two banks had engaged in brief merger discussions in 2020, which fell through due to disagreements over valuation. The immediate response in April was a BBVA stock drop by 5.8%, reflecting the notable increase in Sabadell’s value since 2020.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

ECB starts rate-cutting while U.S. Fed rate is untouched

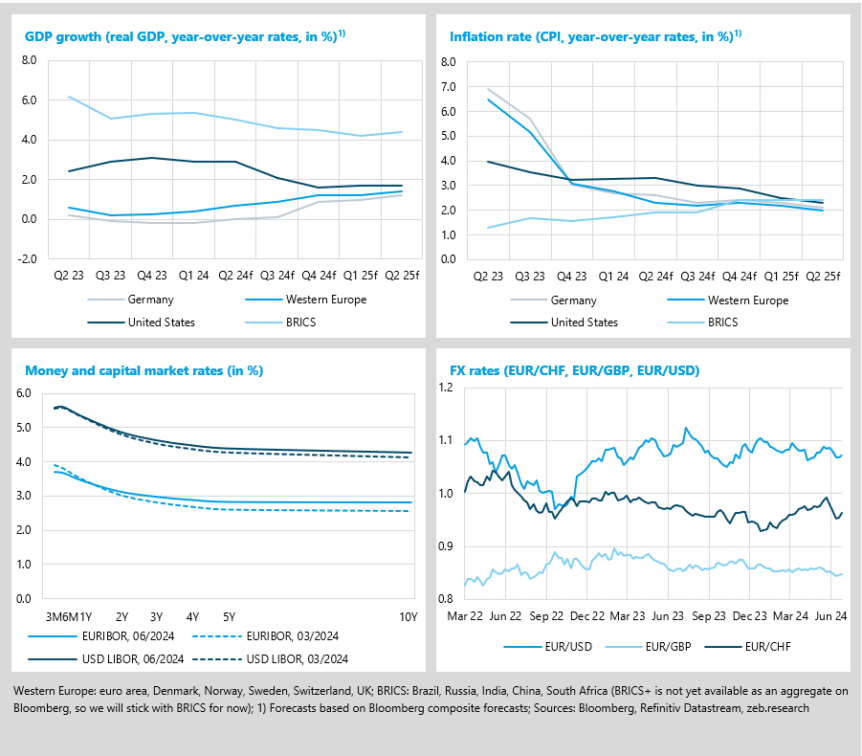

- In Q2 24, inflation is expected to further decrease in Western Europe and Germany, reaching levels of 2.3% YoY and 2.6% YoY, respectively.

- Long-term yields in the euro area and the U.S. shifted upwards in Q2 24 in light of the persistently high level of uncertainty regarding future inflation.

According to previous forecasts, analysts anticipated two consecutive quarters of -0.3% negative GDP growth for Germany in the first half of 2024. Following most recent market expectations, a turning point from stagnation (Q2 24f: 0.0%) to growth is likely to occur towards the end of 2024 (Q4 24f: +0.9%). At the same time, Western European (Q2 24f: +0.7%) and U.S. (Q2 24f: +2.9%) GDP growth rates are expected to converge toward a common Western rate as early as Q4 2024.

Analysts have slightly revised their inflation expectations for Western Europe for Q2 24f from 2.4% to 2.3% with the inflation target now within sight (Q2 25f: 2.0%) for the first time since the Russian attack on Ukraine. Accordingly, the ECB initiated the expected interest rate cut of 25bp in June. In contrast, stubborn inflation (Q2 24f: 3.3%) in the U.S. prompted the U.S. Fed to reduce its original forecast of three interest rate cuts in 2024 to one.

- In Q1 24, inflation further decreased in Germany, reaching 2.6% YoY, while BRICS are even likely to exhibit a more permanent increase on a plateau of 2.4% (Q2 24f: 1.9% YoY).

- Medium- and long-term yields in both the euro area and the U.S. have slightly shifted upwards, with 10-year rates increasing by 26bp and 14bp, respectively. This reflects the continuing high level of uncertainty regarding the long-term success of the fight against inflation, meaning that it is possible that central banks might be forced to keep interest rates high for longer than intended.

- While the EUR/USD and EUR/GBP exchange rates remained relatively stable, the Euro almost reached parity with the Swiss Franc in Q2. However, the Swiss National Bank (SNB) continued its trend of interest rate cuts in June, lowering the rate to 1.25% to counter the recently strengthened Franc, which was reflected in an immediate devaluation of the Franc in June.

In response to the high profits resulting from the rise in interest rates over the last two years, the dividends and share buybacks planned by European banks this year amount to over EUR 100 bn. This is also reflected in an increase of Western European banks’ ROE by 4.5%p QoQ to 13.5% in Q1 24 after having exhibited a decline in profitability in the previous three quarters.

Thereby, Western European credit institutions once again outperformed their U.S. peers, who nevertheless saw their ROE ratios rise by 7.0%p QoQ to 12.3%. This sharp increase is due to the omission of the special assessment by the U.S. FDIC to cover the rescue costs of the aftermath of Silicon Valley Bank’s collapse, which was due in Q4 23 and primarily paid by large U.S. banks, restoring profitability of U.S. banks in Q1 24.

- At the end of 2023, Western European and U.S. banks had experienced a sharp increase in cost-income ratios, primarily driven by rising costs. This trend reversed in Q1 2024, again attributed primarily to the cost side (Western European banks: -11.6% QoQ, U.S. banks: -5.8% QoQ) as year-end specifics such as increased bonus pools and one-offs booked by banks were no longer prevalent. Overall, the average cost-income ratio of the global top 100 banks decreased by 7.8%p to 50.9% in Q1 24.

- Despite CRE market turbulences in the U.S., no significant turning point with respect to U.S. banks’ loan loss provisions could be observed in Q1 24 ( special topic of Market Flash no. 48). Yet, the still promising U.S. GDP forecasts might prompt banks to take a rather calm stance regarding possible loan defaults. While Western European banks’ provisions hardly changed at all in Q1 24, BRICS banks continued their recent ups and downs, recording an increase in loan loss provisions of +24bp QoQ.

- In light of the anticipated ECB interest rate cut in June, customer interest rates exhibited a slight further decline across all considered types of loans in the previous quarter.

Special topic: ESG transformation advancing but still in progress

- Regarding ESG, regulatory and political initiatives but also customers and investors have increased the demands directed at banks in recent years.

- In zeb’s latest study, we look at three key questions: What is the maturity level of banks regarding their sustainability transformation? What challenges do they face? And how do these issues relate to the various areas of a bank?

To shed light on the maturity and challenges of banks in the sustainability transformation, zeb conducted a Europe-wide ESG survey among German, Swiss, Austrian and international banks. The study focuses on the “E” and aims to identify the developmental differences between groups of banks and European financial centres, as well as to determine the patterns of measures in the transformation to date. We present the final key results and analyses here and are happy to discuss them in person in more detail – please feel free to contact us.

The survey consisted of 37 questions covering all areas of a bank. Specifically, five core fields of action were identified, providing the ESG study’s overall structure. These core fields are

- competitive positioning, incorporating, e.g., the relevance of a positive ecological image for overall reputation;

- net-zero ambition and management, i.e., CO2e reduction plans in on-balance sheet business and investment business as well as the “net-zero” target for financed emissions in the loan portfolio and in operations;

- ESG implementation in risk management, e.g., by taking into account physical and transition risks in quantitative risk models;

- data and method frameworks dealing with, e.g., the procurement, storage, and quality of ESG-related data;

- business opportunities, i.e., the consideration of ESG criteria in products and the utilisation of ESG in sales.

In total, 36 European banks of various types participated in our study with respondents being mostly ESG managers. Their assessments allowed us to evaluate the status quo of European banks in the ESG transformation.

Considering the core field of action “competitive positioning”, European banks perceive ESG as a key reputational factor. For nearly all banks surveyed, a positive ecological image is at least as relevant to their overall reputation as, for example, respectability or stable business figures. The most important motives are regulatory requirements and expectations of stakeholders, which are stated as the main drivers for pursuing environmental goals by 53% and 31% of banks, respectively. Earnings and costs hardly play any role.

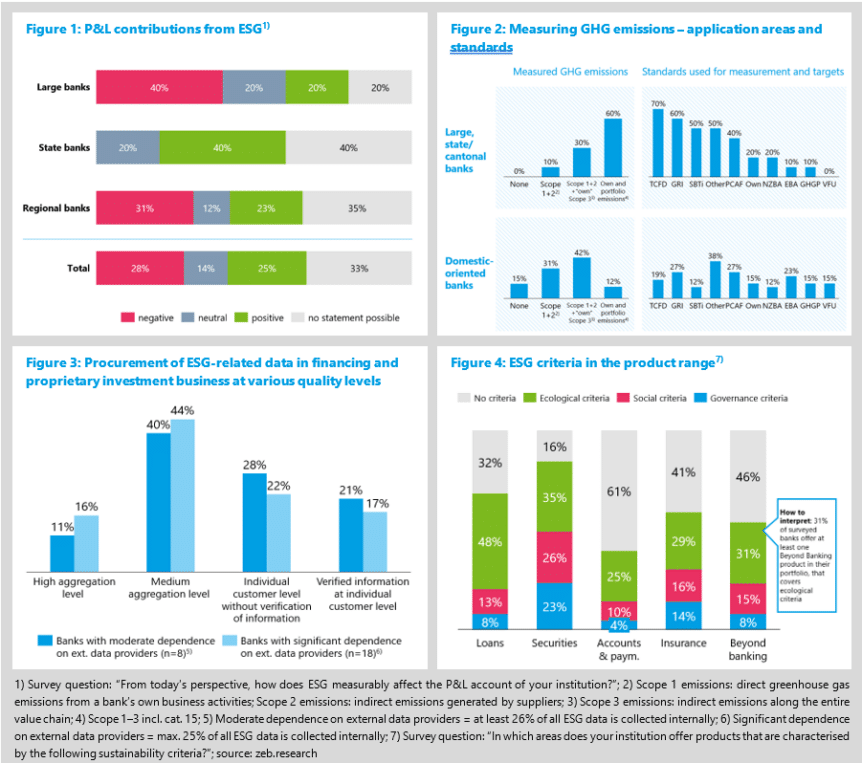

From a business perspective, the ambition to make ESG a differentiator in competitive positioning has not yet been achieved. While 89% of banks expect a competitive advantage through ESG, so far 25% measure positive P&L contributions from ESG. Regarding the latter, Figure 1 shows that there is also substantial heterogeneity across groups of banks. Generally, overarching business success through ESG is not yet to be seen. Only state and cantonal banks report no negative contributions.

In what is arguably the central core field of action, net-zero ambition and management, banks’ responses significantly differ concerning net-zero ambitions for operations and the loan portfolio. On average, operations will achieve net zero much sooner as approximately 50% of institutions plan to be carbon neutral by 2035 at the latest (loans: 3%). Across both categories, there is a clear correlation indicating that smaller banks are more likely to have no net-zero targets. Substantial differences across bank types can also be observed regarding GHG measurements, as shown by Figure 2.

Large banks measure portfolio emissions to a greater extent and often use uniform standards (GRI, TCFD, PCAF and SBTi) to do so. Smaller banks on the other hand focus more on operations and exhibit a greater heterogeneity in the use of standards and tools. Across all banks surveyed, 22% have already defined specific KPIs for reducing GHG emissions in the loan portfolio. In operationalizing their net-zero strategy, most banks focus on excluding certain sectors with fossil energy generation and coal and mining being the most frequently mentioned sectors.

The implementation of ESG in risk management is still in progress. Most credit institutions do not yet evaluate physical and transition ESG risks using existing or specially created risk models. Furthermore, 75% of the banks surveyed state that capital requirements in their economic risk-bearing capacity calculation have not increased as a result of taking physical ESG risks into account (transition ESG risks: 78%).

Turning to data and method frameworks, the lacking availability of ESG-related data is the biggest obstacle to ESG data management. This is reflected in the utilisation for relevant processes: the low use of ESG data is especially prevalent in credit pricing with 66% of the banks surveyed stating that they do not employ ESG data at all. By contrast, 57% of banks use ESG data mainly or even entirely for their own investments as there is a comparatively good data availability. In a comparison, the procurement of ESG data at a high quality level is slightly less common at banks with a significant dependence on external providers.

Figure 3 shows the procurement of ESG-related data in financing and proprietary investment business at various quality levels. For example, 21% of banks with moderate dependence on external data providers use verified information at the individual customer level whereas 17% of banks that have a significant dependence on external data providers use such information.

When it comes to business opportunities, banks are still working on finding a concrete, economically viable ESG business model. For example, 56% of the banks surveyed have not made ecologically induced price adjustments so far. Overall, there are also still many banks without ESG criteria in their product range as shown by Figure 4.

Here, the “E” criteria are most likely to be integrated into the product range, e.g., for loans and beyond banking. In the banks’ self-perception, innovative products are for the most part not really innovations, as they tend to be the market standard already, such as, e.g., refurbishment loans.

When looking at the usage of ESG in sales, the high rate of 67% of banks leveraging sustainability in customer appointments and campaigns is striking. However, ESG qualification of sales staff, measured by training rates and training durations, varies greatly by country and group of banks. For example, Swiss banks exhibit a comparatively high average training rate of 80% (AT: 71%; DE: 53%).

In summary, ESG is and remains an important topic. Sustainability should not only be regarded as a regulatory issue but remains an opportunity for banks. For this to work, however, a number of things need to be done. Evaluating our five core fields of action, banks should focus on certain key levers on their way to becoming green transformers:

- A persistent focus on ESG data;

- Full integration of ESG into management processes and governance structures; and

- Acting as a provider of information and not falling into preacher mode.

It is important to understand that ESG is a fundamental issue that cannot be dealt with by a few reports or calculating some ratios. Decarbonization will change the economy and therefore also the banking landscape. Each bank must actively look at how and where it can and should position itself to benefit from the opportunities that the sustainability transformation provides.