|

Getting your Trinity Audio player ready...

|

Current forecasts point to an economic “soft landing”

In order to get a grip on the rampant inflation since the Russian war of aggression against Ukraine, the ECB started raising key interest rates at an unprecedentedly rapid pace in mid-2022. The ECB argues that the costs of an undercontrolling monetary policy are higher than those of an overcontrolling one. And so far, this assessment seems to be correct, as current forecasts suggest a rather soft landing for the economy despite the contractionary monetary policy.

Surprisingly robust labor markets and a declining inflation

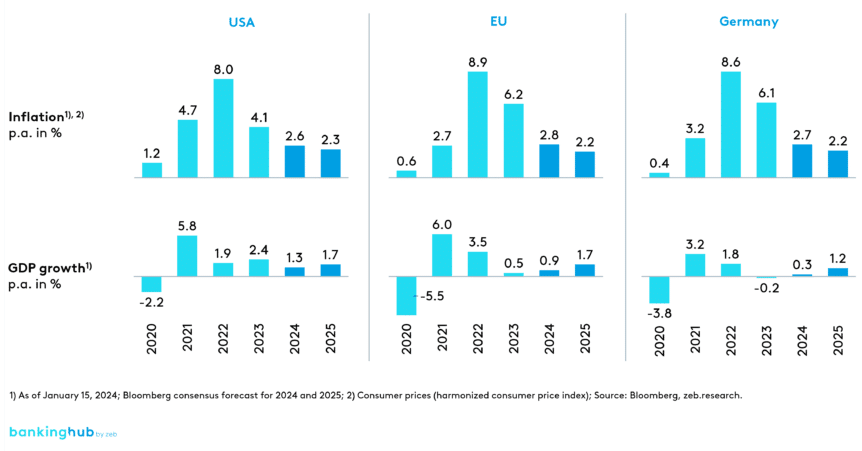

Supported by base effects and falling energy costs, the inflation target of 2% is expected to come into reach again soon, especially in Germany and Europe as a whole. There, analysts expect an inflation rate of 2.2% in 2025 with the USA following close behind at 2.3%. By contrast, in 2023, the USA were ahead of Europe in terms of control over the inflation rates, because the Fed started tightening its monetary policy around four months earlier than the ECB. As a result, the U.S. inflation rate fell by 3.9%pt. to 4.1%, while inflation in Europe fell by only 2.7%pt. to 6.2% over the course of the year.

The historically rapid rise in key interest rates subdued credit dynamics and reduced the overall money supply in Europe and the U.S. However, the labor markets proved surprisingly resilient, and the expansionary fiscal policy also helped to ensure that neither Europe nor the USA slipped into recession in 2023. With a growth rate of -0.2%, even Germany, which is particularly plagued by high energy costs, at least escaped a severe recession.

Expected interest rate cuts give the economy a slight boost

The stable economic outlook is particularly remarkable in light of the current yield curve. The increase in central bank interest rates pushed up the short end of the yield curve in particular, causing an inversion of the curve that began in November 2022, which would normally be considered a clear signal of an emerging recession.

At the beginning of this year, the markets were still expecting the ECB to start cutting interest rates again as early as April 2024, causing medium- to long-term interest rates to fall. Especially highly indebted companies benefit from this development, as they gain some additional breathing space, which in turn increases the likelihood of an economic soft landing. However, various factors, such as the upward revision of GDP forecasts for the fourth quarter of 2023, have recently led the markets to abandon their expectation that the ECB would start lowering interest rates that early.

Hopes for interest rate cuts in the near future were further dampened by the Fed’s recent announcement that it is unlikely to lower the Federal Funds Rate in March, especially as the U.S. are actually expected to once again lead the way in terms of interest rate cuts.

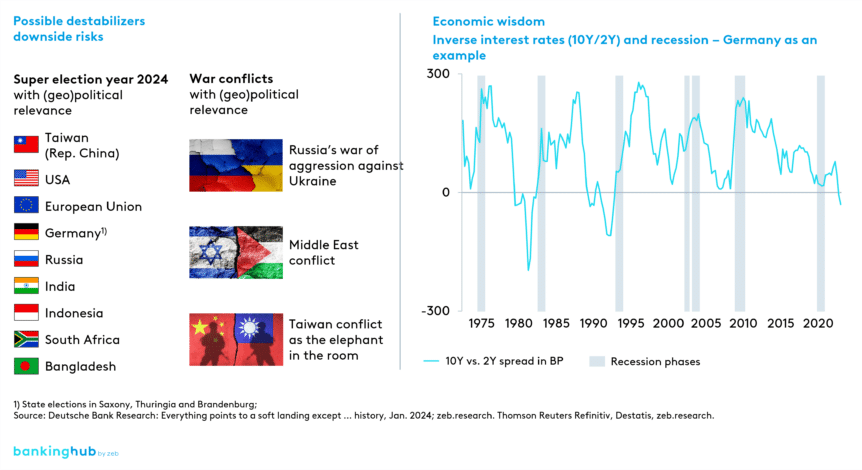

Banks should be prepared for a recession scenario

As reassuring as the rather optimistic economic forecasts are in view of the difficult circumstances, it would be a mistake to settle back just yet. 2024 is shaping up to be a fateful year in which half the world’s population, including the USA, will go to the polls. In light of high geo-economic uncertainties and historical experiences, banks should be prepared for a possible recession scenario.

Geo-economic risks as potential destabilizers in 2024

A crucial factor for the further development of the global economy are the current global conflicts on (or beyond) the verge of breaking out into war. For Germany and Europe as a whole, Russia’s war of aggression against Ukraine continues to jeopardize the stability of value chains and energy prices.

The Middle East conflict, which has been flaring up since October last year, became an even more explosive economic subject in January when the Houthi rebels started attacking merchant ships in the Red Sea. Another cause for concern is the Taiwan conflict, whose chances of de-escalation have not necessarily increased in light of Taiwanese independence advocate Lai Ching-te’s recent electoral victory. And the super election year 2024 has further important elections with high (geo)political relevance in store.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

A look at the past gives cause for concern

But it is not just geo-economic risks that threaten the soft landing. Current economic data shows distinct patterns that give cause for concern – especially in light of historical developments. For example, historical cases from the USA teach us that the transmission of monetary policy stimuli takes on average 29 months. Applied to the euro area, this would mean that the recessionary effect of the ECB’s contractionary monetary policy is still to come and that the economic landing might thus become harder than expected.

Another factor that makes the scenario of an imminent recession appear more likely from a historical point of view is the persistently inverse interest rate structure. It is well known that in the USA, a recession usually occurs when the inverse interest rate structure that preceded it is already in the process of normalizing again.

The right-hand side of Figure 2 shows that this principle also applies to Germany. The chart illustrates the development of the interest rate spread for 10-year and 2-year German government bonds as well as the recession phases of the German economy, which are indicated by the gray bars. On the one hand, we can conclude from the chart that an inverse or at least falling interest rate structure is actually a very good indicator of a looming recession, as the former always precedes the latter.

At the same time, it shows that a recession usually only occurs when the interest rate structure is already in the process of normalizing again. If we apply this knowledge to the current situation, we can conclude that the recession is yet to come and is likely to occur precisely when interest rate spreads start rising again.

Analysts expect a “soft landing” also for European banks

After initially recording losses at the start of the war in Ukraine, the share prices of major European banks have recovered significantly in the meantime. According to analysts’ forecasts, the banking sector can also expect a soft landing in terms of operating profits. However, some risk factors will remain relevant or become even more important in the future.

Stable net interest income made 2023 an exceptional year

The ECB’s rapid interest rate rally gave European banks a huge increase in net interest income and thus made 2023 a record year – the best one since the financial crisis.

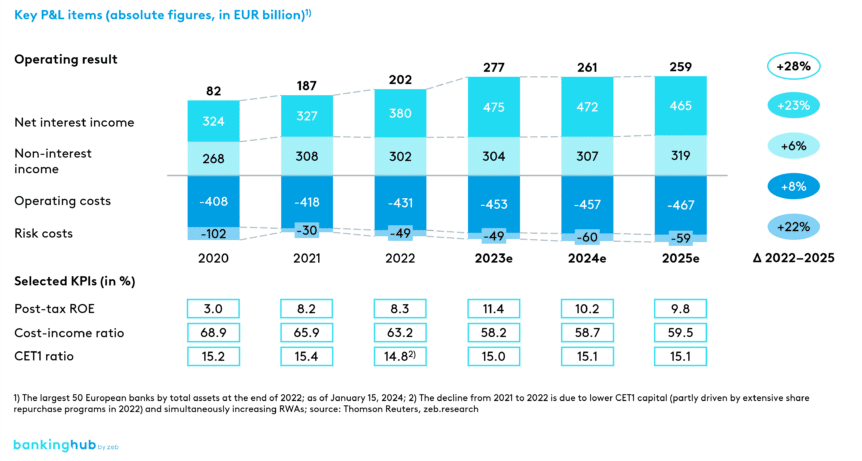

Figure 3 shows the forecast for the development of P&L items and other KPIs for the 50 largest European banks by total assets. Analysts expect that the cumulative operating profits, which were at EUR 202 bn. in 2022, will rise to EUR 259 bn. in 2025. This would constitute a 28% increase.

According to the forecast, 2024/2025 will see only a slight decline in operating profits compared to the peak year of 2023. This confident assessment is based on two decisive factors. The increase in net interest income achieved in 2023 is expected to decline only marginally in 2024/2025, while risk costs (+22% from 2022 to 2025) are expected to normalize. Nine months ago, estimates of how the two earnings components, net interest income and risk costs, would develop in 2024 were significantly less optimistic. At the same time, the impact of inflation on banks’ costs appears to be “manageable” (+8% between 2022 and 2025).

The key question will therefore be whether the current expectations regarding risk costs are too optimistic and whether they can withstand a possible deterioration in the interest rate and economic environment.

Core risks for the banking system dampen euphoria

Due to the crisis on the US office real estate market, banks are currently focusing on real estate market risks. European institutions with large exposures to the (U.S.) commercial real estate sector are therefore particularly at risk. For example, the Pfandbriefbank, which is exposed to the U.S. office real estate market with around 15% of its real estate portfolio, had to dramatically increase its risk provisions, causing its share price to fall to an all-time low.

An economic downturn would exacerbate the risks arising from the real estate market even more. Falling prices and a collapse of the credit market could also cause the value of collateral to fall dramatically.

The macroeconomic dangers mentioned above give rise to numerous other risks for the banking world. Recently, there has been a significant increase in the probability of insolvency among companies. A recession would lead to even higher loan defaults than previously expected, resulting in a notable negative impact on operating profits.

So far, banks have stomached the historic turnaround in interest rates well and, in light of the prospect of falling central bank rates, interest rate risks are presumably going to decrease further. However, an even stronger inversion of the interest rate structure would massively exacerbate the situation, especially for German regional banks that invest more heavily in maturity transformation.

Moreover, banks remain exposed to the risks arising from “hot topics” that are independent from the economic situation. As a consequence of the global increase in attacks on IT systems, the threat level in terms of IT and cybersecurity is currently higher than it has been in years, according to the responsible authorities. Banks have to tackle the risks associated with poor governance, the ongoing relevance of which was recently demonstrated by the downfall of Credit Suisse. The risks posed by climate change are an equally perennial issue. The number of natural disasters remains high and transition risks are already beginning to materialize for many companies.

Conclusion on “soft landing” vs. recession

Despite the recessionary effect of the ECB’s interest rate hikes, current forecasts suggest an economic soft landing. However, historical experience and current geopolitical destabilizers give banks reason not to be lulled into a false sense of security too early and to nevertheless prepare for recession scenarios.

Although analysts expect the top 50 European banks to maintain their earnings level from the exceptional year of 2023, the core risks for the banking system will remain highly relevant in 2024.