|

Getting your Trinity Audio player ready...

|

AI in banking: opportunities and risks

Hello Anna Stepanów and Jarosław Łach, there is a lot of hype about AI. Do you think that the banking industry will be completely transformed by AI in the next 5 years? Do you expect a revolution or rather a gradual, evolutionary process?

The adoption of AI in banking will not be a revolution, but rather a gradual process of transformation. We believe that the AI implementation process in banking will somehow mirror the promotion of the Internet. While the fundamental nature of banking remained unchanged with the advent of the Internet, the methods and speed of information delivery evolved, ultimately resulting a new channel for customer interaction with the bank.

In the target picture, AI will become an integral part of many operational processes, seamlessly integrated in the background. Customers will not even notice: it will simply work. The speed of adoption will depend on the growing understanding of AI‘s capabilities. We will witness a spillover effect, where AI solutions are gradually integrated into more and more processes.

This shift in perspective will reshape the business process landscape. The increasing ease of implementing new AI solutions will allow for more efficient process design, particularly in areas such as customer relationship management (CRM). Enhanced customer data will directly impact the effectiveness of processes such as KYC, AML, fraud prevention and personalization of service offerings.

Excursus: AI in retail banking

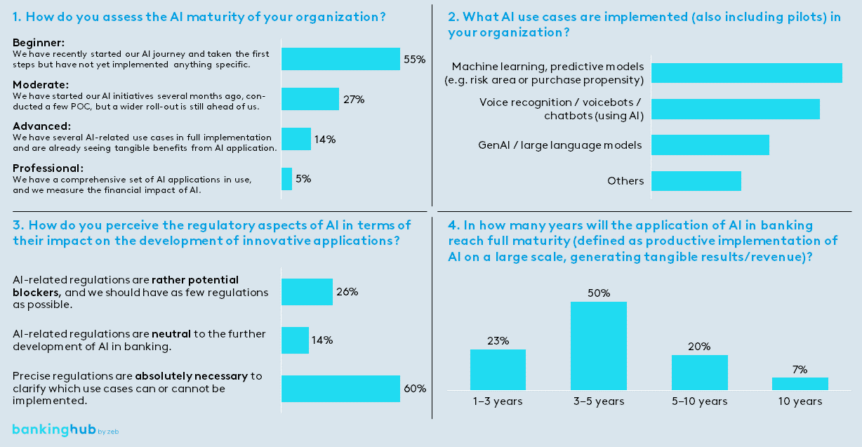

Major findings from the zeb survey on AI solution development in the financial sector

- 55% of respondents have already started their AI journey, but have not yet implemented any AI-powered systems,

- 50% of respondents anticipate AI to achieve full maturity in banking within 3–5 years,

- only 5% of respondents reported using comprehensive AI applications with measurable financial impact.

Do you perceive AI as a threat to banking, or rather as an opportunity?

While AI raises certain concerns, they differ from the common misconceptions often portrayed in popular narratives, such as the fear of AI taking over all our jobs. The biggest concern is AI’s impact on authenticity. The ability of AI solutions to support identity theft, impersonation or, more generally, the creation of deep fakes, raises serious uncertainties about authentication. At the end of the day, this may necessitate a return to traditional methods such as in-person authentication at some point.

Another threat stems from potentially uncontrolled AI model learning processes. Contrary to popular belief, an AI model will not suddenly acquire superhuman knowledge; instead, it may simply stop or start acting irrationally. This could have negative consequences, especially if such models were used to make critical decisions.

Moreover, while AI development progresses with increasing levels of complexity, fewer people will be able to verify the correct operation of the model, and fewer companies deploying such solutions will be able to manage this process properly. One possible solution in the future could be the introduction of qualification verification (e.g. through licensing or certification), applicable for resources and providers implementing AI solutions.

Effect of AI on banking activities

What areas of banking do you think will be most impacted by AI? Is there anything left that will not be massively reshaped by AI? What is your view on the impact of AI on payments?

The answer is simple: AI will impact the entire bank, especially in areas of repetitive activities where unstructured data and various types of documents (also often unstructured) are handled. A good example is the CRM area, in which AI has great potential thanks to its ability to support client advisors in their acquisition and relationship management activities. Here, AI can contribute to further increase the level of process automation, e.g. pricing in sales processes. The advantage of AI over analytics can also be seen in its ability to recognize patterns in large amounts of data without being tied to an initial hypothesis.

Reductions of manual activities owing to AI application can also be expected in the first steps of several back-office processes such as risk or AML, e.g. checking the correctness of data in documents, the presence of stamps or signatures of authorized persons or institutions. It is worth emphasizing that humans will still be needed to make a final decision. This role will certainly remain.

Thanks to AI, many compliance and back-office areas that so far have been overlooked in terms of strategy development will have the opportunity to evolve through innovation. The time-to-market for such solutions is much faster, as these areas do not require a full-fledged implementation and IT architecture transformation.

On the other hand, areas where the usefulness of AI solutions will be limited, are those where we are dealing with small scale or high complexity of activities and a case-by-case approach. Also, areas where a human touch is important if not crucial, such as investment banking or mortgage lending, will have some limitations in the use of AI. An important aspect to take into consideration is the fact that the implementation of AI solutions requires some prerequisites in terms of process digitalization. It should be noted that AI usage is not possible if the process is mechanical (e.g. paper-based). In such a case, basic digitization should be carried out first.

Also in the payments area, there is a lot of space for AI implementations, such as enhancing security measures in AML and fraud detection processes. We also see applicability for cases related to payment reconciliation, monitoring subscription payments or analyzing payment patterns and suggesting or reminding about payments to be executed. However, due to the high sensitivity of payments, AI adoption must be approached with great caution. In our view, AI is not yet likely to manage end-to-end payment flows without human assistance.

BankingHub-Newsletter

Analyses, articles and interviews about trends & innovation in banking delivered right to your inbox every 2-3 weeks

"(Required)" indicates required fields

AI implementation at BNP Paribas Bank Polska

Which specific use cases has your bank already developed?

In terms of financial impact, the most important AI implementations at BNP Paribas Bank Polska are related to customer management: price management and purchase propensity models. These solutions have the greatest impact on the entire organization. However, from the perspective of changing the organization‘s philosophy, the pilot implementation of generative artificial intelligence “GENiusz” (ed. translated to English as “genius”) is also of great importance. This is a knowledge chatbot application that will ultimately allow as many as several thousand employees to access relevant external and internal but non-confidential data.

In the extensive structure of the bank, where a huge amount of information flows, knowledge of procedures, regulations, products and services becomes crucial for effective work. These documents, like the collections of a large library, hide a wealth of knowledge. In this respect, GENiusz becomes an invaluable ally, enabling the quick retrieval of needed information without the tedious task of digging through documents or asking colleagues. This not only saves time that can now be spent on creative tasks, but above all, significantly reduces the risk of making mistakes. From the bank‘s perspective, this is a key change that aims to facilitate and democratize knowledge sharing.

Another example of already implemented use cases is a sophisticated model for managing the cash balance in branches, showing that BNP Paribas Bank Polska is able to work effectively with AI topics, even in such a sensitive area as cash operations.

Challenges and benefits of working with AI

What is, in your opinion, the biggest struggle when working on a specific AI use case? Data quality, data availability, something else?

Data quality and accessibility are key, but the biggest problem we encounter when working with AI is the mindset and attitude of employees. Working with AI solutions requires an interdisciplinary approach, especially at the intersection of data science and business, and data scientists’ understanding of business issues can sometimes be challenging. In addition, it is of vital importance to have the right perception of an initiative – whether it is an opportunity or a threat – to provide the basis for the right decision.

It is crucial to keep in mind that the development of AI solutions should be organized more from the perspective of research and development processes. Not every initiative should be evaluated solely based on its potential for business case viability. An effective framework should facilitate and encourage the development of various use cases, acknowledging that most of them may not yield substantial advantages. The crucial aspect is to focus on delivering a select few of these use cases that will bring significant benefits to the organization.

Our bank focuses on interdisciplinarity and therefore actively seeks talent who combine the very different worlds of banking and the low-level, complex world of servers, graphics cards, CI/CD or IT security. Such a portfolio of skills is rarely available, and the education system has so far focused on generating specialists in specific fields. AI in banking is a topic for generalists with diverse domain knowledge – for example, at the intersection of law, technology and finance. Such a skill set puts a person in a position where AI will not ultimately replace humans. There are not many of these talents, which may pose an obstacle.

How do you measure the benefits of implemented AI use cases (both from an ex-ante and ex-post perspective)?

Our focus is not just on the number of AI use cases, but on their business value and the ratio of benefits to costs. However, avoiding risk at all costs means failing to innovate. AI is a rapidly evolving field, so we must continually invest in research and development to stay up-to-date. The evaluation of implemented AI solutions should be approached similarly to venture capital investments, i.e. in an aggregated manner from an investment portfolio management perspective. Some use cases will be mature and generate tangible value, while others will be in the ideation and exploration phases.

At BNP Paribas Bank Polska, we consider two key factors. The first is adequacy – it is important to adjust the adequacy of ex-ante and ex-post calculations to the scale of our activities. The second is added value – we aim to measure the business value generated by each solution so that we can focus on those that are truly needed. AI value is only generated when it is embedded in and absorbed by business processes.

Plans for the future of AI solutions at BNP Paribas Bank Polska

What are your plans, and what can we expect from you in the coming months?

We are currently focusing on three dimensions that we believe are critical to achieving AI maturity.

Firstly, we are investing in generative AI capabilities. Thanks to GenAI, the topic of chatbots has been revitalized, and we are making efforts to explore this area in depth. The initial GenAI use cases have helped raise AI awareness as they are widely used throughout the organization. In addition, there are numerous other GenAI implementation ideas awaiting assessment for their potential.

Secondly, we are focusing on a long-term strategy and the maturity of the implementation process. While new ideas are promising, to fully leverage the potential of AI solutions, we need to industrialize the implementation process. This approach involves strategizing toward maturity and then progressing toward more stable solutions.

Last but not least, we strive to ensure the reusability of AI solutions. BNP Paribas is a large banking group with multiple business lines, so our goal is to create universal solutions that can be utilized at various levels and across different business areas and units.